BlackRock’s acquisition of 706,000 BTC: A $71 billion wager on the institutionalization of cryptocurrency

- BlackRock added 3,950 BTC to its treasury via IBIT, raising total holdings to 706,000 BTC valued at $71.07 billion. - The firm's $87B spot Bitcoin ETF attracted $60.7B in inflows since January 2024, while Ethereum holdings reached 1.311M ETH ($3.58B). - SEC's streamlined crypto ETF rules enabled BlackRock to launch a Bitcoin Premium Income ETF and expand tokenized products like BUIDL ($2.9B AUM). - Analysts highlight BlackRock's $260M annual crypto ETF revenue and market dominance as the largest institut

BlackRock, recognized as the largest asset manager globally, has acquired an additional 3,950

This purchase follows a larger $533 million investment in both Bitcoin and

The SEC’s recent green light for generic listing standards for crypto ETFs has further accelerated BlackRock’s growth in digital assets. The updated regulations, which shorten the approval period for spot ETFs from 240 days to just 75 days, have fostered a more innovation-friendly regulatory landscape. Among the products set to benefit is BlackRock’s Bitcoin Premium Income ETF, a covered-call fund aimed at generating returns from Bitcoin holdings. The company has already registered the iShares Bitcoin Premium ETF name and is expected to submit an S-1 registration to the SEC soon BlackRock’s $12.5T Bitcoin ETF Filing Shakes Markets [ 3 ].

Industry experts point out that BlackRock’s assertive approach to crypto is surpassing its rivals. Its Bitcoin and Ethereum ETFs have brought in over $260 million in annual revenue within two years, with $218 million coming from Bitcoin-related products. According to on-chain data from

The SEC’s recent pivot toward fostering innovation under Chair Paul Atkins has also shaped BlackRock’s strategy. The regulator’s approval of in-kind redemptions for crypto ETFs—enabling direct asset transfers between custodians—has streamlined large-scale transactions. BlackRock CEO Larry Fink has publicly supported asset tokenization, remarking that “every financial instrument will be on one general ledger.” This outlook is reflected in the firm’s exploration of tokenized ETFs, such as its BUIDL fund, which has reached $2 billion in assets .

Market analysts expect more regulatory transparency and a broader range of products in the near future. The SEC’s generic listing standards are likely to make it easier to approve spot ETFs for alternative coins like

BlackRock’s ongoing Bitcoin acquisitions and ETF developments signal a wider institutional acceptance of cryptocurrencies. The company’s purchases during market dips have strengthened its role as a stabilizing presence, while its tokenization projects indicate a lasting dedication to digital assets. With the SEC continuing to simplify the approval process, BlackRock is well-placed to retain its leadership in crypto ETFs and further its impact in the digital asset sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Πρόβλεψη τιμής Bitcoin για το 2026

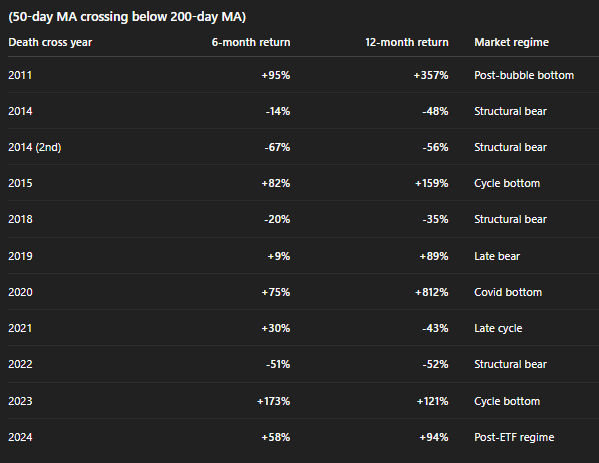

Bitcoin ‘Death Cross’ Panic Returns: History Says It’s A Late Signal

Exodus Picks MoonPay to Issue a Dollar Stablecoin for Exodus Wallet Users