BitGo Makes IPO Filing As Crypto Firms Accelerate Wall Street Listings In 2025

BitGo’s filing follows Circle, Gemini, and other crypto firms going public, marking the latest sign of growing Wall Street appetite for digital asset businesses.

BitGo, one of the most prominent digital asset custody providers, has taken a major step toward becoming a publicly traded company.

On September 18, the Palo Alto-based firm submitted its S-1 registration with the US Securities and Exchange Commission (SEC). The filing outlined plans to list Class A common stock on the New York Stock Exchange under the ticker BTGO.

BitGo Seeks NYSE Listing

According to the filing, the company will adopt a dual-class share structure. Class A shareholders will receive one vote per share, while Class B holders will receive 15 votes each.

Despite this, Mike Belshe, the company’s founder, will still hold a controlling share at the crypto custody service provider.

“Michael Belshe will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change of control transaction. Further, we will be a “controlled company” within the meaning of the corporate governance standards of the NYSE, and we will qualify for, and may rely on, exemptions from certain corporate governance requirements thereunder,” the filing stated.

BitGo stated that the IPO will allow it to raise capital, increase market visibility, and expand financial flexibility.

The firm added that the funds raised will be directed toward working capital, technology development, and potential acquisitions, as well as covering stock-based compensation taxes.

Meanwhile, BitGo’s filing adds momentum to a broader shift in crypto capital markets. Circle’s public debut earlier this year reignited interest in digital asset IPOs, followed by Gemini, Bullish, and Grayscale filings.

Industry leaders argue that these moves reveal the scale of crypto businesses. Bitwise CEO Hunter Horsley pointed out that nearly $100 billion in combined market capitalization has already emerged from this new wave of listings.

“People are discovering how big the businesses of this space are…almost $100 billion of combined market cap… Crypto is an industry,” he wrote on X.

IPO Filing Shows $4 Billion Revenue Surge

BitGo’s decision to go public follows a striking financial performance over the years.

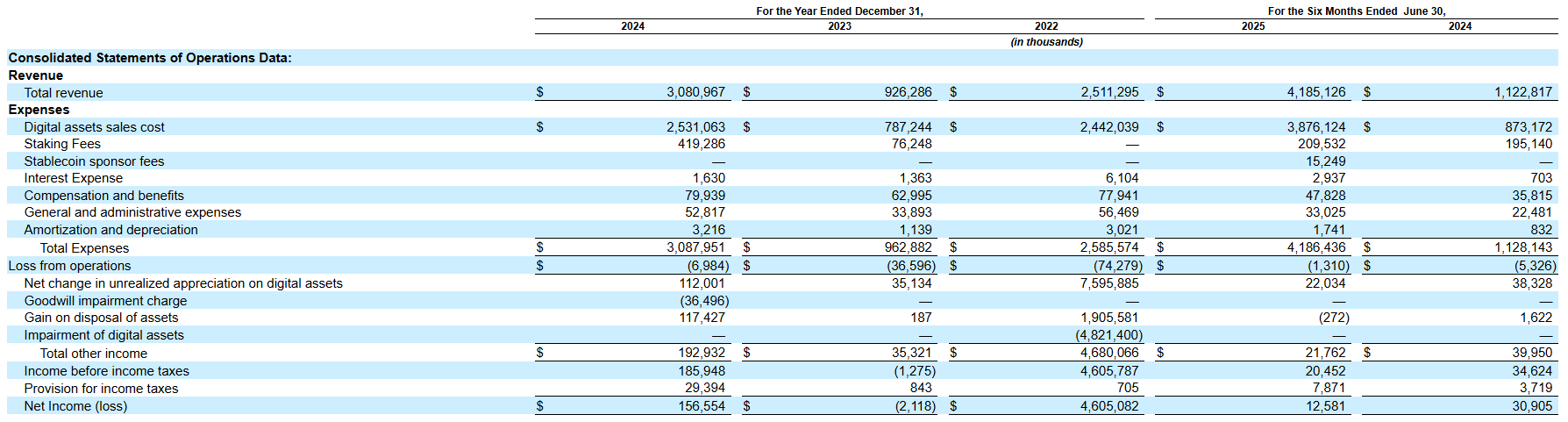

The company reported $4.19 billion in revenue during the first half of 2025, nearly quadruple the $1.12 billion it earned in the same period a year earlier.

BitGo’s Financial Performance Between Since 2022. Source: BitGo IPO Filing

BitGo’s Financial Performance Between Since 2022. Source: BitGo IPO Filing

Yet higher operating costs eroded net income, which fell to $12.6 million from $30.9 million in 2024. This contrast highlights the challenge of scaling infrastructure for institutional clients while balancing profitability.

“Only $12 million in profit on the back of $4 billion in revenue – such low profit numbers. Revenue increased by $3b, but profits dropped by more than half not sure why. Surely these guys can do much much better. Good that they are going public. More public crypto companies is good for the industry and I’m curious how high they will be valued,” Bobby Ong, the co-founder of CoinGecko said.

Over the years, BitGo has positioned itself as the leading crypto custodial service provider. The firm custodies over $100 billion in customers’ assets and has secured licensing in major regions like the EU, Singapore, while pursuing a banking charter in the US.

However, despite its expanding service portfolio, BitGo’s business remains concentrated in a handful of major tokens. As of June 30, 2025, Bitcoin, Sui, Solana, XRP, and Ethereum accounted for over 80% of assets held on its platform.

Staking activity was similarly concentrated, with Sui, Solana, and Ethereum representing the vast majority of client participation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Earn Up to 25 USDT:Buy Crypto with Google Pay/Apple Pay!

Earn Up to 25 USDT:Buy Crypto with Google Pay/Apple Pay!

CandyBomb x IR: Trade to share 600,000 IR

CandyBomb x THQ: Trade futures to share 133,333 THQ!