Ethereum's Emergence as a Corporate Yield Instrument Faces Regulatory Examination

- Over 55 entities now hold significant ETH reserves, using staking (3-5% yields) and DeFi lending to optimize balance sheets, creating supply-side pressures as corporate holdings exceed annual ETH issuance by 186x. - GSR's first ETF bundling ETH-holding firms and Chinese companies like Jiuzi Holdings ($1B crypto allocation) signal institutionalization, blending traditional finance with digital asset strategies. - Regulatory scrutiny of pre-announcement trading and staking's securities classification risks

The increasing use of

Financial products are formalizing institutional involvement. Crypto market-maker GSR has introduced the first ETF that aggregates companies with digital asset reserves, including those holding ETH. This move, part of a larger trend toward mainstream crypto adoption, could boost ETH demand by offering regulated pathways for corporations to engage with digital assets. Other ETFs, such as Grayscale’s

Corporate involvement is moving beyond conventional reserves. Jiuzi Holdings, a Chinese company specializing in EV charging infrastructure, recently authorized a $1 billion crypto investment plan, allocating funds to Bitcoin, Ethereum, and BNB. Their approach focuses on safeguarding long-term value and hedging against macroeconomic risks, reflecting a broader evolution in treasury management. Similar strategies by companies such as SharpLink Gaming and BitMine Immersion Technologies highlight Ethereum’s dual role as both a value store and an operational asset.

Nonetheless, regulatory oversight remains a significant factor. The U.S. Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) are examining unusual trading activity before corporate crypto disclosures, raising questions about market fairness title1 [ 1 ]. Although no official actions have been taken, these investigations underscore the dangers of selective information sharing and insider trading in the volatile crypto sector. Authorities are also assessing whether staking could be classified as a securities offering, a determination that might reshape corporate approaches.

Market experts believe Ethereum’s combined role as a reserve and yield asset could support price stability. Should institutional demand continue to exceed supply, ETH may experience upward price momentum, potentially reaching values like $5,864 if adoption accelerates. On the other hand, stricter regulations or a slowdown in corporate activity could see prices fall below $2,750, as observed in previous downturns. The balance between supply, yield opportunities, and regulatory developments will be crucial in shaping ETH’s future.

Corporate strategies for Ethereum are increasingly incorporating DeFi protocols and liquid staking derivatives, resulting in a hybrid financial model that merges traditional and digital asset management. This shift positions ETH as both a strategic reserve and a source of active income, setting it apart from Bitcoin’s more passive use. As platforms like Morpho and

The growth of Ethereum holdings among corporations signals a fundamental change in corporate finance, where digital assets are becoming essential tools for optimizing balance sheets rather than mere speculative bets. While regulatory ambiguity and liquidity issues remain challenges, the growing use of ETH through staking, ETFs, and DeFi lending points to a maturing market. These trends, combined with supply constraints, could support a positive outlook for ETH, provided adoption continues and regulatory frameworks evolve favorably.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

