"Buy the rumor, sell the fact": BTC pulls back 12% after FOMC, deep cooling risk is accumulating

After the FOMC meeting, bitcoin entered a correction phase. Long-term holders realized profits on 3.4 million BTC, and the slowdown in ETF inflows has made the market more vulnerable. Both spot and futures markets are under pressure, and the cost basis for short-term holders at $111,000 is a key support level. Summary generated by Mars AI. The accuracy and completeness of this summary are still under iterative improvement.

Bitcoin is showing signs of weakness after the rally triggered by the Federal Open Market Committee. Long-term holders have realized profits on 3.4 million BTC, while ETF inflows have slowed. With both spot and futures markets under pressure, the short-term holder cost basis at $111,000 is a key support level; if breached, there could be a risk of a deeper cooling off.

Summary

· After the FOMC-driven rally, Bitcoin has entered a correction phase, displaying a "buy the rumor, sell the news" market pattern, with the broader market structure pointing to weakening momentum.

· The current 8% decline remains relatively mild, but the $67.8 billion in realized market cap inflows and the 3.4 million BTC profits realized by long-term holders highlight the unprecedented scale of capital rotation and selling in this cycle.

· ETF inflows slowed sharply before and after the FOMC meeting, while long-term holder selling accelerated, creating a fragile balance of capital flows.

