Avalanche treasury is a corporate strategy to accumulate and operate AVAX as a core asset. AVAX One (formerly AgriFORCE) aims to raise $550M and accumulate $700M in AVAX, using staking and fintech acquisitions to generate predictable yield and on-chain revenue.

-

Company pivot: AgriFORCE rebrands to AVAX One to build an Avalanche treasury

-

Planned $550M raise includes a $300M PIPE and $250M equity-linked instruments

-

Targeting ~22M AVAX at $31.76; staking APY ~6.7% could yield ~$46.9M annually

Avalanche treasury: AVAX One plans to amass $700M in AVAX via a $550M raise; read key details and implications for staking yield and institutional backing.

By COINOTAG — Published 2025-09-22 — Updated 2025-09-22

What is Avalanche’s new treasury strategy?

Avalanche treasury refers to AVAX One’s plan to centralize assets in AVAX tokens and operate those assets actively through staking and fintech integrations. The model seeks predictable on-chain revenue rather than passive holdings, targeting $700 million in AVAX and using staking yields plus acquired revenue streams to support operations.

How will AVAX One fund and build its AVAX treasury?

AVAX One (formerly AgriFORCE Growing Systems) plans a multi-stage capital raise totaling $550 million: a $300 million PIPE subject to shareholder approval and $250 million via equity-linked instruments. Hivemind Capital is leading the raise, with institutional and crypto-native backers participating. The company aims to convert proceeds into AVAX and acquire revenue-generating fintech businesses to integrate on Avalanche.

The target accumulation—more than $700 million in AVAX—translates to roughly 22 million AVAX at an AVAX price of $31.76 (CoinGecko). At an approximate staking APY of 6.7%, such a treasury could produce an estimated $46.9 million in annual staking rewards before fees and operational costs.

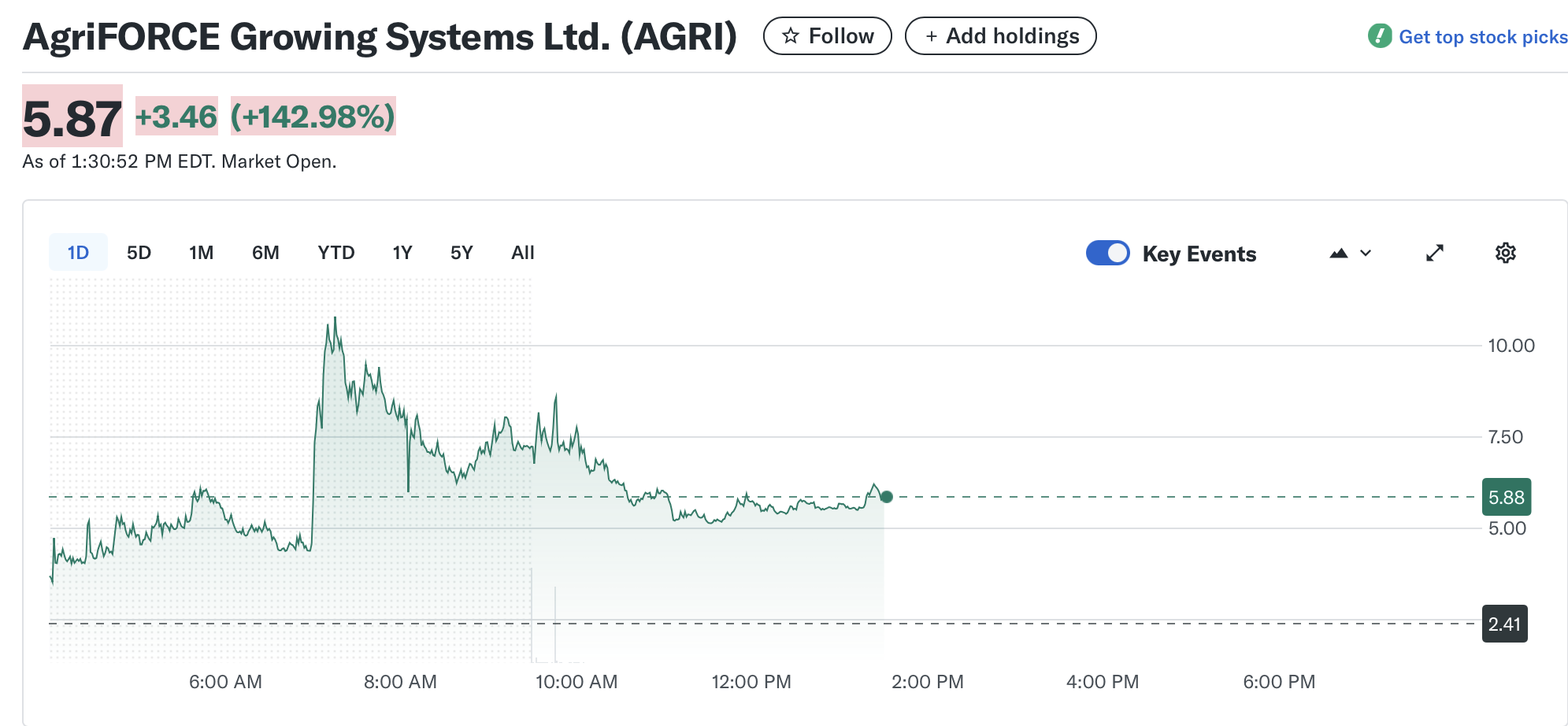

AgriFORCE intraday performance. Source: Yahoo Finance

Why choose Avalanche and how does staking factor into returns?

