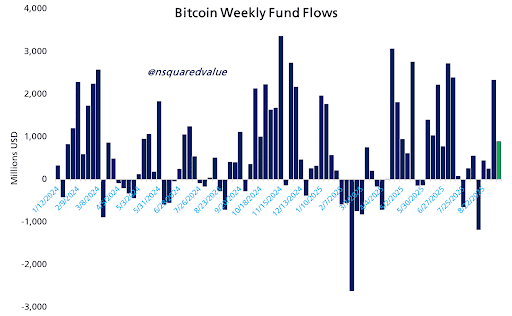

Bitcoin ETF inflows rose by $900M last week, signaling renewed institutional demand that historically correlates with short-term price gains; monitoring weekly ETF fund flows offers a timely indicator for Bitcoin momentum and tactical exposure management.

-

Institutional demand surged with $900M in weekly Bitcoin ETF inflows.

-

Analyst Timothy Peterson finds ETF fund flows can reliably predict short-term Bitcoin returns.

-

Weekly inflow peaks exceeded $3B in recovery weeks; average monthly gains rose from 3.8% to 8.0% under flow-following strategies.

Bitcoin ETF inflows surged $900M last week, signaling institutional demand and potential gains—read how flows predict returns and what investors can do next.

Bitcoin ETF inflows of $900M boost confidence as Timothy Peterson shows flows can predict price moves and strengthen crypto’s market outlook

Bitcoin attracted $900 million into US ETFs last week, reflecting renewed institutional demand and a stronger near-term outlook. According to analyst Timothy Peterson, ETF fund flows are a timely predictor of Bitcoin’s short-term returns; investors increasingly use weekly flow patterns to manage tactical exposure.

What are Bitcoin ETF inflows and why do they matter?

Bitcoin ETF inflows are net purchases into exchange-traded funds that hold Bitcoin exposure. These inflows indicate institutional demand and can create sustained buying pressure that often precedes short-term price appreciation, making flows a practical market signal for traders and asset allocators.

How do ETF fund flows predict Bitcoin returns?

Timothy Peterson’s analysis on X demonstrates that weeks with strong ETF inflows often precede higher short-term returns. His research shows average monthly gains improving from 3.8% to 8.0% when investors follow inflow signals. The correlation is not perfect but is statistically meaningful for tactical strategies.

How did ETF flow patterns evolve through 2024–2025?

Patterns in 2024 showed substantial weekly inflow peaks in early months, with January–February reaching near $2.5 billion. Momentum continued through March above $2.0 billion before moderating in April. Mixed positive and negative weeks in mid-2024 reflected investor caution.

Where is the supporting chart and data?

The chart accompanying Peterson’s post highlights weekly inflows and outflows across 2024 and 2025, documenting peaks above $3.4 billion and significant outflows exceeding $2.5 billion in early 2025. Source attribution: Timothy Peterson (posted on X). No external links are provided.

What happened in 2025: volatility and recovery?

2025 began with sharp outflows in January–February, led by institutional repositioning and liquidity shifts. The market rebounded in March–April with weekly inflows topping $3.0 billion, followed by robust levels through May. June–July were steady, and August showed renewed inflow strength indicating resilient confidence.

How should investors use ETF flows tactically?

Use a flow-based rule set: monitor rolling weekly inflows, set exposure thresholds, and align position sizing with inflow momentum. ETF flows are one input among macro, on-chain, and funding-rate indicators; they are most effective when combined within a disciplined risk framework.

Frequently Asked Questions

Can ETF inflows cause immediate price moves?

Yes. Large, sustained ETF inflows can create buying pressure that translates into near-term price appreciation, especially in low-liquidity windows. ETF inflows are one of several drivers that can accelerate momentum.

How reliable are flows as a trading signal?

Flows are a statistically useful indicator but not infallible. Peterson’s research shows improved average returns when following inflows, but investors should pair flows with risk controls and confirmatory signals before adjusting positions.

Key Takeaways

- ETF flows matter: Strong weekly inflows signal institutional demand and can precede short-term Bitcoin gains.

- Proven correlation: Research by Timothy Peterson shows average monthly returns may double under inflow-led strategies.

- Use tactically: Combine flows with on-chain and macro indicators and apply position sizing and stop rules.

Conclusion

Bitcoin ETF inflows have re-emerged as a core short-term momentum signal for institutional and tactical investors. With weekly inflows rising and documented correlations to returns, flows offer actionable insight for portfolio managers and traders. Monitor inflow trends and integrate them into a disciplined strategy to navigate ongoing volatility.

Patterns in Bitcoin ETF Flows

Timothy presented a chart that shows significant inflows in early 2024, with weekly peaks between January and February close to $2,500 million. Additionally, March continued to pick up steam, with steady activity above $2,000 million.

Source: Timothy Peterson

Weekly data dropped between $500 million and $1,000 million in April 2024, indicating a decline in inflows. This milder trend persisted in May and June, indicating market hesitancy. Mixed flows in July and August suggested increased uncertainty. Momentum resumed in September 2024 and peaked with a $3,400 million week in late 2024.

Volatility and Recovery in 2025

January and February 2025 reversed sharply, with the largest outflow exceeding $2,500 million, driven by institutional repositioning. March and April quickly recovered with inflows topping $3,000 million. May recorded robust levels between $2,500 and $3,000 million, while June–July held steady and August showed renewed positive bars.

Bitcoin ETF flows are influencing short-term price direction and institutional confidence. Tracking weekly inflows gives investors an evidence-based tool to adjust exposure and manage risk amid volatility.