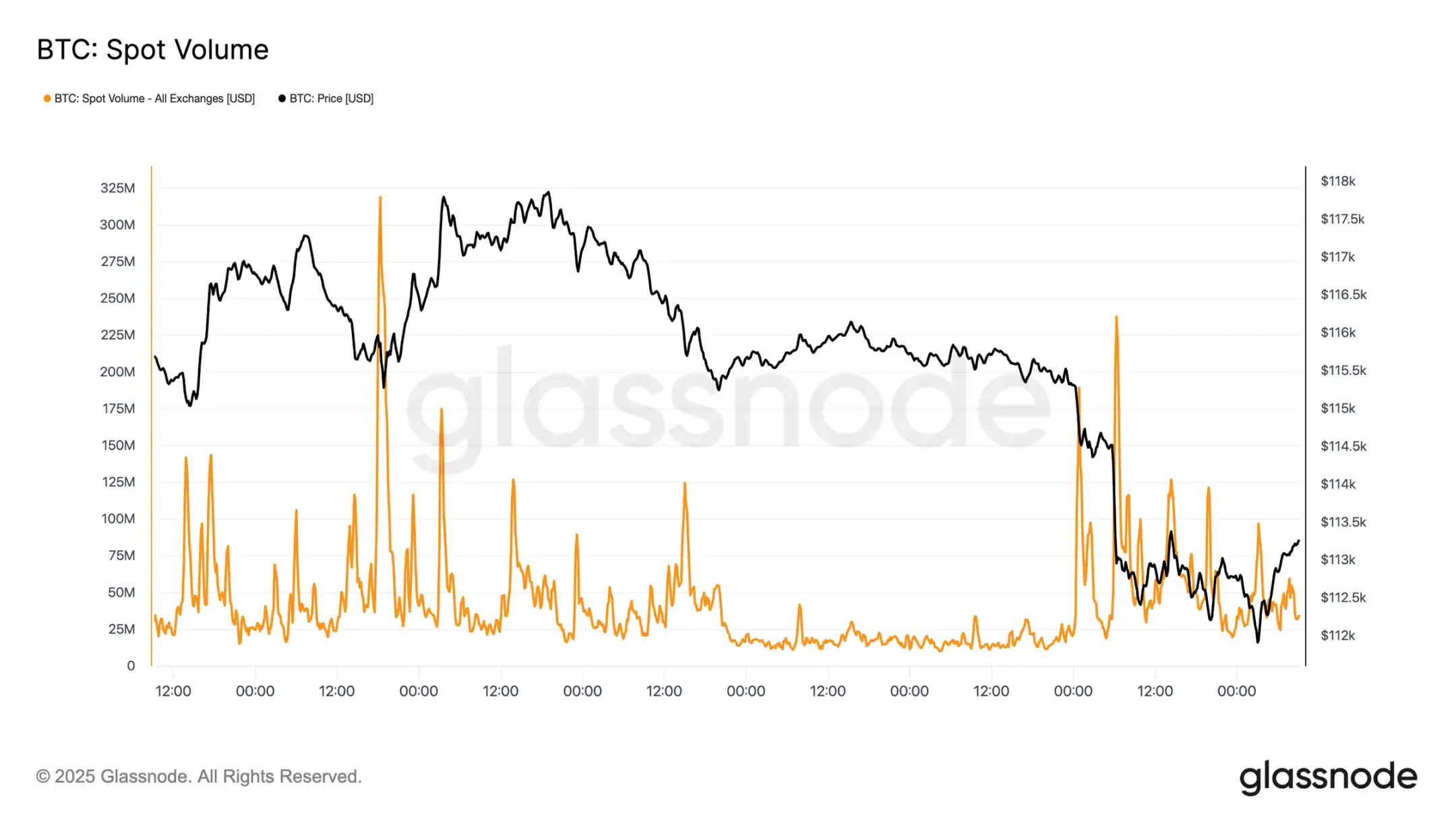

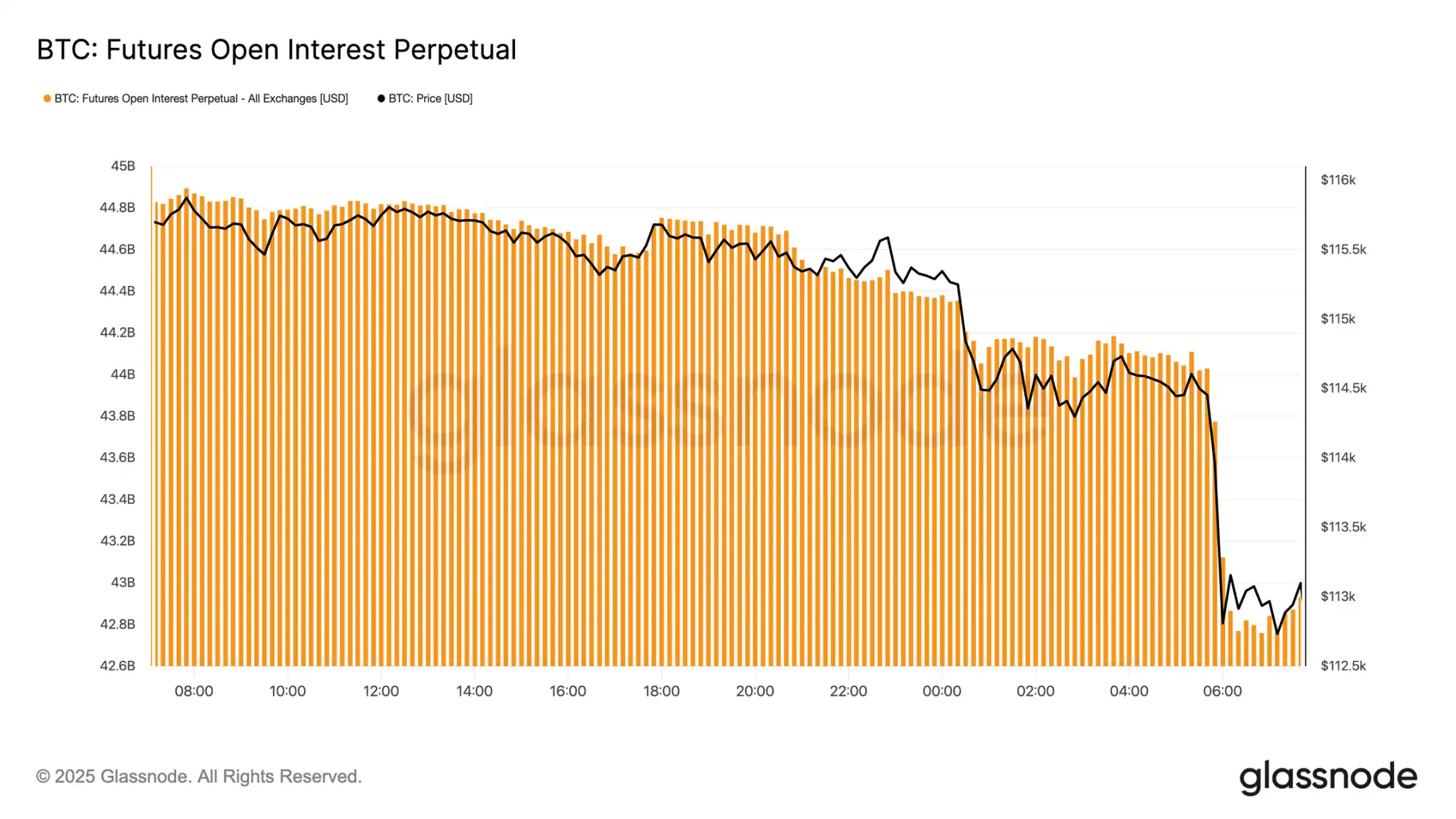

· During the sell-off, spot trading volumes surged, and the futures market saw intense deleveraging volatility. Liquidation clusters revealed the market's vulnerability to liquidity-driven swings in both directions.

