Bitcoin (BTC) is on track for a third consecutive “green” September, a trend that has historically set the stage for a “double-digit” October rally.

With gains for the month currently hovering around 8%, analysts are watching to see if this pattern, dubbed “Uptober”, will repeat itself.

Look Out for the Double-digit October

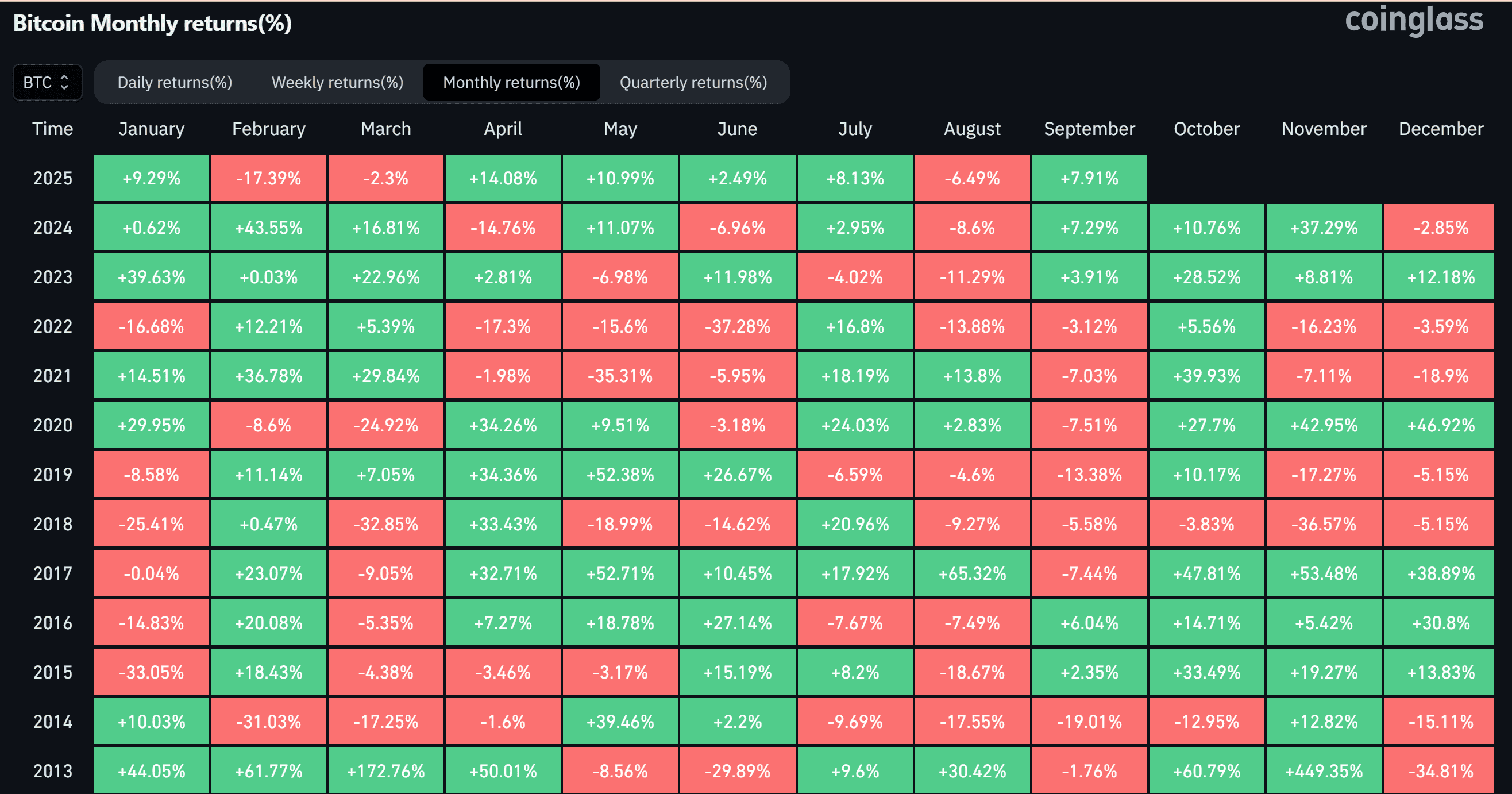

Analysts are watching BTC closely this month, noting that in past years, every September with an upward trend has been followed by double-digit gains in October. For example, in 2024, the asset recorded a +7.29% increase in September, which was followed by a +10.76% rise the next month. In 2023, it gained +3.91% during the same period and was followed by a +28.52% jump in October, as shown below:

BTCUSD monthly returns. Source: CoinGlass

BTCUSD monthly returns. Source: CoinGlass

This consistent trend has led experts to believe that traders and investors could be positioning their portfolios to anticipate a rally, which may result in a self-fulfilling prophecy. As institutional and retail money pours in, the heightened buying pressure creates the very surge they were predicting, amplifying the “Uptober” narrative and making it a key part of the market’s psychology.

The April 2024 Bitcoin halving, which slashed the reward for mining new blocks by 50%, has created a supply shock. Historically, the year following a halving has been a powerful growth period. The “Uptober” rally fits into this broader cycle, as the reduced supply meets sustained demand.

Past data provide evidence of this trend. For instance, the 2016 halving was followed by a landmark bull run in 2017, where BTC’s price surged from a few hundred dollars to nearly $20,000. Similarly, the 2020 halving was the precursor to a historic surge in 2021, when the cryptocurrency’s price skyrocketed from around $10,000 to a peak near $69,000 by November.

Macroeconomic Policy and Institutional Adoption

Following months of economic uncertainty, recent actions by central banks, including a rate cut by the Federal Reserve in September 2025, have injected a sense of confidence into riskier assets. The recent reduction by 25 BPS saw the flagship cryptocurrency’s price rally to $118 K.

Additionally, recent shifts in U.S. government policy are seen as a bullish sign. The Trump administration has taken a pro-crypto stance, with the creation of a Strategic Bitcoin Reserve in March 2025.

The continued growth of spot Bitcoin ETFs, particularly in the United States, has also become a major driver of demand. Recent data highlights this trend. In the first half of September, these investment products saw their largest weekly inflows since July, with some funds accumulating hundreds of millions of dollars in a single day.

Institutional demand is said to be outpacing the pace of new BTC supply coming from mining. The combined holdings of US-listed ETFs have now crossed 1.3 million BTC, showing the adoption by large investors and its impact on market dynamics.