Bitcoin rally is showing early signs of durability: long-term holders (LTHs) have returned to profit, on-chain transaction activity has surged to a year-to-date high, and momentum indicators remain bullish — but stronger buying pressure is required to push BTC convincingly toward $120,000.

-

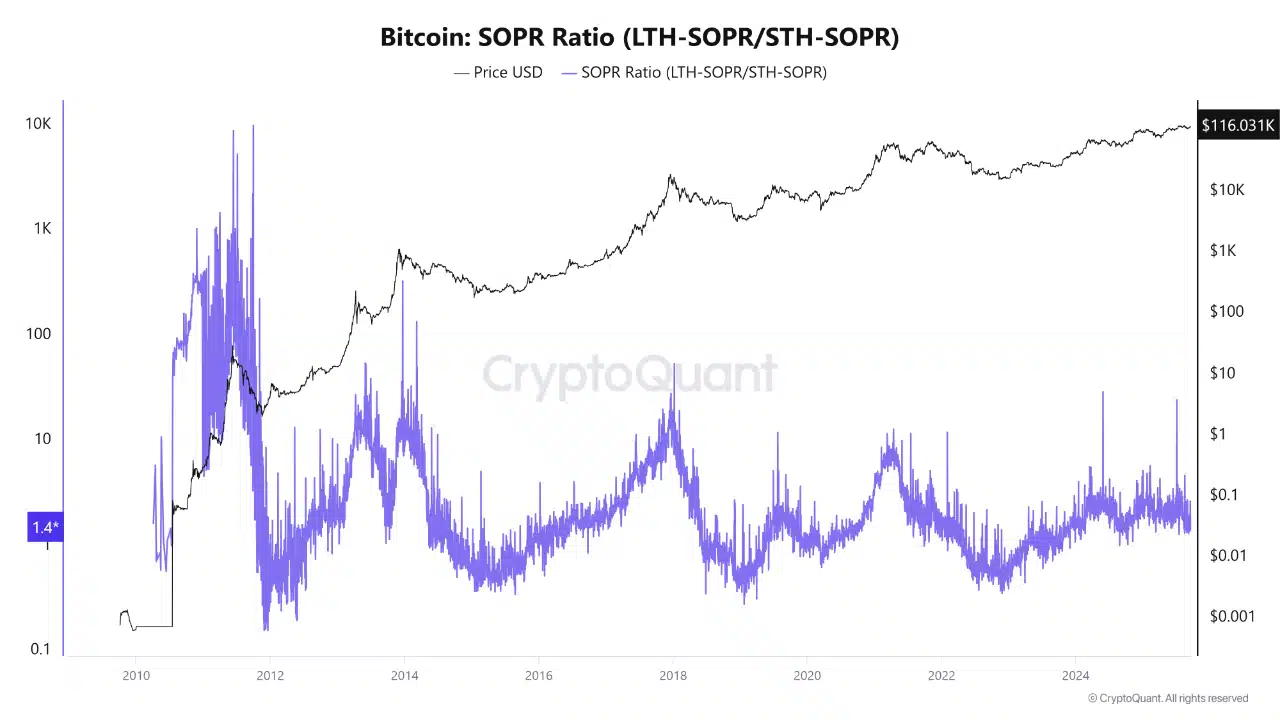

LTHs back in profit — reduces selling pressure and supports rallies

-

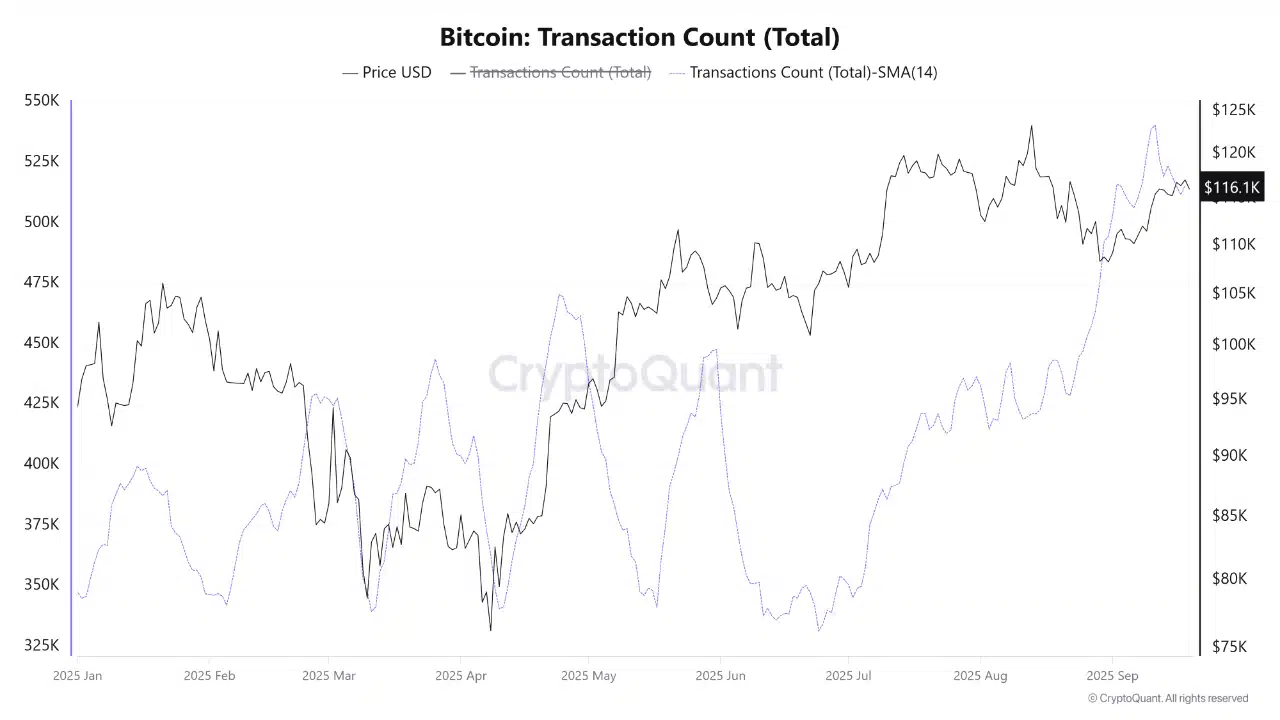

Network transactions 14-day MA near 540,000, driven by Ordinals and Runes usage

-

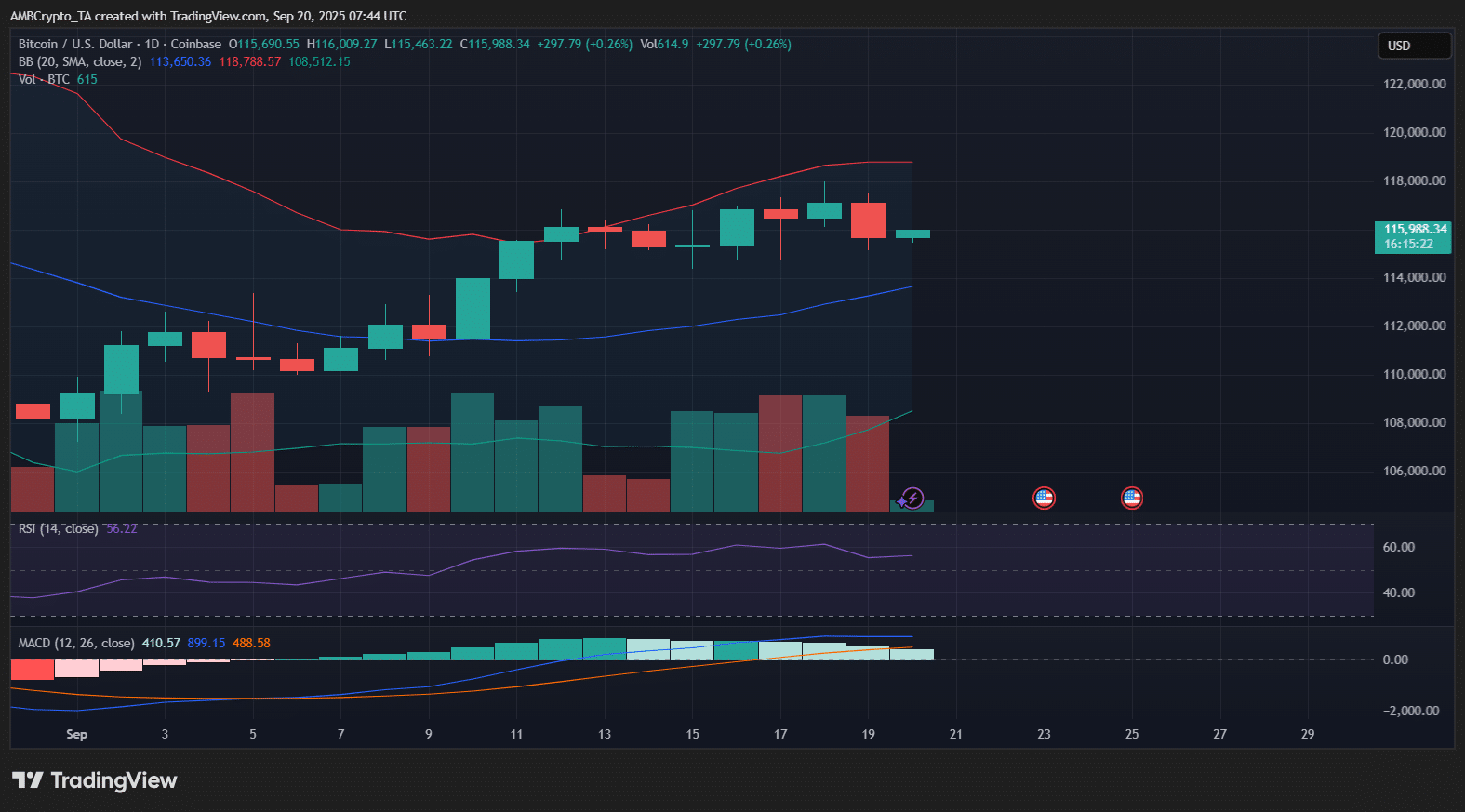

BTC trading ~ $116k with RSI ~56 and MACD positive; consolidation suggests cautious upside

Meta description: Bitcoin rally shows durable signs as long-term holders return to profit and on-chain activity surges — monitor volume and buying pressure for the next leg up.

Is Bitcoin’s rally sustainable?

Bitcoin rally appears more sustainable than recent moves because long-term holders (LTHs) are back in profit and on-chain activity has surged. These conditions historically reduce supply-side pressure and support stronger, multi-week rallies if momentum and volume continue to align.

How are long-term holders influencing price?