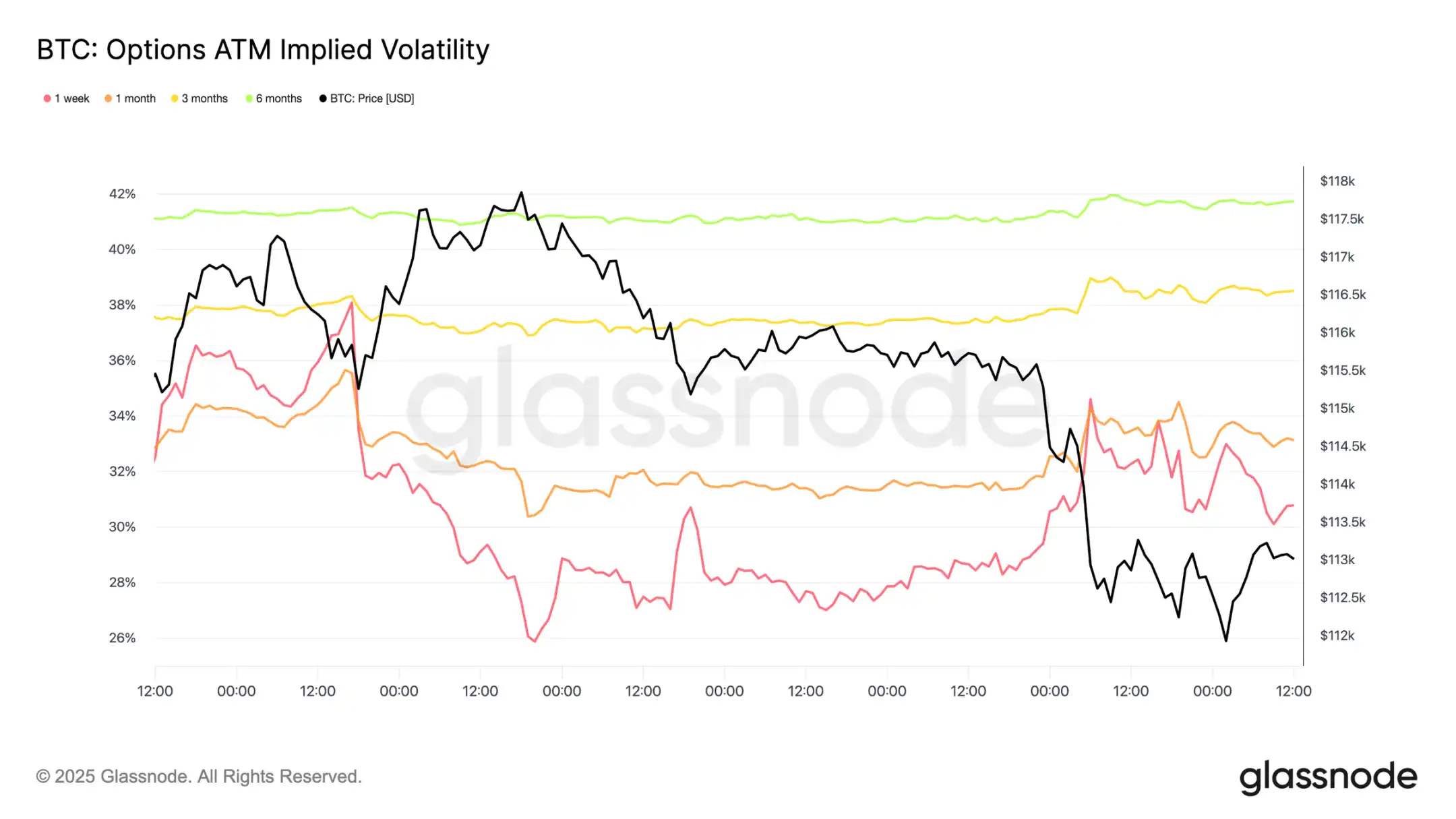

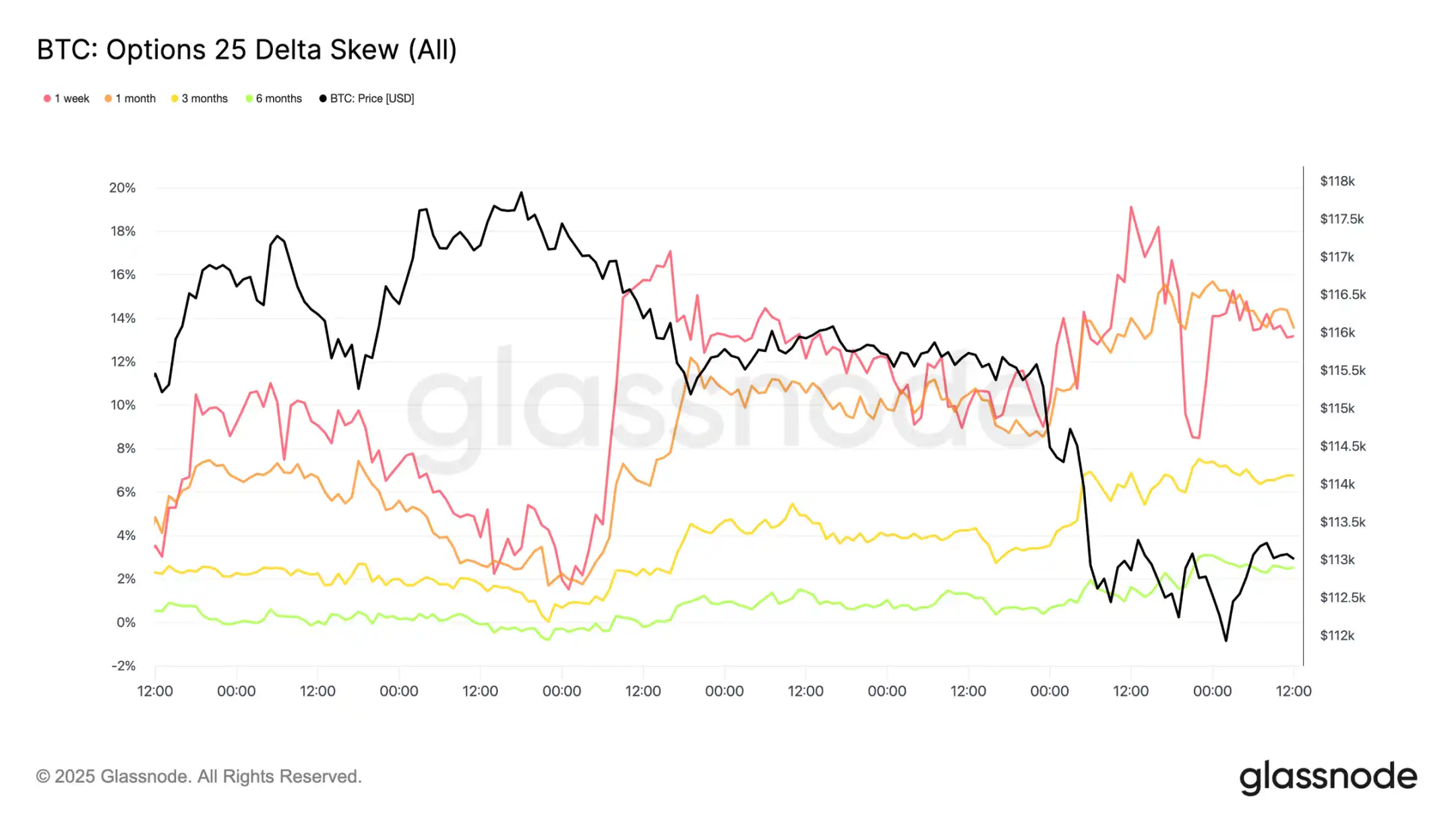

· The options market repriced aggressively, with skew soaring and strong demand for put options, indicating defensive positioning. The macro backdrop suggests growing market exhaustion.

From Rally to Correction

Following the FOMC-driven rally that peaked near $117,000, Bitcoin has transitioned into a correction phase, echoing the typical "buy the rumor, sell the news" pattern. In this issue, we look beyond short-term volatility to assess the broader market structure, using long-term on-chain indicators, ETF demand, and derivatives positioning to evaluate whether this pullback is a healthy consolidation or the early stage of a deeper contraction.

On-Chain Analysis

Volatility Context

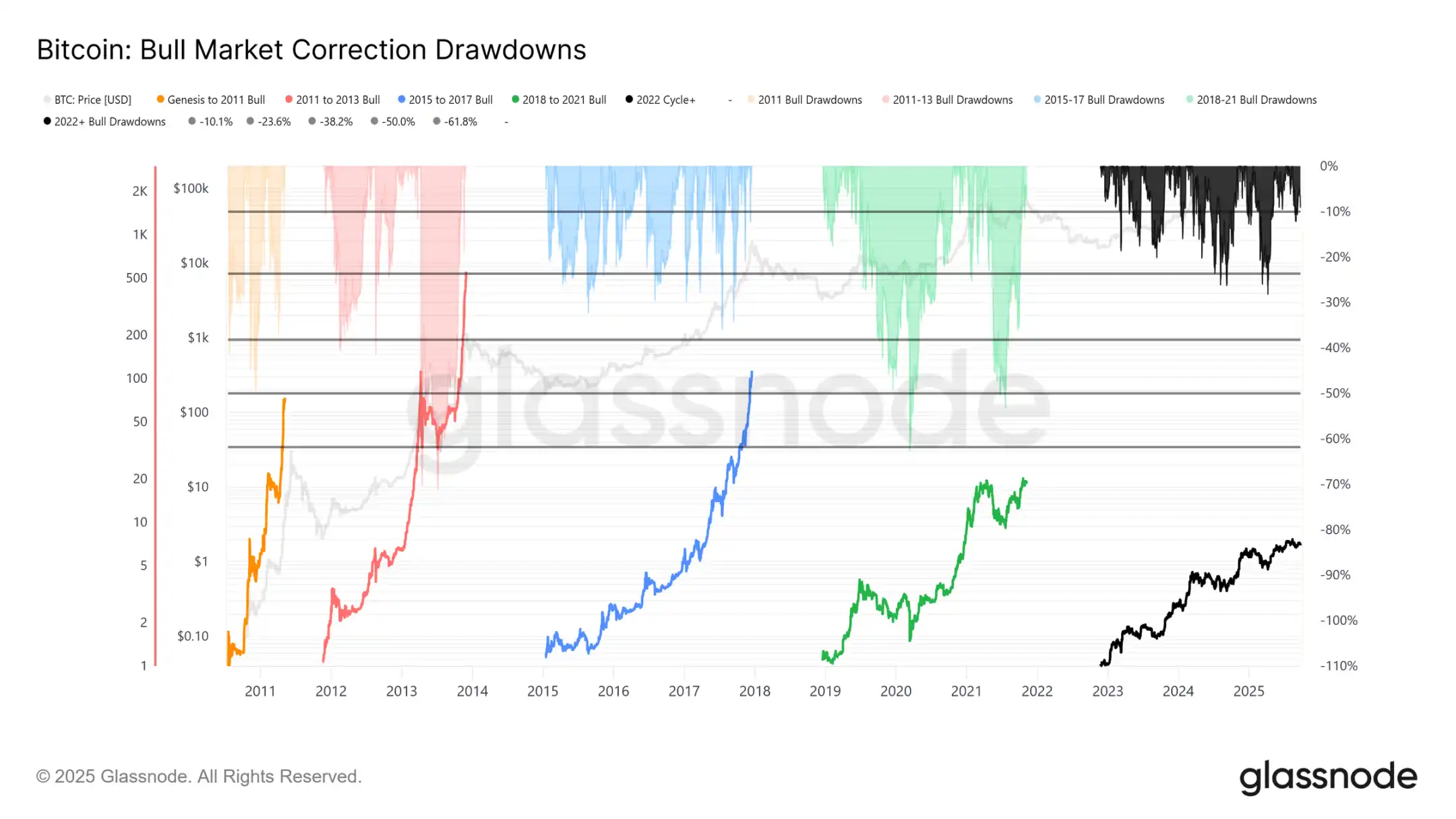

The current pullback from the all-time high (ATH) of $124,000 to $113,700 is only 8% (the latest drop has reached 12%), which is mild compared to the 28% drop in this cycle or the 60% drops in previous cycles. This aligns with the long-term trend of decreasing volatility, both between macro cycles and within phases of a cycle, similar to the steady advance of 2015-2017, though the parabolic blow-off top of that period has yet to appear this time.

