Written by: Ada & Liam, TechFlow

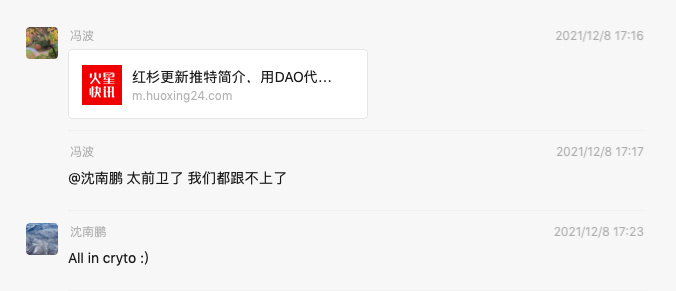

“All in Crypto”!

In 2021, Neil Shen, head of Sequoia China, typed a few words in a WeChat group. The screenshot was quickly forwarded to countless investment groups, like a war drum, pushing market enthusiasm to new heights.

The market atmosphere at that time was almost feverish. Coinbase had just been listed on Nasdaq, FTX was still hailed as "the next Wall Street giant," and almost all traditional VCs were scrambling to label themselves as "crypto-friendly."

“This is a once-in-thirty-years technological wave,” someone described it. Sequoia’s declaration became the most iconic footnote of that bull market.

However, just four years later, this phrase now sounds ironic. Many institutions that once vowed to go “All in Web3” have quietly exited, drastically downsized, or turned to chase AI.

The repeated swings of capital are, in essence, a cold reminder of the cycle.

How are those Asian traditional VCs who entered Web3 back then doing now?

Pioneers of the Wild Era

In 2012, Coinbase had just been founded, and Brian Armstrong and Fred Ehrsam were just a pair of young entrepreneurs in San Francisco. At that time, bitcoin was still seen as a geek’s toy, priced at only a dozen dollars.

At a YC demo day, IDG Capital cast an angel round vote for Coinbase. By the time Coinbase went public on Nasdaq in 2021, the return on this investment was estimated to be over a thousandfold.

The story in China was equally exciting.

In 2013, OKCoin received investment from Tim Draper and Gang Mai; in the same year, Huobi also secured investment from ZhenFund, and the following year received a bet from Sequoia China. According to information disclosed by Huobi in 2018, Sequoia China held a 23.3% stake in Huobi, making it the second-largest shareholder after founder Leon Li.

Also in 2013, Lightspeed Venture Partners’ partner Cao Darong first introduced bitcoin to a man named Changpeng Zhao at a poker game, saying, “You should devote yourself to bitcoin or blockchain entrepreneurship.”

Changpeng Zhao sold his house in Shanghai and went all in on bitcoin. The rest is history: in 2017, he founded Binance, which became the world’s largest crypto spot exchange in just 165 days, and Zhao later became the richest Chinese in the crypto world.

Compared to the other two exchanges, Binance’s early fundraising was not smooth, mainly receiving investment from PanCity Capital (founded by Wei Xing Chen of Kuaidi Dache), Black Hole Capital (founded by Liang Zhang of R&F Properties), and several internet & blockchain founders.

A small story: In August 2017, Sequoia China once had the opportunity to acquire about 10% of Binance’s equity at a valuation of $80 million, but the investment did not go through due to reasons on Binance’s side. Afterwards, Sequoia even sued Binance, and the two sides were at odds for a while.

Also in 2014, angel investor Wang Lijie invested 200,000 RMB in the domestic blockchain project NEO (Antshares), which became the most important investment of his life.

From 2012 to 2014, when crypto-native VCs were still in their infancy, it was traditional VCs that supported half of Web3. Whether it was the three major exchanges, Bitmain, imToken... behind them all were traditional capital like Sequoia Capital and IDG.

Everything went crazy in 2017.

Stimulated, Wang Lijie began to bet wildly on blockchain, claiming, “I go to bed at 1 a.m., get up at 5 a.m., meet project teams and read whitepapers all day, and invest an average of $2 million worth of ethereum every day.” When someone invited him for tea, he replied, “You’re wasting my time making money.”

In January 2018, at a blockchain summit in Macau, Wang Lijie said: “I made more in the past month than in the previous seven years combined.”

