Fed spokesperson: Powell believes interest rates are still tight, which may open up space for further rate cuts

"Fed Whisperer" Nick Timiraos' latest article: Federal Reserve Chairman Powell said that even after last week's rate cut, he still believes the Fed's interest rate stance is "still slightly tight," which means that if officials continue to judge that recent labor market weakness outweighs inflation setbacks, there is still room for more rate cuts this year. Powell largely reiterated his views at the press conference after last week's rate cut. He emphasized the challenges the Fed faces in achieving its two main goals of maintaining low inflation stability and promoting a healthy labor market. Powell said, "Two-way risks mean there is no risk-free path, excessive and rapid rate cuts may continue to push inflation closer to 3% rather than the Fed's target of 2%, and maintaining a restrictive policy stance for too long may unnecessarily weaken the labor market." Powell also reiterated his view that the slowdown in summer job growth this year necessitated more focus on the labor market in last week's policy shift than earlier this year. The slightly tight interest rate setting puts the Fed in a favorable position to address potential economic developments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The strengthening of the Chinese yuan may support bitcoin prices

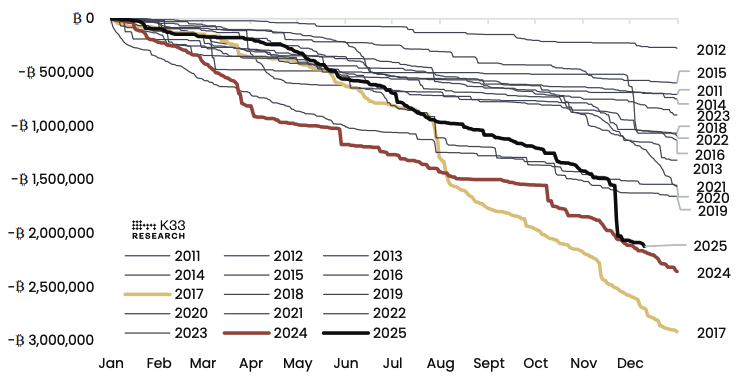

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX