Author: Delphi Digital

Translation: TechFlow

The Fastest Growing Dollar Settlement Layer

Stablecoins are not just another crypto primitive; they are the closest thing the world has to a globally accepted currency. By wrapping the US dollar (and, to a lesser extent, other fiat currencies) into a bearer digital form, stablecoins streamline the process of transfer and settlement. Clearing and settlement can be completed in a single atomic transaction, with near-instant confirmation.

This feature makes stablecoins the functional “Eurodollars” of the blockchain. Stablecoins are portable dollars, operating outside the traditional banking system, without the friction of correspondent banks, credit card networks, or wire transfers.

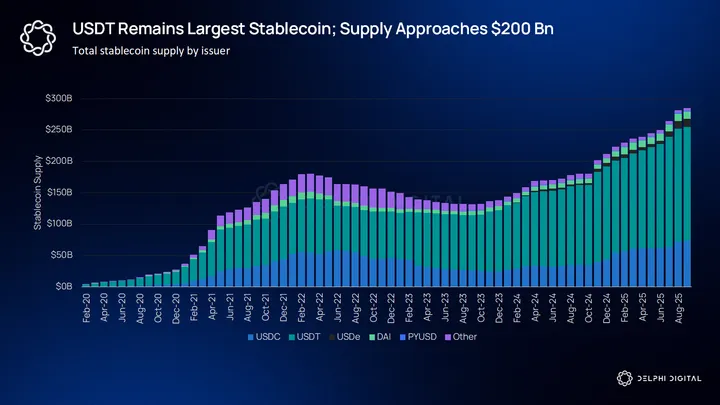

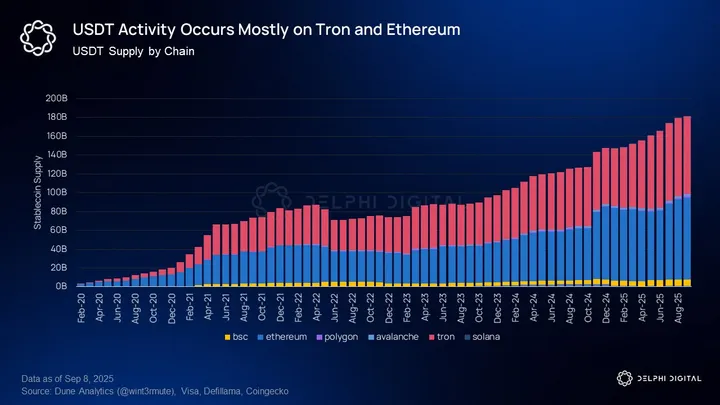

The scale of adoption is already staggering. By mid-2025, over $245 billion in stablecoins will be circulating on public chains, with about 62% in USDT and about 23% in USDC. In 2024, on-chain settlement volume will exceed $15 trillion, surpassing Visa’s $14.8 trillion.

