Glassnode Flags Market Exhaustion as ‘Uptober’ Approaches for Bitcoin

Bitcoin faces pressure from heavy profit-taking and fading ETF demand, breaking key support. Yet historical trends show October as one of BTC’s strongest months, keeping hopes of an Uptober rebound alive.

Bitcoin (BTC) faces heightened downside risks following a recent breach of a key level, according to on-chain analytics firm Glassnode. Furthermore, other metrics also suggest the market could be headed for a deeper correction, with sentiment showing signs of strain after the FOMC rally.

However, many analysts believe that the upcoming ‘Uptober’ could prove bullish for BTC. The asset may find seasonal tailwinds that could stabilize price action and spark renewed optimism.

Why Bitcoin’s Price May Drop Further

In their latest analysis, Glassnode noted that Bitcoin is showing signs of ‘exhaustion’ after the Fed rate cut last week, which pushed the price to $117,000.

“Bitcoin has transitioned into a corrective phase, echoing a textbook ‘buy the rumour, sell the news’ pattern,” Glassnode wrote.

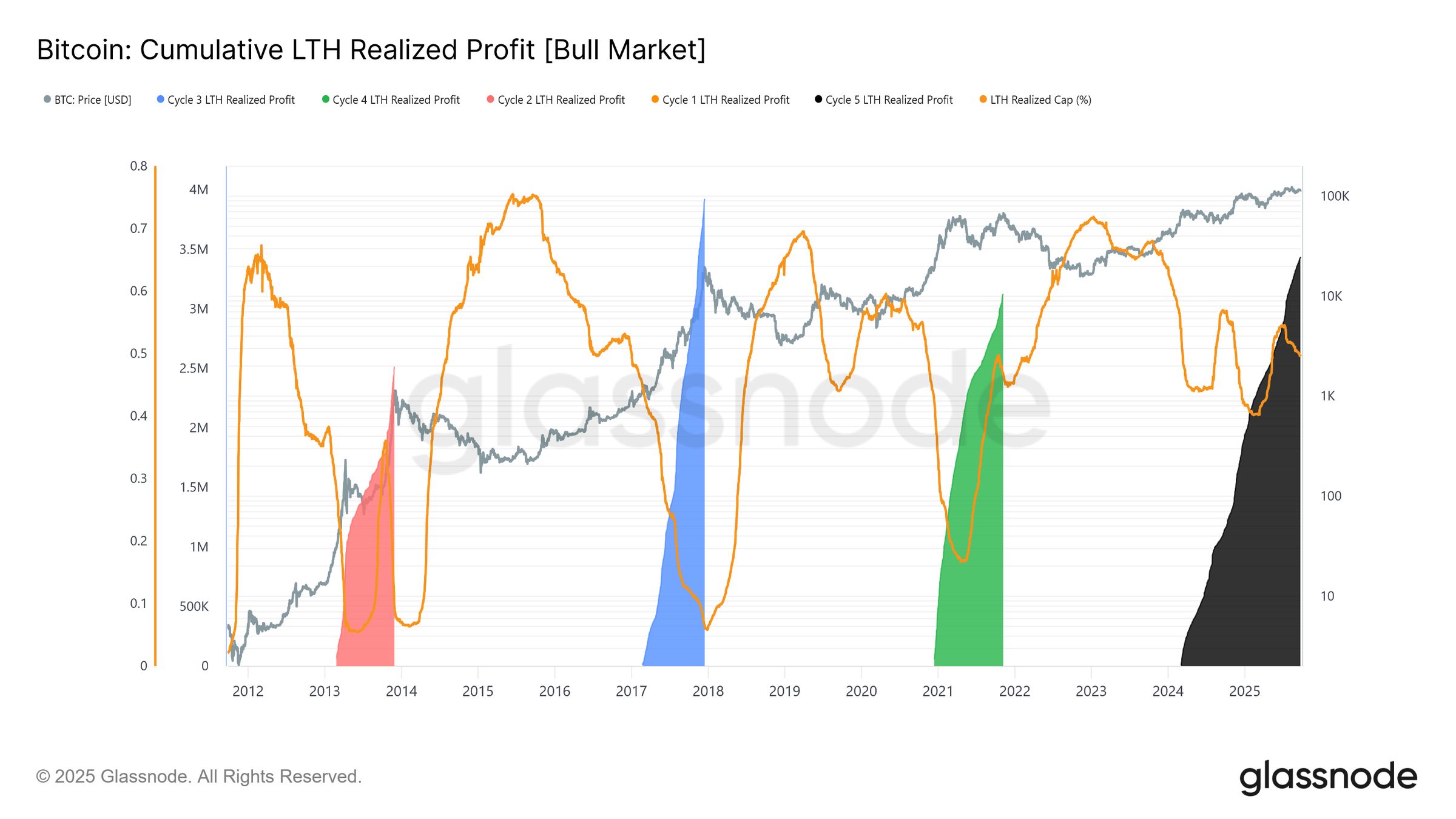

Moreover, underlying metrics suggest vulnerability. The firm highlighted that long-term holders (LTHs) have made massive profits during this phase, realizing around 3.4 million BTC in gains.

This is higher than in any previous cycle. Glassnode added that such large-scale distribution by long-term holders has historically coincided with market tops.

“Unlike the single prolonged waves of earlier cycles, this cycle has seen three distinct multi-month surges. The Realized Profit/Loss Ratio shows that each time profit-taking exceeded 90% of coins moved, marking cyclical peaks. Having just stepped away from the third such extreme, probabilities favour a cooling phase ahead,” the analysts stated.