Cycle Duration

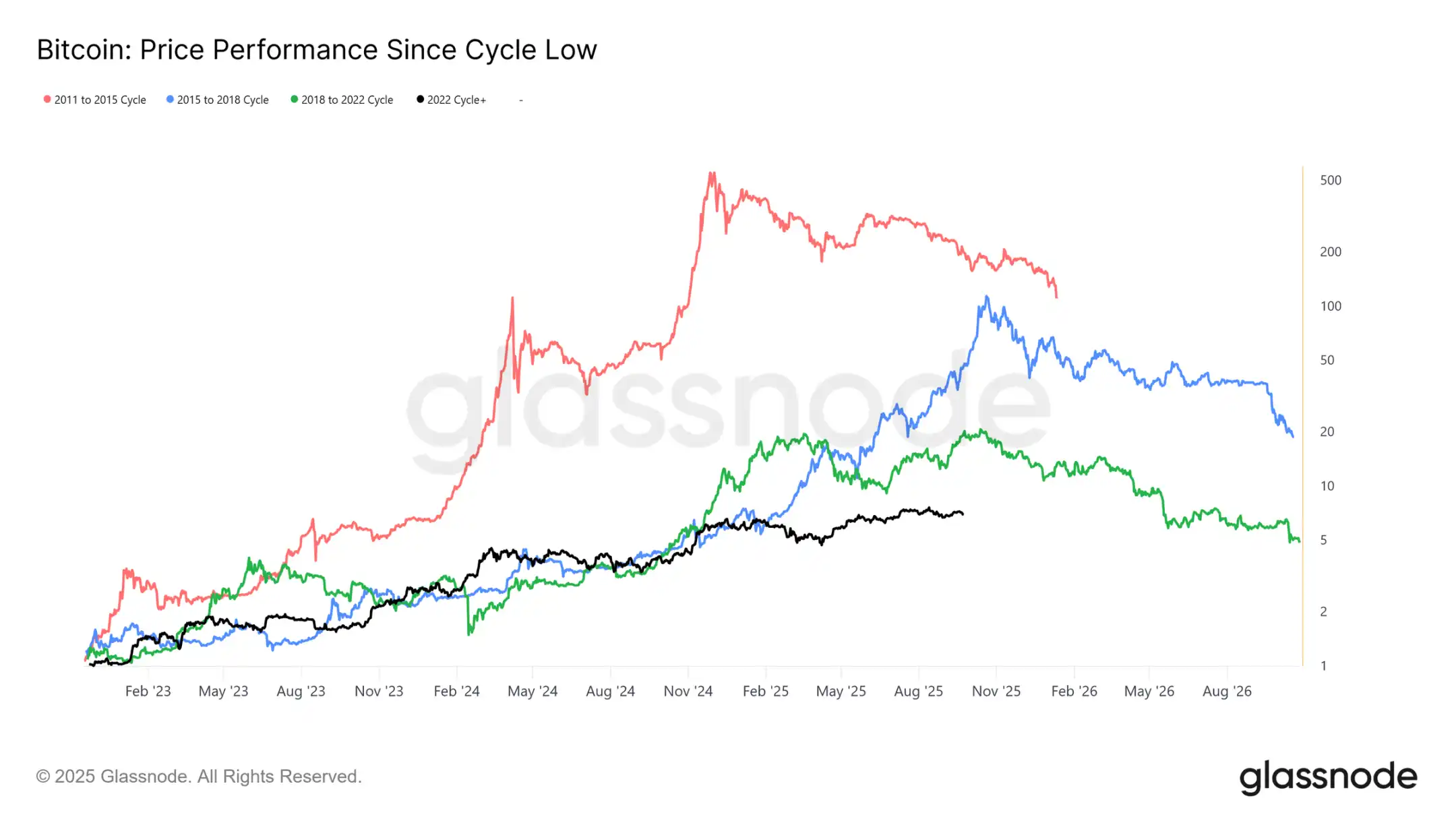

Overlaying the past four cycles shows that even though the current trajectory closely matches the previous two cycles, peak returns have diminished over time. Assuming $124,000 marks the global top, this cycle has lasted about 1,030 days, very close to the roughly 1,060 days of the previous two cycles.

Capital Inflow Measurement

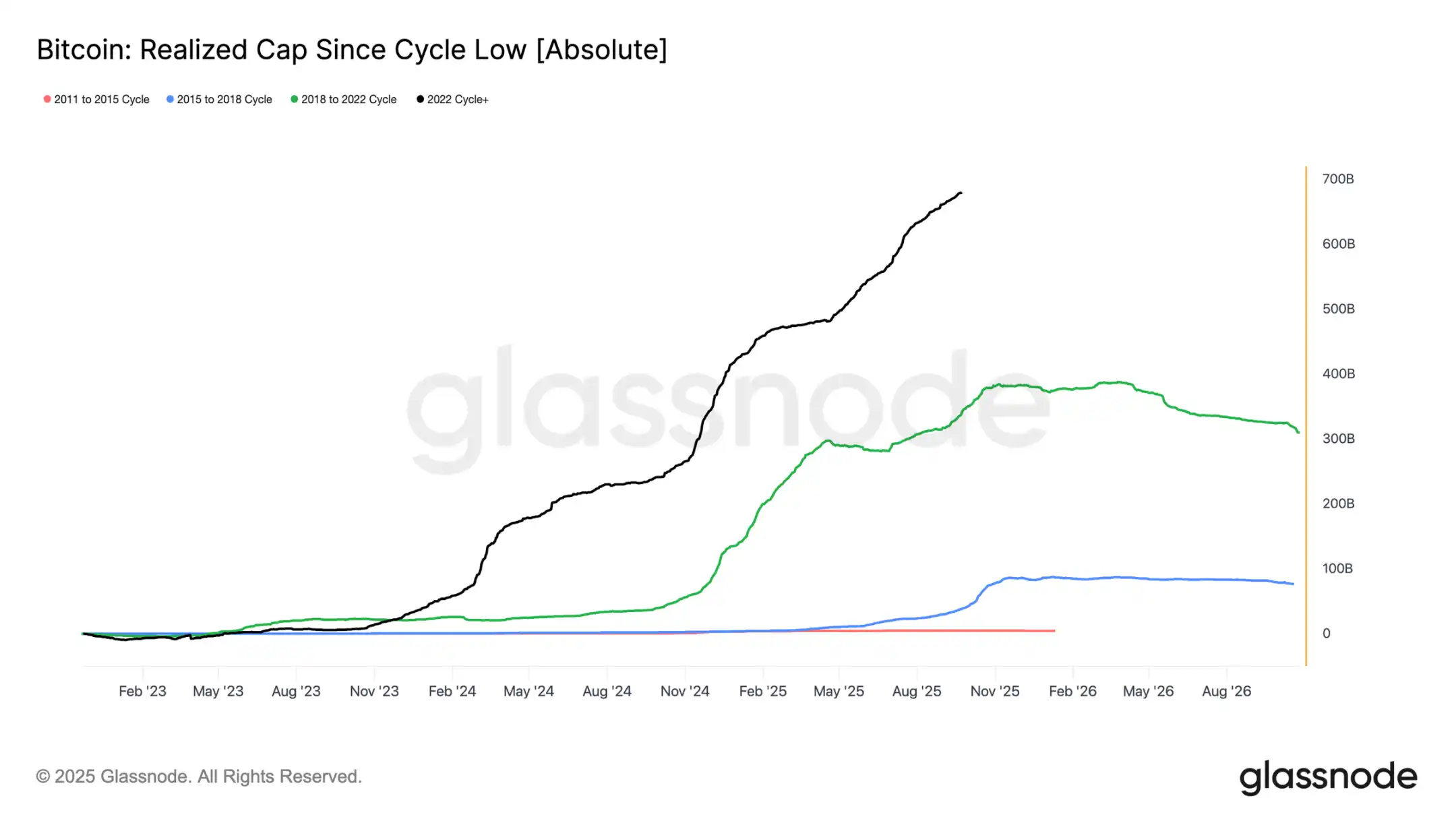

Beyond price action, capital deployment provides a more reliable perspective.

