Grayscale Ranks The Top 20 Tokens That Offered The Best Returns In Q3

Grayscale’s Q3 2025 index revealed altcoins outperformed Bitcoin, with BNB Chain, Prometeus, and Avalanche emerging as top risk-adjusted performers.

Grayscale revealed in an index that altcoins provided the best returns in the third quarter of 2025. Bitcoin’s underperformance became the quarter’s most defining characteristic, while BNB Chain, Prometheus, and Avalanche led the ranking for top risk-adjusted performers.

The index was generally dominated by tokens used for financial applications and smart contract platforms. Thematic narratives centered on stablecoin adoption, exchange volume, and Digital Asset Treasuries (DATs) overwhelmingly drove this outperformance.

Altcoins Dominated Q3 Performance

The third quarter of 2025 proved to be a period of broad-based strength in the digital asset market. According to an index developed by Grayscale Research, some distinct winners generated the best volatility-adjusted price returns.

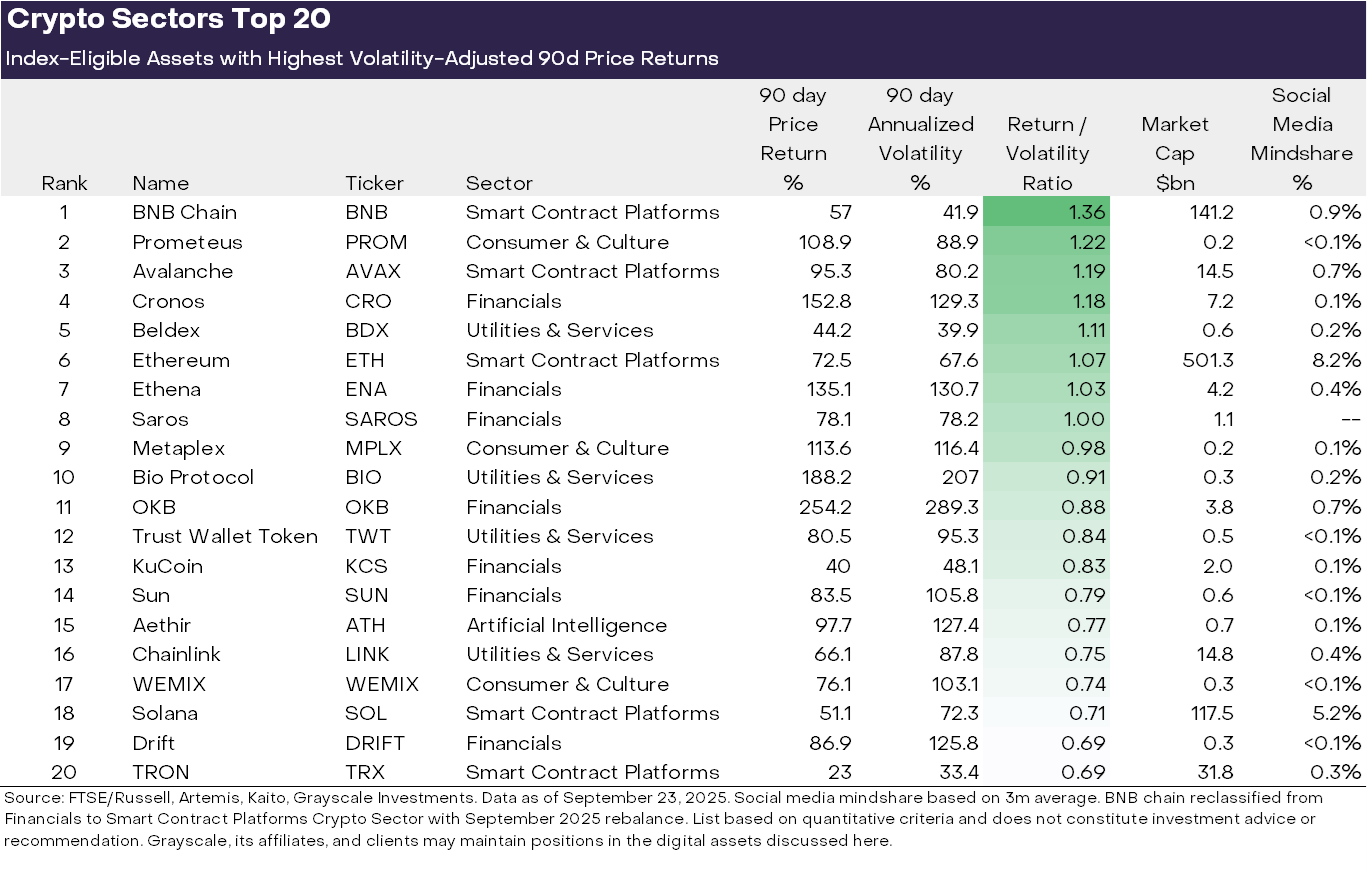

In a ranking of the top 20 best-performing tokens, BNB Chain took the lead, delivering the most favorable returns with relative stability compared to those whose gains were outweighed by excessive risk.

Prometeus, Avalanche, Cronos, Beldex, and Ethereum followed behind it.

Top 20 Performing Tokens. Source:

Grayscale Research.

Top 20 Performing Tokens. Source:

Grayscale Research.

