Crypto’s Two-Pronged Approach: The Reliability of Hedera and Avalanche Compared to BullZilla’s High-Risk Return Potential

- Hedera (HBAR) and Avalanche (AVAX) show stability with 2.5% and 2.12% 24-hour gains, while BullZilla ($BZIL) targets 9,958% ROI via presale mechanisms. - Hedera’s energy-efficient hashgraph model (10,000 TPS) and corporate governance (Google, IBM) support enterprise adoption and $209M daily trading volume. - Avalanche’s $29.04 price and $3.04B 24-hour volume reflect growth in DeFi and gaming via subnet architecture, with a $176.87B market cap. - BullZilla’s $0.00007908 Stage 3D price and Mutation/Roar Bu

Hedera Hashgraph and

Hedera’s expansion is driven by its governing council, which features international giants such as Google and IBM, and its commitment to scalable, energy-efficient technology. Recent collaborations in supply chain solutions and tokenized carbon credits further demonstrate its practical applications. Avalanche, in contrast, utilizes its subnet framework to support custom blockchain launches, drawing in DeFi and gaming ventures. Its 24-hour trading volume of $3.04 billion and a market cap of $176.87 billion indicate robust interest from both institutions and individual investors.

The differing approaches of these projects underscore the diverse possibilities within the crypto sector. Hedera and Avalanche attract those looking for reliability and business integration, highlighting their potential for substantial returns for those who join early. Analysts observe that their methodical ROI targets and community-focused growth differentiate them from standard meme coins, aligning them with the broader movement toward tokenized ecosystems.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UNI Whales Lock in $23.415M Profit, Exiting Five Months Early Ahead of 100 Million UNI Burn

Memecoin Dominance Hits All-Time Lows: 5 High-Risk Coins That Could Lead the Next Speculative Rebound

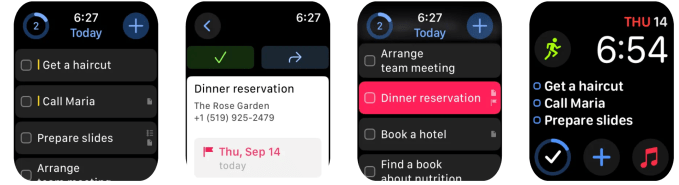

Best Apple Watch apps for boosting your productivity