Banks Invest in Fnality's Blockchain to Shape the Future of Financial Infrastructure

- Fnality secures $136M Series C led by WisdomTree, Bank of America, and Citi to expand blockchain-based wholesale payment systems. - Platform enables real-time, secure tokenized asset settlements using DLT, with £FnPS already operational and USD/euro expansions pending. - Investors highlight its role in modernizing finance by bridging traditional markets with tokenized assets through central bank-backed liquidity. - With $280M+ in cumulative funding from 30+ institutions, Fnality aims to standardize cross

Fnality International has secured $136 million in Series C financing, with the round being spearheaded by

Fnality’s solution connects conventional finance with new tokenized markets by settling transactions in digital cash backed by central banks, helping to lower both counterparty and settlement risks Fnality Raises $136 Million in Series C Funding | Fnality [ 1 ]. The platform supports delivery-versus-payment (DvP) for securities, payment-versus-payment (PvP) for FX, and real-time repo operations, allowing institutions to better manage liquidity and streamline operations Fnality Raises $136 Million in Series C Funding | Fnality [ 1 ]. Investors have highlighted the platform’s transformative potential, with Bank of America Co-President Jim DeMare stating the collaboration “accelerates the digitization of institutional markets,” and Citi’s Deepak Mehra noting its importance in providing “innovative solutions for the digital asset landscape” Fnality Raises $136 Million in Series C Funding | Fnality [ 1 ].

This Series C round follows a $95 million Series B in 2023, led by Goldman Sachs and BNP Paribas, and a $67 million Series A in 2019. With total funding now surpassing $280 million, Fnality’s shareholder base includes over 30 leading financial institutions, demonstrating widespread support for its hybrid finance vision Fnality Raises $136 Million in Series C Funding | Fnality [ 1 ]. The company plans to broaden its network to cover more major currencies, develop on-chain processes, and align with tokenization projects like JPMorgan’s Onyx and HSBC’s deposit token pilots. Jonathan Steinberg of WisdomTree called the investment a “critical foundation for tokenized finance,” highlighting the company’s commitment to blockchain-driven innovation Fnality Raises $136 Million in Series C Funding | Fnality [ 1 ].

Industry experts see Fnality’s progress as a sign of growing institutional interest in tokenized assets. By offering a regulated, central bank-supported settlement layer, the platform helps solve liquidity fragmentation and reduces operational risks for both cross-border and tokenized transactions. Its earmarking feature, which lets institutions allocate funds for specific uses, further boosts automation and programmability in financial operations. As tokenized markets continue to grow, Fnality’s infrastructure is set to play a pivotal role in global capital markets, enabling smooth integration between decentralized finance (DeFi) and traditional systems.

This funding round highlights the pressing need to resolve inefficiencies in wholesale payments, which are currently slow, expensive, and require significant capital reserves. Fnality’s DLT-based model eliminates intermediaries through direct, atomic settlements, giving institutions quicker access to liquidity and reducing operational burdens. As regulatory frameworks adapt to digital assets, Fnality’s partnerships with central banks and market operators position it to help shape the next generation of financial market infrastructure Fnality Raises $136 Million in Series C Funding | Fnality [ 1 ]. CEO Michelle Neal commented that the investment speeds up the creation of a “resilient, inclusive, and hybrid future of global finance,” where traditional and tokenized markets work side by side Fnality Raises $136 Million in Series C Funding | Fnality [ 1 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

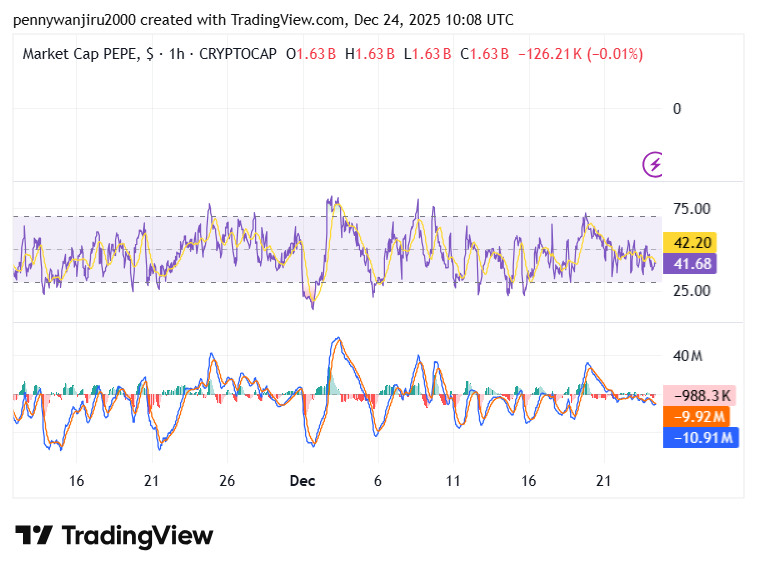

PEPE Price Holds Key Support at $0.053848 as Market Cap Slips 0.20% to $1.63B

Cardano Price Prediction 2026 as Wintermute Warns of Increased Crypto Volatility, Investors Flock to DeepSnitch AI for 100x Returns

