Date: Wed, Sept 24, 2025 | 06:55 AM GMT

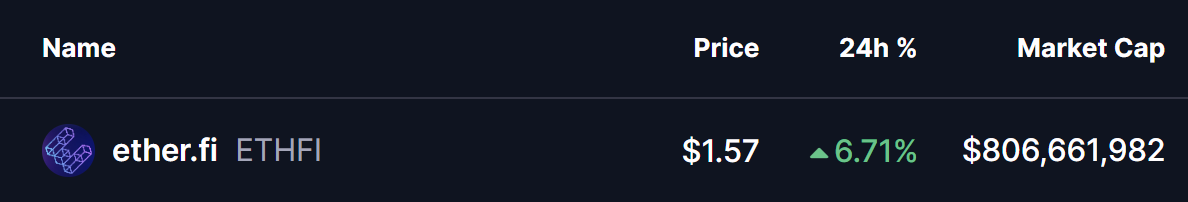

The cryptocurrency market continues to trade under pressure, with Bitcoin (BTC) and Ethereum (ETH) both dipping slightly by over 0.50% today. However, some altcoins are still showing resilience and upside potential — and ether.fi (ETHFI) is among them.

ETHFI has gained more than 6% today, but what makes the move even more interesting is the technical setup: a recent breakout, followed by a clean retest, is now pointing toward the possibility of a bullish continuation.

Source: Coinmarketcap

Source: Coinmarketcap

Retests Symmetrical Triangle Breakout

For several weeks, ETHFI had been consolidating within a symmetrical triangle pattern — a setup that often indicates an upcoming strong move. This time, the breakout has favored the bulls.

The token rebounded strongly from the $0.997 base support, pushing through the upper descending trendline and confirming a breakout around $1.245. That move fueled a rally to $1.568, where profit-taking temporarily capped gains.

ether.fi (ETHFI) Daily Chart/Coinsprobe (Source: Tradingview)

ether.fi (ETHFI) Daily Chart/Coinsprobe (Source: Tradingview)

As is common after a breakout, ETHFI pulled back to retest its trendline support, dipping to around $1.205, a level that also coincides with its 50-day moving average. This zone attracted fresh buying, and ETHFI quickly bounced back, reclaiming momentum and now trading around $1.578 — proof that bulls successfully defended the breakout level.

What’s Next for ETHFI?

The structure remains bullish, but the next move will likely depend on whether ETHFI can break through its immediate hurdle at $1.568. A decisive close above this level could trigger stronger upside momentum, opening the door toward the measured move target at $2.11. This would represent a potential 33% rally from current levels.

On the downside, failure to hold above the $1.205 retest zone and the 50-day MA could weaken the setup, delaying the breakout continuation.

For now, ETHFI stands at a pivotal stage, and the breakout-retest combo is keeping bulls optimistic about a larger move ahead.