Key Notes

- Leading crypto influencers including Helius CEO Mert are actively promoting Zcash as essential for financial privacy.

- Technical experts praise ZEC's zero-knowledge proof implementation as superior to competing privacy cryptocurrencies.

- Cross-chain integration with NEAR Protocol and mobile wallet improvements drive increased adoption and utility.

Zcash ZEC $56.27 24h volatility: 4.8% Market cap: $904.32 M Vol. 24h: $100.56 M , the second-largest privacy cryptocurrency by market cap, has doubled in price in a year from Sept. 25, 2024, as demand for privacy coins surged and big names in the industry have been showing support for ZEC recently. Zcash was the first crypto project to implement the zero-knowledge proof (ZK) technology, going through significant improvements over the years.

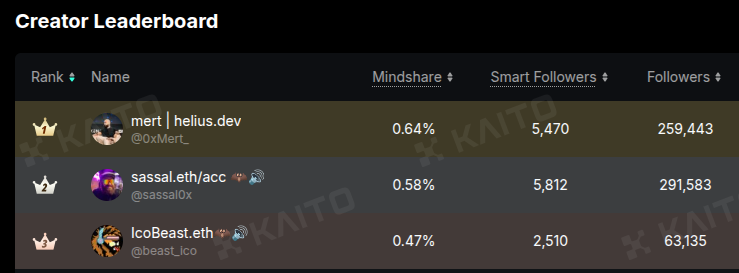

Among the big names contributing to ZEC’s growth in mindshare on X is Mert, the CEO of Helius and a well-known Solana SOL $197.8 24h volatility: 7.5% Market cap: $106.92 B Vol. 24h: $10.74 B advocate—ranked first in the mindshare CT leaderboard by Kaito in the last six months, with a 0.64% mindshare, nearly 260,000 followers, and 5,470 smart followers, per the platform’s algorithm.

CT creator leaderboard in the last 6 months as of Sept. 25 | Source: Kaito

Mert has been making bullish posts about Zcash for a while, commenting recently that he will “continue shilling this until everyone in crypto is allocated at least somewhat to privacy.” Helius’s CEO stressed the importance of having “freedom to transact” and the threat of transacting under “constant surveillance.”

In response to a question about Monero XMR $290.8 24h volatility: 0.2% Market cap: $5.36 B Vol. 24h: $100.34 M on Sept. 24, Mert highlighted weaker “privacy properties” when compared to Zcash. He also mentioned a clear asymmetry from an investment point of view, favoring ZEC to the upside.

privacy properties too weak relative to zcash

also from pure investment POV, clearly asymmetry in zec upside

— mert | helius.dev (@0xMert_) September 24, 2025

Besides the Helius executive, other big names have come to the support of Zcash. Ignas (153,500 followers) explained on Sept. 18 how the X algorithm may be contributing to amplifying ZEC-related content after he liked a post from Mert while making posts about privacy and ZK himself.

Looposhi (105,100 followers) urged his audience to “pay attention to ZEC” from a technical analysis perspective just before Zcash crossed the $50 level. Vik Sharma (22,150 followers), founder and CEO of Cake Wallet and a prominent privacy advocate and crypto investor, said on Sept. 14 he was buying Zcash, kidding about a sudden price increase matching his purchases.

I wish Zcash would chill while I'm trying to stack more. But then I realized, maybe my stacking is what's driving up the price.

(kidding of course.. not stacking that much to sway the price)

— Vik Sharɱa 🇺🇸 (@vikrantnyc) September 14, 2025

From a more technical perspective, Bryan Gillespie, a respected mathematician and cryptographer, praised Zcash’s technology, calling it “ the most impressive formal protocol spec ” he has ever come across “in this space.” Meanwhile, Chris Burniske, partner of Placeholder VC, commented about what is needed for the demand for privacy solutions to grow mainstream—concluding it would first happen “slowly… slowly… then all at once.”

Appreciation of privacy has always required mainstream adoption of transparent blockchains, creating enough problems from unnecessary oversharing, for “privacy on permissionless blockchains” to be valued.

One of those things where it’ll be slowly… slowly… then all at once.

— Chris Burniske (@cburniske) September 24, 2025

Zcash (ZEC) Price Analysis

ZEC is the 84th largest cryptocurrency by market capitalization and the second-largest with a focus on privacy, according to the CoinMarketCap index. By the time of this writing, Zcash was changing hands at $56.29, up 92% in one year, since Sept. 25, 2024, when it was trading at $29.38 per coin.

On Sept. 24, ZEC traded as high as $61.36, effectively doubling in price in the one-year time frame. This happened as Zcash was added to NEAR Intents for seamless cross-chain operations among 20 blockchains , with specific payment solutions implemented by Zashi , the most recommended mobile wallet by the Zcash community.

Zcash (ZEC) price chart and market data as of Sept. 25, 2025 | Source: CoinMarketCap

Besides the compounding growing demand for privacy, Zcash’s growth also coincides with a concerning time for Monero’s security . Throughout August and September, the Monero network has been constantly attacked by the Qubic Pool via a selfish mining strategy that has generated multiple blockchain reorganizations and hundreds of orphaned blocks, as Coinspeaker reported .

Nevertheless, the leading privacy coin has received record amounts in donations for development and other proposals during these months, evidencing XMR’s resilience and the importance of investing in privacy.

next