MoonBull's Presale: Genuine Strategy or Just Another Meme Craze?

- MoonBull ($MOBU) launched a 23-stage Ethereum-based presale offering 24,540% ROI for early investors, with token prices rising from $0.000025 to $0.00616. - Whitelist exclusivity provides staking rewards, 95% APY, and referral incentives (15% per transaction), prioritizing early access and community growth. - Structured tokenomics include liquidity locks, token burns, and governance voting (Stage 12), differentiating it from traditional meme coins through audited contracts. - Competitors like FLOKI and N

MoonBull ($MOBU), a meme

MoonBull’s tokenomics are structured to ensure scarcity and maintain value. The project has allocated 14.6 billion tokens for staking and 8.05 billion for referral rewards, with a capped total supply to control inflation. Plans for token burns and liquidity locks are also in place to further restrict supply. Analysts point out that these mechanisms set MoonBull apart from typical meme coins, which often lack lasting utility title3 [ 3 ]. At Stage 12, a governance system will be introduced, allowing token holders to vote on important project decisions, thus supporting a community-led approach title4 [ 4 ].

While MoonBull is currently in the spotlight, other meme coins such as

This setup has drawn parallels to earlier meme coin successes such as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Are Shiba Inu, PEPE, and Dogecoin Dead in 2025? The Numbers Tell a Brutal Story

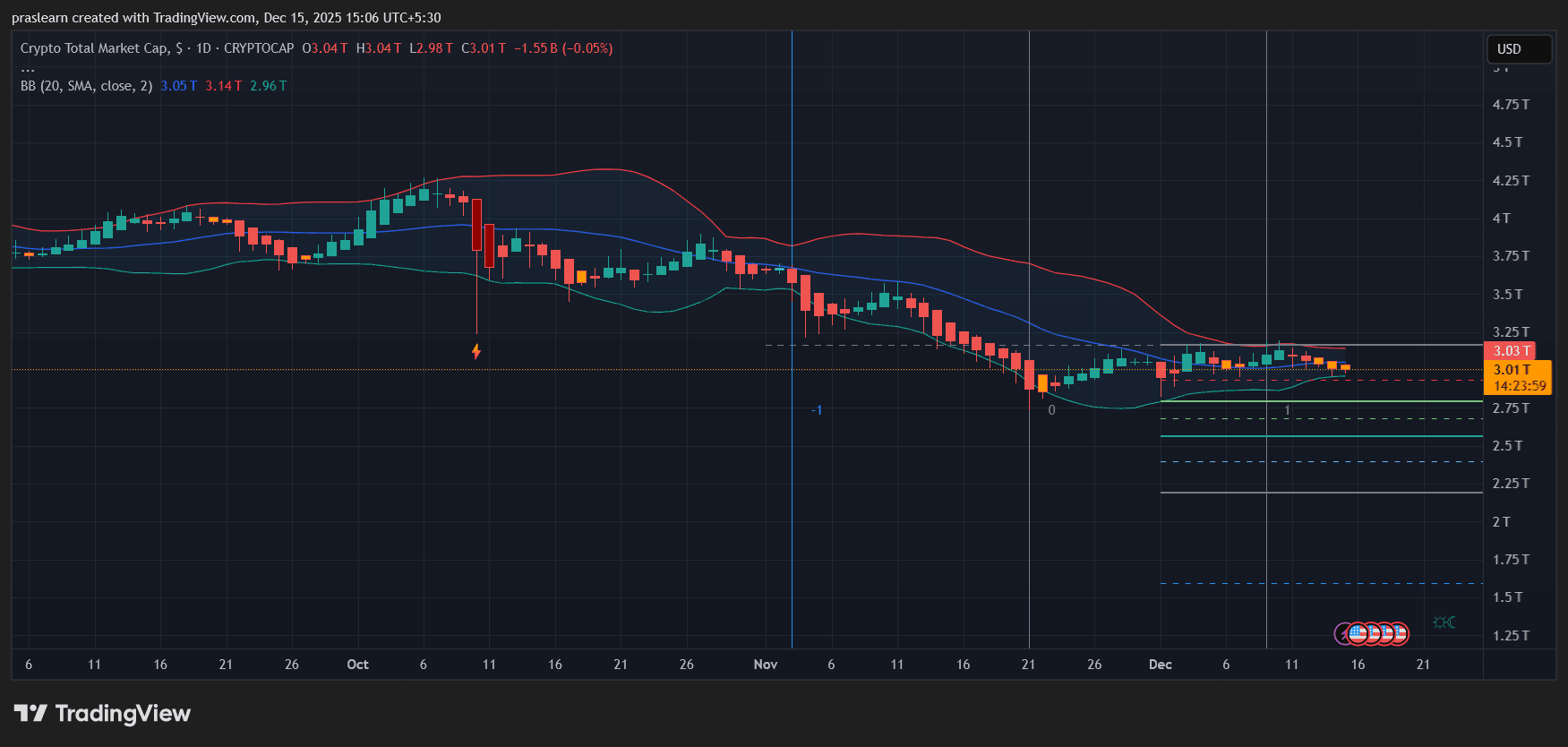

What to Expect in Crypto Markets This Week: Macro Pressure Meets a Fragile Market Structure

Global Liquidity Set to Shrink in 2026. Here’s Why

Clean Energy Market Fluidity: Ushering in a New Age with CFTC-Sanctioned Platforms

- REsurety's CleanTrade, the first CFTC-approved SEF for clean energy , is transforming market liquidity and transparency by standardizing VPPAs, PPAs, and RECs. - The platform attracted $16B in notional value within two months, enabling institutional investors to hedge energy risks while aligning with ESG goals through verifiable decarbonization metrics. - Renewable developers benefit from streamlined financing and securitization tools, creating predictable revenue streams and expanding access to capital