Bitcoin Surges to $109K Despite Fear Index at 28, Igniting Optimism for a Recovery

- Bitcoin's Fear & Greed Index fell to 28, its lowest since April 2025, as BTC traded near $109,000 amid heightened retail bearishness. - Historical patterns show market recoveries after extreme fear metrics, but current macroeconomic risks complicate reversal predictions. - Retail pessimism contrasts with institutional buying, highlighting fragmented market psychology during volatility. - Analysts caution the index reflects sentiment, not fundamentals, requiring technical validation for reversal confirmat

The

The latest index value highlights widespread unease among traders, fueled by global economic uncertainty and regulatory challenges. Social media, a major factor in the index, has seen a spike in negative sentiment, with many retail investors bracing for further declines Crypto Fear & Greed Index Now Echoes $83,000 Bitcoin Price [ 3 ]. Data from Santiment supports this, noting a "high amount of impatience and bearishness" among smaller investors, even as large-scale traders are increasing their positions Crypto Fear & Greed Index Now Echoes $83,000 Bitcoin Price [ 3 ]. This split between retail pessimism and institutional activity underscores the complex psychology at play during turbulent times.

Past trends linking the Fear & Greed Index to BTC price shifts have produced mixed results. The index has sometimes marked market bottoms when fear peaked, such as in February 2025 when it fell to 10 amid U.S. tariff worries Crypto Fear & Greed Index Now Echoes $83,000 Bitcoin Price [ 3 ]. Yet, the current environment is further complicated by inflation and evolving regulations. Experts warn that while the index is a helpful gauge of sentiment, it should be used alongside other technical and fundamental indicators. "Periods of extreme fear can signal undervalued assets, but a true reversal needs more confirmation," said Michael Pizzino, a crypto YouTube commentator Crypto Fear & Greed Index Now Echoes $83,000 Bitcoin Price [ 3 ].

The index’s calculation blends factors like volatility, trading activity, social media trends, and Bitcoin’s market share Live Crypto Fear and Greed Index (Updated: Sep 24, 2025) [ 1 ]. Critics point out that its focus on behavioral data can make it subjective, as sentiment may be swayed by events unrelated to price fundamentals. For example, the current score might not fully reflect institutional moves or broader economic changes that could influence BTC apart from retail attitudes Live Crypto Fear and Greed Index (Updated: Sep 24, 2025) [ 1 ]. Still, supporters argue that the index is useful for spotting contrarian opportunities. "When fear is widespread, it often sets the stage for a rebound as investors look to buy at lower prices," commented an analyst from Coinbird.com Bitcoin Fear & Greed Index (September 2025) - coinbird.com [ 2 ].

Looking forward, the market is at a crucial juncture as participants watch for signs of a turnaround. Historical patterns suggest that prolonged fear could eventually give way to renewed optimism, especially if economic conditions improve. However, uncertainty remains high, and experts stress the importance of caution. "The index offers valuable perspective, but it’s just one tool—not a predictor of the future," Pizzino added Crypto Fear & Greed Index Now Echoes $83,000 Bitcoin Price [ 3 ]. The next few weeks will likely challenge both the index and BTC’s price, as investors weigh short-term swings against long-term prospects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: John Deaton's Crypto-Driven Battle Against Washington: Taking on 'Missing in Action' Senators in Democratic Massachusetts

- John Deaton, a crypto-advocate lawyer, launches 2026 Senate bid in Massachusetts against Democrat Ed Markey. - His campaign emphasizes pro-crypto policies, targeting Markey's climate-focused record and "career politicians." - Deaton faces long odds in a blue state but leverages crypto donations and GOP endorsements to challenge Markey. - Markey's team dismisses Deaton as unproven, highlighting Massachusetts' history of rejecting Republican Senate candidates. - The race highlights crypto's growing politic

