Why did Cloudflare launch its own stablecoin, NET Dollar?

Written by | Sleepy.txt

Edited by | Kaori

Original Title: The Internet Service You Use Every Day Has Just Launched Its Own Stablecoin

You may not have heard of Cloudflare, but as long as you use the internet, it’s almost impossible to avoid its services.

This company is an “invisible giant” in the internet world. Whether you’re ordering takeout, scrolling through short videos, opening your email, or logging into your company’s system, chances are you’re passing through its network. Like a massive digital shield and accelerator, it provides security protection and content delivery services for nearly one-fifth of the world’s websites.

When the web pages you visit load instantly, or your favorite apps withstand hacker attacks, Cloudflare is often working behind the scenes. It truly is the “utilities” of the internet, serving as the foundational infrastructure that supports the efficient and secure flow of global data.

On September 25, Cloudflare made a landmark strategic decision, extending its infrastructure into a whole new dimension by announcing the launch of its own stablecoin—NET Dollar.

Why issue its own stablecoin?

Cloudflare CEO Matthew Prince provided the answer: “For decades, the business model of the internet has been built on advertising platforms and bank transfers. The next era of the internet will be driven by pay-per-use, micropayments, and microtransactions.”

Cloudflare has annual revenue exceeding $1.6 billion, handling trillions of requests daily, making it the underlying “utilities” of the internet. But within this vast digital network, payments are the only link not under its control. This sense of losing control is troubling more and more large enterprises.

Apple settles tens of billions of dollars annually for App Store developers, Amazon handles massive funds for third-party sellers, and Tesla maintains payment relationships with over 3,000 suppliers worldwide. All these giants face the same friction: lengthy settlement cycles, high fees, complex cross-border compliance, and most crucially, a loss of initiative in the most critical closed loop.

As business becomes increasingly digital and automated, this lagging financial infrastructure becomes a bottleneck. Thus, large enterprises are choosing a more direct response: if they can’t change the old system, they’ll build a new one themselves.

Why Do Big Companies Need Their Own Stablecoins?

The emergence of NET Dollar prompts a rethinking of the motivation behind stablecoin issuance. Unlike USDT or USDC, which aim for universal circulation, Cloudflare’s approach is more pragmatic—it wants to first solve payment problems within its own business ecosystem.

This difference is significant.

USDT and USDC targeted the entire crypto market from the start, relying on broad acceptance to build scale; NET Dollar, at least for now, appears more like an “internal currency,” tailored for Cloudflare’s commercial network.

Of course, boundaries are not fixed. PayPal’s PYUSD is a typical example: when it launched in 2023, it only served PayPal’s own payment system, but now it supports exchanges with hundreds of cryptocurrencies, far beyond its initial scope.

Corporate stablecoins are likely to follow a similar path, evolving from internal efficiency tools to broader circulation scenarios.

The key difference lies in motivation. Traditional stablecoin issuers mainly profit from reserve investments, while corporate stablecoins are issued to optimize processes and gain initiative. This different starting point determines their differences in design, application, and future trajectory.

For big companies, payments have always been the “last mile” of the commercial closed loop, but this segment is controlled by banks and payment institutions, with all the problems mentioned at the beginning of the article. So, internalizing payments within their own systems and rebuilding a controllable closed loop with stablecoins has become a strategic choice for large enterprises.

The true value of corporate stablecoins lies in not needing to pursue inflated narratives, but rather in acting like a scalpel to address pain points in processes, greatly improving efficiency.

This value is even more apparent in supply chain finance.