Also in early 2018, ZhenFund founder Xu Xiaoping gave a “do not spread” speech in a 500-person internal WeChat group, stating: Blockchain is a great technological revolution, those who follow will prosper, those who oppose will perish, and it will be even more rapid and thorough than the internet and mobile internet. He called on everyone to learn and embrace this revolution.

Their speeches also became the most famous peak markers of that bull cycle.

In 2018, thousands of tokens’ prices approached zero, and the market value of once-hyped star projects evaporated. Bitcoin also fell from a high near $20,000 all the way down to just over $3,000, a drop of more than 80%.

By the end of that year, “crypto” had become a dirty word in the investment circle.

“At a venture capital event in Beijing, a VC partner joked, ‘It’s okay if your startup fails, just issue a coin,’ and the audience burst out laughing. But I just felt embarrassed,” recalled former blockchain entrepreneur Leo.

In the second half of 2018, the entire industry seemed to hit pause. Once lively WeChat groups fell silent overnight, and project discussion groups were filled with Pinduoduo referral links. By March 12, 2020, the market suffered a brutal single-day halving, with bitcoin’s price plunging 50%, as if it were the end of the world.

“Forget about traditional VCs looking down on crypto, even I felt the industry was finished then,” Leo said.

Both entrepreneurs and investors were treated as jokes by mainstream narratives. As Justin Sun recalled, he would never forget the look of “scammer” in Wang Xiaochuan’s eyes when he looked at him.

In 2018, the crypto world fell from the center of wealth creation myths to the bottom of the disdain chain.

Traditional VCs Re-enter

Looking back, March 12, 2020, was the darkest valley for the crypto industry in the past decade.

WeChat Moments were filled with blood-red K-lines, and people thought this was the final blow, that the industry would end here.

But the turnaround came unexpectedly and violently. The Federal Reserve unleashed a flood of liquidity, pushing the once-dying market to new heights. Bitcoin soared from its low, rising more than sixfold in a year, becoming the brightest asset after the pandemic.

But what truly made traditional VCs re-examine the crypto industry was perhaps Coinbase’s IPO.

In April 2021, this nine-year-old exchange rang the Nasdaq bell. It proved that “crypto companies can go public,” and brought thousandfold returns to early investors like IDG.

The sound of Coinbase’s bell echoed between Wall Street and Liangmaqiao. According to crypto media person Liam, many traditional VC practitioners approached him after that, meeting offline to learn about the overall situation of cryptocurrencies.

But in Leo’s view, the return of traditional VCs was not just about the wealth effect.

“These people naturally wear an elite mask. Even if they secretly bought some coins in the bear market, they wouldn’t admit it publicly.” What really helped them take off the mask was the narrative upgrade: from Crypto to Web3.

This was a conceptual shift vigorously promoted by Chris Dixon, head of a16z crypto. Directly saying “investing in cryptocurrencies” was seen by many as speculation, but changing the term to “investing in the next generation of the internet” instantly added a sense of mission and moral legitimacy. Criticizing the monopolies of Facebook and Google, emphasizing decentralization and fairness, would win support and applause. The DeFi frenzy and NFT explosion could easily fit into this grand narrative framework.

The spread of the Web3 narrative allowed many traditional VCs to shed their moral burden.

Will, a fintech investor at a top institution, recalled: “We went through a cognitive shift. Early on, we saw it as an extension of the consumer internet, but that logic was disproven. What really changed our perspective was fintech.”

In his view, the Web3 boom happened to fall between the end of the mobile internet era and the early days of AI. Capital needed a new story, so it forced blockchain into the internet framework. But what really pulled the industry out of its death spiral was the awakening of financial attributes. “Look at the successful projects—which one isn’t related to finance? Uniswap is an exchange, Aave is lending, Compound is wealth management. Even NFTs are essentially the financialization of assets.”

Another catalyst came from FTX.

Founder SBF burst onto the scene as a “financial genius youth,” capturing the hearts of almost all major traditional VCs. His positive image and rapidly expanding valuation ignited a global FOMO among VCs.

At venture capital gatherings in Beijing, investment bigwigs were asking around, “Who can buy old shares of FTX and Opensea?” and envied those lucky enough to have already bought in.

During this period, an interesting phenomenon emerged: talent flow between traditional VCs and crypto VCs.