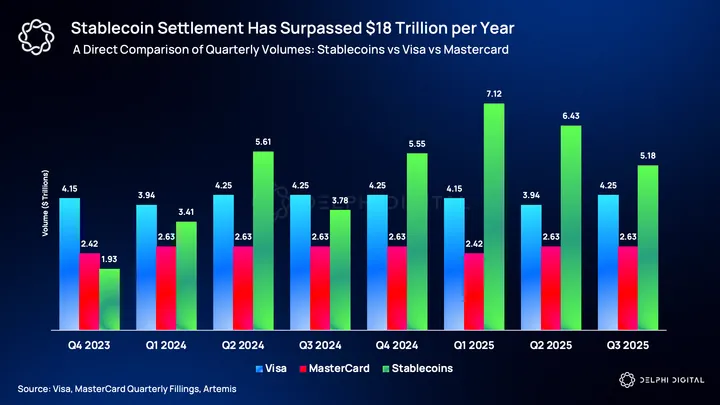

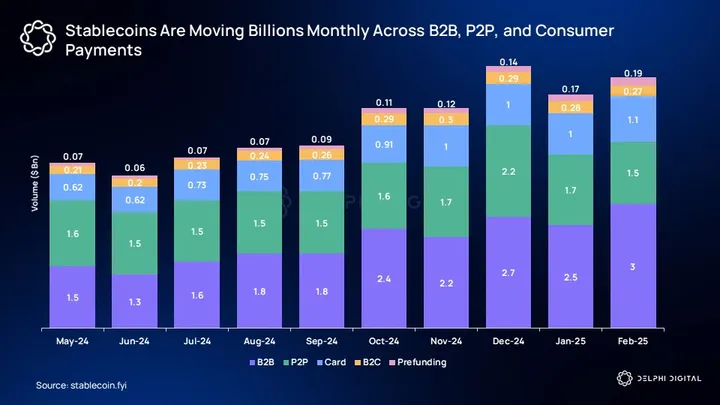

Today, one of the main uses of stablecoins is as a quoted asset for cross-exchange (both centralized and decentralized) trading and as leverage for investors. But stablecoins have rapidly evolved from a niche settlement layer for traders to a payment channel on par with major credit card networks. In Q1 2025, stablecoin settlement volume exceeded $7 trillion, briefly surpassing the combined total of Visa and Mastercard. In each subsequent quarter, stablecoins have maintained a remarkable gap with the cumulative settlement volume of the two major payment processors.

The development trajectories of the two are starkly different. Credit card networks continue to grow steadily, but at a slower pace. In contrast, stablecoins have a much higher compound growth rate; a few years ago, their transaction volume was barely visible, but now it rivals the scale of traditional payment channels.

Initially used as collateral for crypto trading, stablecoins have now gradually evolved into capital flows serving remittances, merchant settlement, and B2B payments. Especially in markets where local currencies are unstable or banking infrastructure is weak, on-chain dollars are not only more functional but also serve as a store of value. Compared to pure payment processing networks like Visa and Mastercard, stablecoin networks can support a wider variety of financial activities, meaning we should expect stablecoins’ market share to continue rising in this context.

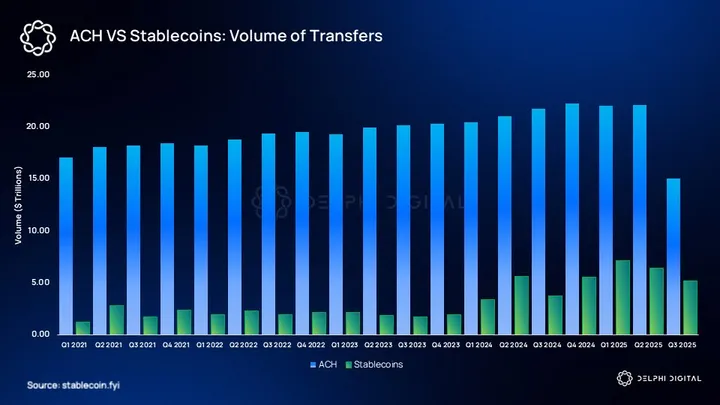

The US interbank transfer system ACH still clears about $20 trillion per quarter, but stablecoins are starting to catch up. In 2021, stablecoins were almost ignored, but now they process over $7 trillion per quarter, gradually eroding ACH’s share of digital dollar settlements.

Plasma: Today’s Opportunity to Build the Future of Payments

Despite their importance, stablecoins are still second-class citizens on the blockchains that host them. Platforms like Ethereum, Tron, and Solana were designed as general-purpose smart contract platforms, not dedicated monetary payment rails. As a result, stablecoin transfers are affected by volatile gas prices, MEV (miner extractable value) attacks, and fee models denominated in speculative native tokens. This mismatch leads to inefficiency: users pay billions of dollars annually for simple ledger updates at the core.

Plasma completely upends this model. It is a Layer-1 blockchain purpose-built for stablecoin finance, making USDT and other fiat-backed tokens the network’s primary workload, not just another application. By optimizing consensus, fee policy, and economic incentives for high-frequency, low-margin flows, Plasma positions itself as the settlement layer for the global dollar economy. In this way, it smartly addresses the trillion-dollar opportunity in cost-sensitive and finality-prioritized cross-border payments, remittances, and merchant settlement markets.

Plasma Architecture Overview

Plasma’s design draws on a decade of L1 experimentation. Its underlying consensus is based on HotStuff’s BFT (PlasmaBFT), providing fast finality and high throughput. On mainnet launch day, TPS will exceed 1,000, and can ultimately scale to over 10,000 TPS. On top of this, it uses a Reth-based execution layer, ensuring full EVM equivalence and compatibility with existing tools and contracts.