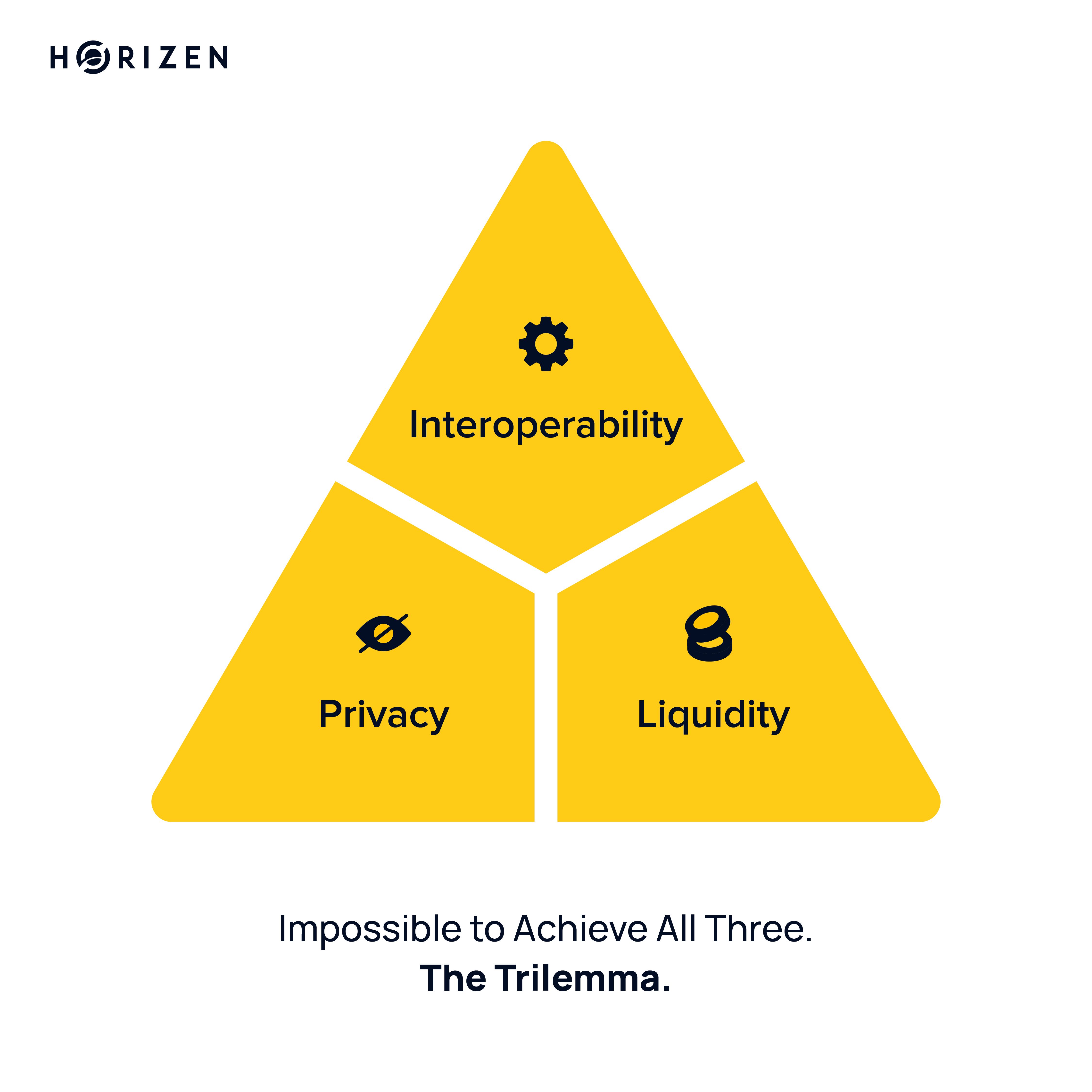

The Institutional Blockchain Trilemma

Visa Now Lets You Get Paid in Stablecoins

BNB News Today: BNB Surges Back to $1,000—Is This a Genuine Breakout or Just a Temporary Rally?

- Binance Coin (BNB) rebounds above $1,000 after hitting $900 lows, sparking debate over sustained recovery or bearish reversal. - BNB Chain upgrades security by migrating multi-signature wallets to Safe Global, aiming to boost user confidence and EVM compatibility. - Nano Labs repays bonds early to mitigate risk, reflecting institutional focus on liquidity amid crypto market volatility. - AI models predict $1,600 BNB by 2026 if on-chain activity and institutional demand persist, but key resistance at $1,1