Bitcoin correction: BTC fell below $109,000 after long-term holders realized roughly 3.4 million BTC in cumulative profits and ETF inflows slowed, signaling potential cycle exhaustion and increasing the risk of a deeper short-term pullback for the market.

-

Long-term holders realized ~3.4M BTC in profits, matching prior cycle tops.

-

Price dipped to a four-week low near $108,700; downside risk to ~$107,500 remains.

-

On-chain metrics (SOPR, NUPL) and slower ETF inflows point to a potential cooling phase.

Bitcoin correction: BTC fell under $109,000 as long-term holders realized 3.4M BTC in profit; read analyst views and steps traders can take.

Bitcoin dropped to under $109,000 as long-term holders realized 3.4 million Bitcoin profits and ETF inflows slowed, signalling potential cycle exhaustion.

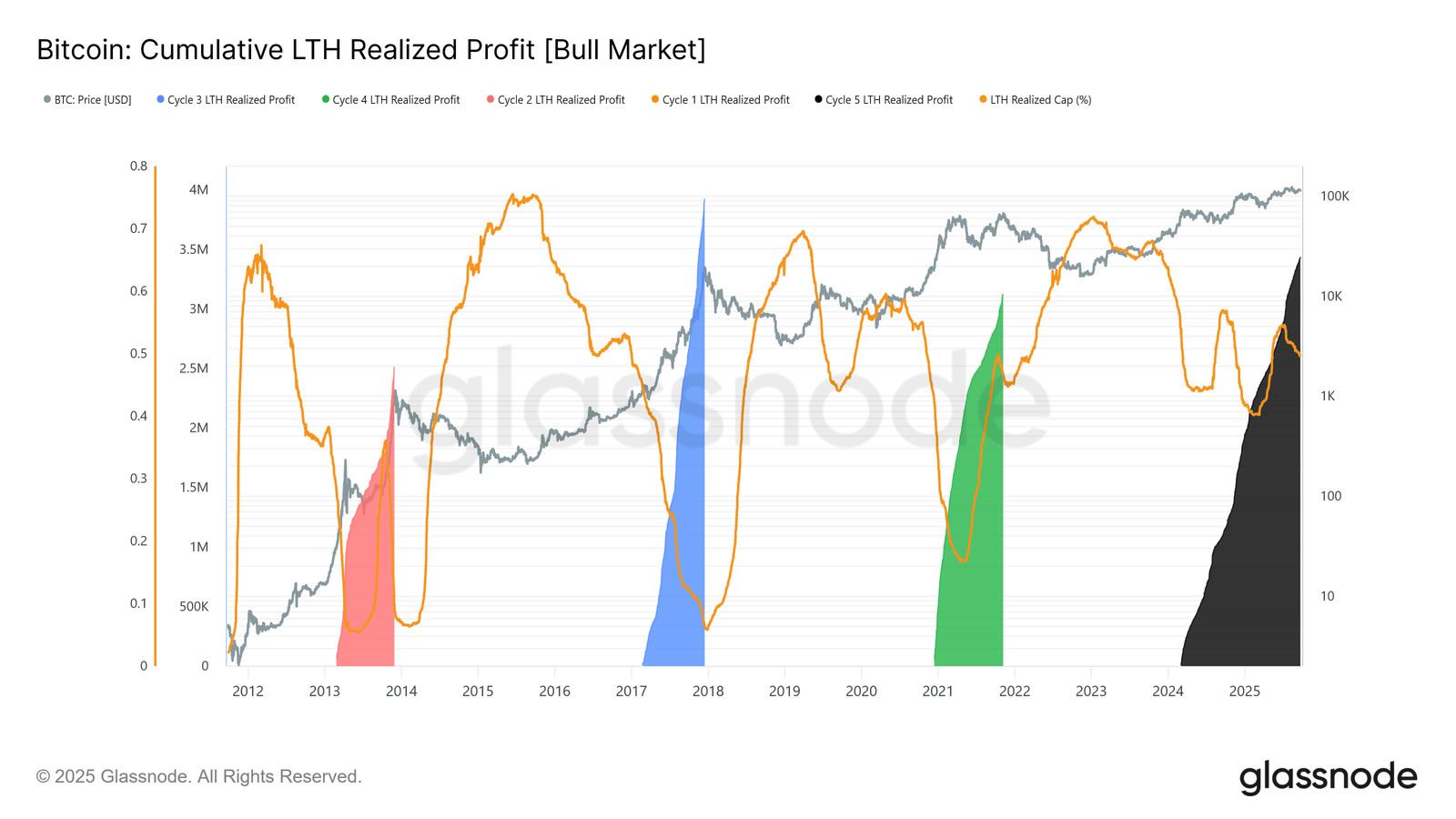

Bitcoin could be headed for a deeper correction as cumulative realized long-term holder profit taking has now reached levels seen in previous market cycle tops, on-chain analysis shows.

Long-term holders realized roughly 3.4 million Bitcoin (BTC) in profit this cycle, and exchange-traded fund inflows have slowed, according to Glassnode — a combination the data firm says is consistent with market “exhaustion” following recent macro moves.

BTC slipped below a nearby support zone at ~ $112,000 and traded as low as $108,700 on Coinbase in late Thursday activity, per TradingView price feeds. Analysts warn a retest of $107,500 is possible if selling momentum resumes.

BTC is retreating from a lower high. Source: Tradingview

What is driving the current Bitcoin correction?

The primary drivers are realized long-term holder profits and a slowdown in ETF inflows, which together weaken demand while increasing supply pressure. On-chain metrics and trading activity front-load the explanation: cumulative profit-taking has reached levels seen at prior cycle peaks, increasing the probability of a cooling phase.

How do on-chain metrics signal exhaustion?

Glassnode’s realized profit/loss ratio and the Spent Output Profit Ratio (SOPR) reveal elevated profit-taking and instances of holders selling at or near breakeven. SOPR is at ~1.01, indicating some sellers realize only minimal gains or losses — a historical sign of market stress. The Short-Term Holder NUPL is also approaching zero, which can precede forced selling by newer holders.