Main design choices include:

-

Stablecoin-centric fee model: USDT transfers are zero-fee, while non-stablecoin transactions follow a modified EIP-1559 burn mechanism, returning value to the XPL token. This mechanism applies only to transfers, not to other transaction types such as swaps.

-

Validator security via XPL staking: XPL serves as Plasma’s reserve collateral, ensuring economic security and coordinating long-term incentives.

-

Liquidity alignment with USDT: USDT is natively integrated at genesis, with issuers and trading partners providing instant depth to settlement pools.

-

Cross-asset bridge rails: A native Bitcoin bridge positions Plasma as the intersection of the two most used on-chain asset classes, BTC and stablecoins.

Plasma is not about adding yet another L1 blockchain, but rather about anchoring the next phase of global dollar settlement around a chain designed for stablecoins.

Zero-Fee USDT Transfers: Plasma’s Strategic Breakthrough

One of Plasma’s boldest design choices is making USDT transfers fee-free at the base layer. At first glance, this seems counterintuitive. Blockchains typically profit from transaction fees, and stablecoins—especially USDT—are the highest-frequency use case in crypto today. Why would a new chain choose to give away its most valuable flow for free?

The answer lies in how Plasma captures value. Stablecoin quarterly settlement volume already exceeds $10 trillion. The real opportunity is not in the marginal fee for transfers, but in becoming the default ledger for these transfers. Just as internet companies offer free email, messaging, and search to monetize downstream activities enabled by these free services, Plasma is using zero-fee USDT transfers as a customer acquisition strategy for global dollar flows.

For example, PayPal cultivated its early network by offering free peer-to-peer payments, later monetizing through merchant checkout fees and FX spreads. Google took a similar path, distributing the Android OS for free to capture search and app store revenue. Plasma is replicating this strategy in the stablecoin space: offering the most basic service for free to attract flows, applications, and developers, then monetizing higher-value layers such as settlement, liquidity, and financial services.

It’s important to note that zero-fee transfers apply only to simple USDT sends and receives, similar to sending money on Venmo. Any other interaction involving USDT—such as swaps, lending, or contract calls—still requires regular fees. This exemption is deliberately narrow, designed to make the most frequent, commoditized on-chain operation feel frictionless, while preserving validator incentives and the broader fee model’s integrity.

The paradox of offering the most commonly used function for free is intentional. By removing friction at the base layer, Plasma aims to be the cheapest and fastest platform for USDT transfers across wallets, exchanges, and settlement rails. For high-frequency participants most sensitive to transfer costs—such as market makers, CEX offramps, PSPs, and remittance operators—Plasma’s appeal is especially strong.

The ultimate vision: if USDT flows begin to concentrate on Plasma, liquidity will deepen, balances will accumulate on-chain, and USDT activity will migrate from a fragmented multi-chain footprint to a more unified gravitational hub.

Plasma does not expect to profit from USDT transfers themselves. The free transfer layer is the wedge to attract flows into the system, while monetization happens downstream, via fee-paying DeFi trades, FX conversions, and settlement services. The long-term bet is simple: XPL will capture value by securing the infrastructure that supports these flows, rather than taxing simple transfers.

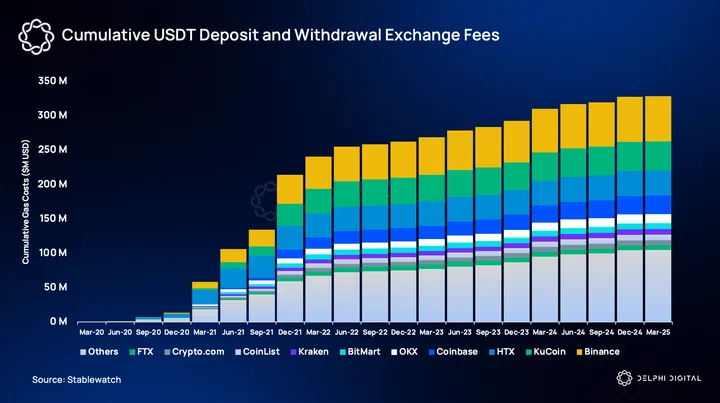

Over the past five years, users have spent over $300 million withdrawing/depositing USDT on centralized exchanges (CEXs). This is strong evidence of how free USDT transfers provide a compelling reason for users to choose Plasma as the USDT hub over any other chain.