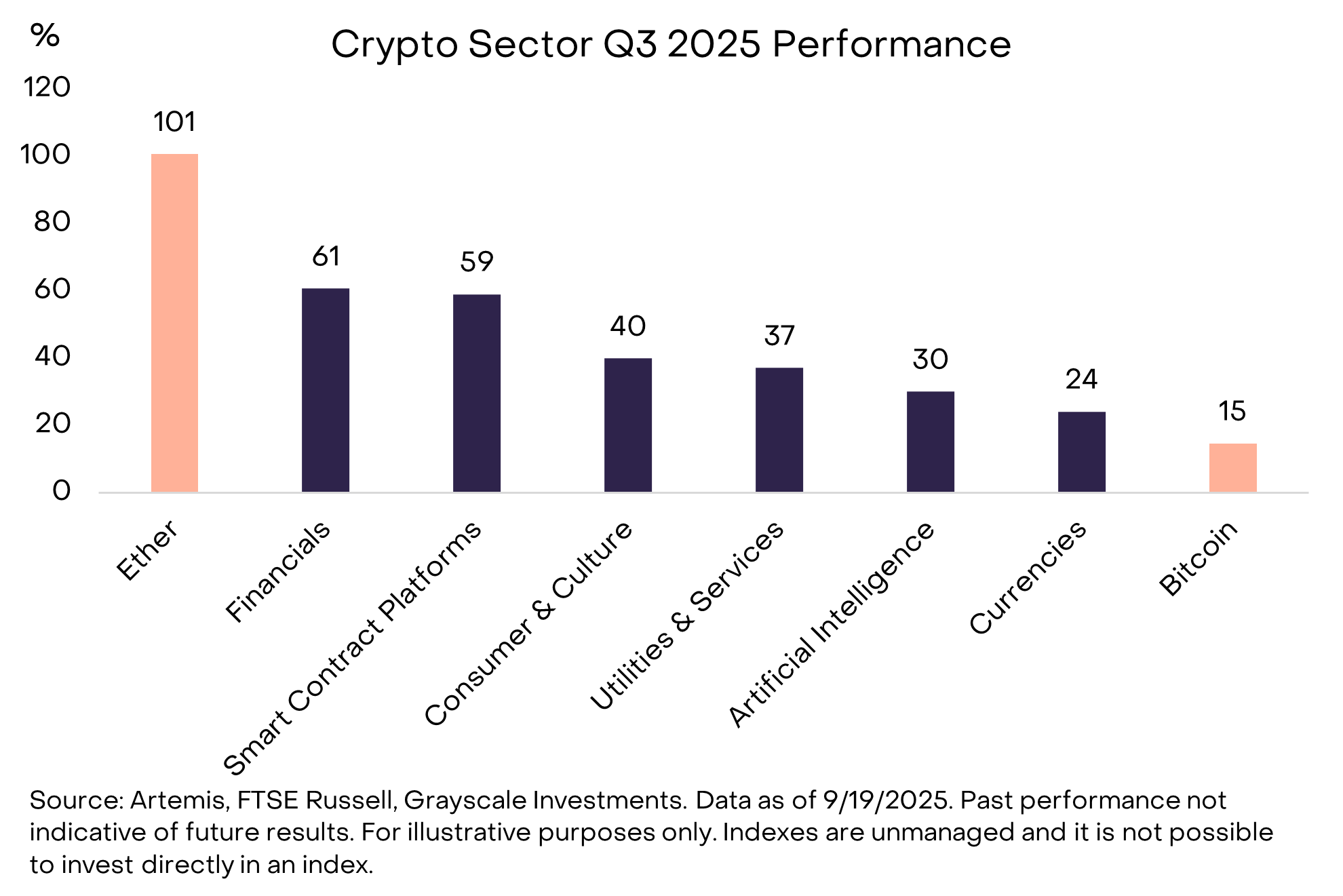

Grayscale organizes the digital asset market into six segments based on the protocol’s core function and use case: Currencies, Smart Contract Platforms, Financials, Consumer and Culture, Utilities and Services, and Artificial Intelligence.

Seven top-performing tokens formed part of the Financials segment, while five came from Smart Contract Platforms. These results effectively quantified the shift away from Currencies. Most notably, Bitcoin did not make the cut.

Why Bitcoin Lagged Behind

The most telling data point of Grayscale’s research was not so much who made the list as who was conspicuously absent: Bitcoin.

While all six sectors produced positive returns, Currencies notably lagged, reflecting Bitcoin’s relatively modest price gain compared to other segments. When measuring performance by risk, Bitcoin did not offer a compelling profile.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

The assets that made the list were overwhelmingly driven by thematic narratives related to new utility and regulatory clarity. These narratives specifically centered on stablecoin adoption, exchange volume, and DATs.

According to Grayscale Research, the rising volume on centralized exchanges benefited tokens like BNB and CRO. Meanwhile, increasing DATs and widespread stablecoin adoption fueled demand for platforms like Ethereum, Solana, and Avalanche.

Specific decentralized finance (DeFi) categories also showed strength, such as decentralized perpetual futures exchanges like Hyperliquid and Drift, which contributed to the strength of the Financials sector.

Bitcoin was less exposed to these specific catalysts as a peer-to-peer electronic cash and store-of-value asset. This lack of exposure allowed altcoins tied to functional platforms and financial services to surge in risk-adjusted performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap News Today: Uniswap's CCA Makes Token Launches More Accessible, Reducing Whale Influence

