Ethereum Tests Support: Holder Conviction Sets Stage for a Rebound to $4,775

Ethereum price slipped below $4,500, but nearly $8 billion in maturing ETH supply signals strong investor conviction. If ETH reclaims support, a rally toward $4,775 and new highs could follow.

Ethereum has seen a 4% decline in recent days, pulling the altcoin king just under $4,500.

While this short-term dip may concern some traders, the long-term outlook remains bullish as strong fundamentals and investor behavior suggest resilience ahead.

Ethereum Supply Is Maturing

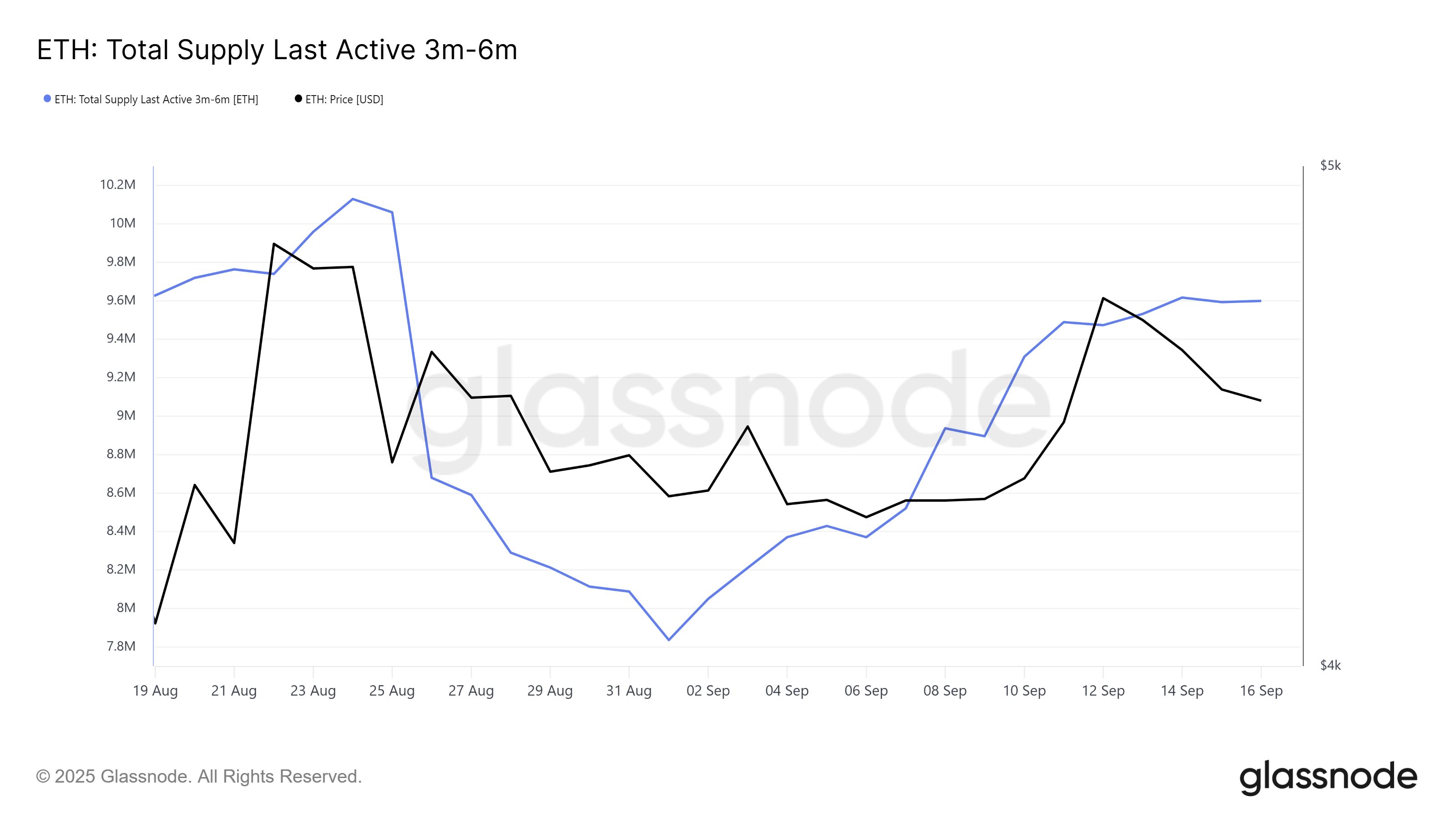

Ethereum supply has matured significantly, reinforcing investor confidence in the asset’s long-term strength. Since the beginning of the month, the 3-6 month-old supply has grown by 1.76 million ETH, now valued at nearly $8 billion. This indicates that holders refrained from liquidating even during market volatility.