Plasma One: How to Monetize Flow?

The next question is how to capture and monetize these flows. This is where Plasma One, a new stablecoin-native bank, comes into play.

Plasma One is designed as an entry point for users, merchants, and enterprises. It extends the base layer advantage of zero-fee transfers into a daily currency experience. Users can save in dollars, earn yield, spend at merchants, and send payments instantly for free. For merchants, Plasma One offers direct USDT settlement, eliminating intermediaries and FX costs. Developers and institutions can also access Plasma’s distribution network via Plasma One.

The economic model shifts from taxing each transfer to monetizing the layers above transfers. Plasma One has the potential to capture value in three ways:

-

Card interchange and merchant settlement: Each swipe or payment generates a fee, just like traditional card networks, but at lower cost and broader coverage.

-

FX and conversion spreads: Converting between USDT, local currencies, and other stablecoins naturally generates spreads, which Plasma can capture via its integrated FX system.

-

Yield capture: User deposits on Plasma One can be deployed into on-chain money markets, with the yield shared with users or partially retained by the ecosystem.

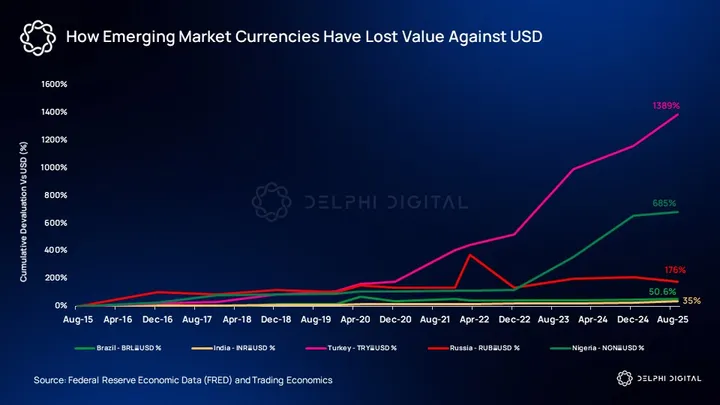

As Plasma targets emerging markets where currencies are continually devalued against the dollar and euro, this value proposition will become even stronger.

By owning both the blockchain and the new bank, Plasma forms a closed loop between infrastructure and distribution. Zero-fee transfers attract flows, while Plasma One provides a home for those flows and monetizes them through people’s expectations of banking services—but these services are delivered via stablecoin rails.

Plasma’s Position in the Stablecoin L1 Race

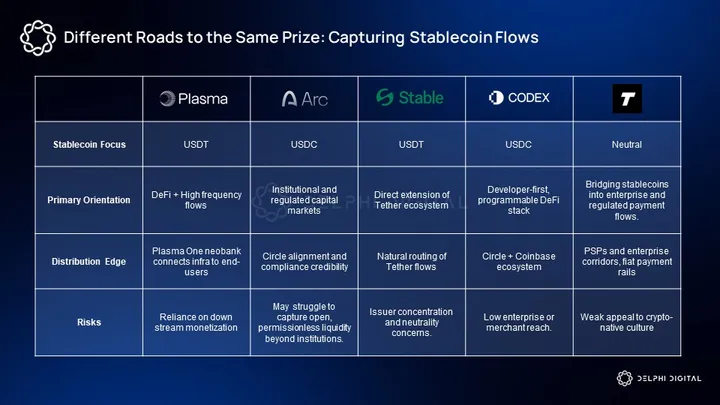

Over the past year, blockchain projects focused on stablecoins have proliferated, with every company realizing that dollar settlement is crypto’s killer app. Some projects, such as Arc and Codex, work closely with Circle and naturally favor USDC, though they remain open to inflows of other stablecoins like USDT. Their messaging focuses on regulatory transparency and institutional adoption, positioning themselves as compliant rails for capital markets.

Other companies, such as Stable, position themselves as platforms for USDT circulation but lack issuer neutrality. Tempo sits somewhere in between, emphasizing regulated channels and compliance-first integrations with enterprises and PSPs. While these issuer-centric or compliance-focused models offer strong enterprise alignment, they may recreate silos that limit experimentation and composability.

