3 Altcoins Crypto Whales Are Buying After Fed’s Rate Cut Decision

Whales are making bold moves after the Fed’s latest rate cut, quietly adding millions across three altcoins. Backed by rising technical signals and a supportive low-rate outlook, these coins could be setting up for outsized gains if key levels hold.

Altcoins targeted by crypto whales have suddenly come into focus following the Fed’s 25-bps rate cut. The move wasn’t a surprise, and more easing is expected ahead. Markets finally reacted today to the dovish outlook, but what stands out isn’t the usual gain-and-move trade.

Instead, whales, the conviction players, are quietly building positions in a few select tokens. Their accumulation hints at potential upside ahead, backed by strong technicals and a low-rate outlook.

EigenCloud (EIGEN)

EigenLayer has rebranded its platform under the name EigenCloud, while the token continues to trade as EIGEN. The project is catching unusual attention, especially from big players, after the Fed’s recent rate cuts, making it one of the top altcoins crypto whales are buying right now.

On-chain data shows whales have stepped in aggressively over the past 24 hours. Their holdings jumped 6.05%, now at 4.85 million EIGEN. Mega-whales also added, lifting balances by 0.1% to about 1.13 billion EIGEN.

At today’s price of $2.04, whales picked up roughly 2,80,000 tokens ($837,000), while mega-whales added about 1.13 million ($2.04 million).

EIGEN Whales In Action:

Nansen

EIGEN Whales In Action:

Nansen

This surge in whale buying could be tied to the broader rate environment. Lower interest rates are often seen as supportive for yield-focused platforms because investors look beyond traditional savings for higher returns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

On the charts, EIGEN has broken out of an ascending triangle with gains of over 33% in the past 24 hours, a bullish setup that points to continuation. If the price holds above the breakout level of $2.14, targets stretch toward $2.50 and even $3.20.

EIGEN Price Action:

TradingView

EIGEN Price Action:

TradingView

Adding to the case, the Smart Money Index (SMI) — which tracks faster traders who look for short-term rebounds — is also rising. While not as aggressive as whale flows, this shows that active traders are positioning cautiously in the same direction, strengthening the overall breakout narrative.

Still, risks remain. A dip under $1.73 would weaken the structure, and a move below $1.48 would invalidate the bullish outlook completely.

Avantis (AVNT)

Avantis is a newly launched token on Base that has quickly become one of the more talked-about plays after the Fed’s recent rate cuts. Over the past 24 hours, AVNT is up nearly 25%, with whales and top addresses piling in aggressively.

On-chain data shows whales have boosted their holdings by 11.5%, now sitting at 1.08 million AVNT. That means they picked up about 111,390 tokens, worth around $125,800 at the current price of $1.13.

The conviction looks stronger at the top-holder level: the top 100 addresses added 4.78 million tokens, a 0.49% rise, bringing their total to 979.44 million AVNT. In dollar terms, that’s roughly $5.4 million picked up in just one day.

AVNT Whales:

Nansen

AVNT Whales:

