Analyst: The risk of US Treasury yields repeating last September's post-Fed rate cut scenario is limited

Jinse Finance reported that Dario Messi, Head of Fixed Income at Julius Baer, said that there are concerns that the scenario of a rise in long-term US Treasury yields after a 50 basis point rate cut by the Federal Reserve in September 2024 could repeat itself. However, this time the risk of such a recurrence is limited. Although there are some reasonable arguments, the current starting point provides more of a buffer for such developments, and the risks are more limited at present. Currently, the 10-year US Treasury yield is higher than it was when the Federal Reserve began cutting rates in September 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenAI report: Enterprise AI applications surge

BlackRock: The wave of capital flowing into AI infrastructure is far from peaking

US crypto stocks opened higher, with MSTR up 2.61% and BMNR up 4.9%.

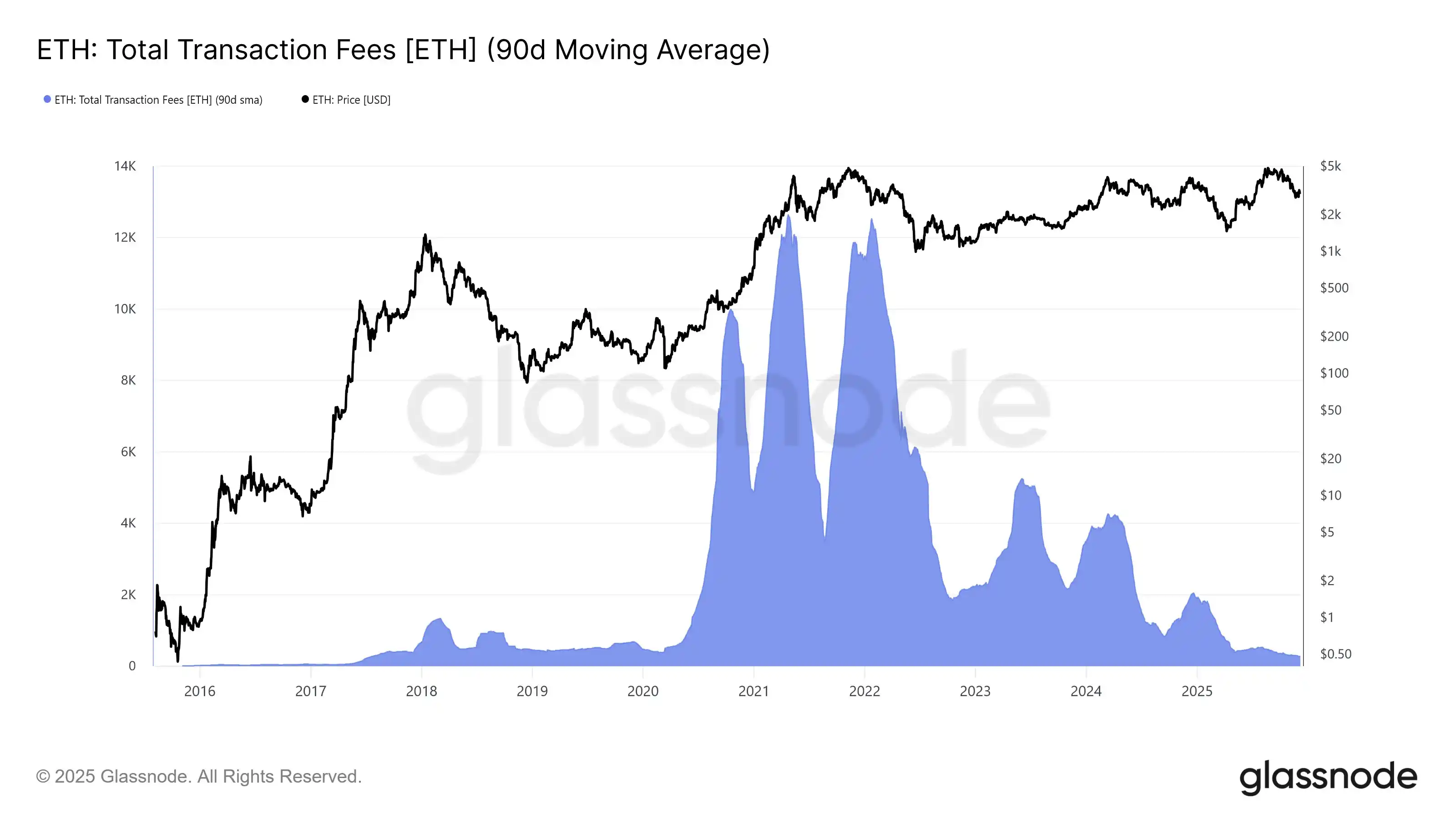

Ethereum network’s average daily total transaction fees hit the lowest level since July 2017