Whale Movements and Fed Rate Cuts: What’s Next for XRP Price?

XRP price is under pressure after two massive whale transactions totaling over $812.6 million shook investor confidence. At the same time, macro factors like the Federal Reserve’s rate cut and crypto market crash have added another layer of volatility, leaving XRP traders questioning whether the current dip is just a pullback or the start of a deeper correction.

XRP Price Prediction: Whale Transactions Create Shockwaves

On-chain data flagged two unusually large XRP transfers: 135.54 million tokens worth $397 million and 141.81 million tokens worth $415 million, both between unknown wallets. Such movements typically raise speculation about potential sell-offs, especially when combined with visible price weakness.

Historically, large undisclosed wallet-to-wallet transfers often precede heightened volatility, as traders brace for possible liquidity shocks.

The Macro Trigger: Fed Rate Cuts

The Fed’s 0.25% rate cut was initially a bullish spark for risk assets, including cryptocurrencies. However, the rally was short-lived. Traders quickly sold the news, shifting focus toward future catalysts rather than the cut itself. With Stephen Miran, a Trump appointee, advocating for even deeper cuts, uncertainty around Fed leadership and policy trajectory is now in play. For XRP price, this creates a conflicting setup: macro tailwinds support upside, but investor behavior signals caution until new drivers emerge.

XRP Price Prediction: Breakdown at a Critical Level

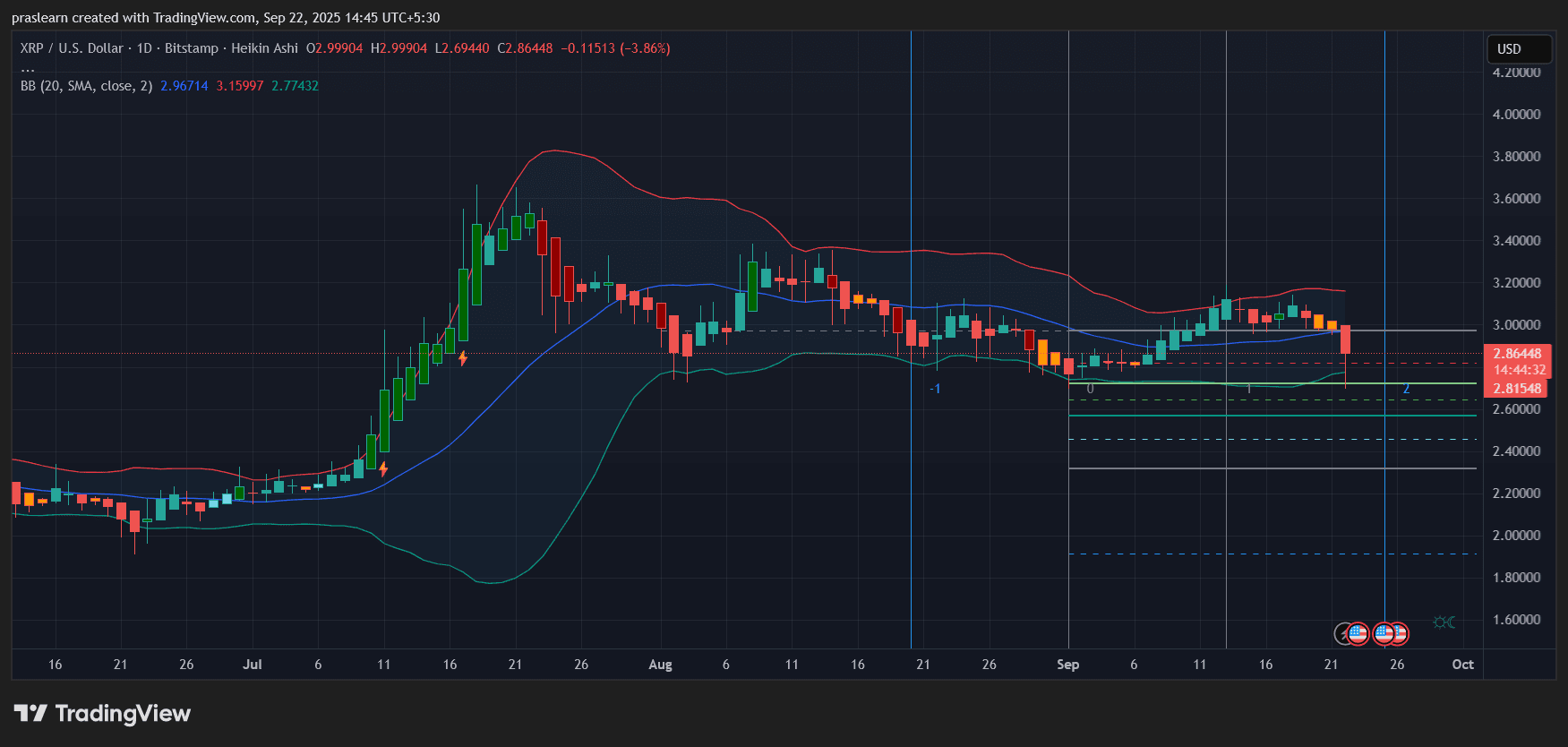

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

Looking at the daily XRP/USD chart, several technical signals stand out:

- XRP Price is currently trading around 2.86, slipping below the mid-Bollinger Band near 2.96, which has now turned into resistance.

- The candle structure shows strong bearish momentum, with today’s move confirming a break under short-term support.

- If the sell-off continues, the next support levels are visible around 2.81, followed by deeper levels near 2.60 and 2.40, marked by horizontal demand zones and Bollinger Band lows.

On the upside, XRP price needs to reclaim the 2.96–3.00 region quickly to avoid further downside pressure. Only a sustained close above 3.15 would bring bullish momentum back into play.

Investor Sentiment and Near-Term Outlook

The combination of whale transfers and post-Fed profit-taking has created a negative feedback loop in XRP’s short-term trajectory. Traders are not just watching technicals but also waiting for renewed catalysts—be it regulatory clarity, institutional inflows, or macroeconomic developments. Until then, every large on-chain transfer could amplify fear of heavy selling.

XRP Price Prediction: Consolidation or Deeper Correction?

In the immediate term, XRP price is likely to retest the 2.80–2.60 support zone . A bounce from there would fit the pattern of consolidation within the broader 2.60–3.20 channel. However, if selling accelerates and price breaks under 2.60, XRP could slide toward 2.40 before finding stability. Conversely, reclaiming 3.00 swiftly would invalidate the bearish setup and reopen the path toward 3.20–3.40.

$XRP is caught between whale-driven uncertainty and macroeconomic shifts that could either fuel a rebound or deepen the decline. Traders should watch the 2.80–2.60 zone closely, as this level will decide whether XRP consolidates or breaks lower in the coming sessions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether financial analysis: Needs an additional $4.5 billion in reserves to maintain stability

If a stricter and fully punitive approach is applied to $BTC, the capital shortfall could range from 1.25 billion to 2.5 billion USD.

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?