Nansen

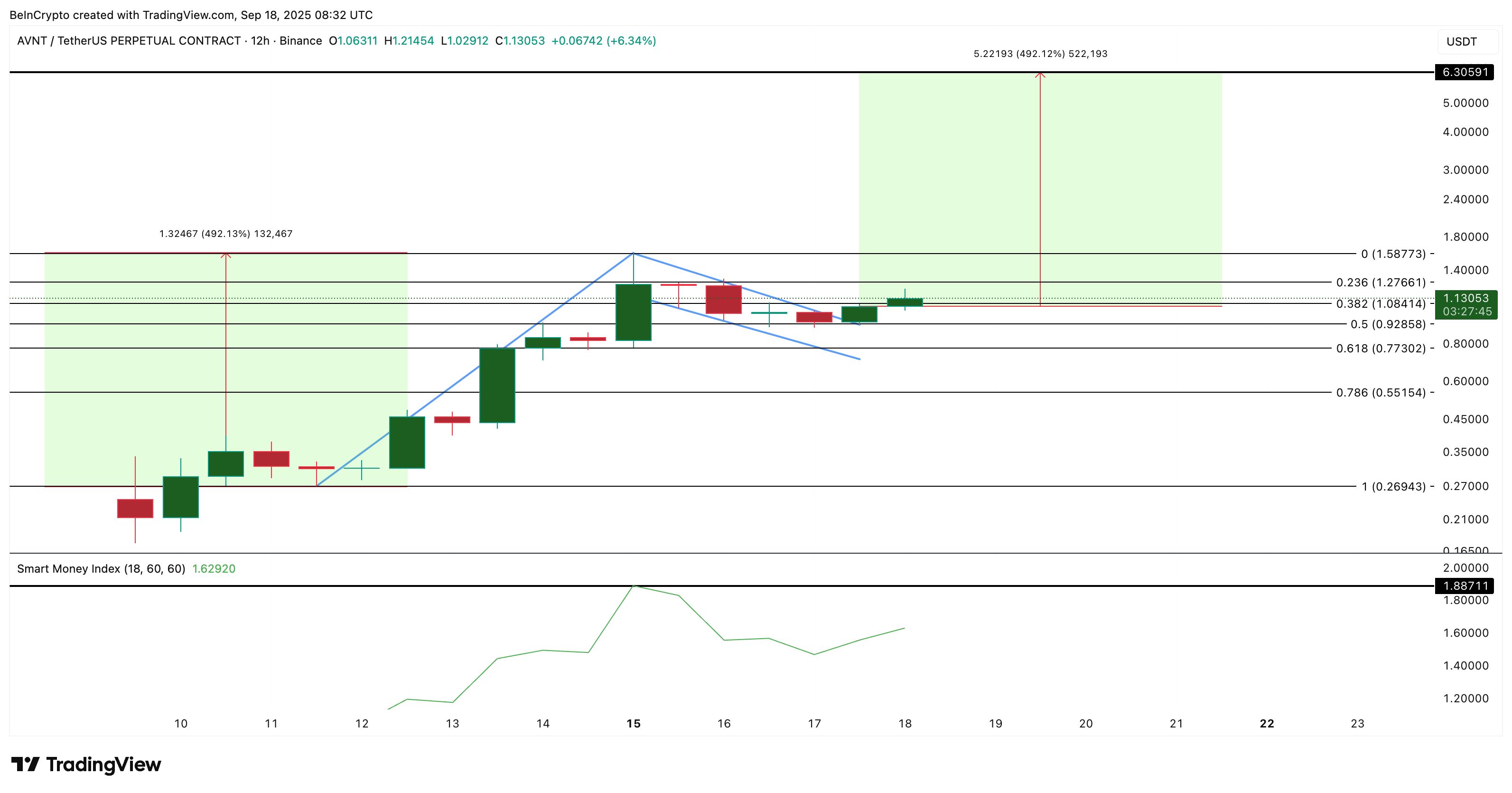

On the charts, AVNT is flashing a bullish flag and pole pattern on the 12-hour timeframe. While the setup points to a bold target near $6.30, that figure is best read as an upper extreme rather than a base case. For now, the more immediate level to watch is $1.58.

A move above it would further validate the flag breakout and open the way for further upside, even if it falls short of the lofty target.

AVNT Price Analysis:

TradingView

AVNT Price Analysis:

TradingView

The Smart Money Index (SMI), which tracks fast-moving traders, has also climbed to 1.62. While this indicates growing interest, stronger confirmation of breakout momentum would occur if the SMI pushes above 1.88. That would signal short-term conviction aligning with whale activity.

However, risks remain, too, as the bullish hypothesis would be undermined if the AVNT price dips below $0.77. That could push the dip to as low as $0.26, another bold point, but on the downside.

Kamino Finance (KMNO)

Kamino Finance, a decentralized finance (DeFi) protocol on Solana, has been seeing rising whale activity following the Fed’s recent rate cut. Known for its borrow-lend platform, Kamino Lend, and automated liquidity vaults, Kamino has quietly built momentum as investors search for yield in a lower-rate environment.

On-chain data shows whales have stepped up in a big way over the past 24 hours. Their holdings climbed 35.9%, now sitting at 29.39 million KMNO. That means whales added about 7.77 million KMNO, worth roughly $629,000 at today’s price of $0.081.

KMNO Tokens And Whale Positioning:

Nansen

KMNO Tokens And Whale Positioning:

Nansen

Smart Money flows — traders who tend to act quickly on short-term opportunities — have also jumped, surging more than 1,200% over the same period. This confirms that not only long-term players but also faster-moving traders are positioning into the token.

Adding to the case, the Bull-Bear Power (BBP) indicator, which measures the strength of buyers (bulls) versus sellers (bears), is showing that bull power continues to rise even after the latest red candle. This suggests that buyers remain firmly in control of the rally despite short-term pullbacks.

On the charts, KMNO has broken out of an ascending channel, with targets stretching as high as $0.13 if momentum continues. But risks remain. If KMNO falls below $0.06, it would invalidate the bullish setup and suggest a deeper correction.

Kamino Finance Price Analysis:

TradingView

Kamino Finance Price Analysis:

TradingView

The setup suggests that Kamino Finance may be one of the more interesting altcoins crypto whales are buying right now. With whales adding millions, Smart Money flows surging, and bull-bear power leaning strongly toward buyers, KMNO could extend its rally further — provided it holds above key support levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market Cap Crashes: 8-Month Low Sparks Panic and Opportunity

The New York Times: Trump is pushing cryptocurrency toward a capital frenzy

Metya Joins Forces With 4AIBSC To Power Decentralized AI Agents in Web3 SocialFi Platform

Stunning Bitcoin Price Prediction: BOJ Policy Could Catapult BTC to $1 Million, Says Arthur Hayes