Zeus Broadens Bitcoin’s Capabilities: Experience DeFi on Solana Without Custody Risks

- Zeus Network launches BitcoinKit to integrate BTC into Solana’s DeFi ecosystem via non-custodial zBTC tokens, enhancing liquidity without wrapped assets. - Toolkit includes APIs and node systems for DEXs and cross-chain protocols, building on existing projects like APOLLO and btcSOL to create a "Bitcoin economy" on Solana. - The Layer 1.5 hybrid model combines Bitcoin’s security with Solana’s speed, enabling custody-free DeFi participation while addressing $1B+ BTC liquidity on Solana. - Challenges inclu

Zeus Network has introduced BitcoinKit, a toolkit for developers that enables

This release builds upon Zeus’s previous offerings like APOLLO, which issues zBTC, and btcSOL, which transforms Solana (SOL) staking rewards into Bitcoin. Another service, LightningFi, aggregates Bitcoin yields, contributing to what Zeus calls the “Bitcoin economy on Solana” [1]. BitcoinKit extends this ecosystem by supplying developers with a robust set of tools, aiming to make cross-chain operations more user-friendly and scalable. The network’s cross-chain approach is based on a network of nodes, guardians, and verification systems, though its effectiveness in real-world scenarios is yet to be proven [4].

Zeus Network utilizes a decentralized, permissionless communication protocol, described as a “Layer 1.5” hybrid system. This design merges Bitcoin’s robust security with Solana’s high-speed capabilities, allowing for smooth interaction between the two chains [3]. The ZeusNode and Zeus Program Library (ZPL) infrastructure support secure cross-chain transfers. Guardians are responsible for validating and

This project is in line with broader trends in the crypto sector, as Bitcoin liquidity on Solana has reached unprecedented highs. Data from Solana Sensei shows that BTC supply on Solana surpassed $1 billion, resulting in quicker transactions, reduced costs, and greater composability within DeFi platforms [3]. By connecting Bitcoin’s value proposition with Solana’s performance and scalability, Zeus aims to establish a “global financial layer” that merges Bitcoin’s trustworthiness with Solana’s efficiency [3].

Experts point out that BitcoinKit could transform cross-chain connectivity, though there are still hurdles to overcome. The cross-chain system’s reliance on untested real-world scenarios may reveal weaknesses, and ongoing regulatory ambiguity in DeFi could affect its uptake [1]. Nevertheless, the toolkit marks a notable advancement in bringing Bitcoin into multi-chain environments, potentially broadening its use beyond being just a store of value [2].

Zeus Network’s initiatives reflect the increasing need for interoperability solutions in the industry. As Solana’s DeFi sector evolves, tools like BitcoinKit may drive the growth of cross-chain applications, opening up decentralized markets to more participants. The project’s success will hinge on its ability to uphold security, scalability, and user confidence while adapting to changing regulatory requirements [1].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

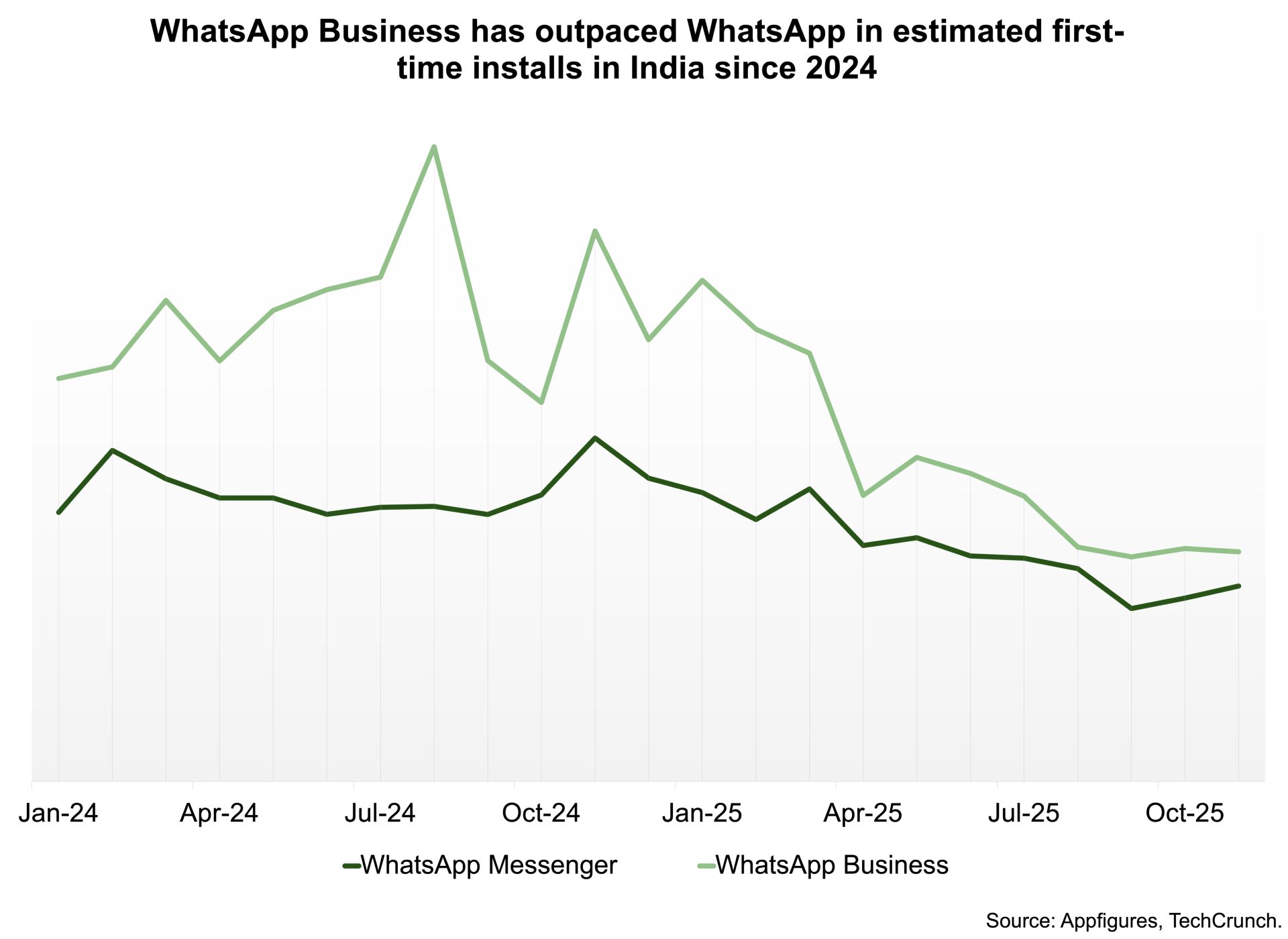

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026