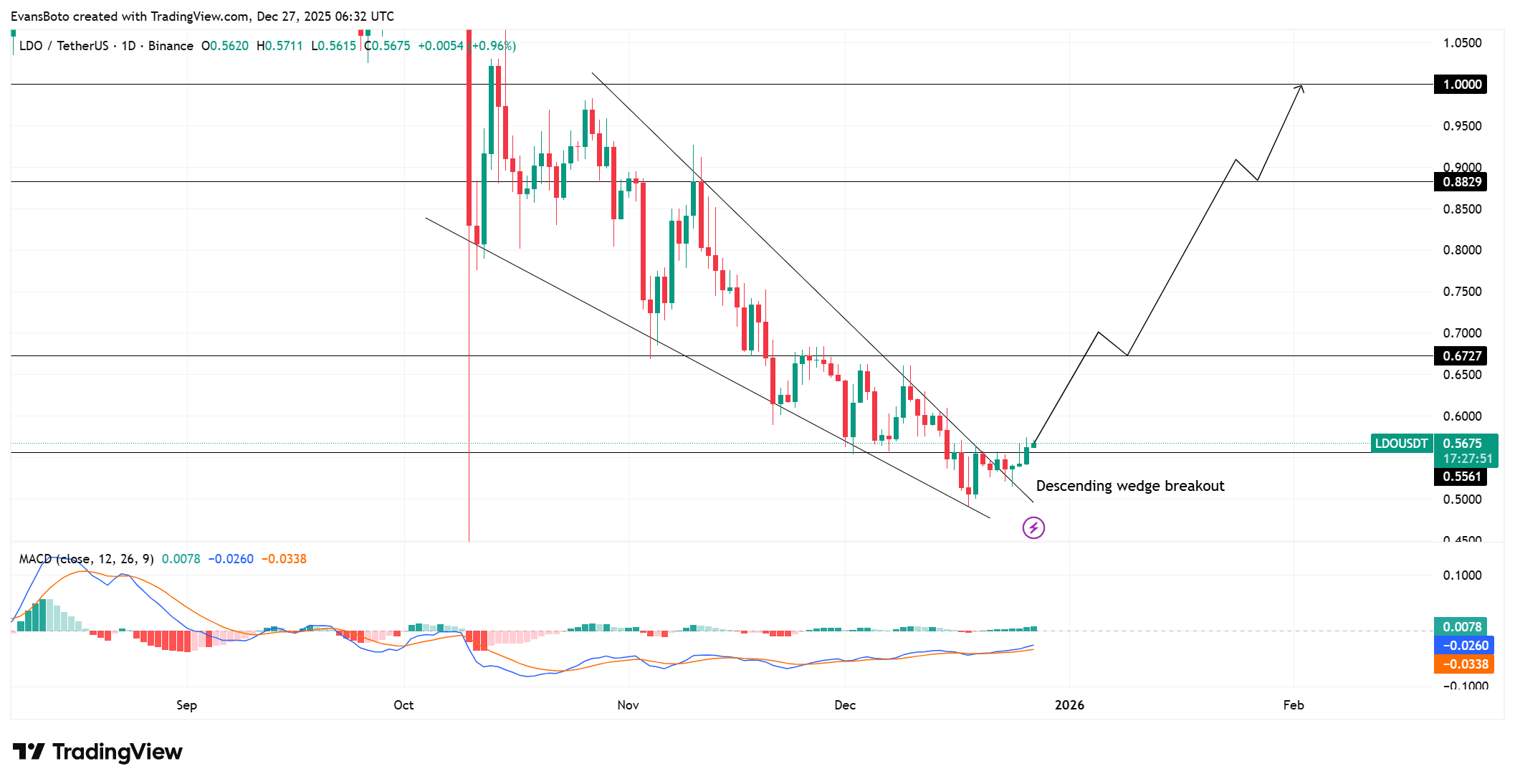

Arthur Hayes goes in on LDO, PENDLE – Is a DeFi rally taking shape?

XRP ETFs Pause Raises Questions About Market Dynamics