Such conviction suggests that investors anticipate higher prices and are willing to ride out short-term declines. By keeping ETH locked, these holders are reducing the circulating supply, which can create favorable conditions for upward price momentum when demand returns. This behavior is a bullish foundation for Ethereum’s growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

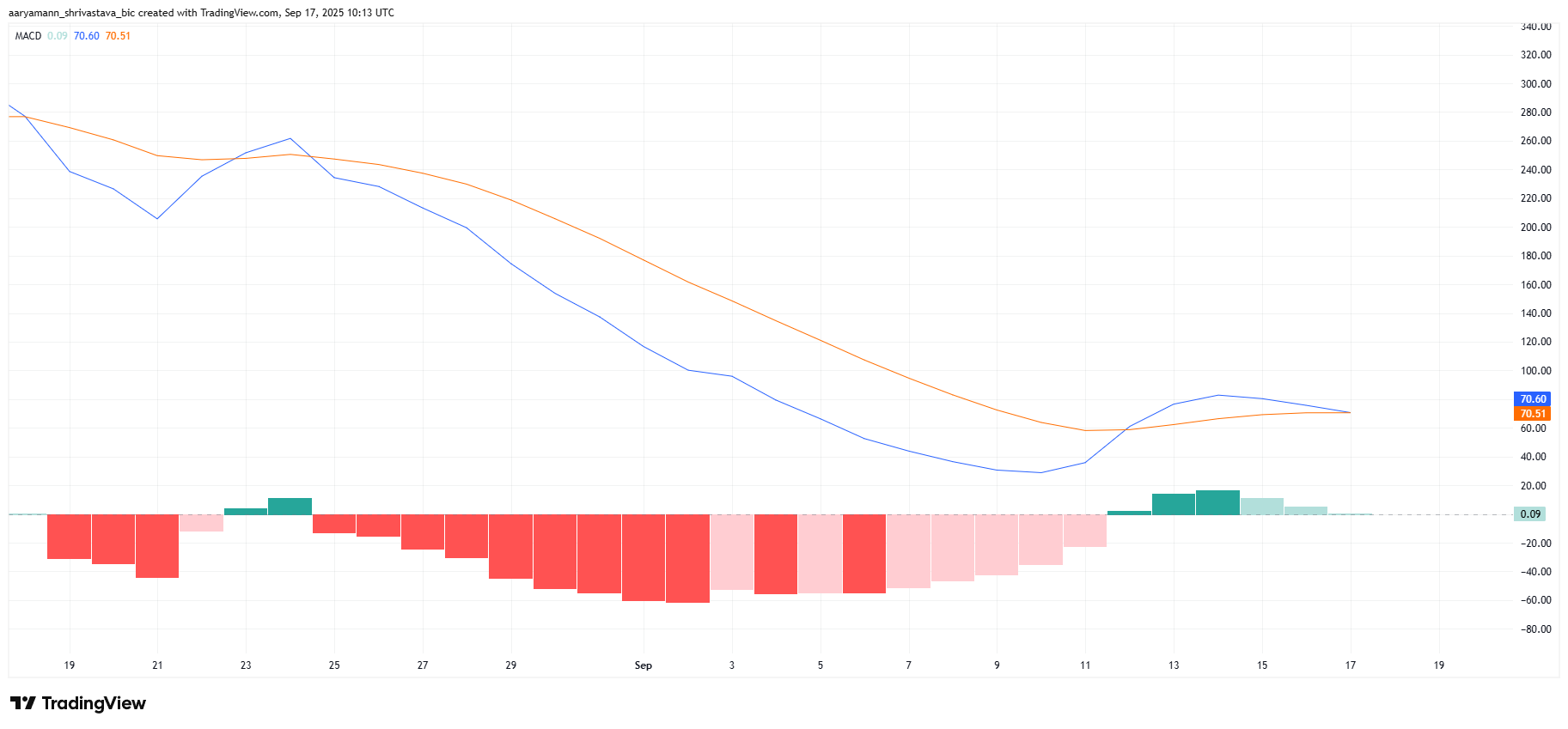

On the technical side, Ethereum’s momentum appears mixed in the near term. The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish crossover, signaling the possibility of short-lived downside pressure. This aligns with ETH’s recent price slip below the $4,500 level.

However, the broader market cues remain constructive. Even if the MACD confirms a bearish crossover, investor sentiment and maturing supply could support a quick recovery. Such dynamics highlight that any decline would likely be temporary, with ETH primed for a strong rebound soon after.

