Trader Says Bitcoin Primed for More Downside Before ‘Up-Only Mode,’ Updates Outlook on Ethereum

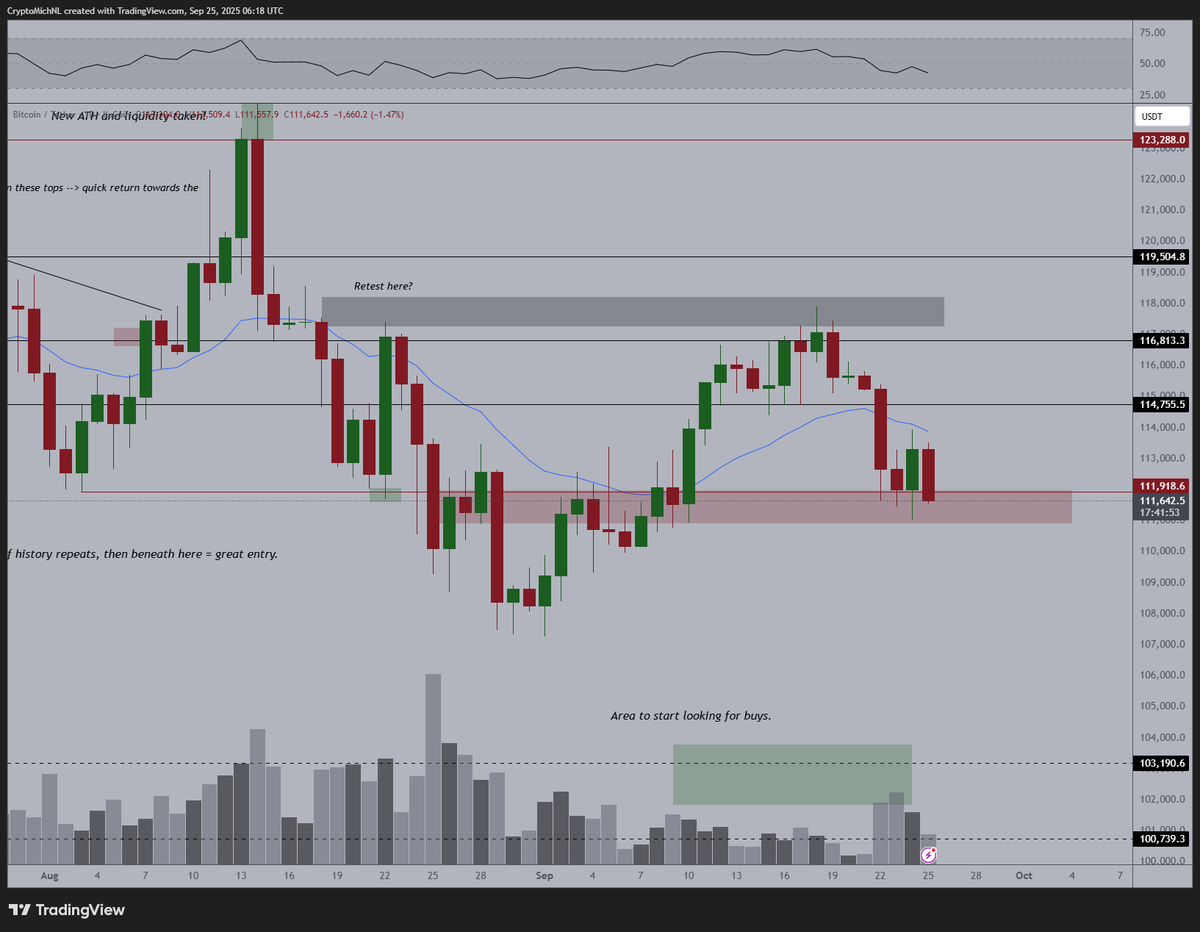

Crypto trader Michaël van de Poppe says that Bitcoin ( BTC ) may have a deeper correction before an explosive move to the upside.

Van de Poppe tells his 808,600 followers on X that Bitcoin may decline below its current $111,000 range before entering a period of bullish momentum.

“I would assume that we’ll be going to get some more downside and then we’re done for the current period, meaning that we’ll be in up-only mode.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Looking at his chart, the trader suggests Bitcoin may retest the level around $108,000 similar to late August.

Bitcoin is trading for $111,075 at time of writing, down 2.3% in the last 24 hours.