Why could prices test lower support levels?

Short-term technicals show loss of momentum after a brief rebound, and stop-loss clusters sit near $107,500. If selling accelerates, cascade liquidations could push price toward those levels. Analysts, including Markus Thielen of 10x Research, note that many market participants are positioned for a Q4 rally — a mismatch that raises the chance of surprise downside instead.

What are institutional views on the dip?

Views vary: some strategists remain neutral until BTC reclaims $115,000, while others, including high-profile institutional proponents, expect a Q4 recovery once macro headwinds fade. These perspectives reflect differing time horizons and risk tolerances among large holders and institutions.

Cumulative realized profits coincide with cycle peaks. Source: Glassnode

Frequently Asked Questions

Could the Bitcoin correction become a sustained bear phase?

Not necessarily. Current data indicate a cooling phase rather than a full bear market. If institutional demand and long-term holder accumulation re-emerge, the correction could be limited. Persistent declines in demand would increase the odds of a deeper drawdown.

How should traders prepare for this Bitcoin pullback?

Traders can tighten risk controls, size positions conservatively, and set stop-loss levels to manage downside. Maintaining liquidity and monitoring on-chain metrics (SOPR, NUPL) and ETF flow updates helps align position sizing with evolving market conditions.

Key Takeaways

- Realized profits spike: Long-term holders realized ~3.4M BTC, a level seen near prior cycle tops.

- On-chain stress signals: SOPR ~1.01 and Short-Term NUPL near zero suggest rising short-term selling pressure.

- Actionable step: Traders should manage risk, monitor ETF flows and key support near $107,500–$112,000.

Conclusion

Bitcoin’s recent decline under $109,000 reflects elevated realized profits and softer ETF inflows, creating conditions for a cooling phase unless institutional demand reasserts itself. Market participants should watch SOPR, NUPL and support at $107,500–$112,000; risk-aware positioning is advised as signals evolve.