Bitcoin’s Cumulative LTH Realized Profit. Source:

Glassnode

Bitcoin’s Cumulative LTH Realized Profit. Source:

Glassnode

Meanwhile, a slowdown in fresh demand compounded this pressure. ETF netflows collapsed from 2,600 BTC per day to near zero, just as LTH selling accelerated.

“ETF inflows have so far balanced LTH selling, but with little margin for error. Around the FOMC, LTH distribution surged to 122k BTC/month, while ETF netflows (7D-SMA) collapsed from 2.6k BTC/day to nearly zero. The combination of rising sell pressure and fading institutional demand created a fragile backdrop, setting the stage for weakness,” the analysis read.

In addition, spot markets showed signs of stress as volumes spiked during the post-FOMC sell-off. Futures markets experienced sharp deleveraging, with open interest dropping by billions of dollars.

Options markets also turned defensive, with put demand surging and skew rising sharply, underlining traders’ caution. Amid this, Glassnode pointed out that $111,800, the short-term holder cost basis, is an important level to sustain.

“With spot and futures under stress, the short-term holder cost basis at $111k is the key level to hold or risk deeper cooling,” the firm stressed.

Now, since Bitcoin has already slipped below the cost basis, the probability of further declines has increased significantly. Analyst Quinten Francois suggested that while the outlook is not particularly bullish in the short term, the market may lean sideways rather than an immediate bearish breakdown.

“BTC fell under the $111.8k support and the uptrend support. Made its daily close under these important levels. I think we’re in a no-trade zone and see which direction we go. Might go sideways and liquidity flowing to alts, since the BTC.D is still very bearish,” Francois remarked.