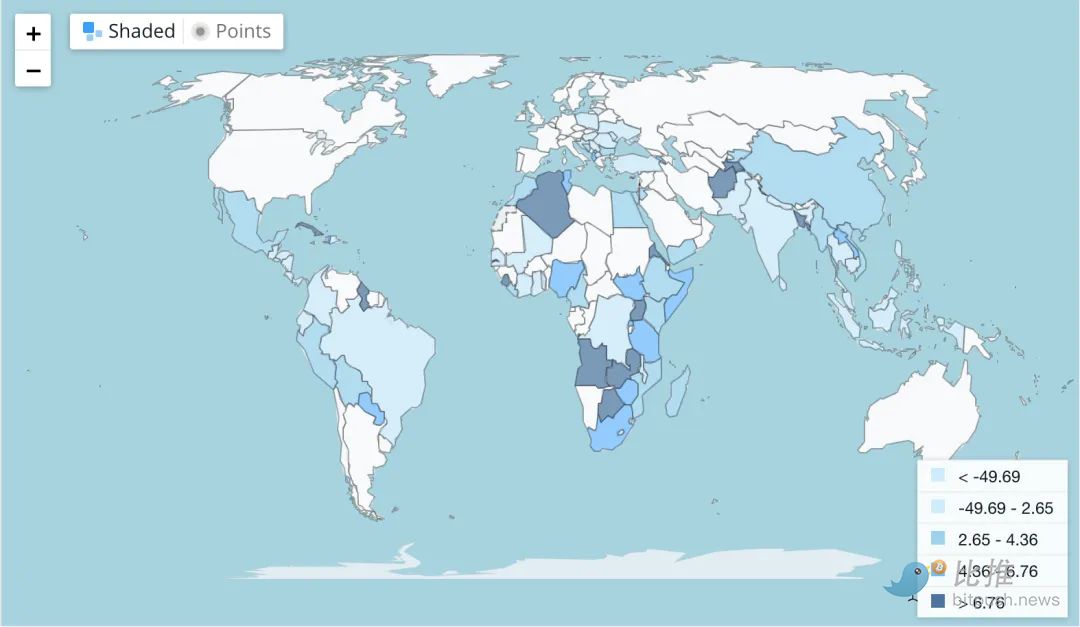

International supply chain finance is inherently a system full of friction. A payment from the US to Vietnam must cross multiple time zones, currencies, and banks. According to the World Bank, the global average remittance cost is still above 6%.

Average transaction cost for remittances to specific countries/regions (%) | Source: WORLD BANK GROUP

Corporate stablecoins can compress this process to just minutes. A US company can pay a Vietnamese supplier in minutes, with costs dropping below 1%. The time funds are in transit is greatly reduced, improving the entire supply chain’s turnover efficiency.

More importantly, the ownership of settlement rights has also changed.

Previously, banks were intermediaries, controlling the speed and cost of transactions; in a stablecoin network, companies themselves can dominate this critical link.

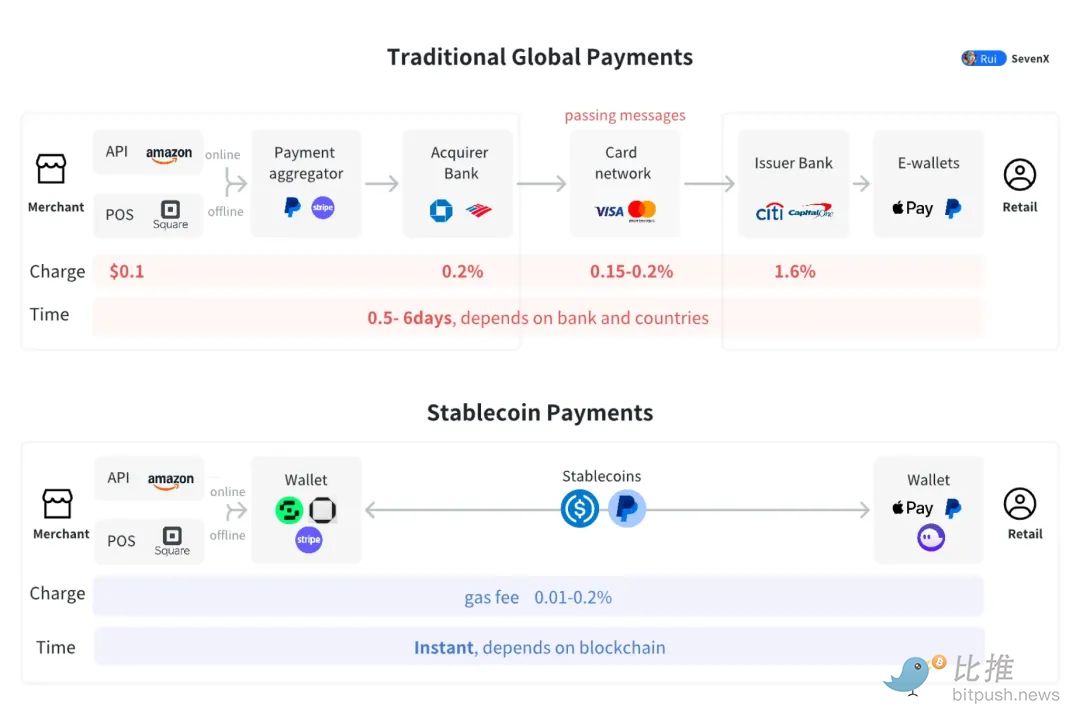

Besides efficiency, cost is also a burden companies cannot ignore. Exchange rate losses, bank processing fees, and card network fees in cross-border payments may seem minor individually, but together they can erode a company’s competitiveness.