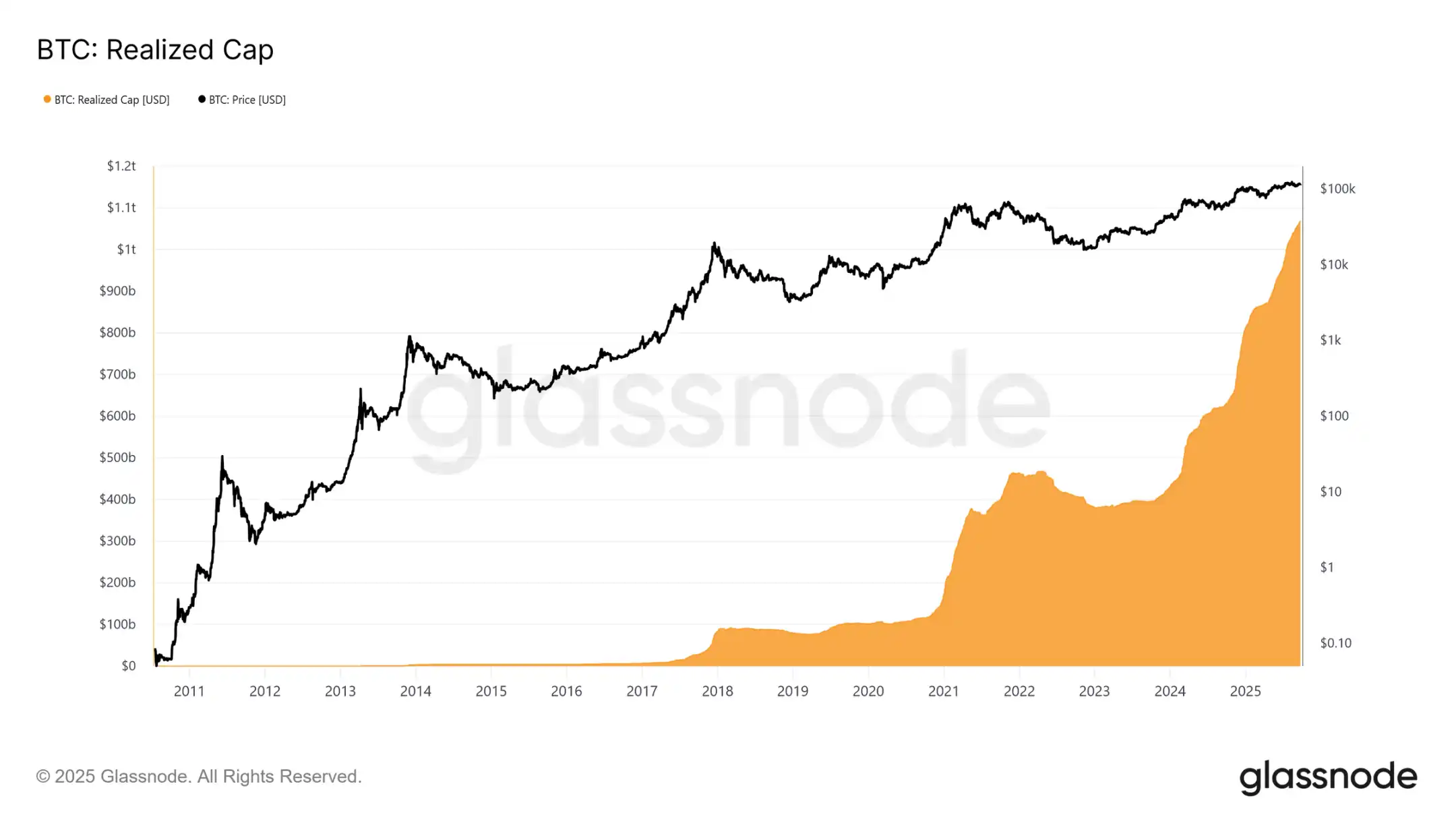

Realized market cap has seen three waves of increases since November 2022, bringing the total to $1.06 trillion, reflecting the scale of capital inflows supporting this cycle.

Realized Market Cap Growth

Background comparison:

· 2011–2015: $4.2 billion

· 2015–2018: $85 billion

· 2018–2022: $383 billion

· 2022–present: $67.8 billion

This cycle has absorbed a net inflow of $67.8 billion, nearly 1.8 times the previous cycle, highlighting the unprecedented scale of capital rotation.

Profit Realization Peaks

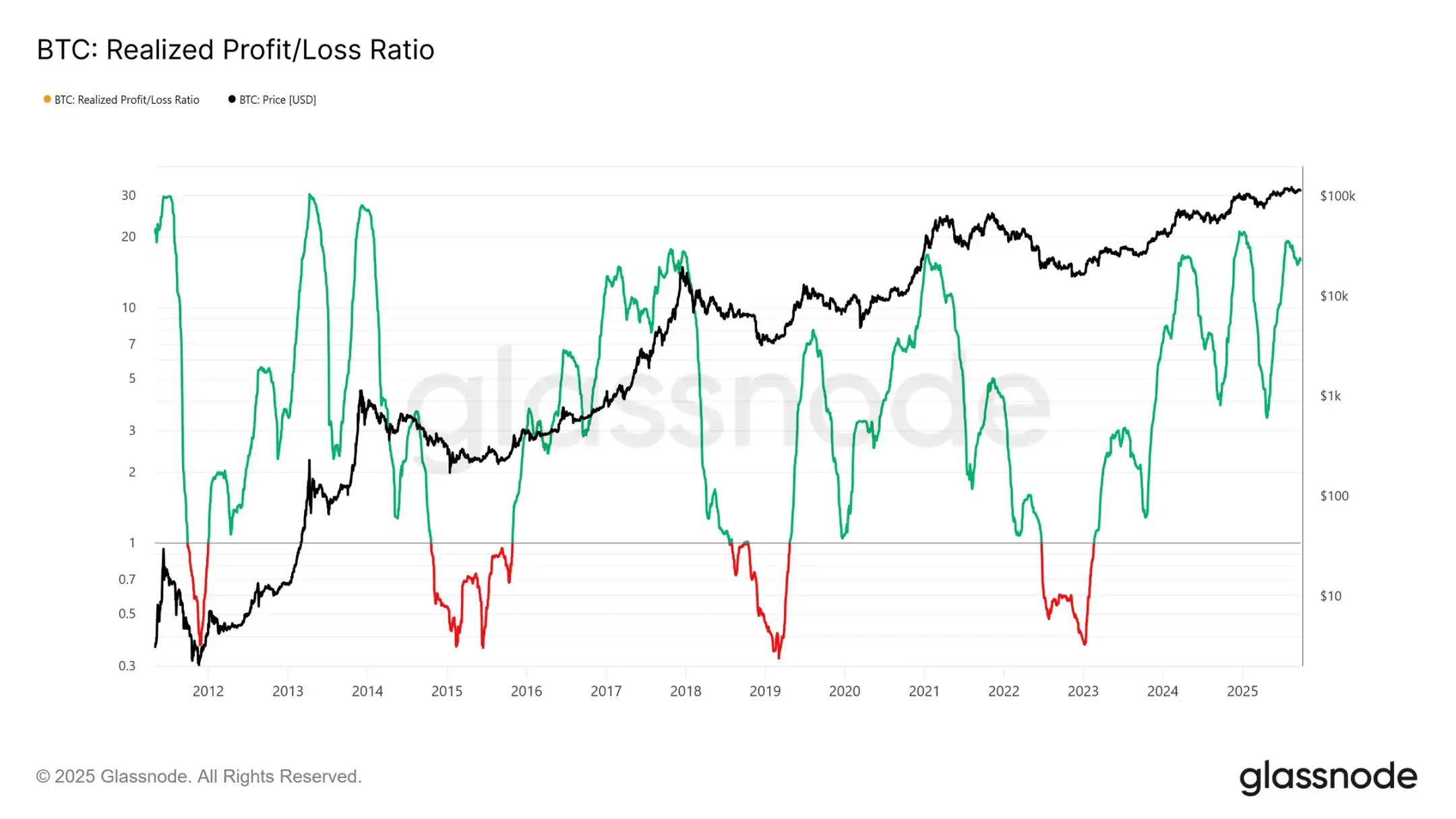

Another difference lies in the structure of inflows. Unlike the single wave of earlier cycles, this cycle has seen three distinct, months-long surges. The realized profit/loss ratio shows that each time profit realization exceeds 90% of moved tokens, it marks a cyclical peak. Having just emerged from the third such extreme, the probability now favors a cooling-off phase ahead.

