XRP Surge: Optimistic Trends Clash with Broader Market Downturn Impacting Altcoins

- XRP breaks above 50-day EMA with rising RSI and volume, signaling bullish momentum amid altcoin market shifts. - Fed policy and USD strength weigh on crypto, while Bitcoin's 61.20% dominance drains capital from smaller tokens like XRP. - Institutional whale purchases (60M XRP) provide temporary support, but $2.83 support and $2.95 resistance will determine trend sustainability. - Analysts split on XRP's trajectory: $3.00 potential if volume holds, but $2.70 breakdown risks 25% drop to $2.08 amid macroeco

The cryptocurrency sector is undergoing a significant transformation, as shifts in liquidity and technical signals point to a possible upswing in altcoins, especially

On the macroeconomic front, the U.S. Federal Reserve’s cautious approach and the robust U.S. dollar continue to exert pressure on the overall crypto landscape. XRP’s price movement has reflected the broader altcoin downturn, with sellers dominating as Bitcoin’s market share climbs to 61.20%, diverting funds from smaller assets. Nonetheless, blockchain data shows modest inflows of $392K in recent days, hinting at selective accumulation despite lackluster price action XRP Price Prediction: Why Is XRP Going Down? [ 2 ]. Institutional involvement remains unpredictable, with large holders—such as a 60 million XRP purchase during a 24-hour dip to $2.40—offering short-term support.

Technical analysis highlights the vulnerability of XRP’s current rally. Although breaking above the 50 EMA is encouraging, the token is still confined within a descending wedge, and three straight bearish candles point to persistent negative sentiment XRP Price Prediction: Why Is XRP Going Down? [ 2 ]. The Chaikin Money Flow (CMF) indicator signals capital outflows, while the MACD histogram displays red bars, indicating ongoing downward pressure XRP Price Prediction: Why Is XRP Going Down? [ 2 ]. Ultimately, XRP’s capacity to defend the $2.83 support and reclaim $2.95 resistance will be key in determining if a lasting upward trend can develop XRP Price Prediction: Why Is XRP Going Down? [ 2 ].

The wider altcoin space is at a turning point as liquidity moves between

Expert opinions are split regarding XRP’s short-term direction. Some foresee a move to $3.00 if momentum and trading activity remain robust, while others warn that a fall below $2.70 could lead to a 25% decline toward $2.08. The U.S. Treasury’s upcoming payment infrastructure upgrade on September 30 has also fueled speculation about XRP’s potential use, though analysts stress that regulatory certainty, rather than speculation, will be the main driver of sustainable price growth XRP Price Prediction: Why Is XRP Going Down? [ 2 ].

To sum up, XRP’s recent technical breakout and ongoing macroeconomic challenges paint a complicated picture for altcoins. While waves of liquidity and institutional interest could push XRP closer to $3.00, the risk of deeper pullbacks remains if Bitcoin’s dominance continues or trading volume drops. Market participants will keep a close eye on the 50 EMA, the $2.83 support, and broader economic trends to assess the durability of this rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Mirrors Its 2020 Blastoff: Is ADA Headed for $5 or $10 This Altseason?

Weeks after raising $100M, investors pump another $180M into hot Indian startup MoEngage

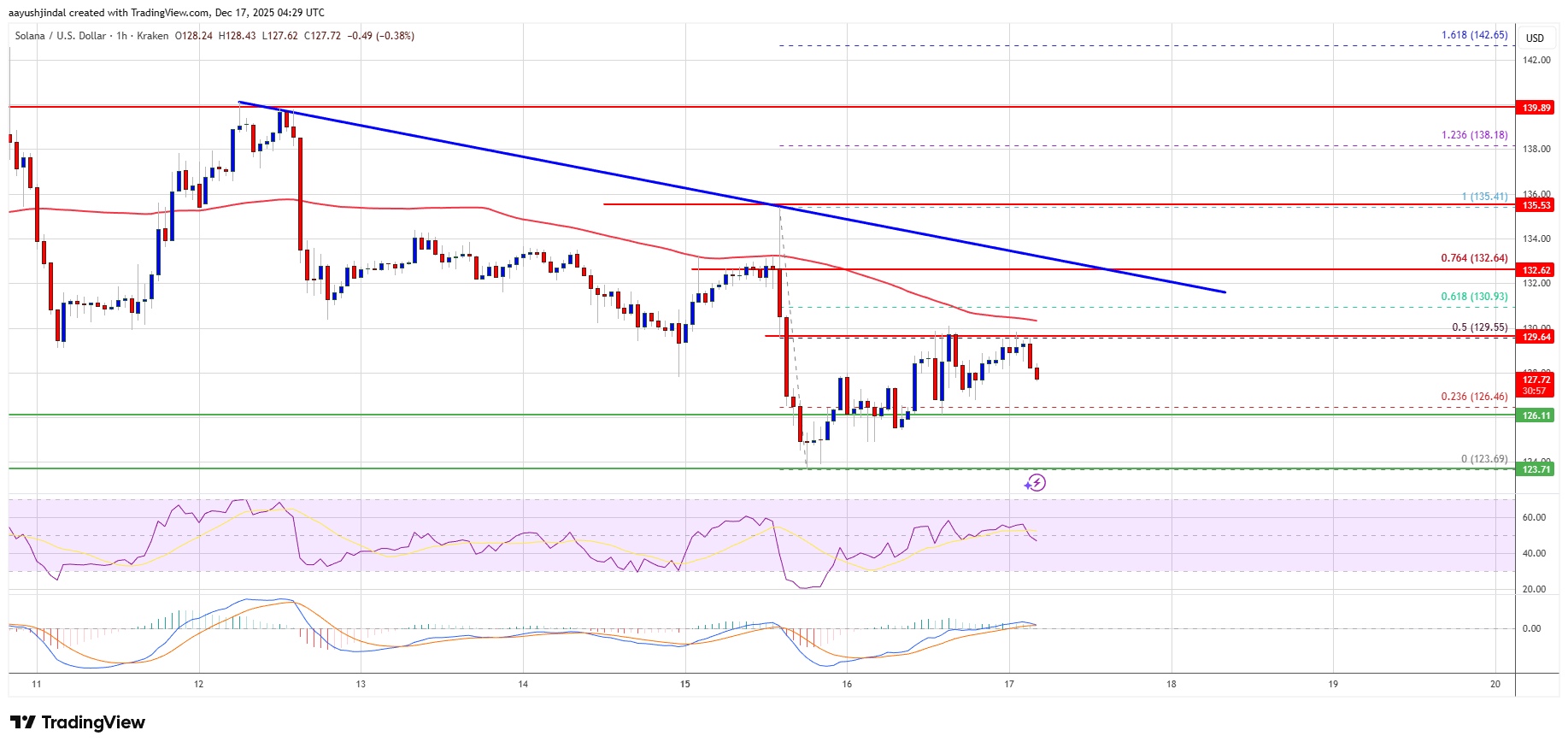

Solana (SOL) Loses Momentum—Could Sellers Take Control Again?

Fed Chair Selection: How Christopher Waller’s Crypto-Friendly Stance Could Transform US Monetary Policy