This is the significance of corporate stablecoins—they bypass traditional financial intermediaries and reconstruct the cost structure. The change is not only in the absolute reduction of costs, but also in the simplification and transparency of the structure. In traditional models, companies face complex fee structures—fixed fees, percentage fees, exchange rate spreads, intermediary fees—with opaque calculations, making precise forecasting difficult.

In a stablecoin network, costs are almost reduced to just one item: on-chain transaction fees. These are public, predictable, and relatively stable. Companies can therefore calculate expenses and profits more accurately, making decisions with greater confidence.

Comparison of global payment steps in traditional finance vs. stablecoin payments | Source: SevenX Ventures

Furthermore, cash flow management itself can be transformed. Traditional methods rely on manual operations and banking systems, which are complex, inefficient, and prone to errors.

When corporate stablecoins are combined with smart contracts, fund flows can be executed automatically according to preset conditions. After suppliers deliver goods and pass inspection, payments are automatically released; when a project reaches a milestone, corresponding funds are disbursed instantly. Companies no longer need to manually monitor accounts, but can write the rules into contracts.

The change brought by this mechanism is not just improved efficiency. Transparent and immutable payment logic reduces the trust cost between partners and resolves potential disputes in advance.

As more partners are included in the same payment system, network effects begin to emerge. Suppliers, distributors, partners, and even end users all settle in the same stablecoin, and the network’s value grows exponentially.

This value is not only reflected in scale, but also creates a locking effect. Once deeply integrated into a company’s stablecoin system, the cost of switching to another system becomes high—not just in terms of technology, but also learning, relationships, and even opportunity costs.

This stickiness becomes the company’s most solid moat. In fierce competition, companies with stablecoin ecosystems can not only better control costs and cash flow, but also consolidate long-term advantages through network effects.

How Corporate Stablecoins Enter Various Industries

Different industries have their own pain points, and corporate stablecoins are being used as potential solutions. They may not yet be widely implemented, but they already show the potential to penetrate real business scenarios.

E-commerce Platforms: Automation of Deposits, Commissions, and Refunds

For e-commerce platforms, stablecoins are becoming experimental tools for building next-generation payment infrastructure. The partnership between Shopify and Coinbase allows merchants in 34 countries to accept USDC settlements, but this is just the beginning.

The deposit paid by merchants when joining can be directly written into a smart contract, automatically deducted for violations, and automatically refunded at the end of the contract. Platform commissions can also be settled in real time—each transaction triggers an automatic transfer from the merchant’s stablecoin account to the platform.

The refund process is also being reshaped. Previously, cross-border refunds could take weeks and go through multiple banking processes; with stablecoins, funds can arrive within minutes, offering a completely different experience.

Furthermore, stablecoins can support micropayment scenarios. Consumers can pay to browse product pages, for personalized recommendations, or even for priority customer service—these fragmented transactions, almost impossible in traditional payment systems, can all be realized in a stablecoin environment.

Manufacturing Giants: Unified Network for Supplier Payments and Inventory Financing

Manufacturing is the most globalized industry, with supply chains often spanning dozens of countries. For companies like Apple and Tesla, coordinating payments, financing, and deposits for thousands of suppliers is a massive system engineering challenge.

If these companies issue their own stablecoins, they can establish an efficient, low-cost internal payment network. Payments to upstream suppliers, inventory financing, and quality assurance deposit management—all processes that previously required cross-bank, cross-currency, and heavy manual intervention—can now be completed instantly within the same network.

More importantly, this digital payment system can be integrated with existing enterprise management systems. When ERP detects a shortage of parts, it can automatically trigger orders and payments; if the quality inspection system finds a problematic batch, it can instantly deduct from the supplier’s deposit.

Take Tesla as an example: it has over 3,000 suppliers across more than 30 countries. If settlements are unified with stablecoins, suppliers can use “Tesla Coin” directly, with Tesla handling USD exchanges. This not only reduces costs but also means stronger initiative in key links.