Plasma takes a different stance. By anchoring to USDT while maintaining issuer neutrality and full EVM programmability, Plasma positions itself as a more convenient platform for DeFi and organic stablecoin applications. It aims to absorb complex, high-frequency flows that drive real liquidity—such as remittances, trading, and merchant settlement—rather than just serving curated institutional channels.

Stablecoin settlement value per quarter is already in the trillions; blockchains that maintain liquidity and composability are more likely to become true settlement hubs. Neutrality, rather than enterprise alliances, may be the more solid foundation for capturing the next wave of stablecoin applications.

XPL Tokenomics

At the core of Plasma is XPL, the network’s native token.

XPL is the native token of the Plasma blockchain, similar to ETH on Ethereum and SOL on Solana. XPL can be used as a gas token for transactions and smart contract execution, as staking collateral for network security, and as a reward token for validators.

As mentioned earlier, Plasma’s architecture allows end users to make gasless stablecoin transfers, but any more complex interaction (contract deployment, advanced dApp usage) requires XPL as gas or automatic conversion of a portion of stablecoins into XPL to pay fees.

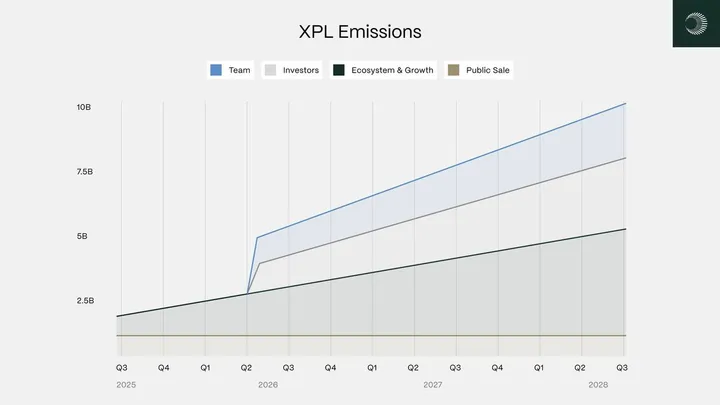

Like most Layer1s, XPL does not have a fixed supply cap and uses programmatic inflation similar to ETH or SOL. At mainnet beta launch, XPL’s initial supply is 10 billion, with an annual inflation rate of 5% to reward validators. Thereafter, the inflation rate will decrease by 0.5% per year, eventually stabilizing at 3% long-term.

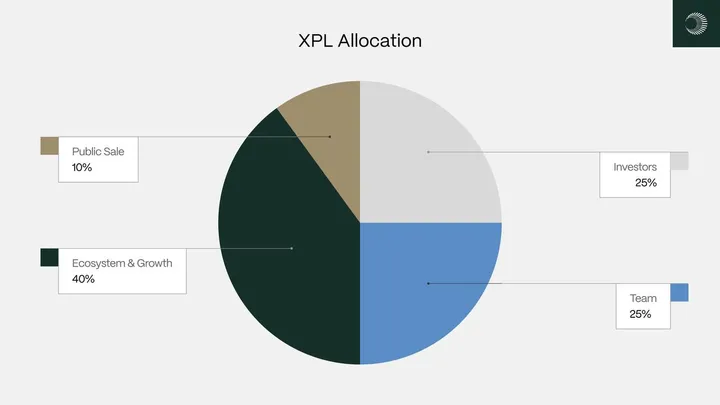

Distribution:

-

Public sale: 10% (unlocked at TGE for non-US investors, US investors unlock on July 28, 2026)

-

Ecosystem and growth: 40%

-

Team: 25% (1-year lockup + 2-year linear release)

-

Investors: 25% (1-year lockup + 2-year linear release)

Plasma adopts Ethereum’s EIP-1559: base transaction fees will be burned. Network growth will put deflationary pressure on token issuance. In practice, heavy usage could make XPL a net deflationary token.

The initial circulating supply at mainnet launch will include public sale tokens (10% minus the US investor allocation), all unlocked ecosystem tokens (8% unlocked immediately), and possibly a small portion for strategic partners. Team and investor tokens (a total of 50%) are locked at genesis. Therefore, the initial circulating supply is relatively limited, expected to reach about 18% of total supply at TGE.