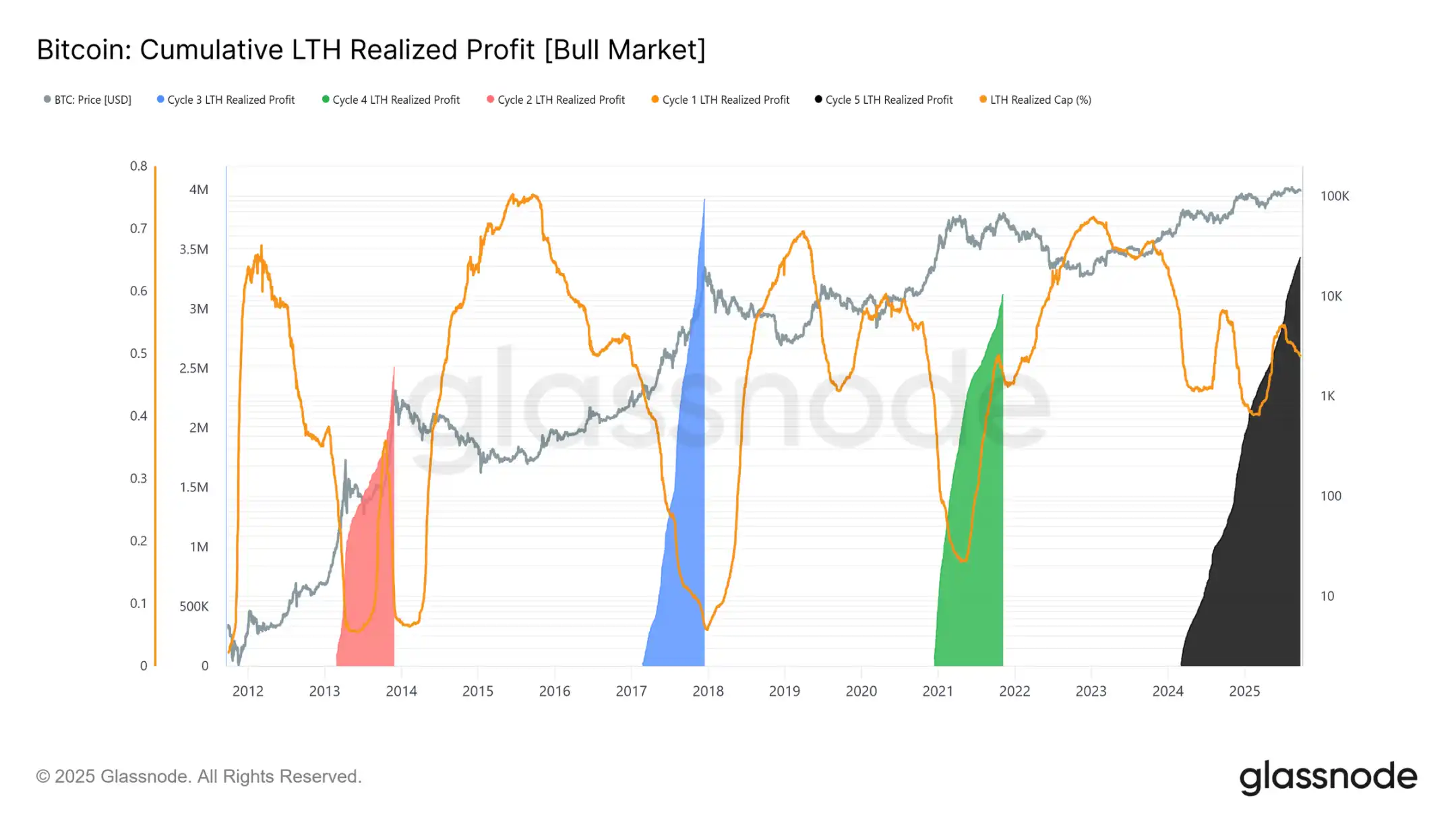

Long-Term Holder Profit Dominance

Focusing on long-term holders, the scale becomes even clearer. This metric tracks the cumulative profits of long-term holders from new ATHs to the cycle peak. Historically, their heavy selling has marked the top. In this cycle, long-term holders have realized profits on 3.4 million BTC, already surpassing previous cycles, highlighting the maturity of this group and the scale of capital rotation.