Content Platforms: New Paths for Revenue Sharing and Micropayments

The content industry is undergoing a creator-driven restructuring. Whether it’s short video platforms like YouTube and TikTok, or text platforms like Substack and Medium, the biggest challenge is how to efficiently and fairly distribute revenue to global creators.

Corporate stablecoins are seen as a possible solution. They allow platforms to instantly settle revenue shares with global creators, without relying on complex cross-border banking systems or incurring high fees. Furthermore, micropayment mechanisms enable even finer revenue distribution.

YouTube pays creators tens of billions of dollars annually, but payment methods vary by country, exchange rate fluctuations affect actual income, and tax processes are extremely cumbersome. If the platform builds its own stablecoin network, truly unified global settlement can be achieved.

This mechanism could also spawn new business models: readers can pay per article, viewers can pay for individual video clips, and listeners can pay for a single song. More granular value distribution not only gives creators more direct returns but also incentivizes higher-quality content production.

Cloud Service Providers: Settlement Testbed for the Machine Economy

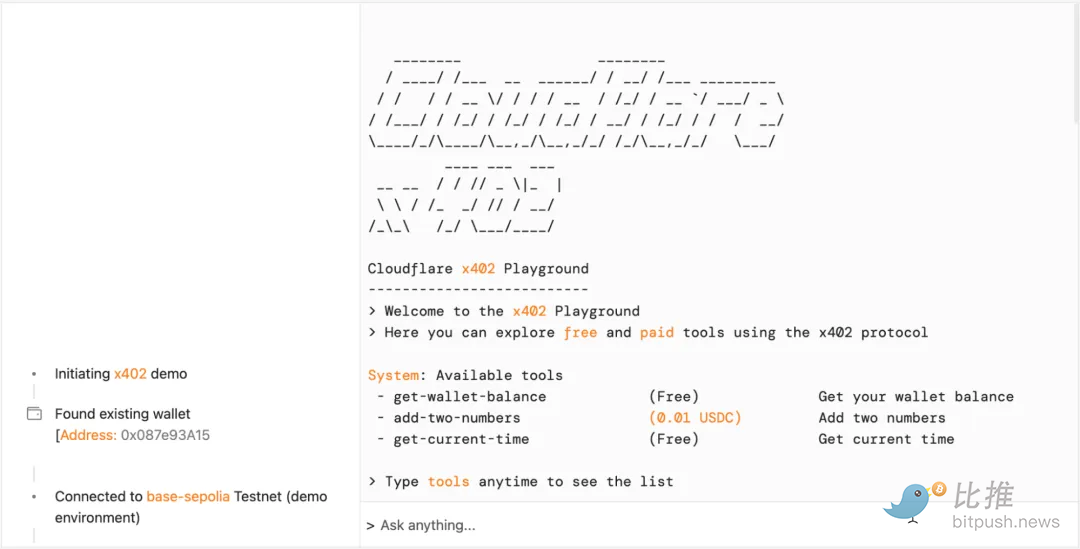

Cloudflare’s NET Dollar can be seen as a typical case of cloud service providers experimenting with stablecoins. With the development of AI and IoT, machine-to-machine communication and transactions are becoming more frequent. These are characterized by high frequency, small amounts, and full automation—something traditional payment systems cannot support.

In such scenarios, an AI model may need to pay for calling another model’s API, an IoT device may need to settle its computing power consumption, and a self-driving car may need to pay for map services. These payments may be just a few cents or even fractions of a cent, but could be triggered thousands of times per second.

Stablecoins, especially those like NET Dollar designed for programmatic transactions, can support this kind of high-frequency, low-value automated payment. Machines can autonomously decide when, how much, and to whom to pay according to preset rules, without human intervention.

To this end, Cloudflare and Coinbase have jointly established the x402 Foundation, developing a protocol that allows machines to complete payments directly. When one AI model calls another’s service, fees are settled instantly. Such explorations are building the payment infrastructure needed for the future machine economy.

Cloudflare’s x402 testbed real-time demo interface | Source: Cloudflare

Stablecoin Swaps and the New B2B Payment Network

Once every large enterprise issues its own stablecoin, the next question is: how will these “corporate currencies” interoperate? The answer points to an entirely new B2B payment network.

In such a network, different corporate stablecoins can be seamlessly converted via swap protocols, possibly relying on decentralized exchange liquidity pools. A supplier receiving “Tesla Coin” can instantly exchange it for “Apple Coin” or USD, without going through cumbersome banking systems.