Can Uptober Save Bitcoin? Historical Data Suggests Strong Gains

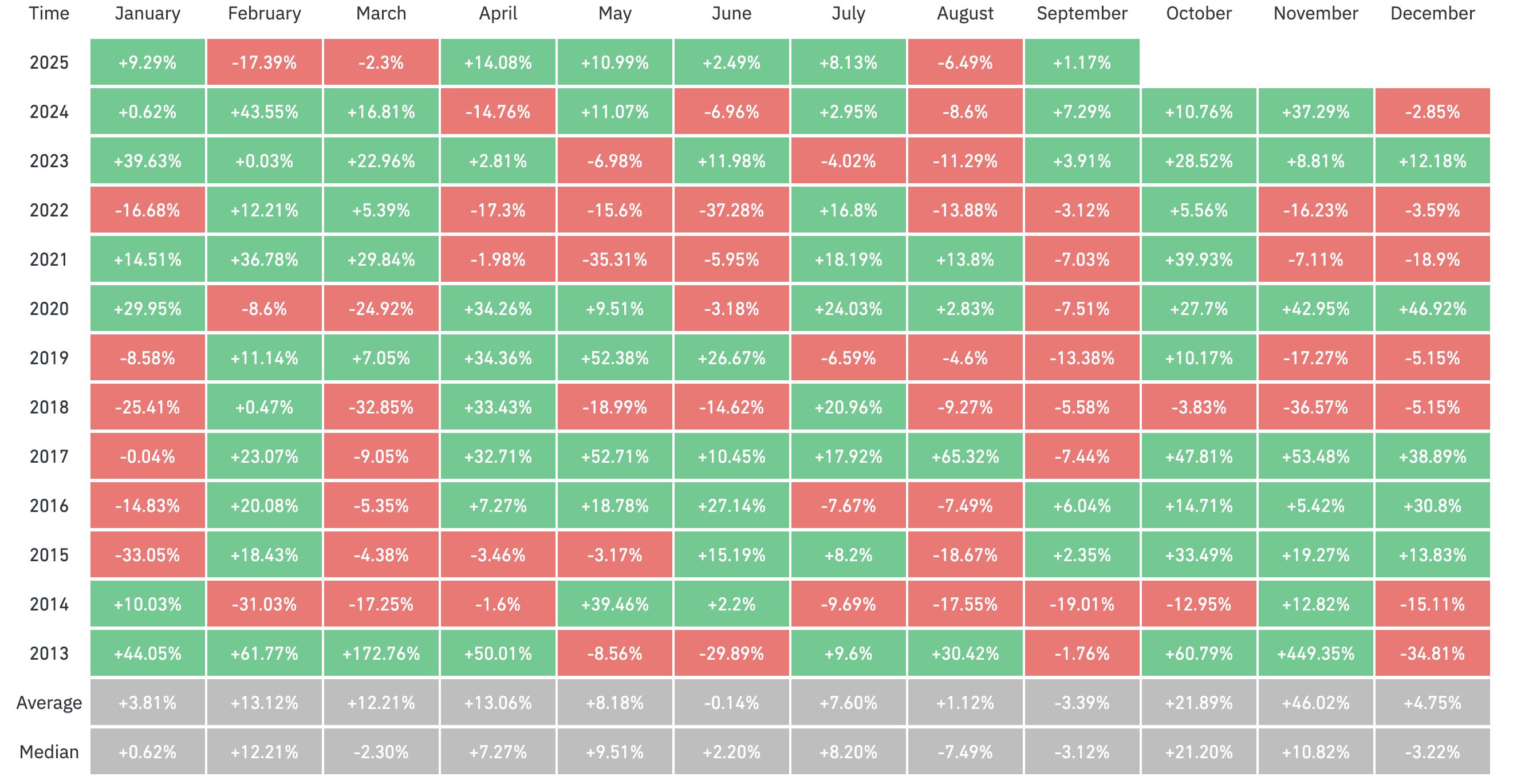

Despite these headwinds, seasonal factors offer a bullish counterpoint. October, often dubbed ‘Uptober’ in cryptocurrency circles, has historically been one of Bitcoin’s strongest months. Data from Coinglass revealed that BTC has posted an average return of 21.89% in the month.

Bitcoin Monthly Returns. Source:

Coinglass

Bitcoin Monthly Returns. Source:

Coinglass

Furthermore, analyst Darkfost noted that over the past 16 years, BTC has closed October in the red only four times.

“If you had invested in BTC on October 1st, you would have ended up in profit 12 times since 2009, with a maximum monthly return of 213% in 2010. Looking more recently since 2020, a simple October 1st investment in BTC would have yielded between 7.5% and 30.5% within the month alone. After this, it’s hard to argue that BTC has no seasonality at all, although it could also be part of a broader seasonal effect across financial markets,” he posted.

This performance has raised market hopes of a potential rally in the upcoming month.

