Ethereum News: Will ETF Outflows Push ETH Price Below $4,000?

Ethereum price has slipped under the $4,200 support zone, triggering a sharp correction that has rattled the broader altcoin market. With ETF flows weakening, macro uncertainty growing, and technical breakdowns appearing on the daily chart, investors are asking the same question: is ETH price headed for a deeper correction or just a temporary shakeout?

Ethereum News: Why Ethereum Price Fell Below $4,200?

The latest dip was triggered when Ethereum lost its $4,200 support, a level that had previously served as a strong defensive line. This breakdown coincided with cascading liquidations worth over $1.7 billion across altcoins, of which $212.9 million came from ETH alone. That kind of forced selling accelerates momentum to the downside and often overshoots fundamental value.

Image Source: coinglass ETH ETF Overview

Image Source: coinglass ETH ETF Overview

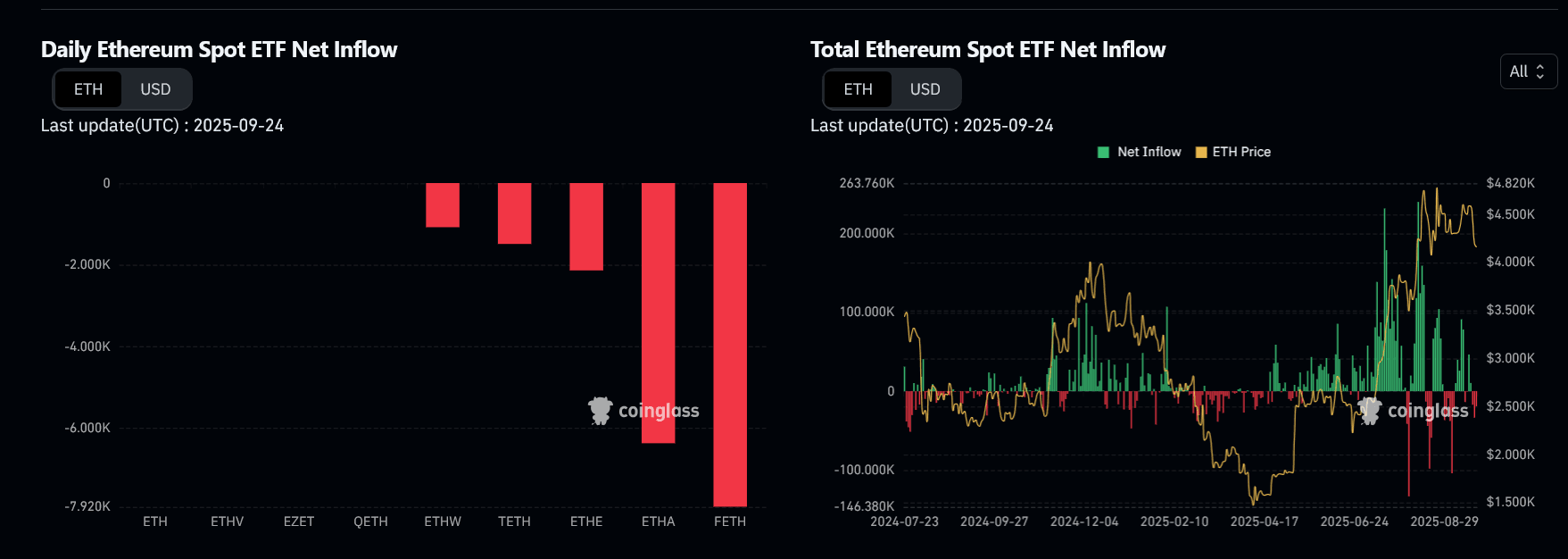

The Ethereum ETF data tells the real story here. September has seen just $110 million in net ETH ETF inflows, a massive drop compared to August’s $3.8 billion. Worse, the most recent data shows consistent outflows across multiple Ethereum ETF products, with FETH and ETHA showing the heaviest redemptions. This is a clear sign that institutional appetite is cooling, which removes a key driver of the summer rally.

On the cumulative ETF net inflow chart, the momentum shift is obvious. After peaking in mid-2025 with large spikes in green bars, inflows have flattened and slipped negative. That weakens the narrative of ETFs being a sustained bull driver.

Ethereum News: Fed Rate Cuts Lose Their Punch

While the Fed did cut rates by 25 basis points in September, Chair Jerome Powell’s statement t hat he is “in no hurry” to cut further undermined market confidence. The lack of dovish follow-through has meant crypto traders are no longer betting on rapid liquidity injections. This neutral to slightly hawkish stance reduces the appeal of speculative risk assets like ETH, especially after such a big rally.

