I. Project Introduction

Mira Network is an infrastructure project focused on

verifiable AI, aiming to make AI outputs and behaviors verifiable on-chain. It addresses the current deficiencies of AI in

transparency, traceability, and trustworthiness.

The project is committed to building a

trusted verification layer for AI outputs to improve the reliability, transparency, and accuracy of intelligent reasoning. By leveraging a distributed network that aggregates collective intelligence, Mira processes up to

300 million tokens of data per day, achieving

96% verification accuracy.

Mira abandons the traditional centralized AI training and inference path, instead emphasizing a

trustless verification mechanism for outputs. Built on

Base (Ethereum Layer 2), Mira is compatible with mainstream chains such as Bitcoin, Ethereum, and Solana, supporting smart contracts, DApps, and DAO governance. It aims to solve critical issues such as AI bias and hallucination while enabling user-driven governance and avoiding single-point trust risks.

Its core methodology includes:

Claim Decomposition: Breaking down AI responses or outputs into multiple sub-claims.

Distributed Verification: These sub-claims are distributed to Mira’s Verifier Nodes, where each node independently checks their validity.

Consensus & Aggregation: Nodes validate and aggregate results through mechanisms such as Proof-of-Verification, outputting a final “verified result.”

Additionally, Mira has already partnered with and deployed within the

Base ecosystem, reflecting not only a technical experiment but also an emphasis on integration with existing ecosystems to reduce barriers for developers and users.

II. Project Highlights

Large-Scale User Base & Superior AI Performance

Mira Network currently attracts

4–5 million users, processing

19 million queries weekly, demonstrating strong real-world applicability. Its core innovation—the

AI Verification Layer—has increased AI output accuracy to

96% and reduced hallucination rates by

90%. Proprietary products such as the

Klok chatbot and

Astro search tool already boast

over 500,000 users, showcasing Mira’s effectiveness in enhancing AI trustworthiness.

Advanced Decentralized AI Verification Architecture

Built on Base, Mira operates as a

Layer 1 verification network utilizing a

multi-model consensus mechanism. It integrates

over 110 AI models and leverages distributed nodes for verification, effectively reducing single-point failures and hallucinations. This system is comparable to

“multi-party proctoring and decentralized auditing”, significantly improving the reliability of outputs and providing a solid trust foundation for AI applications.

Top-Tier Backing & Experienced Team

Thanks to its innovation and technological strength, Mira has secured investments from

BITKRAFT Ventures, Framework Ventures, Accel, Mechanism Capital, and the

founder of Polygon. The project raised

$9 million in seed funding and

$850,000 from community node sales, evidencing strong market recognition of its “Blockchain + AI” model. The team brings extensive experience in AI and blockchain product development and operations, laying the groundwork for long-term infrastructure growth.

