The Crypto Crash Orchestrated by the Federal Reserve: With $1.82 Trillion Evaporated, Is the Real Rally Only Just Beginning?

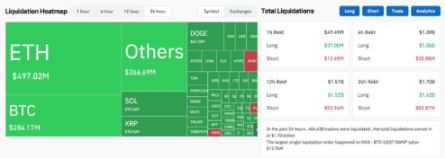

In the past week, the crypto market experienced a cold shower-like plunge. In just one day, $1.7 billions in funds were liquidated, catching many investors off guard. But if you think this was just a random market fluctuation, you may be underestimating the tactics of the Federal Reserve and Wall Street.

1. Profit Taking After Good News, Plunge Lurking

The recent rally was almost entirely built on market expectations of a Federal Reserve rate cut. The media and social platforms kept amplifying this sentiment, creating the illusion of a “one-way up” market. As a result, after the Federal Reserve meeting, the market chose to “sell the news,” triggering large-scale liquidations.

This is not the first time—this is the classic “buy the rumor, sell the news” market pattern.

2. Market Makers Manipulation: Plunge as a Deeper Liquidation Tool

In addition to the Federal Reserve’s statements, the actions of market makers and major platforms also amplified market volatility. For example, large exchanges may create long and short traps on their own platforms, selling off while liquidating retail investors’ positions. Such scenarios have been common in several past bull market cycles.

3. Turning Point in Market Sentiment

Before the plunge, there were already signs of overheating in the market:

Perpetual contracts were excessively popular

Certain tokens (such as $ASTER) surged too quickly

Social platforms were filled with “new highs keep coming” sentiment

This is the typical market rhythm of local frenzy → plunge and liquidation.

4. The Medium-Term Trend Remains Upward

Although the short-term plunge caused panic, the mid- to long-term logic has not changed:

The U.S. economy remains resilient

There are still expectations of 1–2 rate cuts in the coming months

Global crypto asset adoption continues to rise

Funds are still steadily flowing into the crypto market

These factors together lay the foundation for the next round of gains. Historical data shows that October (Uptober) and November are the strongest months for the crypto market:

Average increase in October: 21.89%

Average increase in November: 46.02%

Looking back at 2021, it was the massive rate cuts that triggered a 21-fold surge in bitcoin. A similar logic may play out again in 2025.

Conclusion

This round of crypto market plunge is not the end of the bull market, but more like a carefully orchestrated liquidation and shakeout. Whether it’s the Federal Reserve’s policy guidance or short-term manipulation by market makers, the goal is to clear out weak hands and pave the way for the next rally.

Investors need to remember:

Short-term declines ≠ trend reversal

Patience and position management are key

With rate cuts, a weakening dollar, and the continued advance of global adoption, October to November may once again become an acceleration phase for bitcoin and crypto assets. True returns often belong to those who can remain calm amid chaos.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IOTA partners with top global institutions to build Africa’s “digital trade superhighway”: a new $70 billion market is about to explode

Africa is advancing trade digitalization through the ADAPT initiative, integrating payment, data, and identity systems with the goal of connecting all African countries by 2035. This aims to improve trade efficiency and unlock tens of billions of dollars in economic value. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated.

Panic selling is all wrong? Bernstein: The real bull market structure is more stable, stronger, and less likely to collapse

Bitcoin has recently experienced a significant 25% pullback. Bernstein believes this was caused by market panic over the four-year halving cycle. However, the fundamentals have changed: institutional funds such as spot ETF are absorbing the selling pressure, and the structure of long-term holdings is more stable. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved.

Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom

Rare Bitcoin futures signal could catch traders off-guard: Is a bottom forming?