Analysis: Bank of Japan statement paves the way for a possible rate hike as early as Q4, yen strengthens pushing USD/JPY towards the 147 level

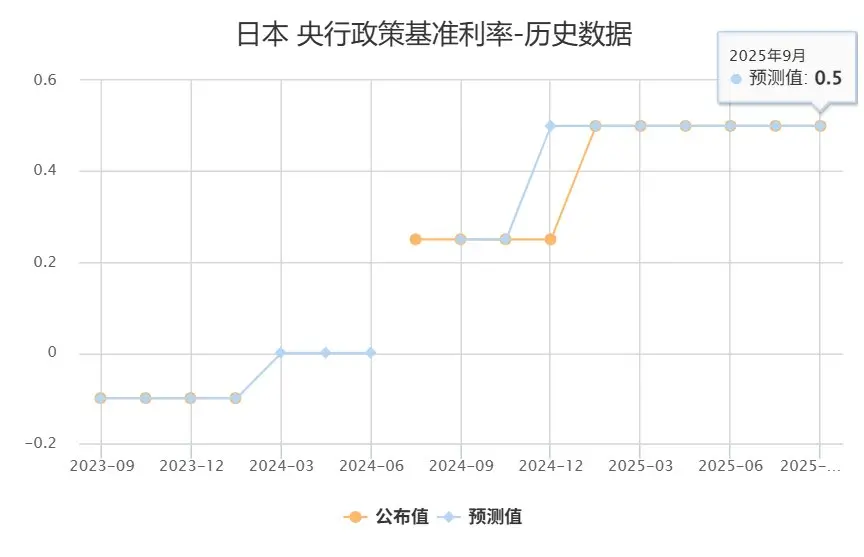

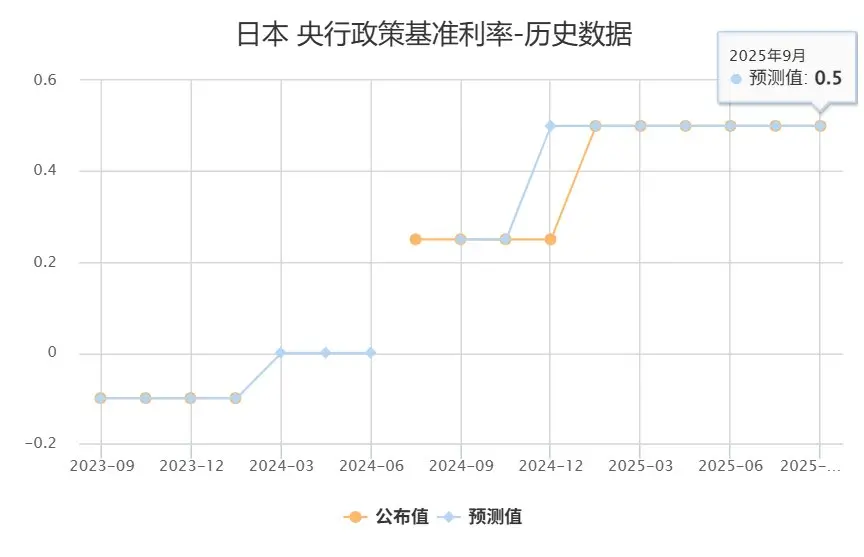

According to ChainCatcher, citing Gelonghui, institutional analysis indicates that the Bank of Japan maintained its policy interest rate at 0.50% with a 7-2 vote, in line with broad market expectations. Policy board members Hajime Takata and Naoki Tamura voted against maintaining the rate, advocating for a 25 basis point rate hike.

The policy statement is more detailed than before, reiterating the assessment that the economy is “showing mild recovery overall, despite some areas of weakness,” and emphasizing close monitoring of uncertainties affecting the financial and foreign exchange markets, Japanese economic activity, and prices. The Bank specifically pointed out that the outlook faces “multiple risks,” stating that “the evolution of trade and other policies in each jurisdiction, as well as overseas economic activity and price responses, remain highly uncertain.”

Although a trade agreement has been signed between Japan and the US, the statement still highlights elevated uncertainty and clearly states that the tariff environment is less favorable for Japanese businesses compared to the zero-tariff era before the Trump administration.

The USD/JPY continued its decline, hitting a new post-decision low of 147.28, while generally remaining around the 148.00 level during the Tokyo morning session. The yen led G10 currencies today, with the market interpreting the Bank of Japan’s statement as paving the way for a possible rate hike as early as the fourth quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Recall: Belief rewards will be distributed to eligible users this week

Data: SOL spot ETF saw a net inflow of $46.34 million last week, marking three consecutive weeks of net inflows.

Messari releases Filecoin Q3 report: Utilization rises to 36%, capacity shrinks to 3.0 EiB

Alibaba Qianwen App launches public beta