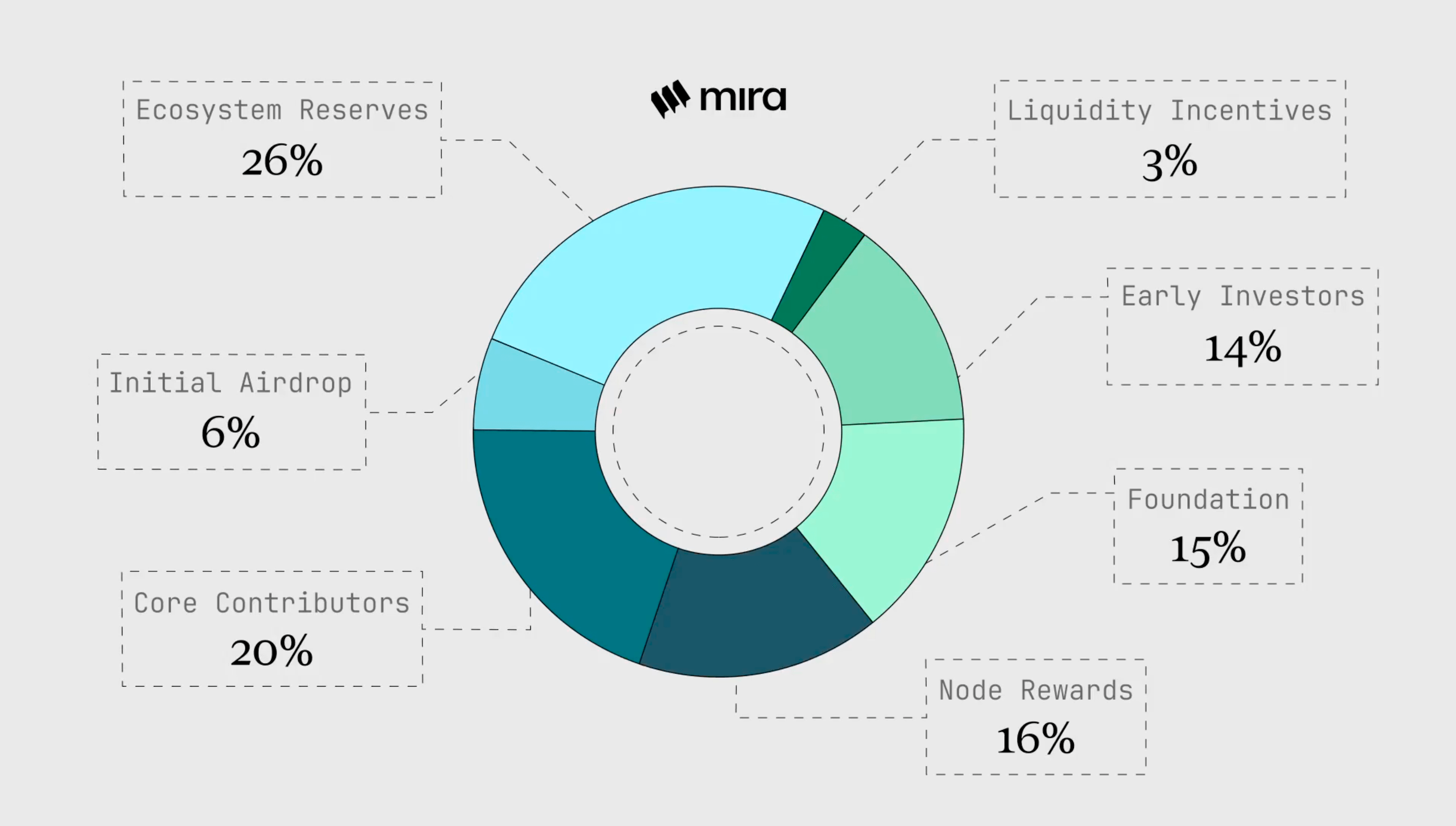

Robust Tokenomics & Ecosystem Expansion

The

MIRA token serves as the core of the Mira ecosystem, with a

fixed total supply of 1 billion and

19.12% circulating supply at TGE. Tokens are used for AI verification, governance, staking, and ecosystem incentives. This includes a

6% airdrop and

16% validator rewards, reinforcing decentralization and long-term network security.

In

August 2025, Mira launched an independent foundation and a

$10 million Builder Fund to expand the ecosystem and foster partnerships, including with

Kaito, furthering the adoption of AI infrastructure and supporting long-term value creation.

III. Tokenomics

Total Supply: 1,000,000,000 MIRA

Initial Circulating Supply: 191,200,000 MIRA (19.12%)

Distribution:

6% Initial Airdrop: Distributed to early ecosystem participants, including Klok and Astro users, node delegators, Kaito community members, Kaito stakers, and active Discord contributors.

16% Validator Rewards: Programmatically released to verifiers performing honest reasoning.

26% Ecosystem Reserve: For developer grants, partnerships, and growth incentives.

20% Core Contributors: Allocated to current and future team members, locked for 12 months, then linearly vested over 36 months.

14% Early Investors: Strategic partners providing early capital; locked for 12 months, vested over 24 months.

15% Foundation: For protocol development, governance, research, and treasury. Locked for 6 months, vested over 36 months.

3% Liquidity Incentives: For market-making, exchange listings, and liquidity programs.

Utility:

API Access & Value Capture: Payment for AI verification APIs.

Node Staking: Staking requirement for verifier nodes to earn rewards.

Governance: Participation in protocol upgrades, fund allocation, and ecosystem decisions.

Ecosystem Incentives: Rewards for developers, partners, and community contributors.

Other Innovative Use Cases: Content incentives within Kaito, charitable initiatives, and beyond.

IV. Team & Fundraising

Team Background:

Karan Sirdesai (CEO) – Former Accel & BCG, led investments in Polygon and Nansen, Chartered Accountant (India).

Siddhartha Doddipalli (CTO) – Former architect at FreeWheel, ex-CTO of Stader Labs, IIT & Columbia background, AI & blockchain specialist.

Ninad Naik (COO) – Former GM at Amazon Alexa, ex-Uber product lead, MBA from Columbia University.

Funding History:

Seed Round (July 2024): $9 million, led by

BITKRAFT Ventures and

Framework Ventures, with participation from

Accel, Crucible, Folius Ventures, Mechanism Capital, SALT Fund, among others. Proceeds support global expansion, team growth, and development of Mira Network & ecosystem apps (e.g., Klok).

Node Sales:

1st Round (Dec 17–18, 2024): ~$250,000

2nd Round (Jan 16–17, 2025): ~$600,000

Total Raised: $9.85 million

V. Risk Factors

The

decentralized AI infrastructure sector is still nascent, lacking a mature business model. A decline in industry momentum could affect Mira’s ecosystem activity and token liquidity, pressuring $MIRA’s secondary market performance.

Unlocking Schedule: Initial circulating supply is 19.12%.

End of Year 1: ~33% unlocked

End of Year 2: ~61% unlocked

End of Year 3: ~83% unlocked

End of Year 7: 100% unlocked

Short-Term (TGE–3 months): Major sell pressure from the airdrop and partial ecosystem reserve unlocks.

Mid-Term (Year 2+): Unlocks from core contributors and early investors could trigger significant volatility.

Long-Term (>3 years): Unlocking stabilizes, shifting risks toward fundamentals and adoption.

VI. Official Links

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.