- Dogecoin shows renewed bullish momentum as open interest rises, signaling fresh long positions and potential continuation above the $0.267 mark.

- Hedera faces repeated resistance near $0.246, with declining momentum and negative volume dominance highlighting stronger selling pressure.

- Ethereum maintains stability around $4,489, supported by balanced trading activity and a bullish crossover on momentum indicators.

Altcoin markets showed mixed conditions as Dogecoin, Ethereum, and Hedera exhibited different price behaviors in short-term perpetual contract trading. Dogecoin highlighted recovery momentum, Ethereum demonstrated relative stability, and Hedera struggled with repeated resistance. Together, these movements underscored varied sentiment across the broader crypto market landscape.

Dogecoin Shows Renewed Strength

Dogecoin traded near $0.2678, reflecting multiple intraday swings before staging a strong rally late in the session. The token rebounded from lows near $0.263 and touched almost $0.269, signaling sharp volatility. Buy and sell volume data indicated stronger green bars during the rally, supported by rising open interest.

Source: Coinalyze

The increase in open interest suggested new long positions entered the market, adding weight to the upward move. Gradual build-up in demand pointed to growing confidence despite earlier sell-offs. Sustaining gains above $0.267 would allow Dogecoin to challenge $0.270 in the short term.

The Aroon indicator highlighted a climb in bullish momentum as the Aroon Up line advanced. This signal suggested continuation potential if buying pressure holds steady. However, a slip back toward $0.265 would test support strength and threaten the momentum.