As Bitcoin trades below key support levels, the coming weeks will test whether the asset will fulfill its Uptober promises or if the correction will continue.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

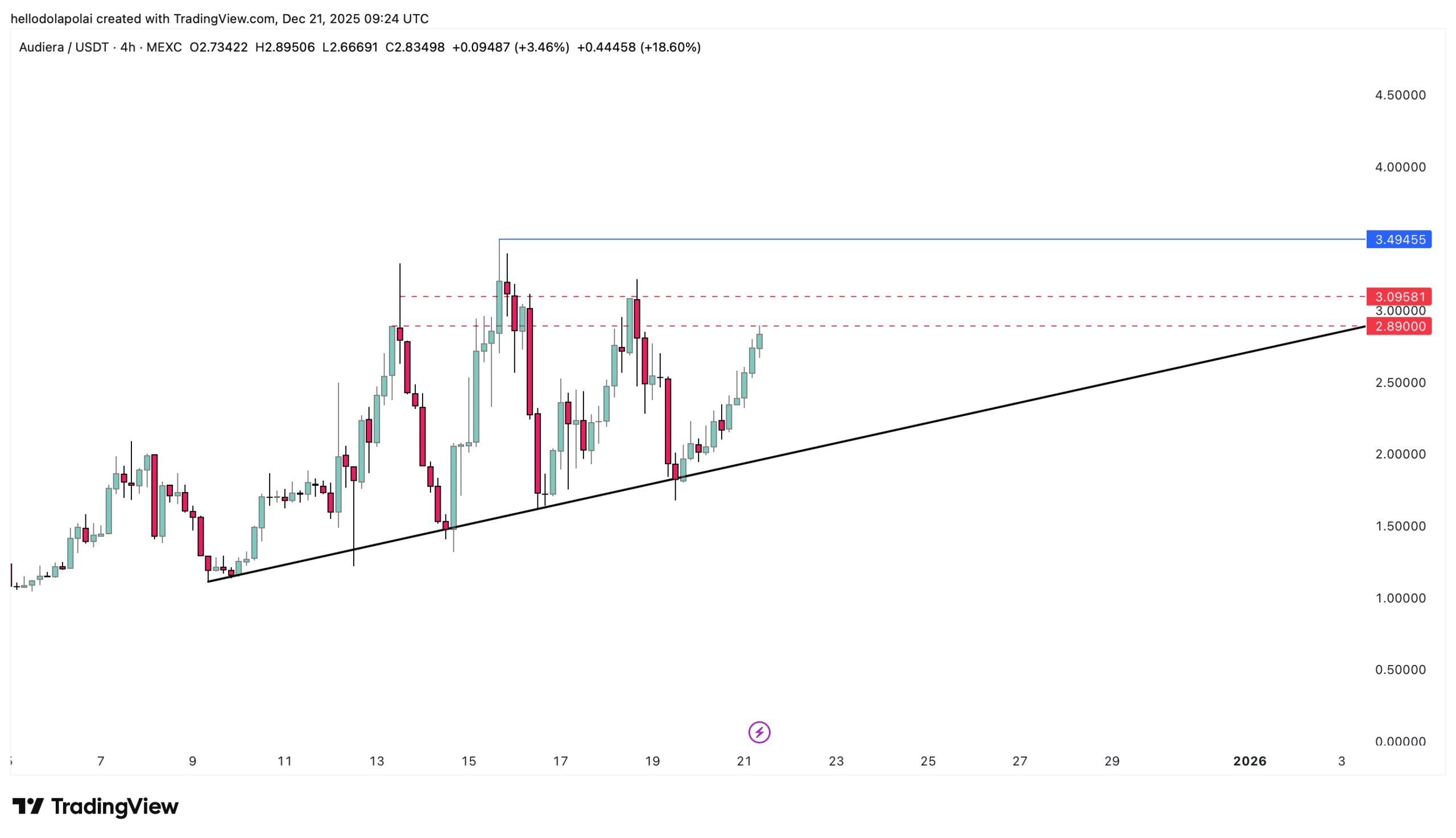

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low