To make this system truly work, several hurdles must be overcome.

First is exchange rate pricing. How will exchange rates between different corporate stablecoins be determined? This may require a supply-demand pricing mechanism similar to the forex market.

Second is liquidity provision. Who will provide sufficient liquidity? Will it rely on professional market makers, or will companies set up channels with each other? There is no conclusion yet; further industry exploration is needed.

Finally, risk management. How to prevent credit and operational risks during exchanges? This is not only a technical issue but also requires clear compliance guidelines.

Stripe has already started experimenting in this direction. In May 2025, it launched the world’s first payment AI model and rolled out a stablecoin payment suite. Enterprises can enable it with one click on the platform, using USDC to settle on Ethereum, Solana, Polygon, and other public chains.

Stripe’s approach is clear: rather than issuing its own coin, it aims to make it easy for more companies to access stablecoin settlements, thus positioning itself as the underlying infrastructure for stablecoin payments.

More interestingly, “industry consortium stablecoins” may emerge in specific sectors. For example, several major automakers could jointly issue an “auto coin,” covering the entire value chain from parts procurement to vehicle sales. Such a unified currency system can significantly reduce transaction costs and promote industry collaboration.

The complexity of the automotive industry chain makes it the ideal testing ground. A car involves tens of thousands of parts, with suppliers worldwide. If the entire chain settles in the same stablecoin, redundant multi-currency and multi-bank processes can be bypassed, greatly simplifying payments.

The advantages of consortium stablecoins are also clear. The industry’s scale can support liquidity, transaction models are standardized, and closed loops reduce the impact on the traditional financial system. But challenges remain: how to balance the interests of different companies, whether large enterprises will use this to strengthen control, and whether governance mechanisms can remain transparent—all these can only be answered in practice.

All corporate stablecoin concepts ultimately hinge on regulatory compliance. Whether a single company or an industry consortium, to gain real market acceptance, they must establish transparent reserve custody, regular third-party audits, and full disclosure to regulators.

In July 2025, the US “GENIUS Act” will take effect, for the first time drawing clear legal boundaries for stablecoin issuance. Stablecoins with issuance exceeding $10 billion must be federally regulated, with reserves limited to USD, bank deposits, or short-term US Treasuries, and completely segregated from other assets of the issuer.

In August of the same year, Hong Kong’s “Stablecoin Ordinance” will be officially implemented. It requires issuers to hold at least HKD 25 million in paid-up capital, accept ongoing supervision and annual audits by the HKMA, and establish comprehensive anti-money laundering and customer identification systems.

For enterprises, compliance is not just a “must-do” requirement, but the prerequisite for earning trust. Without transparent and credible reserve management, even the strongest business logic will struggle to convince suppliers, partners, and customers to follow.

Stablecoins and the New Commercial Order

The emergence of corporate stablecoins is not just a change in payment tools, but a harbinger of the restructuring of future commercial order.

They deeply couple payments with systems, giving devices and programs independent economic capabilities. Self-driving cars can autonomously complete charging and settlement when low on power, industrial robots can automatically order parts when worn out—machines thus become real economic agents rather than mere tools.

Micropayments provide new distribution logic for the content industry: videos can be charged by the second, novels by the chapter, software by the function. Income is split more finely, and incentive mechanisms change accordingly.

Combined with artificial intelligence, the imagination expands further. Once AI agents have stablecoin budgets, they can autonomously purchase data, computing power, or other services to complete complex tasks.

In September 2025, Google will launch the Agent Payments Protocol (AP2), partnering with sixty institutions to build payment channels for AI agents, enabling them to settle directly while performing tasks. This means AI will no longer be just a tool, but a “digital employee” with economic capabilities, forming new collaborative relationships with humans.

For banks and payment companies, this is a structural challenge. If enterprises can build their own payment and clearing systems, the role of traditional financial institutions in cross-border settlement and treasury management will be weakened. In the future, banks are more likely to shift to roles such as reserve custody, compliance, and auditing, while payment companies will need to become stablecoin infrastructure providers.

From a macro perspective, corporate stablecoins may signal the emergence of a new commercial order. In this system, value creation and distribution will be completed with unprecedented efficiency, and business relationships will become more transparent and efficient.

From medieval Venetian bills of exchange to today’s stablecoins, the logic has always been the pursuit of more efficient exchange media. In this technology-driven transformation, any company wishing to secure a place in the future digital economy cannot stand aside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.