Off-Chain Analysis

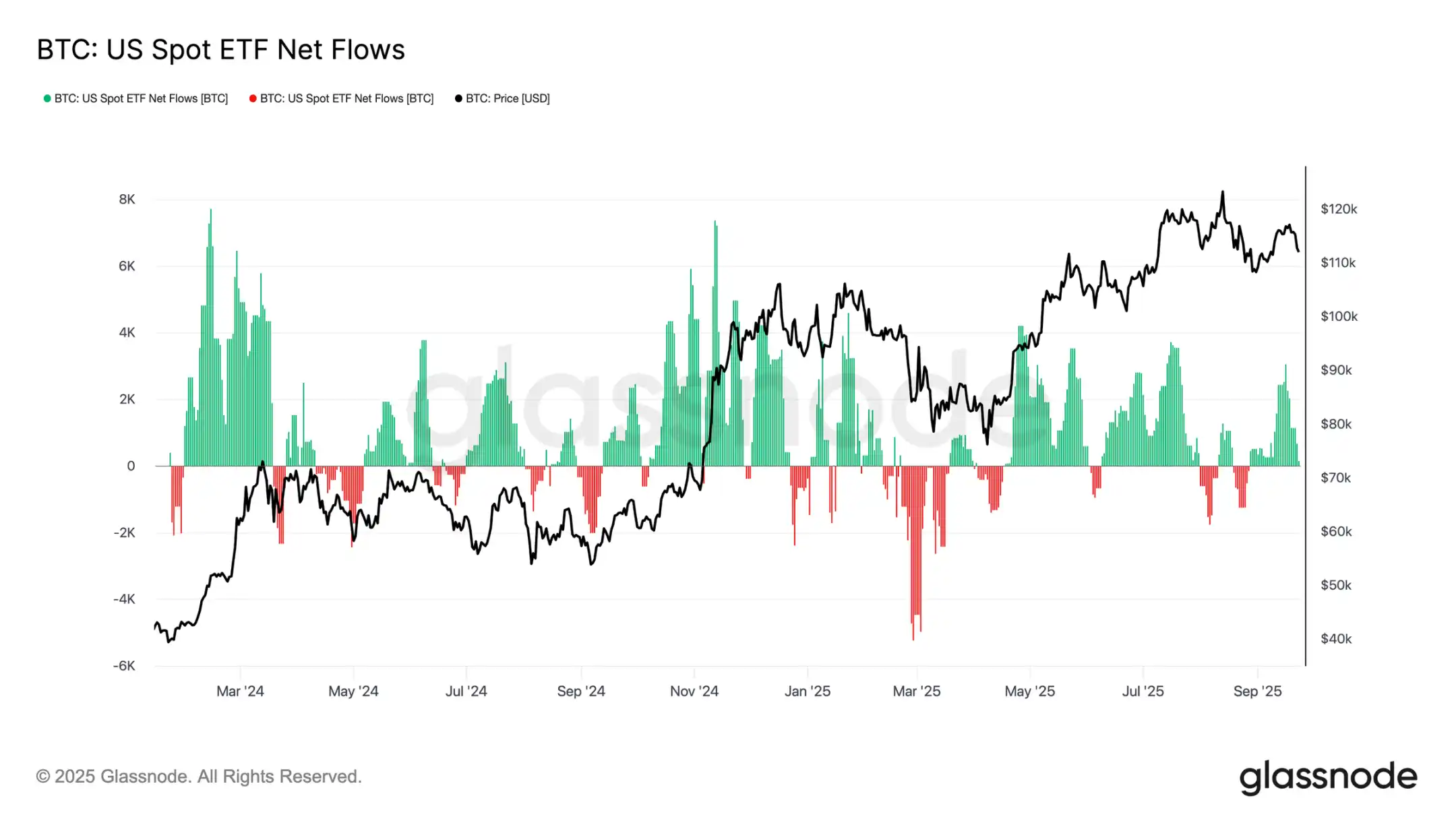

ETF Demand vs Long-Term Holders

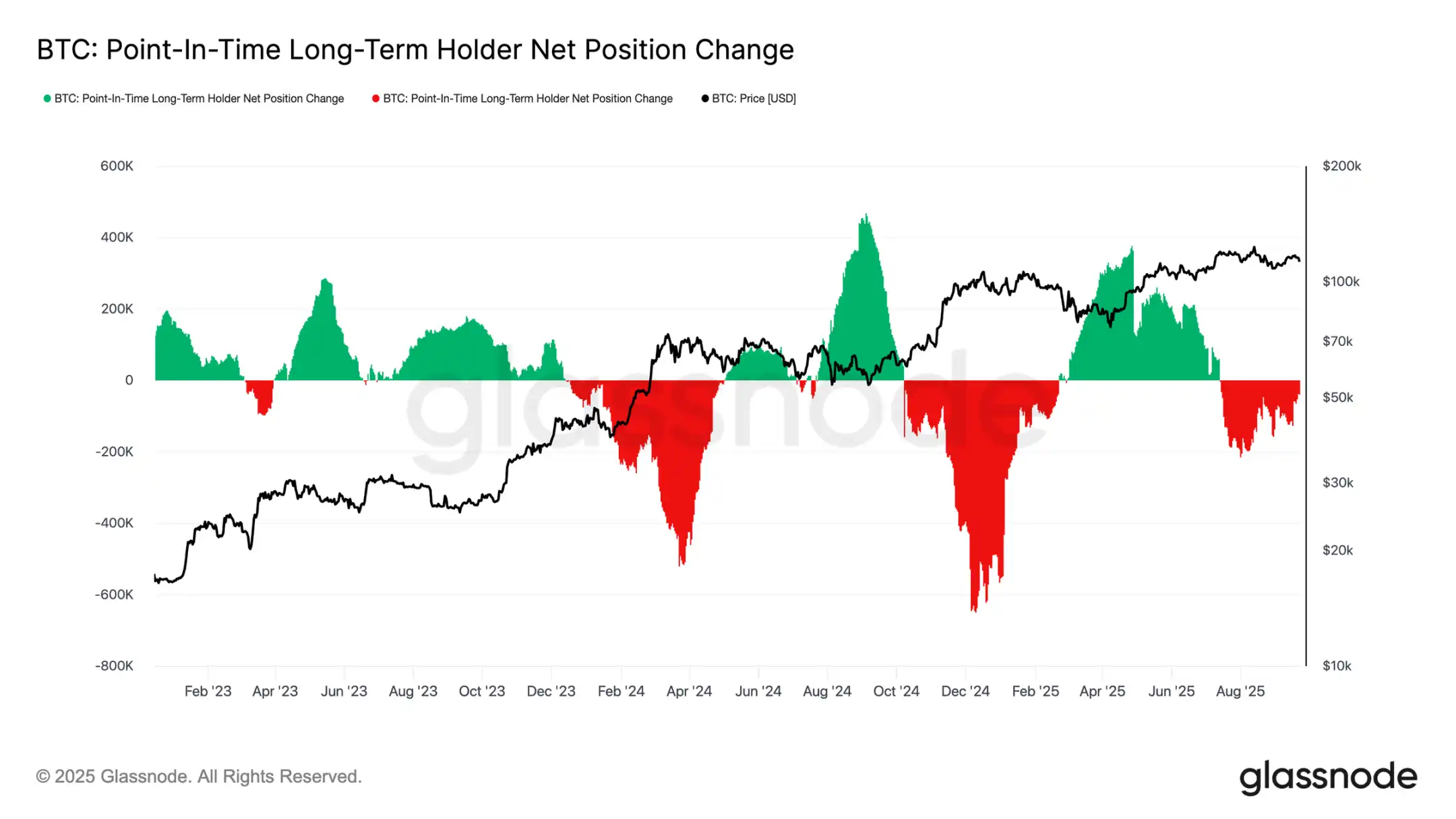

This cycle has also been shaped by a tug-of-war between long-term holder selling and institutional demand via US spot ETFs and DATs. With ETFs becoming a new structural force, prices now reflect this push-pull effect: long-term holder profit-taking caps the upside, while ETF inflows absorb the selling and sustain the cycle's progress.

Fragile Balance

ETF inflows have so far balanced long-term holder selling, but the margin for error is slim. Around the FOMC meeting, long-term holder selling surged to 122,000 BTC/month, while ETF net inflows plunged from 2,600 BTC/day to nearly zero. The combination of increased selling pressure and weakening institutional demand created a fragile backdrop, setting the stage for weakness.

Spot Market Pressure

This fragility is evident in the spot market. During the FOMC-induced sell-off, trading volumes surged as forced liquidations and thin liquidity amplified the downward move. While painful, a temporary bottom formed near the short-term holder cost basis of $111,800.

Futures Deleveraging

Meanwhile, as Bitcoin fell below $113,000, futures open interest dropped sharply from $44.8 billion to $42.7 billion. This deleveraging event flushed out leveraged longs, amplifying downside pressure. While destabilizing in the short term, this reset helps clear excess leverage and restore balance to the derivatives market.

Liquidation Clusters

The perpetual contract liquidation heatmap provides more detail. As prices broke below the $114,000–$112,000 range, dense clusters of leveraged longs were wiped out, triggering mass liquidations and accelerating the decline. Risk pockets remain above $117,000, leaving the market vulnerable to liquidity-driven swings in both directions. Without stronger demand, fragility near these levels increases the risk of further sharp volatility.

Options Market

Volatility

Turning to the options market, implied volatility offers a clear view of how traders navigated a turbulent week. Two main catalysts shaped the market: the first rate cut of the year and the largest liquidation event since 2021. As hedging demand built up, volatility climbed ahead of the FOMC meeting but quickly faded after the rate cut was confirmed, indicating the move was largely priced in. However, the violent Sunday night futures liquidation reignited demand for protection, with one-week implied volatility leading the rebound and strength extending across tenors.