AVAX One’s leadership cited Avalanche’s focus on on-chain finance and partnerships as decisive. Staking is central: locking AVAX secures the network and generates yield, which AVAX One projects will make the treasury operationally profitable from inception.

Using conservative estimates, a $700M AVAX position earning 6.7% APY could yield ~6.7% annually in staking rewards. That yield can be reinvested or used to fund acquisitions, payroll, and operational growth while preserving principal exposure to AVAX appreciation or depreciation.

From gaming to ETFs, how is Avalanche growing?

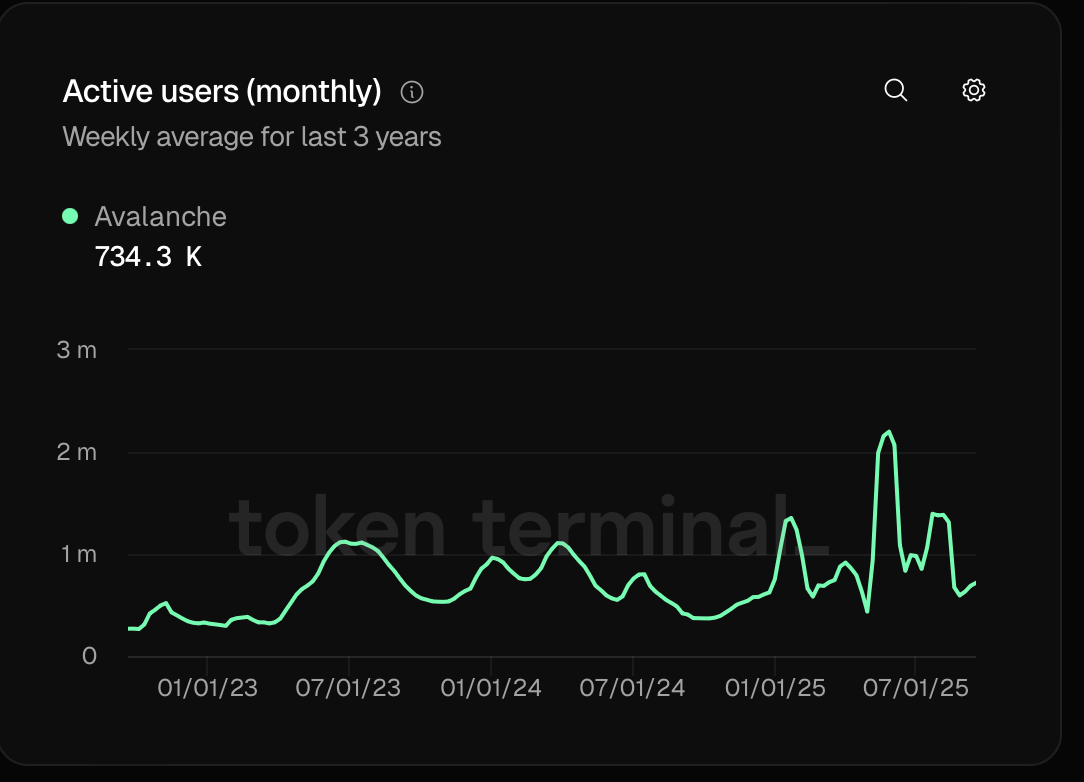

Avalanche is an open-source blockchain designed for smart contracts and DeFi. Recent growth vectors include Web3 gaming (e.g., MapleStory Universe) and institutional products like exchange-traded products and ETF filings. On-chain activity spiked: Avalanche reported significant transaction growth and user activity in recent weeks, with more than 11.9 million transactions during a high-growth period.

Avalanche monthly active users. Source: TokenTerminal

What market reaction followed the announcement?

Shares of AgriFORCE surged on the news—opening at $7.30 from a $2.41 close—later settling at $5.73, a 137% rise on the trading day (Yahoo Finance). The market response reflects investor appetite for tokenized treasuries and institutional endorsement of AVAX as a strategic reserve asset.

Funding and yield at a glance

| PIPE | $300,000,000 | Subject to shareholder approval |

| Equity-linked instruments | $250,000,000 | Convertible/equity-linked raise |

| AVAX accumulation target | $700,000,000 | ~22M AVAX at $31.76 |

| Estimated staking yield | ~6.7% APY | ~$46.9M annual rewards (pre-costs) |

Frequently Asked Questions

How many AVAX tokens would a $700M treasury hold?

At an AVAX price of $31.76, $700 million equates to roughly 22 million AVAX tokens. That calculation is a snapshot based on the quoted price and will change with market movement.

Will staking make the treasury profitable immediately?

Staking provides recurring yield; at ~6.7% APY the projected staking rewards on a $700M position could be around $46.9M annually. Profitability depends on operational costs, validator fees, and how rewards are allocated or reinvested.

Who is backing the raise and what does that signal?

Hivemind Capital is leading the raise, with participation from institutional and crypto-native firms listed as supporters. Institutional involvement signals increasing mainstream interest in tokenized treasuries and AVAX as a strategic reserve asset.

Key Takeaways

- Strategic pivot: AgriFORCE rebrands to AVAX One to build an operational AVAX treasury.

- Funding plan: $550M raise with $300M PIPE and $250M equity-linked instruments to acquire AVAX and fintech businesses.

- Yield mechanics: Staking at ~6.7% APY could generate meaningful recurring revenue, supporting early profitability.

Conclusion

AVAX One’s move creates a new model for corporate treasuries built around native blockchain tokens and active on-chain operations. With institutional backers and a clear staking-led revenue plan, the strategy highlights Avalanche’s expanding role in institutional crypto capital allocation. Monitor capital approvals and AVAX market moves for next steps.