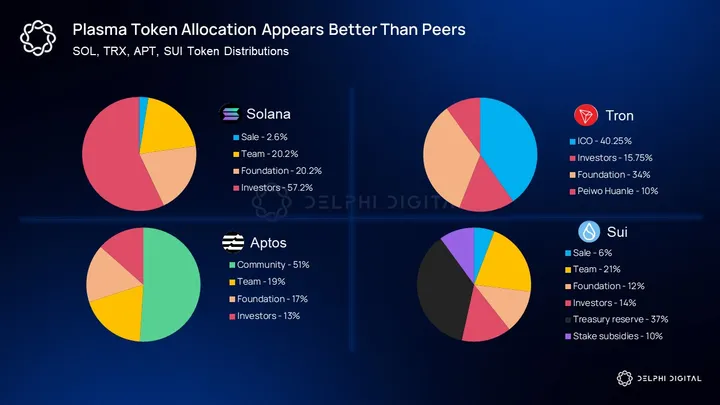

For L1 tokens, token distribution is crucial. While this is just a discussion point for governance tokens, L1 tokens need to consider public interest, decentralized infrastructure, and commodity value. Aggressive or predatory token allocations will affect the blockchain ecosystem throughout its lifecycle. From this perspective, XPL’s overall token distribution is very healthy compared to other L1 tokens.

It is not yet clear how XPL’s token distribution compares to more ideal peers like Tempo and Arc. We will continue to monitor as more details are disclosed.

Why XPL Has Value

Plasma’s value proposition is closely tied to the idea of stablecoins as crypto’s killer app. As mentioned earlier, on-chain stablecoin transaction volume in 2024 has reached a staggering $27.6 trillion, surpassing the combined annual volume of Visa and Mastercard. Crypto innovation, especially DeFi, is currently at a bottleneck. Connecting traditional money to blockchain rails is key to driving the next phase of innovation.

When evaluating L1 tokens, analysts typically use two frameworks:

-

Real Economic Value (REV) – Fees + MEV (maximal extractable value). This method treats the token as a stock with a claim on cash flows.

-

Monetary premium—this method values the token as a currency based on its utility and network effects.

For new chains like Plasma, initial fee capture is low, especially since Plasma offers zero or near-zero fees to bootstrap usage. Therefore, valuing Plasma based on REV is unrealistic. Other new chains like Aptos and Sui have never been valued by the market on this basis.

The monetary premium aspect is more relevant for XPL at this stage. People value XPL not because it immediately pays large staking rewards or dividends, but because they expect Plasma to become critical infrastructure in a stablecoin-dominated future.

Staking rewards and deflationary pressure from burning will help measure this progress and validate the thesis. Monetary policy is crucial for L1s and helps establish their perception as effective stores of value. However, a deflationary issuance mechanism is unlikely to be the core of Plasma’s valuation, especially in the early stages.

The new L1 token market tends to price closer to the potential of the new chain, rather than day-one fundamentals.

For example, excitement about MoveVM and Solana-competitive throughput has drawn attention to alternative high-throughput chains like Sui and Aptos—this desire for faster chains drives their valuations more than anything else.

Since Plasma is at the core of crypto’s most basic use case—stablecoins, XPL’s main value source will come from its perceived monetary premium. As the chain and its ecosystem launch and mature, we expect REV and core economic metrics to begin growing as well.

The Current Competitive Landscape

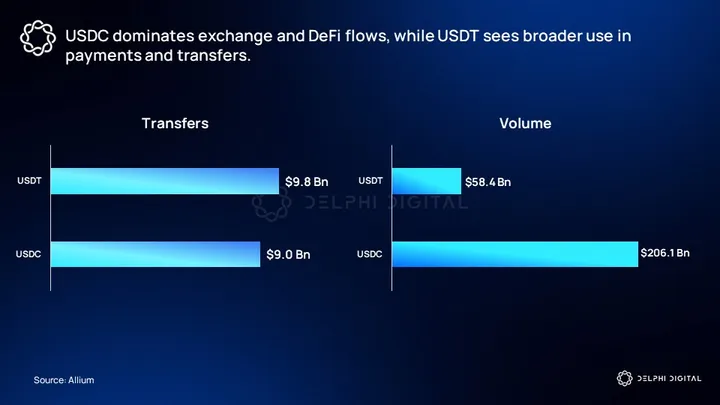

USDT is the largest and most liquid stablecoin on centralized exchanges (CEXs). USDC is favored in DeFi, with numerous integrated projects, serving as the main trading pair for DEX liquidity, and is gaining momentum in payments. Despite the expanding design space and growing market interest for stablecoins, USDT’s market share continues to consolidate, with supply approaching $200 billion.