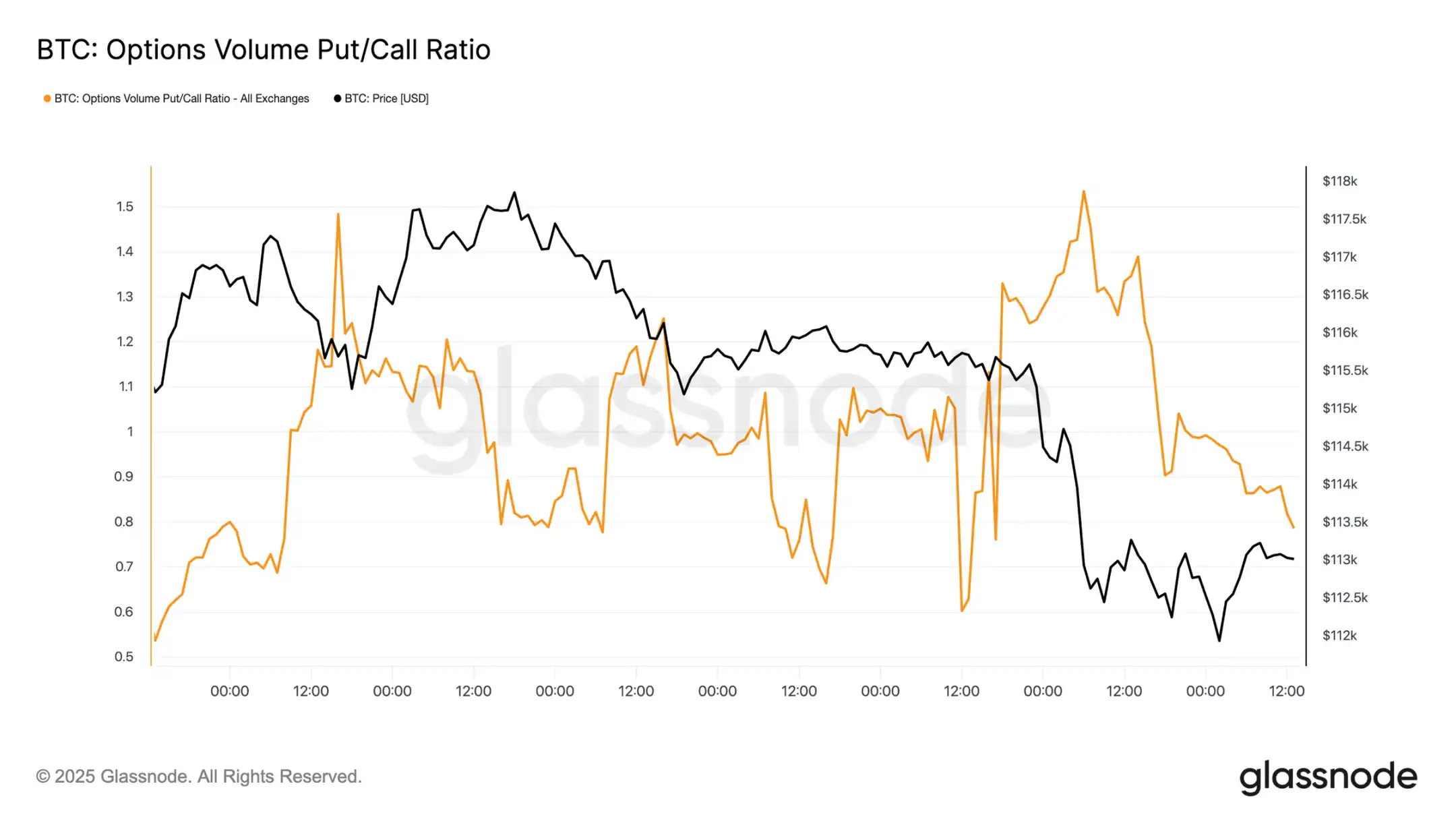

Market Repricing Rate Cuts

After the FOMC meeting, there was aggressive demand for put options, either as protection against sharp declines or as a way to profit from volatility. Just two days later, the market delivered on this signal with the largest liquidation event since 2021.

Put/Call Option Flows

After the sell-off, the put/call option volume ratio trended downward as traders locked in profits on in-the-money puts while others rotated into cheaper calls. Short- and medium-term options remain heavily skewed toward puts, making downside protection expensive relative to upside. For participants with a constructive view toward year-end, this imbalance creates opportunities—either to accumulate calls at relatively low cost or to finance them by selling overpriced downside risk exposure.

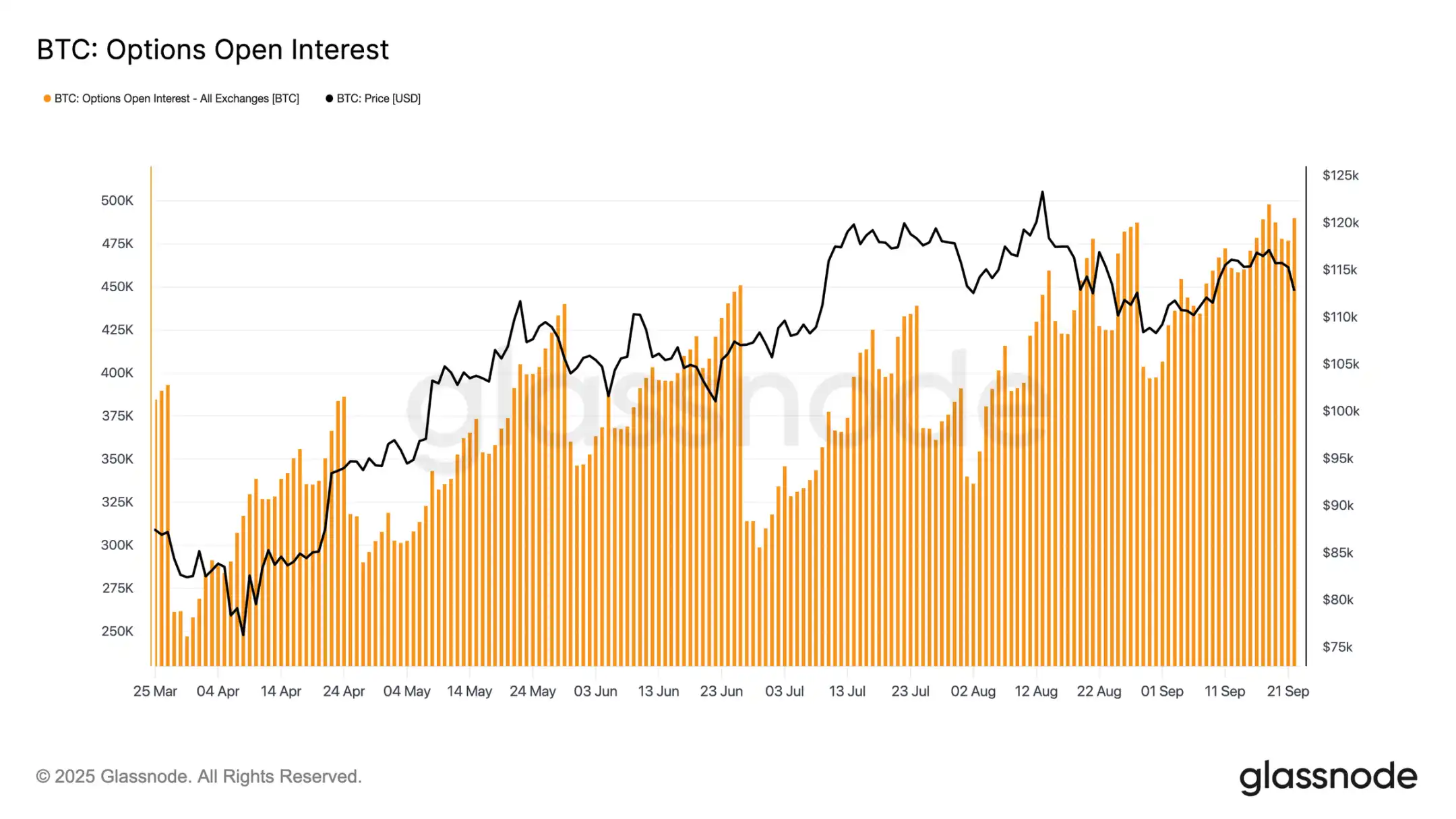

Options Open Interest

Total options open interest hovers near all-time highs and will drop sharply at Friday's expiry before the market is rebuilt heading into December. Currently, the market is in a peak zone, where even small price moves force market makers into aggressive hedging. Market makers are short on the downside and long on the upside, a structure that amplifies sell-offs while capping rebounds. This dynamic skews near-term volatility risk to the downside, increasing fragility until expiry clears and positions reset.

Conclusion

Bitcoin's pullback after the FOMC meeting reflects a typical "buy the rumor, sell the news" pattern, but the broader context points to growing exhaustion. The current 12% drop is mild compared to past cycles, but it comes after three major waves of capital inflows that pushed realized market cap up by $67.8 billion, nearly double the previous cycle. Long-term holders have already realized profits on 3.4 million BTC, highlighting the scale of selling and maturity in this rally.

Meanwhile, ETF inflows that previously absorbed supply have slowed, creating a fragile balance. Spot trading volumes have surged due to forced selling, futures have seen sharp deleveraging, and the options market is pricing in downside risk. Together, these signals indicate that market momentum is running out, with liquidity-driven volatility dominating.

Unless institutional and holder demand realigns, the risk of a deep cooling off remains high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.