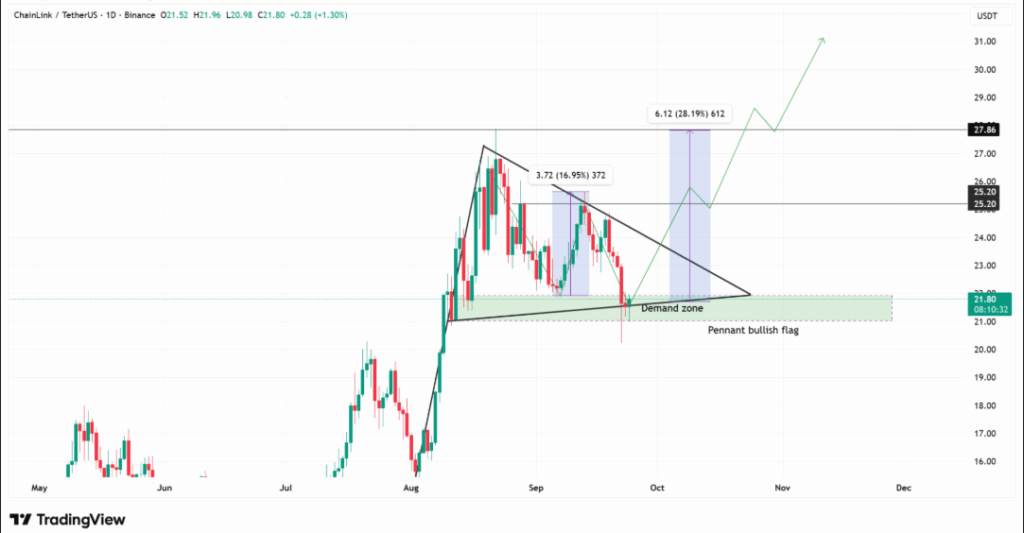

Chainlink price is holding at a key demand zone near $21.80 and shows breakout potential: a bullish pennant and heavy whale accumulation (800,000+ LINK) reduce selling pressure and raise the probability of a rally toward $27.86–$30 if resistance is cleared.

-

Chainlink price sits in a critical demand zone with a bullish pennant hinting at upside.

-

Whales accumulated 800,000+ LINK during the dip, signaling confidence and reduced exchange supply.

-

Exchange netflows show $14.45M outflows, indicating lower sell pressure and stronger holder conviction.

Chainlink price update: LINK price at $21.81, bullish pennant and whale accumulation suggest breakout potential—track $25.20 and $27.86. Read analysis now.

What is Chainlink price doing now?

Chainlink price is consolidating within a defined demand zone around $21–$22 and forming a bullish pennant that could trigger a breakout if resistance near $25.20 is taken out. Short-term momentum and whale accumulation are supporting a favorable risk/reward for upside continuation.

How does the bullish pennant and demand zone affect LINK’s outlook?

The bullish pennant is a continuation pattern suggesting a pause before potential upside continuation. LINK tested support near $21 on September 2 and rebounded ~17% to $25.60, then pulled back to consolidate. A break above $25.20 would validate the pennant and project targets at $27.86 and $30.

Chainlink’s price remains in a critical demand zone, with whales accumulating and a bullish pennant pattern hinting at a potential breakout.

Key Insights:

- Chainlink price shows strong potential for a breakout with a bullish pennant formation and continued demand zone support.

- Whale accumulation during the recent dip signals confidence in LINK’s long-term growth, with over 800,000 LINK added.

- Negative netflows highlight reduced supply pressure, suggesting lower selling activity and reinforcing a positive outlook for LINK’s price.

Chainlink’s price is holding steady at a critical point, currently trading at $21.81. This consolidation sits in a demand zone that has historically provided support. The market structure, including a double bottom in early September, points to a rebound scenario if support is defended.

Following the support test near $21 on September 2, Chainlink surged roughly 17% to $25.60 before a modest pullback and renewed consolidation. The formation of a bullish pennant reinforces the possibility of continuation above near-term resistance levels.

Source: TradingView

Why does whale accumulation matter for LINK?

Large-holder behavior often precedes durable moves. Recent on-chain snapshots show whales added over 800,000 LINK during the dip, concentrating supply off exchanges. This accumulation decreases immediate sell-side liquidity and can amplify upside if buying pressure resumes.

Netflow metrics on September 24 reported $14.45M in outflows from exchanges, an indicator that holders are moving LINK into custody rather than selling. Reduced exchange balances typically translate into diminished selling pressure and improved price dynamics for assets like LINK.

How to monitor the breakout and manage risk?

Use clear technical triggers and position sizing rules. Key levels to watch are $21 (demand support), $25.20 (pennant resistance), $27.86 (first upside target). Manage risk with stop-losses below the demand zone and scale positions if confirmed volume accompanies a breakout.

| Current price | $21.81 | Demand zone support |

| Immediate resistance | $25.20 | Pennant breakout trigger |

| Near-term target | $27.86 | Confirms pennant projection |

| Extended target | $30.00 | Further confirmation and momentum |

Frequently Asked Questions

Is Chainlink in a bullish setup right now?

Yes. Chainlink is in a bullish setup characterized by a demand zone near $21, a bullish pennant, and significant whale accumulation that reduces immediate selling pressure. A confirmed break above $25.20 would increase bullish conviction.

How much LINK did whales accumulate during the dip?

Whales accumulated over 800,000 LINK during the recent dip, according to on-chain analytics. This accumulation coincided with exchange outflows totaling approximately $14.45M on September 24, indicating reduced available supply.

When should traders expect a confirmed breakout?

A confirmed breakout would be a clear close above $25.20 with expanding volume and continued outflows from exchanges. Traders should watch for follow-through above $27.86 to validate the pennant projection.

Key Takeaways

- Demand zone support: Chainlink is holding a key support area near $21 that has acted as a base.

- Whale accumulation: Over 800,000 LINK moved to large holders, reducing exchange sell-side liquidity.

- Breakout criteria: A close above $25.20 with volume and continued outflows could open targets of $27.86 and $30.

Conclusion

Chainlink price is positioned at an important inflection point where technical structure and on-chain activity align. With a bullish pennant, strong whale accumulation, and declining exchange supply, LINK’s risk/reward favors an upside scenario if $25.20 is overtaken. Monitor volume and netflows for confirmation and adjust positions accordingly.

Published: 2025-09-26 | Updated: 2025-09-26 | Author: COINOTAG