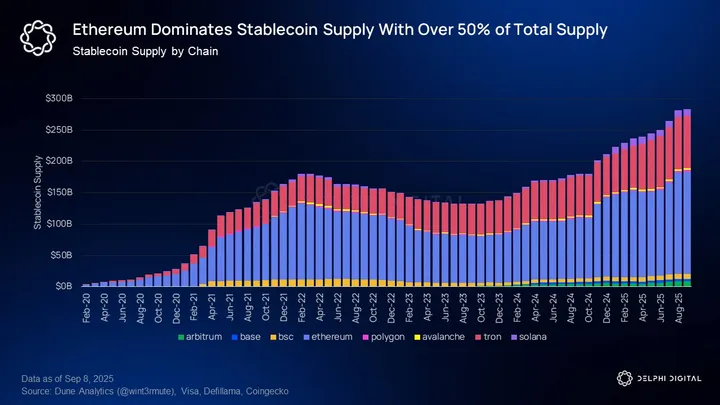

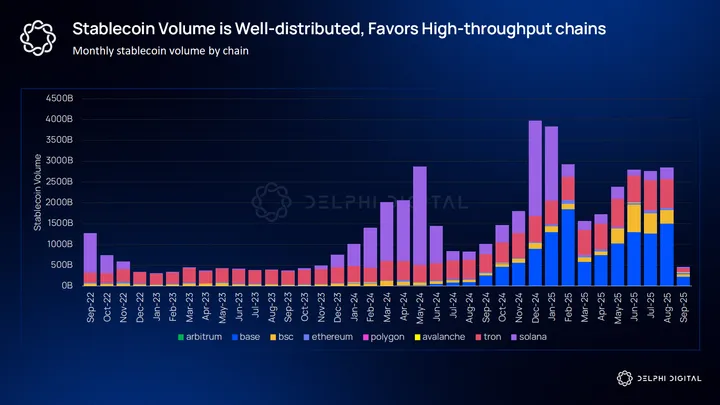

Ethereum, with its strong grip on DeFi innovation and activity, is the main liquidity hub for stablecoins. While Solana, Aptos, and Sui are gaining attention, these chains have yet to attract stablecoins at the scale of Ethereum and Tron.

Tron is the second-largest public chain by stablecoin supply and has become the unofficial public chain for USDT transfers. Aside from USDT, Tron’s stablecoin and DeFi activity is limited, but its market share is impressive: Tron’s $83 billion USDT supply is very close to Ethereum’s $87 billion.

Stablecoin transaction volume is more widely distributed across ecosystems. Ethereum lags far behind Layer2s and competing Layer1s. Tron, Solana, Base, and BSC all have higher stablecoin transaction volumes than Ethereum. The high-throughput theory is best illustrated here, as Ethereum mainnet gas fees are too high for everyday stablecoin use. Therefore, Ethereum is mainly used for complex, high-risk DeFi tools.

Plasma’s zero-fee USDT transfers are openly positioning itself as a “Tron killer.” Although Tron has found product-market fit as the USDT chain, it has failed to build an active DeFi ecosystem around it—at least not one matching its $83 billion USDT supply.

Plasma’s goal should be to partner with major DeFi teams to go beyond the remittance chain niche and capture both TVL and transaction volume. This goal has already made significant progress.

The Binance Earn product on Plasma is a fully on-chain USDT yield product, with $1 billion committed before mainnet beta launch. Users can lock USDT via Binance Earn, which will be deployed on Plasma’s infrastructure rails to generate yield. This product is similar to native USDC yield on Base.

In addition, Plasma has announced partnerships with Aave, Fluid, Wildcat, Maple Finance, and USD.AI. These partnerships balance between crypto-native applications (Aave, Fluid, USD.AI) and institution-facing fintech applications (Maple Finance, Wildcat, USD.AI). Positioning Plasma as a blockchain where users can conduct business as usual, while fintech applications have a better chance of achieving product-market fit, is a reliable strategy for winning sustained usage and building a real moat.

Theoretical Valuation Model

For Plasma, the most reasonable comparables are Stable, Arc (Circle), and Tempo (Stripe). But these blockchains are not yet liquid. Currently, high-throughput, DeFi-dominated blockchains like Tron, Solana, Ethereum, Aptos, and Sui are the best choices.

