Financial Giant Citi Predicts Stablecoin Market Cap Could Balloon to $4,000,000,000,000 in Just Five Years

The financial services giant Citi foresees explosive growth for the stablecoin market by the end of the decade.

Stablecoins are digital assets backed by high-quality short-term securities or cash-like assets that operate on blockchains.

In a new report , Citi says that in a best case scenario, the total market cap of stablecoins will surge to $4.0 trillion in the next five years.

“We are revising our stablecoin total issuance forecasts in this report to: $1.9 trillion base case (previously $1.6 trillion) and $4.0 trillion bull case ($3.7 trillion), due to the strong growth of the market in the past six months and the wide range of project announcements, in the U.S. and internationally.”

The bank says it is raising its original forecast in its April 2025 Citi GPS: Digital Dollars report because of the strong momentum in the ecosystem, which includes the integration by payment networks, launch of new layer-1 blockchains and regulatory clarity in key markets.

The report says the issuance volumes of the nascent asset grew by over 20% in the past six months and nearly 40% year-to-date.

During this period, US legislators passed the GENIUS Act to establish a regulatory framework for stablecoins. The European Union also began the enforcement of the Markets in Crypto-Assets Regulation (MiCAR) that covers electronic money tokens and Hong Kong introduced licensing rules for stablecoins.

“Summer 2025 has been dubbed ‘Stablecoin Summer’ by industry participants. New business activity around stablecoins, for solutions including commerce, payments and ‘real world’ applications, have heated up over the summer. We believe these could further power issuance and transaction volumes during 2026 and beyond.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Prediction: Why the $3 December Target Is More Hope Than Reality

“Bitcoin Rodney” Faces Decades in Prison as Feds Expand HyperFund Charges

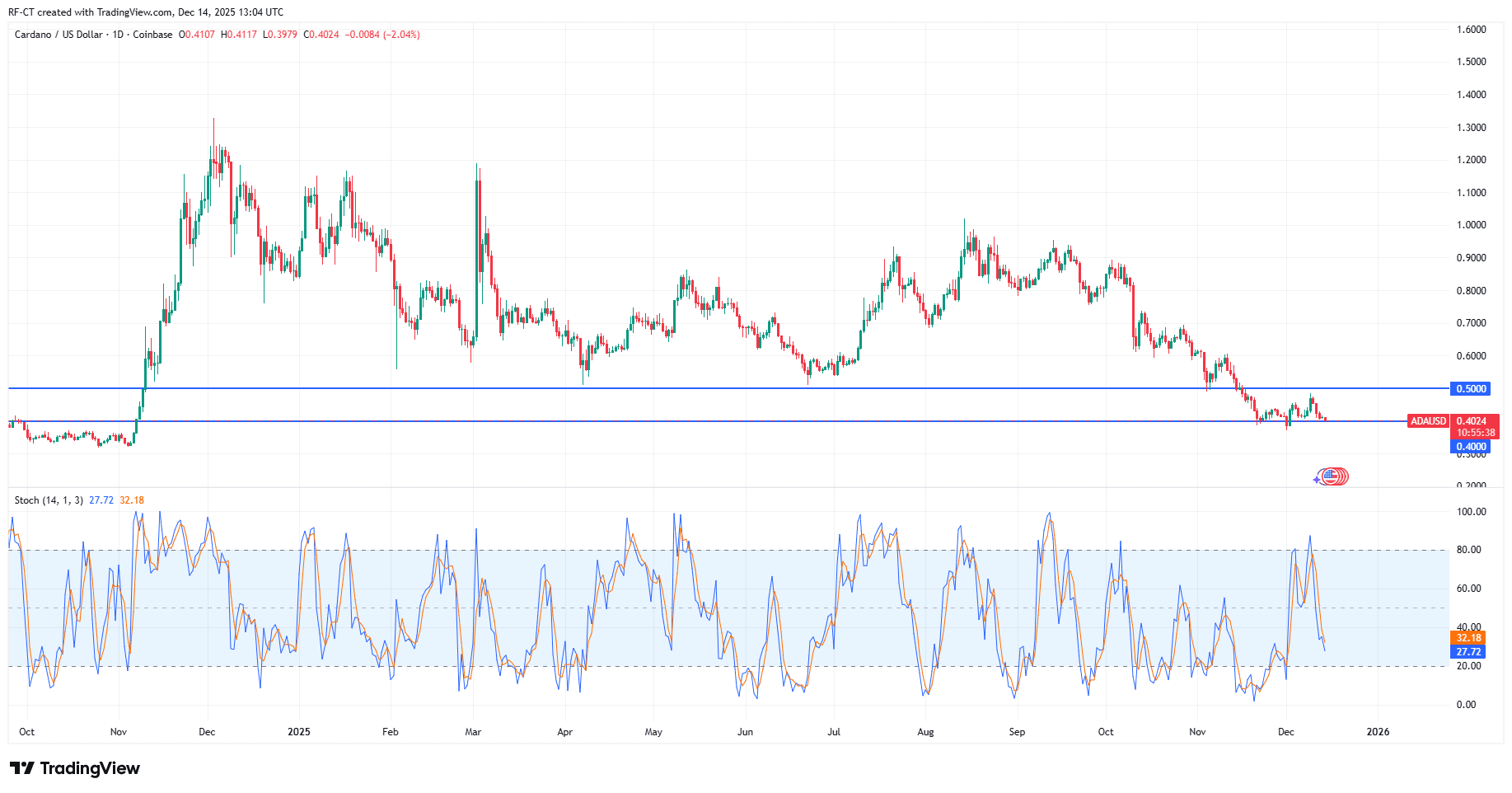

Cardano Price Prediction: Is ADA Forming a Base or Headed for Another Breakdown?

The ICP Surge: Unpacking a 30% Jump and Its Driving Factors

- ICP surged 30% in late October 2025 amid speculation and institutional adoption, driven by Microsoft/Azure partnerships and AI upgrades like Caffeine. - On-chain data shows 35% growth in active addresses but 91% fewer token transfers during downturns, highlighting fragile retail-driven momentum. - TVL hit $237B via asset tokenization, yet dApp engagement dropped 22.4%, signaling volatility despite 40+ tech upgrades including Chain Fusion. - Analysts project $11.15–$88.88 price ranges by 2030, contingent