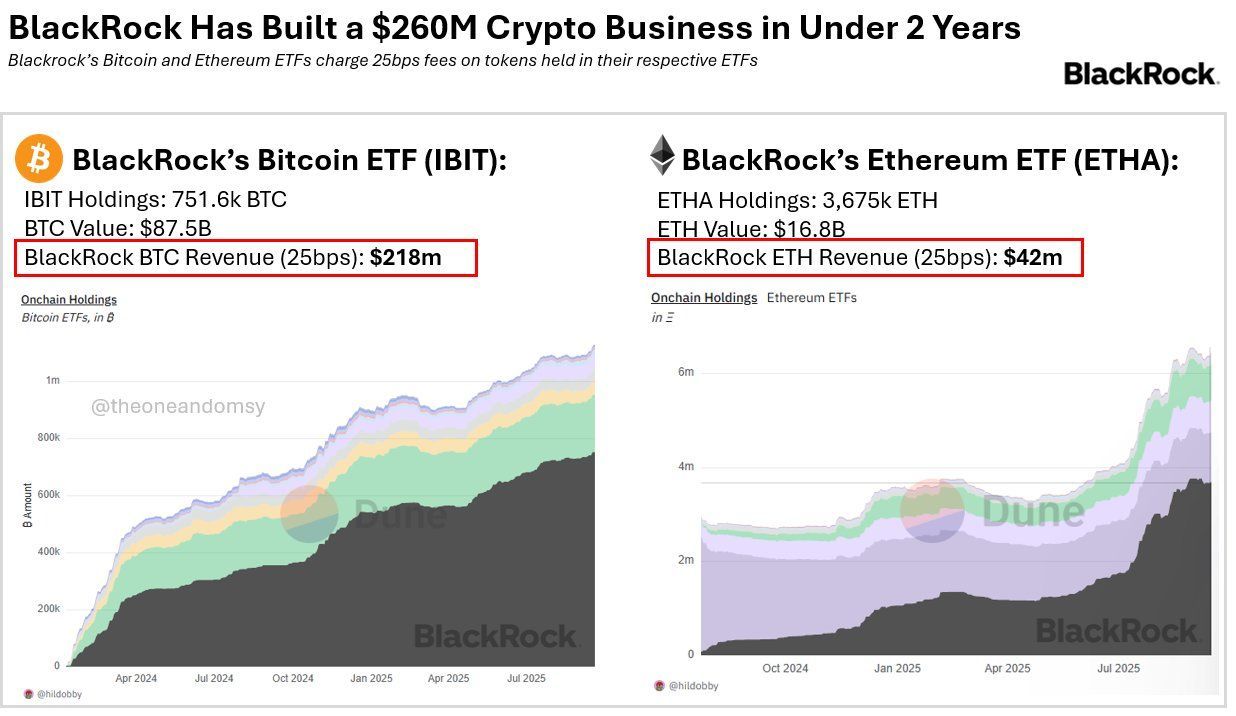

BlackRock’s Bitcoin and Ether ETFs are producing roughly $260 million in annualized revenue — about $218 million from Bitcoin ETFs and $42 million from Ether products — positioning BlackRock’s crypto ETFs as a near-term benchmark for TradFi adoption and institutional inflows.

-

BlackRock’s crypto ETFs generated $260M in annualized revenue.

-

Bitcoin ETFs account for $218M; Ether ETFs contribute $42M.

-

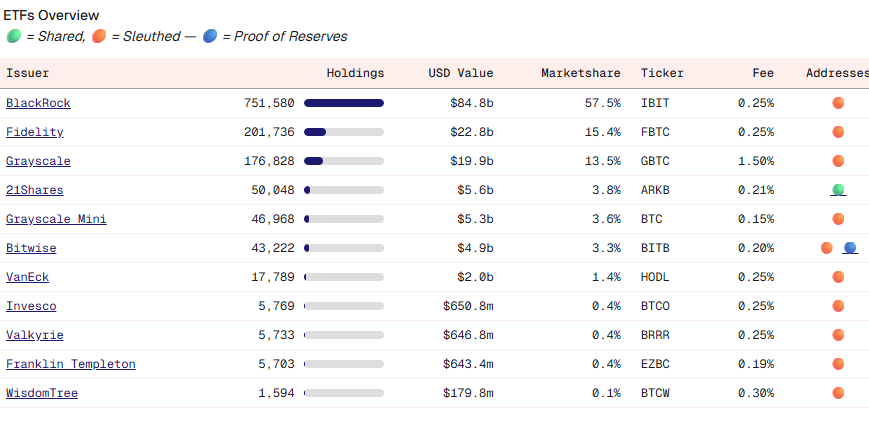

BlackRock’s spot Bitcoin ETF nears $85B AUM and 57.5% U.S. market share.

BlackRock Bitcoin ETF revenue hits $260M annualized; learn why this matters for TradFi adoption — read analysis and next steps.

BlackRock’s Bitcoin and Ether ETFs are generating over a quarter of a billion dollars for the world’s largest asset manager as the next potential adoption “benchmark” for TradFi.

What is BlackRock’s Bitcoin and Ether ETF revenue and why does it matter?