Ethereum Price Prediction: Breakdown Signals Risk Ahead

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

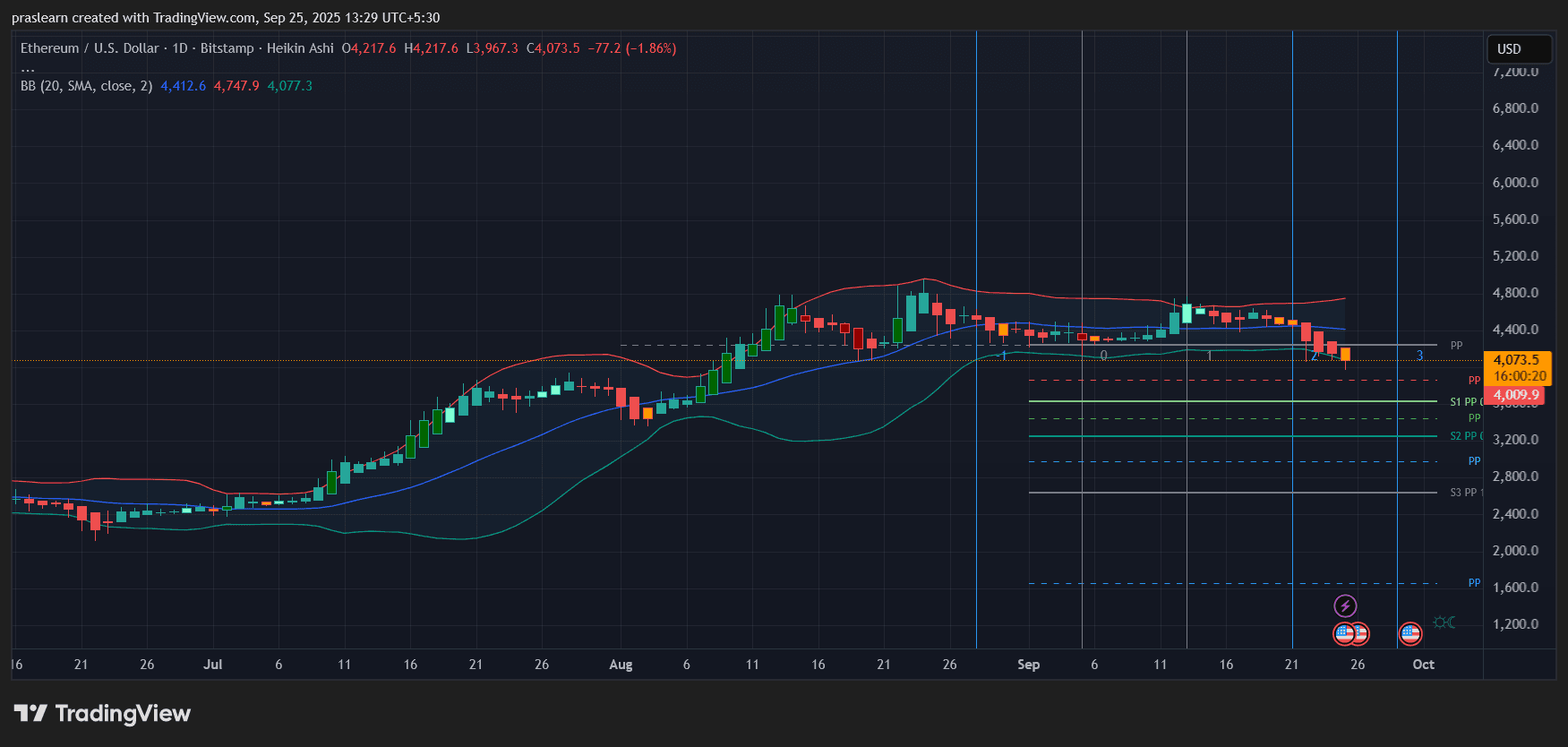

On the TradingView daily chart, ETH price is trading near $4,073, with price slipping below the mid-line of the Bollinger Bands and heading toward the lower band support near $4,000. The Heikin Ashi candles have turned red for several consecutive sessions, showing clear selling momentum.

Key support levels now lie at:

- $4,000 psychological barrier

- $3,750 pivot support

- $3,200 (S2 pivot) as the deeper downside target

On the upside, resistance is at $4,400 and $4,750, both of which must be reclaimed quickly to reset bullish momentum.

The pivot chart shows Ethereum price breaking under its central pivot, suggesting sellers are in control for now. If price closes decisively below $4,000, the next leg could easily test $3,750 or even $3,200.

Short-Term Ethereum Price Prediction: Can ETH Price Hold $4,000?

The combination of ETF outflows, failed macro catalyst, and technical breakdown makes $4,000 the key battleground. A bounce from here would need renewed ETF inflows or strong spot buying to reverse sentiment. Without that, ETH could consolidate between $3,750–$4,200 for weeks, frustrating bulls who expected a breakout toward $5,000.

If ETF flows remain negative, $ETH risks slipping toward $3,200 in Q4. On the other hand, if U.S. macro data softens and Powell signals more cuts, ETF inflows could revive, giving ETH the push back above $4,500.

Ethereum’s correction is not just a chart-driven event; it’s being reinforced by weakening ETF flows and a less supportive Fed. Traders should watch $4,000 closely. A failure to hold it could open the door to a much deeper correction, while a quick reclaim of $4,400 would restore confidence. For now, caution is warranted, and downside protection looks wise until flows turn positive again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?

Crucial Decision: Trump’s Final Interviews for Federal Reserve Chair Could Reshape Markets