REV is an intuitive metric and makes sense as a mental model for understanding Layer 1 value capture. However, it is clearly almost unrelated to market pricing and irrelevant to current Layer 1 valuations. Solana’s REV data is attractive because its ecosystem attracts many active users. TVL remains the most commonly used metric for measuring blockchain attractiveness, while stablecoin supply provides a good supplementary data point.

These two metrics show reasonable consistency in the sample group’s valuations, with multiples below 15, usually in the mid-single digits.

Tron has a niche use case, with limited growth prospects due to low DeFi penetration and lacking the technical premium typical of next-generation blockchains. Therefore, its 0.4 stablecoin price-to-supply ratio may be somewhat anomalous.

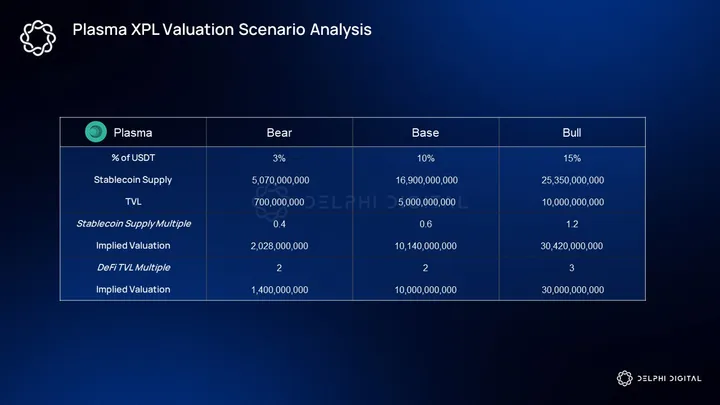

By making reasonable assumptions about how the market will respond to different levels of traction, we can conduct scenario analysis for Plasma’s XPL valuation.

Our bear, base, and bull cases assume market shares of 3%, 10%, and 15% of USDT supply, respectively.

It’s important to note potential flaws in these assumptions:

-

Downside risk: There could be a saturation of the enterprise chain narrative, with these chains cannibalizing each other’s usage and attention, compressing multiples. For this, we use a lower stablecoin supply multiple in the bear case, using Tron’s anomalous 0.4 value.

-

Upside potential: Our USDT market share assumes a fixed market share. For example, Tether does not issue additional USDT, and Plasma itself has no impact on new USDT issuance. Both are unlikely, so this is an extremely conservative assumption. If market share continues to grow at the current pace, Plasma can achieve the same results even at lower market share numbers.

XPL’s pre-market valuation is largely consistent with this network valuation approach. The upside here mainly depends on driving narrative and divergent appeal through partnerships and milestones. The biggest risk is a flood of similarly branded chains entering the market. Plasma’s goal is attractive, and its narrative is a cornerstone of the cycle.

Conclusion

The development of Tether and Circle as issuers, the absolute number of stablecoins used on on-chain platforms, the emergence of new-era products like Ethena and Wildcat, and the widespread acceptance by traditional payment companies like PayPal and Stripe all tell us one thing: the stablecoin opportunity is undeniable.

At the same time, it is necessary to continue upholding the core spirit of crypto. Permissionless usage, decentralization, and grassroots community building remain its core elements. With the rise of stablecoin L1s (some of which may appear as company-adopted blockchains), Plasma seems best positioned in this regard. With strong day-one integration capabilities while maintaining some distance from centralized operators, Plasma perfectly combines the advantages of stablecoins with the ethos of on-chain capital markets.

The L1 race has become increasingly commoditized. High throughput is now a basic requirement. The real battle is in ecosystem building and user acquisition.

Plasma firmly believes that the cost of stablecoin transfers should ultimately approach zero, and the real value lies in facilitating high-risk activities such as lending/financing and trading. In short, Plasma’s real business model is rooted in becoming the center of stablecoin liquidity. And one of the simplest ways to achieve this is to offer high-frequency use cases (such as simple payments/transfers) to users for free.

From Plasma One and the various DeFi protocols soon to be deployed on-chain, Plasma sees distribution as its true differentiator, not just technical architecture. As the world’s acceptance of stablecoins increases, Plasma is committed to becoming one of the leading platforms where developers and users gather around stablecoin products.