The balance of power has shifted toward LTHs, with SOPR trending upward. When SOPR rises alongside declining active supply, it signals that patient investors are realizing gains and short-term selling pressure typically weakens. CryptoQuant data referenced by market analysts shows this pattern often precedes extended rallies.

What does current network activity indicate?

Bitcoin’s 14-day moving average of transactions recently reached a yearly high near 540,000, indicating heightened on-chain usage. This surge is partially driven by protocols such as Ordinals and Runes, and higher transaction counts have tracked price appreciation since July, per on-chain monitoring platforms.

Source: CryptoQuant (plain text)

Why does on-chain volume matter now?

Higher transaction averages confirm that the rally is backed by usage, not just speculative flows. When price and on-chain activity move together, market structure strengthens. Continued demand from Ordinals and Runes users could sustain fee-driven interest and network activity.

How are technicals shaping near-term risk/reward?

At press time BTC traded near $115,988. Daily charts show consolidation near the upper Bollinger Band, RSI around 56, and MACD positive. These readings imply bullish structure but also signal potential short-term cooling without additional volume.

Source: CryptoQuant (plain text)

Frequently Asked Questions

Is Bitcoin rally driven by real demand or speculation?

On-chain indicators show a real pickup: transactions and protocol usage have risen alongside price since July. This suggests demand-driven activity rather than pure speculative inflows. Continued monitoring of volume, SOPR, and active supply is necessary to confirm durability.

How likely is Bitcoin to reach $120,000 in the next quarter?

Reaching $120,000 requires sustained buying pressure and higher volume. Current structure is bullish, but indicators point to consolidation. If LTH selling remains muted and on-chain activity holds, a move toward $120,000 becomes more probable.

Source: TradingView (plain text)

Key Takeaways

- LTHs back in profit: Reduces immediate selling pressure and historically precedes stronger rallies.

- On-chain activity surge: 14-day MA of transactions near 540,000 indicates real demand and protocol usage.

- Watch volume and momentum: Sustained buying and higher volume are needed to reach $120,000.

Conclusion

Bitcoin rally conditions are improving: long-term holders returning to profit and a clear uptick in network usage strengthen the bullish case. Nevertheless, traders and investors should watch volume and momentum indicators closely. COINOTAG will continue to monitor on-chain and chart-based signals as the market evolves.