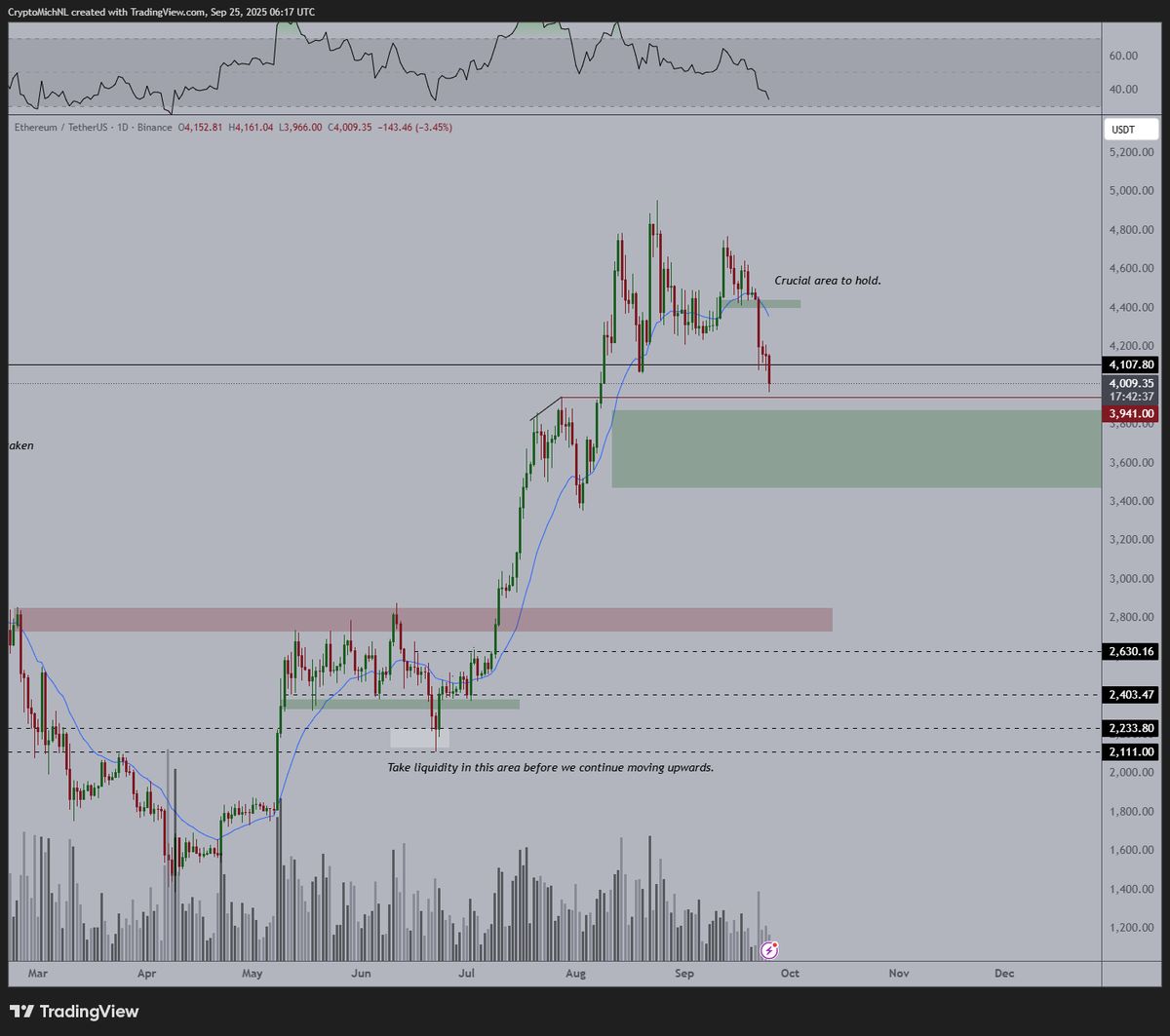

Next up, the analyst says that Ethereum ( ETH ) may form a local market bottom around the $3,800 level.

“I don’t think there’s much more downside to come. Would suggest that the green zone is where we’ll be bottoming out. Perhaps another 5% drop on ETH and that should be it.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

The analyst also predicts that ETH will hit five-figures this cycle and other altcoins may increase 400% from their current values.

“It’s near the bottom on altcoins and ETH. What’s next? ETH at $10,000. Altcoins to go 3-5x. It’s not the end of the bull market, it’s the start of the bull market and recent listings have shown proof of this.”

ETH is trading for $4,002 at time of writing, down 4.5% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The HYPE Token Crypto Rally: Unveiling the Driving Force Behind Its Week-Long Surge

- HYPE Token's 7-day surge in late 2025, reaching $35.08, was driven by protocol upgrades, institutional backing, and retail FOMO. - Institutional investments like Paradigm’s $581M stake and retail-driven momentum mirrored the 2021 Dogecoin rally. - However, looming token unlocks and bearish indicators, including a $11B unlock of 237M tokens, raised sustainability concerns. - Technical analysis showed mixed signals, with consolidation near support levels and short-term volatility risks, while broader trend

How CFTC-Recognized Platforms Such as CleanTrade Are Transforming the Landscape of Clean Energy Investments

- CFTC-approved CleanTrade introduces a regulated SEF for clean energy derivatives, addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of vPPAs/RECs, achieving $16B notional volume in two months by aggregating demand/supply. - Integrated risk analytics (e.g., CleanSight) enhance transparency, allowing investors to hedge project-specific risks like grid congestion and curtailment. - Dual investment pathways attract hedge funds/pension funds through direct

The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

The Increasing Overlap Between Health and Financial Wellbeing in Managing Personal Finances

- Global wellness economy to hit $9 trillion by 2028, driven by holistic well-being trends. - Millennials/Gen Z prioritize wellness as lifestyle, with 55% spending over $100/month on health. - Employers integrate financial wellness into health programs to reduce burnout and boost productivity. - Investors target wellness-driven SaaS, healthcare tech , and financial literacy platforms for holistic solutions.