- Uniswap v4 launches Continuous Clearing Auctions (CCA), a permissionless protocol for transparent, community-driven token launches with Aztec. - CCA divides token sales into blocks settled at market-clearing prices, reducing volatility and sniping while enabling equitable distribution. - The protocol automatically seeds liquidity post-auction and supports privacy via Aztec's ZK Passport, marking a DeFi innovation in fair token distribution. - CCA aims to standardize on-chain price discovery, countering w

Why MUTM’s Approach to DeFi Might Establish New Standards for Liquidity

- Mutuum Finance (MUTM) nears 99% Phase 6 presale allocation ahead of Q4 2025 V1 lending protocol launch on Sepolia testnet. - Project has raised $18.6M through strong retail and institutional participation, positioning it as a rising DeFi contender focused on liquidity and execution speed. - V1 will introduce ETH/USDT lending, mtTokens, and a Liquidator Bot, marking transition from theory to practical DeFi implementation. - Market attention centers on MUTM's $0.05+ token price, transparent roadmap, and Ph

Solana News Update: Solana's DeFi Expansion Poses a Threat to Ethereum's Leading Position as Buybacks Drive Further Development

- Solana's Pump.fun accelerates growth via $173.7M PUMP token buybacks, reducing supply by 10.928%. - Solana's DEX volumes ($5.11B daily) now surpass Ethereum and BNB Chain, driven by 21.5 development activity score. - Ethereum's 67.65% DeFi TVL lead faces pressure from Solana (8.9%) and Tron (25.78% stablecoin share). - Institutional inflows and macroeconomic factors determine Solana's $180 price breakout potential (29% probability). - Pump.fun's sustainability hinges on maintaining user base amid Solana'

Tether’s Approach to Gold: Integrating Blockchain Technology with Precious Metals to Transform Trust

- Tether , issuer of the world's largest stablecoin, has accumulated $8.7B in Swiss gold reserves by 2025, becoming a top private gold holder. - The company restructured reserves to prioritize gold, aligning with central bank trends and tokenizing $1.5B in bullion via XAU₮. - Tether hired HSBC executives and launched a $200M gold treasury venture, vertically integrating into mining and royalty firms. - Its strategy reflects macroeconomic shifts toward gold as an inflation hedge, but faces scrutiny over tra