Some left Sequoia and IDG to join emerging crypto funds; others moved from crypto VCs to traditional institutions, immediately taking on the title of “Web3 head.” The two-way flow of capital and talent brought the crypto market into the mainstream investment narrative for the first time.

The 2021 bull market was like a carnival.

WeChat groups were buzzing, and unlike before, this time they included traditional VCs, family offices, and internet giants.

NFTs were all the rage, and VC bigwigs changed their profile pictures to monkeys, Punks, and other high-value NFTs. Even Zhu Xiaohu, who once criticized cryptocurrencies, switched to a monkey. At offline conferences, in addition to crypto-native entrepreneurs, elite traditional VC partners began to appear.

Traditional VCs entered Web3 in various ways: directly investing in crypto projects and pushing valuations higher; investing as LPs in crypto VCs—Sequoia China, which once went to court with Binance, became an LP of Binance Labs after reconciliation; directly buying bitcoin in the secondary market...

Crypto VCs, traditional VCs, exchanges, and project teams became intertwined, project valuations kept rising, and everyone expected an even more glorious bull market. But behind the noise, risks were quietly brewing.

VCs Fall

If the 2021 bull market was heaven, then 2022 instantly became hell.

FTX made it, FTX destroyed it. The collapse of LUNA and FTX not only shattered market confidence but also dragged a batch of traditional VCs down. Sequoia Capital, Temasek, and other institutions suffered heavy losses, and Temasek, as state capital, was even questioned in the Singapore parliament.

After the bull market bubble burst, many once high-valued crypto projects were brought back to reality. Unlike the “syndicate” style of crypto-native VCs, traditional VCs were used to making big bets, often investing tens of millions of dollars in a single deal. They also bought large amounts of SAFTs from crypto VCs, becoming an important exit liquidity channel for crypto VCs in the last cycle.

What made traditional VCs even more disheartened was the rapid narrative change in the crypto industry, which exceeded their investment logic. Projects that were once highly anticipated could be completely abandoned by the market within months, leaving investors with only deeply trapped equity and liquidity dilemmas.

The Ethereum L2 track is a typical case. In 2023, Scroll completed financing at a valuation of $1.8 billion, with Sequoia China and Qiming Venture Partners among the investors. However, on September 11 this year, Scroll announced the suspension of DAO governance and the resignation of the core team, with a total market value of only $268 million left, and VC investment losses as high as 85%.

At the same time, the strong position of exchanges and market makers made VCs seem increasingly redundant.

Investor Zhe bluntly said: “For those projects valued below $30–40 million, if they can get listed on Binance, they can still make some money, after the lock-up period ends, maybe two or three times return. But if it’s a bit more expensive and can only get listed on OKX or smaller exchanges, then it’s a loss.”

In his view, the logic of making money has long had nothing to do with the project itself, but depends on three things:

Can it get listed on Binance?

Is the token allocation structure favorable?

Is the project team willing to “feed the meat”?

“Anyway, exchanges have the biggest say and get the biggest share. How much is left for others depends on luck.”

Zhe’s words reflect the pain of many traditional VCs.

They found that their role in the primary market was increasingly like that of a “porter”: spending money to invest in projects, only to have the greatest value harvested by exchanges, leaving themselves with scraps. Some investors even lamented: “Actually, the primary market isn’t needed anymore. Project teams can just get listed on Binance Alpha and make money themselves. Why share profits with VCs?”

As capital logic failed, the focus of traditional VCs also shifted. As Will said, the Web3 boom happened to coincide with the end of the mobile internet and the early days of AI—a “gap period.” When ChatGPT burst onto the scene, the true North Star appeared.

Funds, talent, and narratives instantly redirected toward AI. In WeChat Moments, VC practitioners who once actively shared Web3 financing news quickly switched to the identity of “AI investor.”

According to former traditional VC investor Zac, during the industry’s peak in 2022–2023, many traditional VCs were looking at Web3 projects, but now, 90% have stopped. He predicts that if the Asia-Pacific crypto primary market remains this quiet for another six months to a year, even more will give up.

No More All-in Bets

The Web3 primary market in 2025 overall looks like a shrinking chessboard.

The bustle has faded, few players remain, but the landscape is being quietly reshaped.

As a weathervane for traditional VCs, Sequoia Capital’s moves are still worth watching.

