Tether's USDT Expansion on Ethereum Drives DeFi Expansion and Boosts International Transactions

- Tether mints 1 billion USDT on Ethereum to expand stablecoin utility in DeFi and cross-border payments. - Ethereum-based USDT (USDT-ETH) now accounts for growing supply share, driven by institutional/retail demand for DeFi compatibility. - The move leverages Ethereum's smart contracts for transparent, censorship-resistant transactions amid 25% YoY transaction growth. - USDT-ETH competes with USDC/DAI but maintains 60%+ market cap dominance, boosting DEX liquidity and global payment efficiency. - Tether C

Tether has created an additional 1 billion

This latest issuance of 1 billion USDT on Ethereum comes amid a surge in stablecoin activity, with Ethereum-based tokens gaining popularity thanks to their seamless integration with DeFi platforms and automated market makers (AMMs). Tether’s move to strengthen its presence on Ethereum is anticipated to further support USDT’s use in efficient value transfers, especially on decentralized exchanges and blockchain-powered remittance platforms. Blockchain data shows that USDT transactions on Ethereum have jumped by 25% since the start of the year, fueled by its adoption across leading DeFi services and cross-chain bridges.

From a technical standpoint, the deployment underscores Ethereum’s strengths for stablecoin management. By operating through Ethereum’s native smart contracts,

Industry experts believe that expanding USDT on Ethereum may heighten competition with other Ethereum-based stablecoins, including USD Coin (USDC) and

Paolo Ardoino, Tether’s CEO, highlighted the importance of this milestone, stating that Ethereum’s scalability and robust security are crucial for addressing the growing appetite for stablecoins in both conventional and decentralized finance. “Growing USDT’s footprint on Ethereum is a deliberate move to encourage wider blockchain adoption and streamline global payments,” Ardoino remarked. This supports Tether’s broader goal of establishing USDT as a universal exchange medium, especially in regions where fiat currencies are unstable or face regulatory challenges.

The rollout of 1 billion USDT on Ethereum also demonstrates Tether’s dedication to interoperability, as the company continues to pursue multi-chain expansion on networks such as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Price Prediction: Staking Absorbs Supply As ETH Stalls Below Key EMAs