ETH MACD. Source:

TradingView

ETH MACD. Source:

TradingView

ETH Price Could Bounce Back

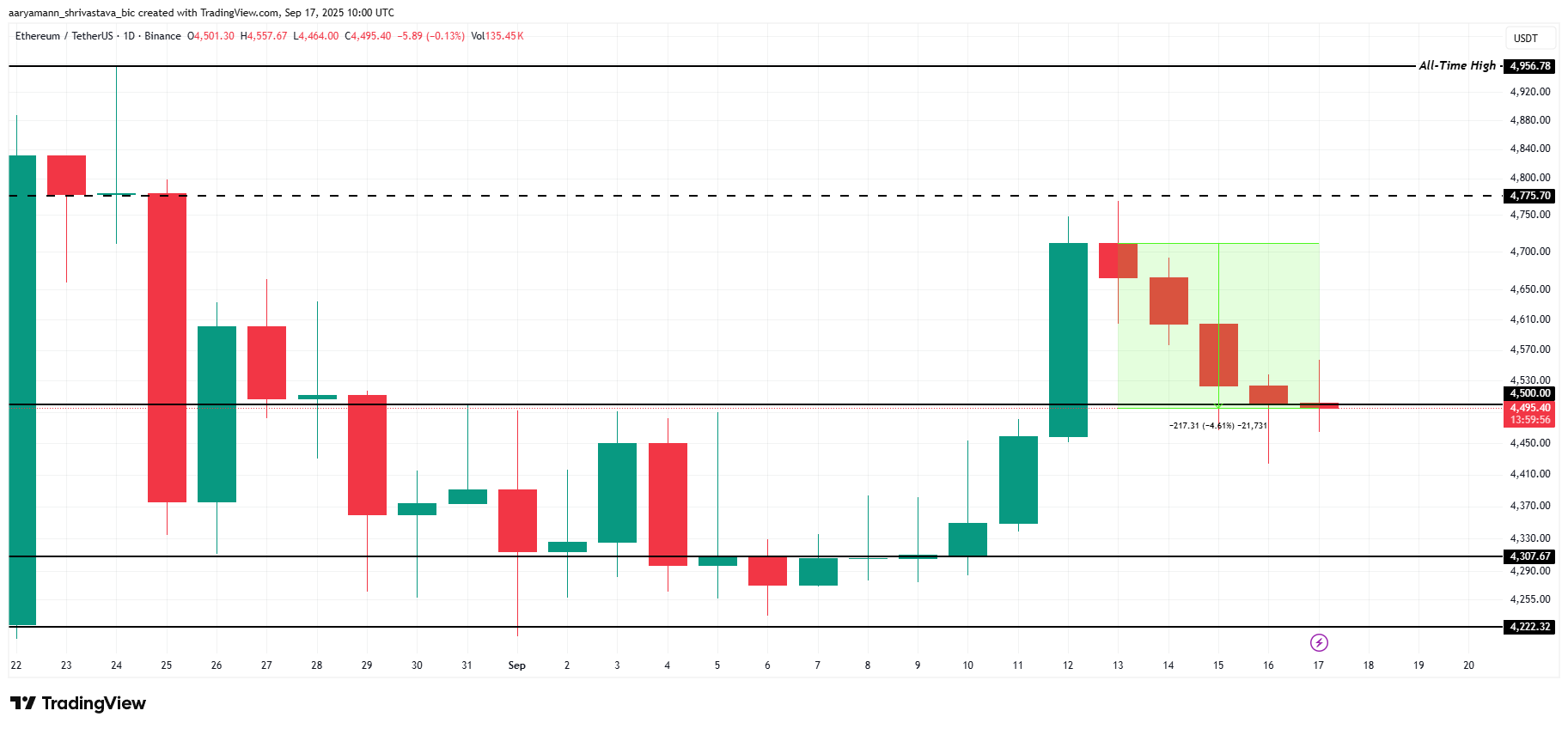

Ethereum is currently trading at $4,495, just below the $4,500 support line. It has not yet closed below $4,500, so the support is still valid.

The maturing supply and bullish long-term outlook indicate that Ethereum could bounce from the support. With fewer coins entering circulation, the altcoin has structural support for renewed upward momentum to $4,775 despite short-term volatility.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if the price closes below the support, ETH may slip toward $4,307, invalidating the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Raking in crypto dividends: How did the family of Trump's Commerce Secretary earn $2.5 billion a year?

After Howard Lutnick became the Secretary of Commerce in the Trump administration, his family's investment bank, Cantor, is heading for its most profitable year ever.

Qianwen app: How will Alibaba create China’s “ChatGPT”?

This is the third time this year that Alibaba has concentrated its efforts on major initiatives.

Real Vision founder: Federal Reserve may adjust policy to address liquidity crisis

This year's 30% gains have been completely wiped out, and Bitcoin has fallen into a bear market.

The reversal from the historical highs in October is mainly attributed to fading optimism over US pro-crypto policies, a shift in the macro market toward risk aversion, and the quiet withdrawal of institutional buyers such as ETF investors.