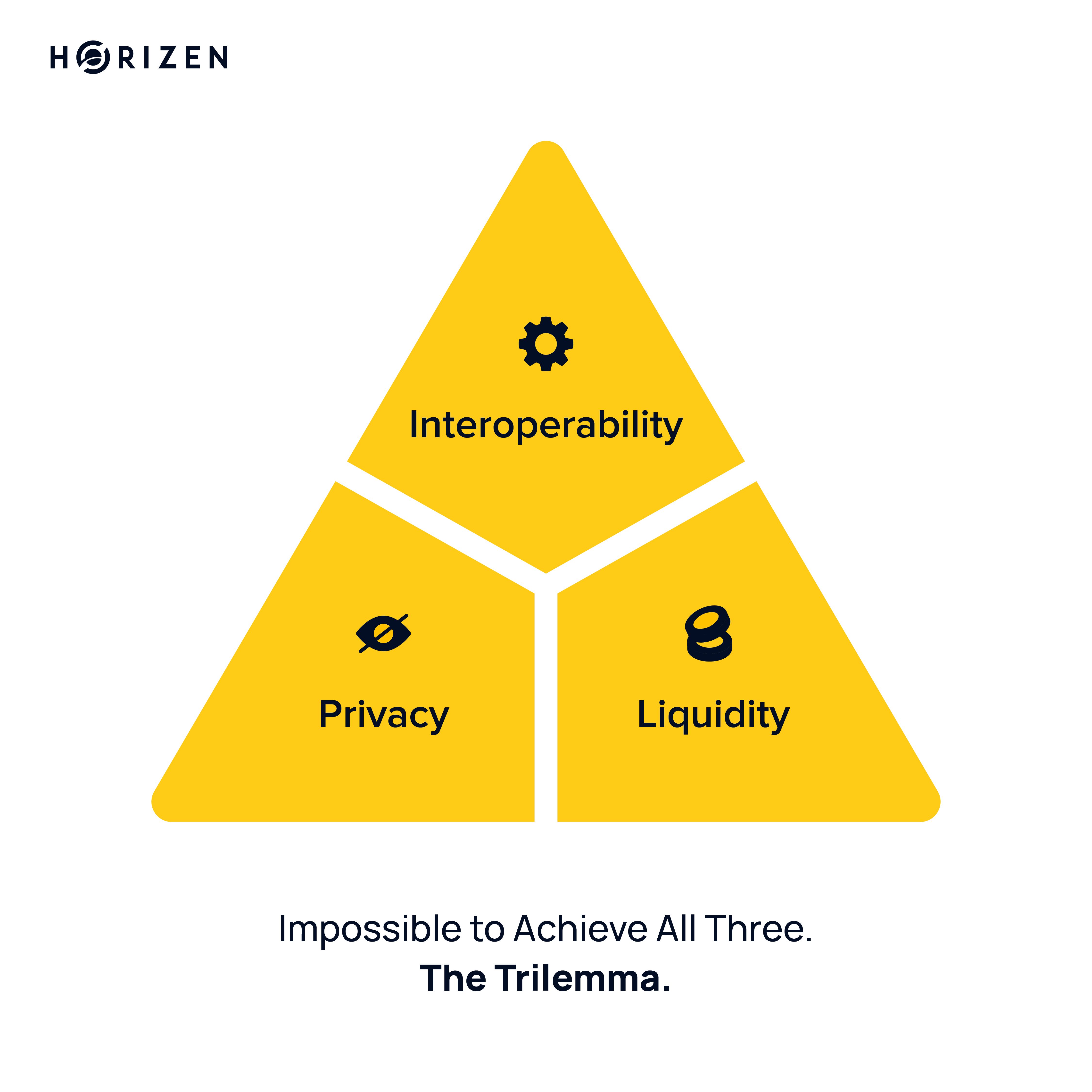

The Institutional Blockchain Trilemma

Visa Now Lets You Get Paid in Stablecoins

BNB News Today: BNB Surges Back to $1,000—Is This a Genuine Breakout or Just a Temporary Rally?

- Binance Coin (BNB) rebounds above $1,000 after hitting $900 lows, sparking debate over sustained recovery or bearish reversal. - BNB Chain upgrades security by migrating multi-signature wallets to Safe Global, aiming to boost user confidence and EVM compatibility. - Nano Labs repays bonds early to mitigate risk, reflecting institutional focus on liquidity amid crypto market volatility. - AI models predict $1,600 BNB by 2026 if on-chain activity and institutional demand persist, but key resistance at $1,1

Bipartisan Agreement Concludes 43-Day Government Shutdown, Delaying Healthcare Dispute

- U.S. House to vote on bipartisan deal ending 43-day government shutdown, with short-term funding extending through January 30. - Agreement includes three-year appropriations bills but fails to extend Affordable Care Act subsidies, sparking Democratic criticism over unmet healthcare demands. - Economic fallout includes 1.5% GDP growth drop, unpaid federal workers, and disrupted SNAP programs affecting 42 million Americans. - Market rebounded with Bitcoin surging past $106,000, but partisan tensions persis