HBAR Price Faces Downtrend, But Key Indicators Suggest Reversal Ahead

HBAR price remains stuck in a two-month downtrend, but rising inflows and bullish momentum indicators hint at a possible reversal toward $0.248.

Hedera’s price action continues to struggle as the altcoin faces a persistent decline that began nearly two months ago.

Attempts to reverse the downtrend have failed so far. Despite this, market conditions show resilience, with inflows suggesting renewed optimism among investors.

Hedera Has Investor Support

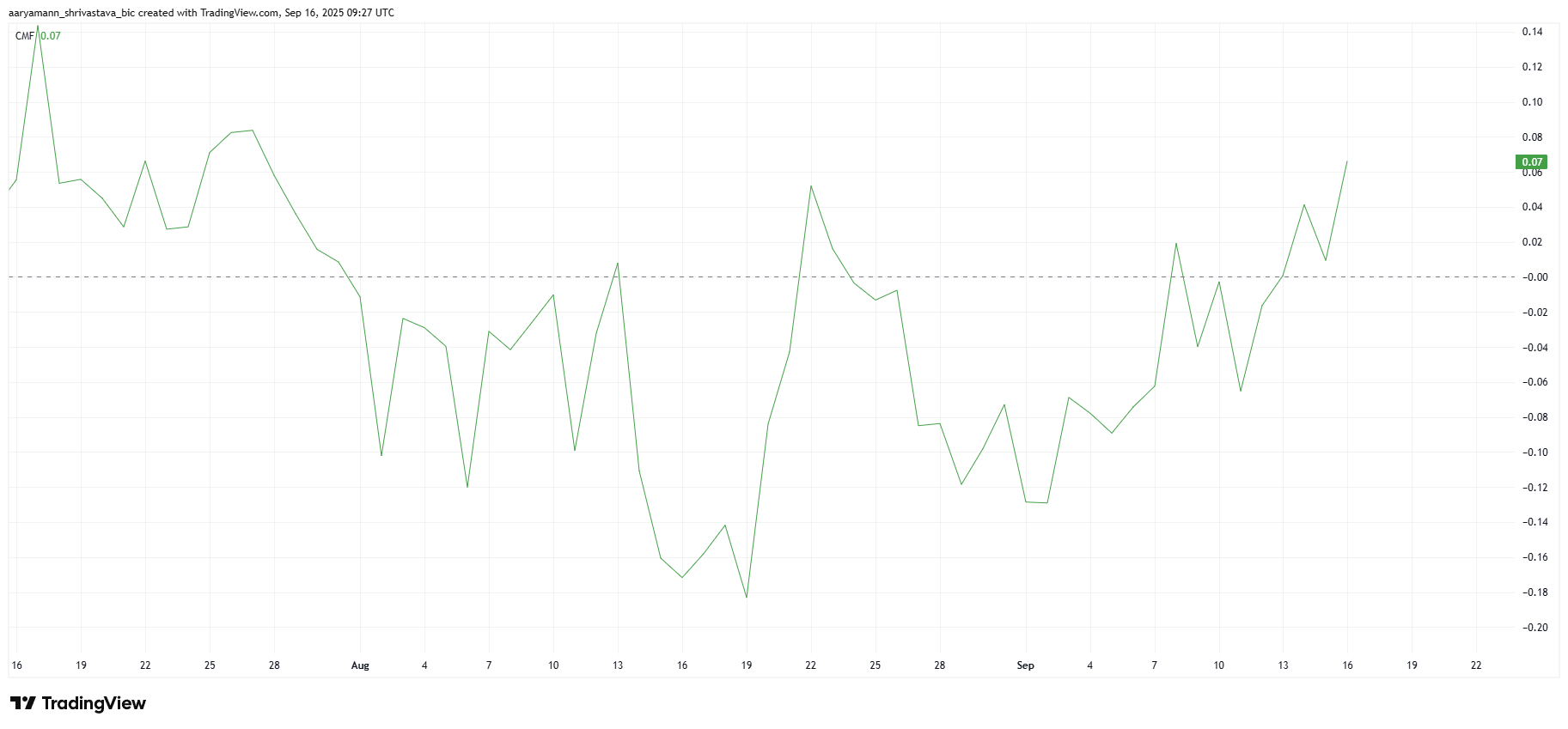

The Chaikin Money Flow (CMF) indicator highlights a sharp uptick, pointing to strong capital inflows into Hedera. These inflows have reached a two-month high, highlighting growing investor interest in the asset during a period of broader market uncertainty.

Such activity indicates confidence in Hedera’s potential to stage a recovery. Investors appear to be buying into the weakness, aiming to capture gains should the cryptocurrency manage to break through its resistance levels. This renewed capital flow could help support a reversal.

HBAR CMF. Source:

HBAR CMF. Source:

From a technical perspective, Hedera’s Relative Strength Index (RSI) is holding above the neutral 50.0 mark. This placement suggests the bullish momentum remains intact despite recent struggles with price performance, keeping recovery hopes alive for the altcoin.

The persistence of strength in the RSI reflects a positive macro backdrop for HBAR. While the downtrend is still in effect, maintaining RSI in the bullish zone provides Hedera with a potential edge to counter short-term bearish pressure.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR Price Fails Breakout

At the time of writing, Hedera is priced at $0.237, facing resistance at $0.241. The cryptocurrency has been weighed down by a two-month-old downtrend that began after it failed to break above $0.248 earlier this summer.

Given current market inflows and bullish technical indicators, HBAR is likely to bounce back from the $0.230 support. If successful, the price could retest $0.241 and possibly $0.248. Surpassing this level would officially end the ongoing downtrend.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if bearish sentiment intensifies, Hedera could lose its footing. A breakdown below $0.230 would expose the cryptocurrency to a fall toward $0.219. Such a move would invalidate the bullish outlook and risk extending the downtrend further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly News Preview | Immunefi (IMU) launches token sale on CoinList; SharpLink and ETHZilla release financial reports

This week's key news highlights from November 10 to November 16.

Crypto ETF Weekly Report | Last week, US spot bitcoin ETFs saw a net outflow of $1.208 billion; US spot ethereum ETFs saw a net outflow of $507 million

Franklin Templeton's XRP ETF has been listed on the DTCC website with the ticker XRPZ.

Kodiak launches Berachain native perpetual contract platform—Kodiak Perps, enhancing its liquidity ecosystem

The native liquidity platform of the Berachain ecosystem, Kodiak, recently launched a new product, Kodiak Perps,...

![[Bitpush Weekend Review] 21Shares submits XRP spot ETF application to US SEC, review period begins; JPMorgan acquires stake in Ethereum reserve leader Bitmine, holding position valued at $102 million; US CFTC may allow the use of stablecoins as tokenized collateral in derivatives markets](https://img.bgstatic.com/multiLang/image/social/2a1a2173cbafb215a12f5cbcd176e38f1762708864006.png)