Bitcoin dominance has climbed to about 57.5%, signaling a possible end to the recent altcoin rotation as Ethereum’s volume share fades and capital shifts back toward Bitcoin, which may reclaim market leadership if dominance holds above resistance zones.

-

Bitcoin dominance near 57.5% suggests altcoin momentum is weakening.

-

Ethereum’s trading volume share has dropped while capital moved into smaller tokens.

-

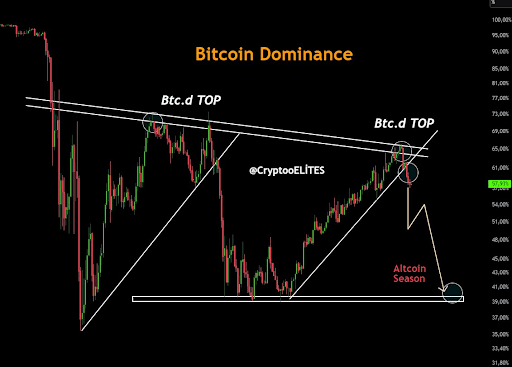

CryptoQuant and CryptoELITES charts and on-chain flows show rotation exhaustion and rising BTC market share.

Bitcoin dominance near 57.5% signals altcoin rotation cooling; read expert analysis and prepare trading strategies — stay informed with COINOTAG coverage.

What is Bitcoin dominance and why does it matter now?

Bitcoin dominance is the percentage share of Bitcoin’s market capitalization relative to the total crypto market. It matters now because dominance at ~57.5% often marks resistance that can precede a shift in market leadership, indicating capital may consolidate into Bitcoin as altcoin momentum fades.

How is the altcoin rotation changing market structure?

Altcoin rotation began when Ethereum’s rally shared volume with smaller tokens, extending the cycle. Data from CryptoQuant shows Ethereum’s trading volume share declined while flows moved into mid- and small-cap altcoins. Analyst mignoletkr observed the rotation “lasted longer than expected,” and CryptoELITES charts highlight cyclical tops and an “Altcoin Season” zone at lower BTC dominance.

Altcoin rally shows signs of exhaustion as Ethereum fades and Bitcoin’s dominance nears 57.5%, hinting at a shift in market leadership.

- Ethereum’s volume share is fading as altcoin momentum cools, while Bitcoin’s growing dominance signals a potential market shift.

- Bitcoin holding near 57.5% dominance shows altcoin strength may be running out of steam, pushing traders to rethink positioning.

- The long rotation into smaller tokens looks tired, and Bitcoin could soon reclaim leadership as sentiment steadies.

Altcoin traders now face a critical turning point as rotation patterns stretch longer than expected. CryptoQuant notes Ethereum once held greater share after Bitcoin’s sideways period, but that activity spread across numerous altcoins.

This wider rotation has begun to fade, signaling a possible shift in market sentiment. Bitcoin’s price action remains rangebound, and the asset has yet to demonstrate a convincing breakout despite rate-cut speculation and other macro hopes.

CryptoQuant highlighted that Ethereum’s rally eventually lost steam as its trading volume share dropped. Capital then flowed into smaller altcoins, extending the rotation cycle beyond typical durations.

At the same time, Ethereum withdrawals have emerged, reinforcing cautious signals across on-chain indicators. Analyst mignoletkr commented: “The altcoin rotation has lasted longer than expected, and this pattern has clearly emerged.”

Why has Bitcoin dominance reached key levels?

CryptoELITES expanded this view, showing dominance moved from near 35% up to above 70% in earlier cycles, then stabilized between 40%–45% before the current recovery. The recent climb toward 57.5% places BTC.D near historical resistance that often marks reversal zones.

Source: CryptoELITES

Source: CryptoELITES

Charts identify an “Altcoin Season” zone at lower BTC dominance, which corresponds to periods when alternative tokens typically outperform Bitcoin. The inverse relationship between dominance and altcoin outperformance explains why a rising BTC.D can cool altcoin rallies.

Frequently Asked Questions

How likely is Bitcoin to reclaim leadership from altcoins?

Technical signals and on-chain flows suggest a realistic chance for Bitcoin to reclaim leadership if dominance holds above resistance and ETH volume shares do not recover. Traders should watch confirmation on daily charts and volume trends.

What indicators should traders monitor for confirmation?

Focus on BTC dominance, exchange netflows, Ethereum trading volume share, and on-chain withdrawal activity. Consistent BTC inflows and falling altcoin volumes are reliable early signals.

Key Takeaways

- Dominance signal: Bitcoin near 57.5% signals potential end to the recent altcoin rotation.

- Volume dynamics: Ethereum’s faded volume share and increased withdrawals reinforce rotation exhaustion.

- Trader action: Monitor BTC.D and on-chain flows; consider rebalancing risk away from small-cap altcoins if trends persist.

Conclusion

Bitcoin dominance approaching 57.5% and falling Ethereum volume shares indicate the altcoin rally is showing early signs of exhaustion. Investors and traders should monitor BTC dominance, exchange and on-chain flows, and volume metrics to confirm whether market leadership shifts back to Bitcoin. COINOTAG will continue to report updates and analysis as conditions evolve.