Global Markets Surge with Promising Returns

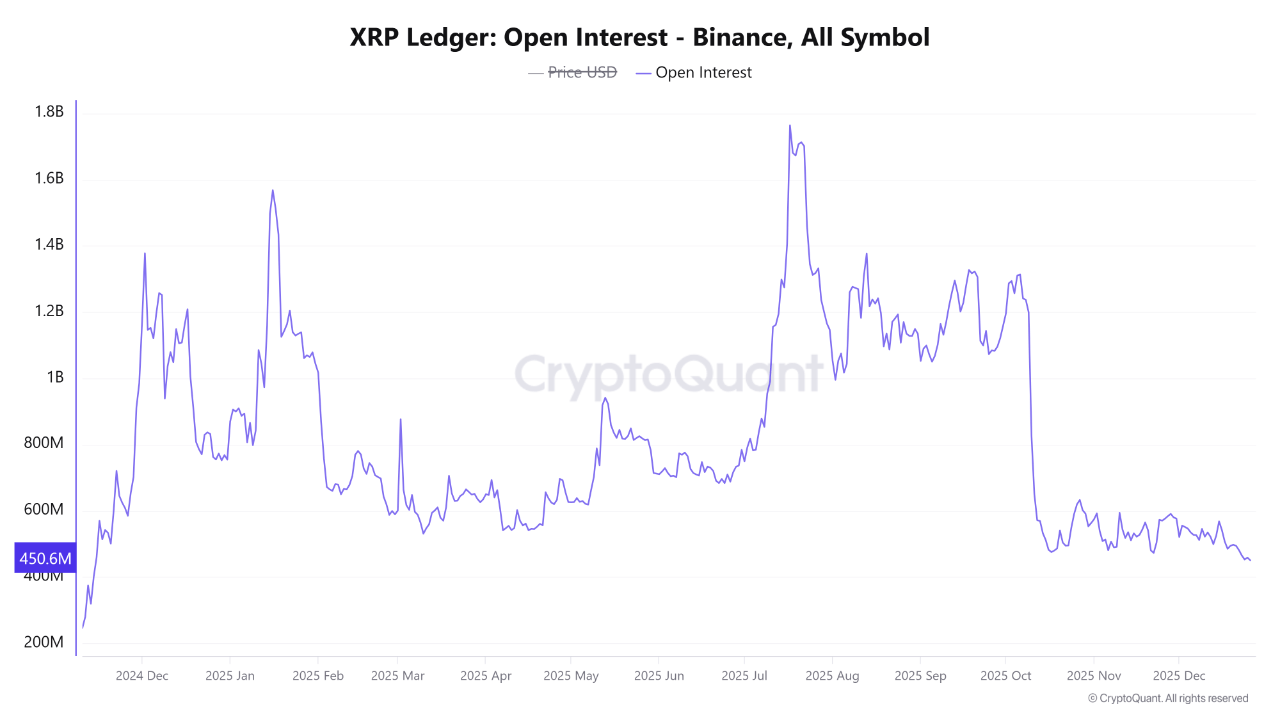

Analyst Says XRP Price On The Verge Of Bearish Breakdown

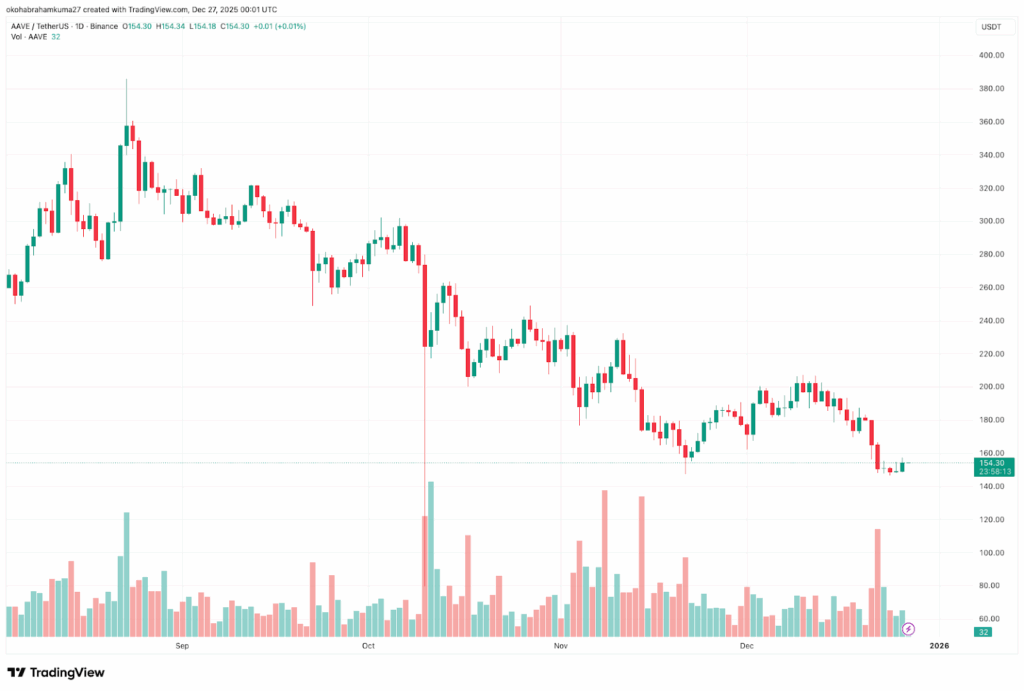

BlockchainFX Price Prediction 2026: Aave Governance Stumbles as DeepSnitch AI Proves Utility Is King