BlackRock’s Bitcoin and Ether ETFs generated approximately $260 million in annualized revenue, with $218 million from Bitcoin ETFs and $42 million from Ether products. This level of profit signals a scalable revenue model that may prompt more traditional asset managers to launch regulated crypto products.

How were these revenue figures calculated and who reported them?

Leon Waidmann, head of research at the Onchain Foundation, shared data showing the revenue split. The numbers combine management fees and trading spreads across BlackRock’s spot Bitcoin and Ether ETF products. These figures were derived from ETF AUM and published fee schedules.

Source: Leon Waidmann

Source: Leon Waidmann

BlackRock’s crypto ETFs have quickly become a material profit center. The firm’s combined ETF revenue is notable for two reasons:

- Scale: Rapid fee income at scale signals product-market fit for regulated crypto ETFs.

- Institutional signal: Profitable ETFs make crypto exposure easier to justify for pension funds and large asset allocators.

How large is BlackRock’s Bitcoin ETF and what market share does it hold?

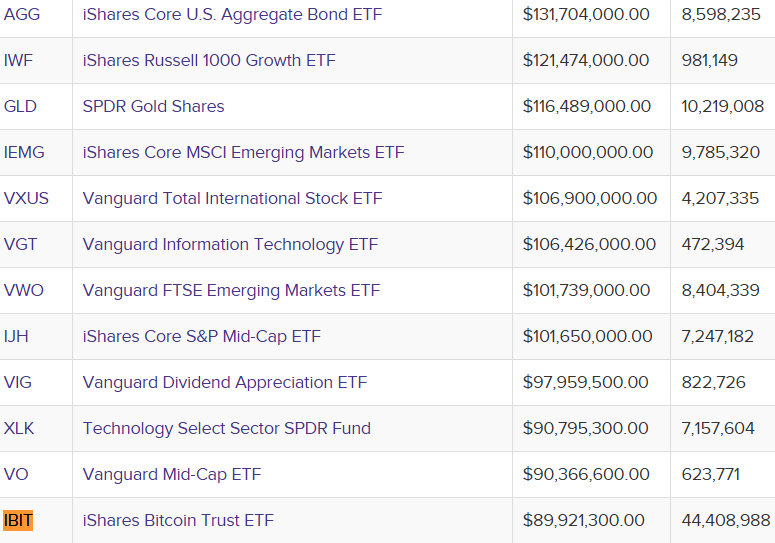

BlackRock’s spot Bitcoin ETF is approaching $85 billion in assets under management (AUM), representing roughly 57.5% of the total U.S. spot Bitcoin ETF market share, according to blockchain and market data sources. The fund’s rapid growth positions it among the largest funds globally.

Bitcoin ETFs by market share. Source: Dune.com

Bitcoin ETFs by market share. Source: Dune.com

By comparison, other major spot Bitcoin ETFs hold materially less AUM, underscoring BlackRock’s dominance in the new product category. Industry data places BlackRock’s fund among the world’s largest ETFs, reflecting fast institutional adoption.

World’s largest ETFs. Source: ETF Database

World’s largest ETFs. Source: ETF Database

Why could BlackRock’s ETF success influence TradFi and retirement plans?

BlackRock’s ETF profitability creates a replicable template for traditional managers. Analysts and asset managers note several pathways for additional flows:

-

– Inclusion of crypto exposure in defined contribution plans and 401(k) products.

– Corporate treasury allocation increases and institutional treasury diversification.

– Competitive launches by other major asset managers seeking fee income and client retention.

Industry commentators, including research heads at asset managers, have suggested that retirement-plan adoption and ETF inflows could materially boost demand for Bitcoin and Ether in the near term.

Frequently Asked Questions

How does BlackRock’s ETF revenue compare to other revenue sources?

BlackRock’s $260M annualized crypto ETF revenue is substantial for a newly launched product line and compares favorably to long-established revenue streams at smaller fintech firms. It demonstrates rapid monetization potential in regulated crypto ETFs.

What could ETF inflows mean for Bitcoin price dynamics?

ETF inflows can provide steady institutional demand that supports price discovery. Analysts cite ETF and corporate treasury inflows as factors that may extend the market cycle beyond historical halving-driven patterns.

How to interpret the BlackRock ETF revenue data?

- Review AUM and published fee rates: Revenue estimates are based on AUM multiplied by management fees and estimated spread income.

- Compare market share: Assess fund AUM versus total market to understand dominance and potential flow sustainability.

- Monitor regulatory and retirement plan adoption: Policy changes and 401(k) inclusion can accelerate inflows.

Key Takeaways

- Revenue scale: BlackRock’s Bitcoin and Ether ETFs generated about $260M annualized, evidencing profitable crypto product demand.

- Market dominance: The spot Bitcoin ETF is near $85B AUM and holds a majority U.S. market share.

- Industry impact: Profitable ETFs act as a benchmark for other TradFi firms and could catalyze broader institutional and retirement-plan adoption.

Conclusion

BlackRock’s early success with Bitcoin and Ether ETFs — producing roughly $260 million in annualized revenue — demonstrates a viable, high-scale revenue model for regulated crypto products. This performance strengthens the case for broader TradFi participation and could accelerate institutional and retirement-plan allocations into digital assets. Monitor ETF AUM, fee structures, and retirement-plan developments for next-stage adoption signals.