According to Rootdata, Sequoia China invested in 7 projects in 2025, including OpenMind, Yuanbi Technology, Donut, ARAI, RedotPay, SOLO, and SoSoValue. Next were IDG Capital, GSR Ventures, and Vertex Ventures. Previously active Qiming Venture Partners’ last web3 investment was in July 2024.

According to Zac’s observation: “Now, you can count the number of traditional VCs still looking at Web3 projects on one hand.”

In his view, the quality of crypto projects has seriously declined.

“Teams striving for PMF and creating long-term value for users get far less positive feedback than those focusing on the attention economy and active market making.” Zac said.

In addition, crypto treasury companies represented by MicroStrategy and BMNR have become a new investment option, but this has again created a siphoning effect on the already dwindling crypto primary market.

“Do you know how many PIPE projects are in the market now?” said Draper Dragon partner Wang Yuehua. “At least 15, each requiring an average of $500 million. That’s $7.5 billion. Most of the big money is on Wall Street, and they’re all participating in PIPE.”

PIPE (Private Investment in Public Equity) refers to listed companies issuing shares or convertible bonds at a discount to specific institutional investors for rapid financing.

Many listed companies originally unrelated to crypto businesses have obtained large financing through PIPE, then bought large amounts of BTC, ETH, SOL and other assets, transforming into crypto treasury companies. Investment companies entering at a discount often make substantial profits.

“That’s why there’s no money in the primary market now,” said Wang Yuehua. “Big money is playing with the more certain PIPE deals. Who still wants to take risks on early-stage investments?”

Some leave, some stay. Will still chooses to believe and persist. He believes in Web3, also in AI, and is even willing to invest in seemingly “non-commercial” public goods.

“Not everyone has to do business,” Will said. “Truly great projects often start as simple public goods. Just like Satoshi Nakamoto created bitcoin—no pre-mining, no fundraising, but created the most successful financial innovation in human history.”

The Dawn of the Future

Several major events in 2025 are changing the game.

Circle’s IPO is like a spark, lighting up stablecoins and RWA (Real-World Assets) together.

This stablecoin issuer landed on the NYSE at a valuation of about $4.5 billion, giving traditional VCs a long-awaited “non-tokenized” exit example. Subsequently, Bullish, Figure, and others went public, giving more investors confidence.

“We don’t touch pure token primary or secondary markets, but we look at stablecoins and RWA,” several traditional VC investors said. The reason is simple: the space is large enough, cash flow is visible, and the regulatory path is clearer.

The business model of stablecoins is more “bank-like,” with reserve interest spreads, issuance/redemption and settlement fees, and service fees for compliant custody and clearing networks, all naturally offering sustainable profitability.

RWA brings receivables, treasury bonds, mortgages/real estate, fund shares, etc. “on-chain,” with income coming from issuance/matching/custody/circulation and other multi-link fees and spreads.

If the previous generation of crypto companies listed in the US were mainly exchanges, mining companies, and asset management firms, the new generation of prospectuses belongs to stablecoins and RWA.

Meanwhile, the boundary between stocks and tokens is becoming blurred.

The “MicroStrategy-style” treasury strategy has attracted a group of imitators. Listed companies use equity financing or PIPE placements to allocate BTC/ETH/SOL and other top assets, transforming into “coin stocks.”

Behind the leaders in this track, you can see the presence of many traditional VCs like Peter Thiel. Some institutions have even entered directly, such as China Renaissance announcing a $100 million purchase of BNB, choosing to participate in crypto asset allocation through the public market.

“The traditional financial world is embracing crypto,” said Wang Yuehua. “Look at Nasdaq investing $50 million in Gemini. This is not just a capital move, but a change in attitude.”

This shift is also reflected at the LP level. According to several interviewees, traditional LPs such as sovereign wealth funds, pension funds, and university endowments have begun to re-evaluate the allocation value of crypto assets.

A decade of capital stories has ebbed and flowed like the tide. Asia’s traditional VCs once pushed exchanges onto the stage, once shouted “All in” in the bull market, but in the end became marginal figures in the crypto world.

Now, although reality is cold, the future may yet see a dawn.

Just as Will firmly believes: “Traditional VCs will definitely allocate more to fintech investments related to crypto.”

Will traditional VCs re-enter on a large scale in the future? No one can say for sure. The only certainty is that the pace of progress in the crypto world will not stop.