Hedera Encounters Selling Pressure

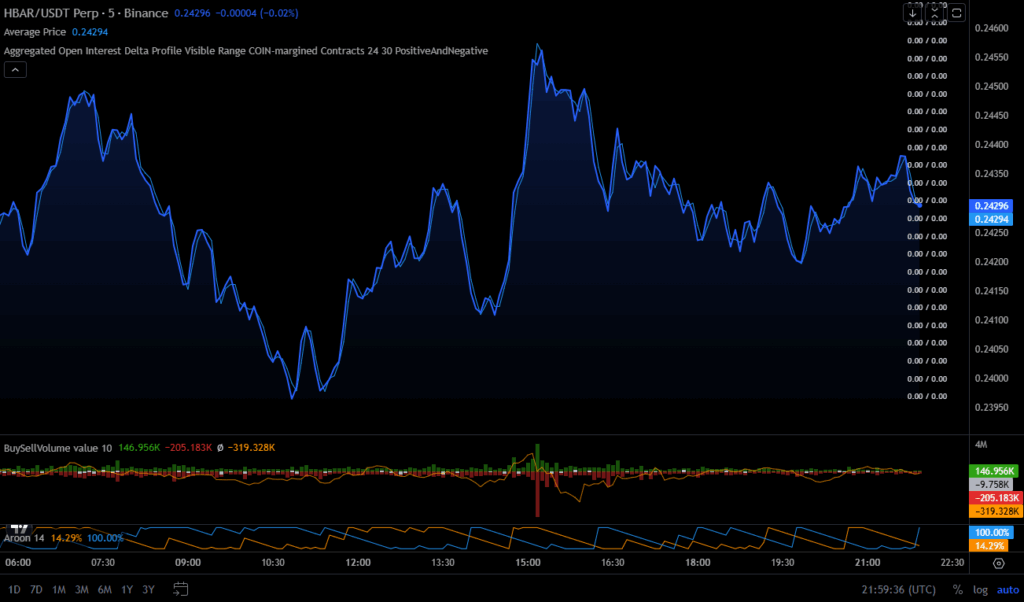

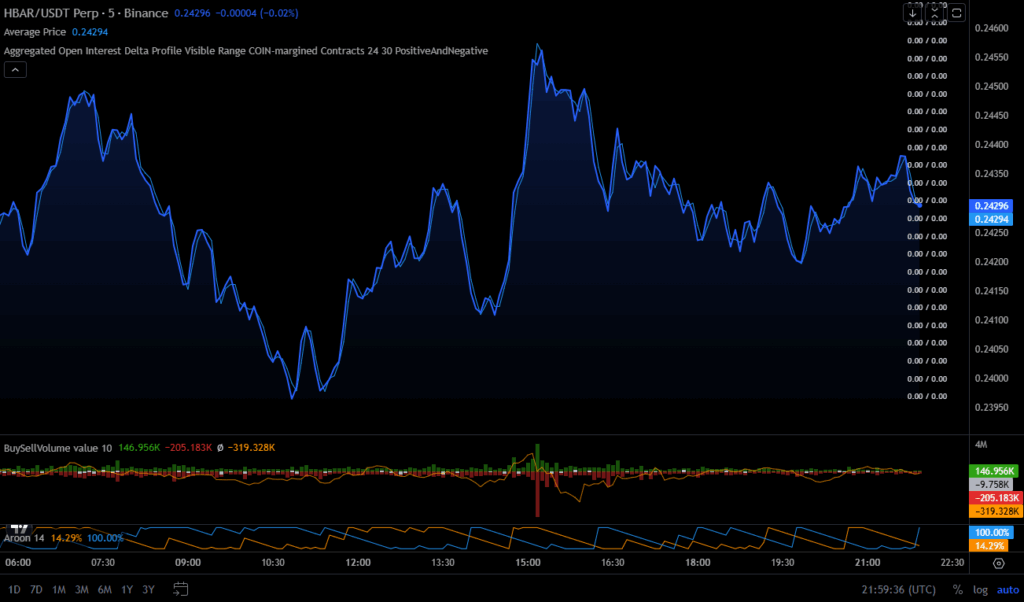

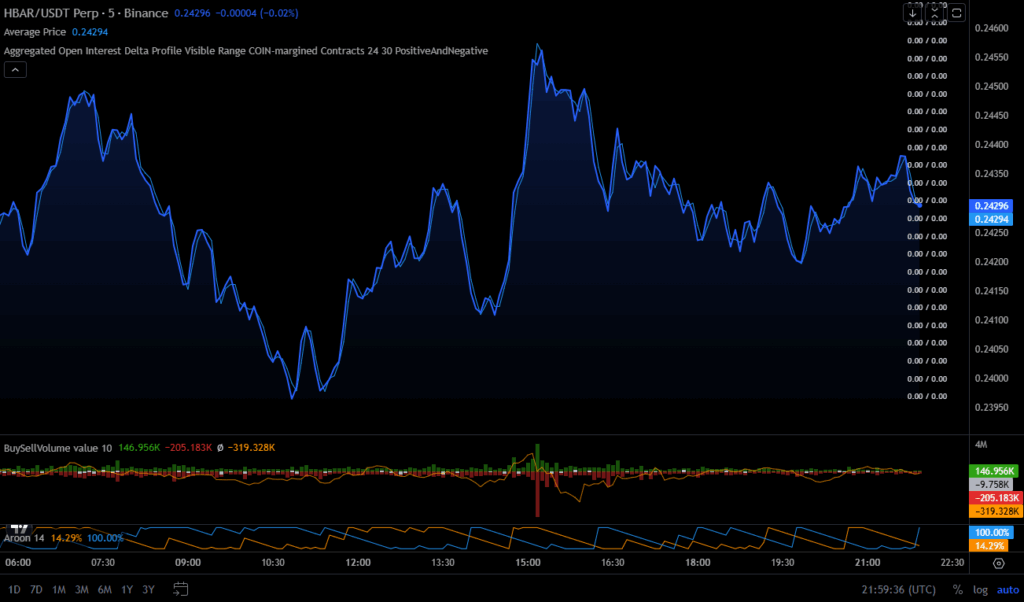

Hedera traded around $0.2429 and recorded sharp intraday movements marked by rallies and immediate pullbacks. Price action showed two strong attempts toward $0.246, but sellers capped both surges. This resistance zone confirmed heavy supply near that level.

Source: Coinalyze

Volume data showed a dominance of red bars, reflecting stronger selling despite brief green bursts. Net volume remained negative, indicating that sellers controlled the broader direction. Weakening momentum supported the view of short-term downward pressure.

The Aroon indicator revealed high bullish readings early in the session, but these levels declined as selling pressure persisted. With fading upward signals, Hedera’s resistance at $0.246 remains firm. Maintaining support at $0.240 will be crucial to avoid a deeper decline.

Ethereum Retains Stability

Ethereum traded near $4,489, maintaining stability across multiple intraday swings. The token pushed above $4,500 during a mid-session rally but later pulled back slightly. Despite the retracement, Ethereum stabilized close to its earlier gains.

Source: Coinalyze

Volume activity appeared balanced compared with Dogecoin and Hedera, as buy and sell activity remained near equilibrium. Liquidation data showed limited forced selling, highlighting relative stability in Ethereum’s futures market. This steadiness reflected controlled market conditions.

The Aroon indicator showed a bullish crossover, with the Aroon Up line sustaining elevated levels. This trend pointed toward continuation potential if the price holds key levels. Ethereum faces resistance at $4,520, while support at $4,460 will define near-term direction.

Market Outlook

Overall, Dogecoin demonstrated recovery momentum, Hedera remained under selling pressure, and Ethereum displayed relative resilience. These differing conditions reflected split sentiment across the crypto market. Altcoin prospects now hinge on short-term breakouts or breakdowns from defined resistance and support zones.