Date: Sun, Sept 21, 2025 | 06:54 AM GMT

The cryptocurrency market is undergoing a slight retracement after the initial Fed-driven surge, with Bitcoin (BTC) and Ethereum (ETH) both trading flat now. However, several altcoins are flashing bullish setups — and among them is dYdX (DYDX).

DYDX has already surged by an impressive 10%, but the chart is suggesting a much bigger development — a bullish rounding bottom formation that could set the stage for further gains in the coming sessions.

Source: Coinmarketcap

Source: Coinmarketcap

Rounding Bottom in Play?

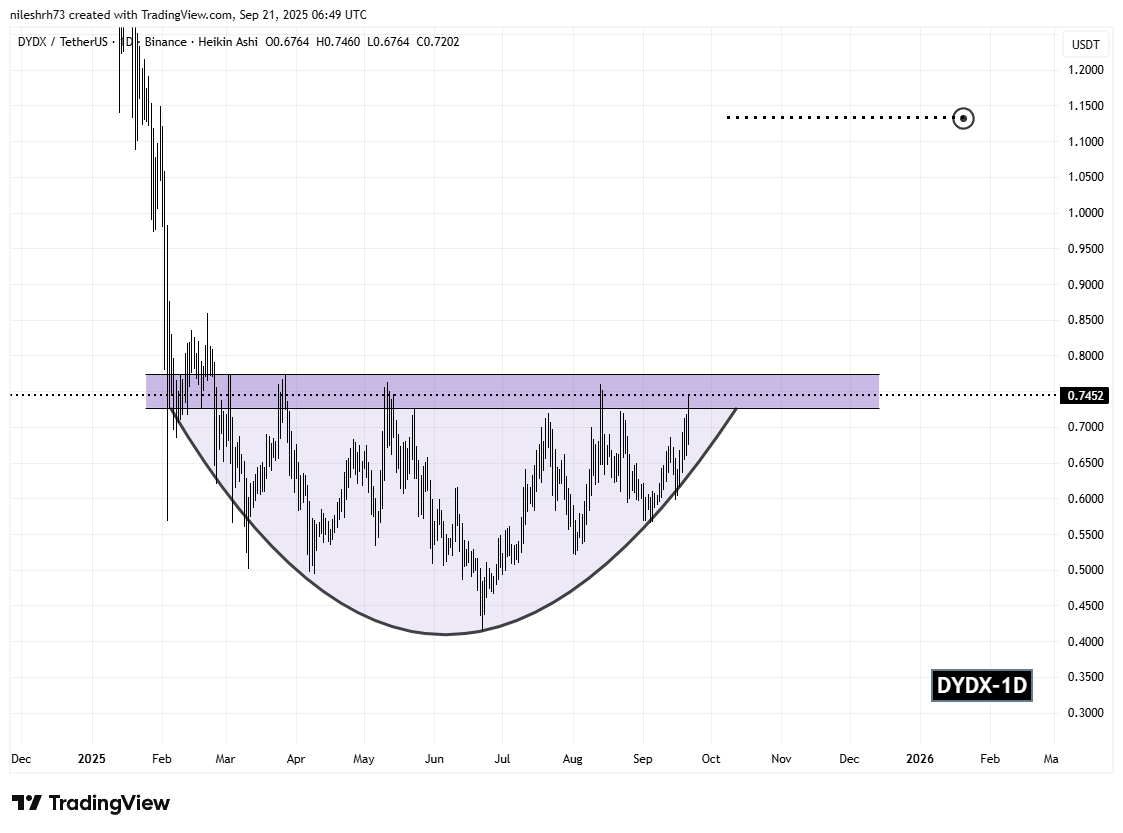

On the daily chart, DYDX is shaping a rounding bottom , a classic bullish reversal pattern that often marks the end of a prolonged downtrend and the start of accumulation before a stronger rally.

The formation began earlier this year when DYDX faced rejection from $0.7738 in February 2025, triggering a sharp correction toward $0.4136. That zone marked the bottom of the curve, where strong demand stepped in. Since then, DYDX has gradually carved higher lows, creating the smooth curvature of the rounding bottom.

dYdX (DYDX) Daily Chart/Coinsprobe (Source: Tradingview)

dYdX (DYDX) Daily Chart/Coinsprobe (Source: Tradingview)

Currently, DYDX is trading near $0.7452, pressing into the neckline resistance zone between $0.7250 and $0.7738. This area is crucial as it represents the final barrier that bulls must clear for confirmation of the reversal.

What’s Next for DYDX?

If DYDX decisively breaks above $0.7738, the rounding bottom setup would be confirmed , opening the path for higher levels. The initial upside target sits near $0.8597, while the full breakout projection points toward $1.1340, representing an upside potential of nearly 51% from current prices.

That said, traders should also keep an eye on possible short-term pullbacks. A dip back toward the rounding support line before the breakout cannot be ruled out.