Bank of England Supports Tokenized Deposits to Mitigate Stablecoin Threats

- UK banks including HSBC and Barclays launch tokenized deposit pilot to modernize financial infrastructure via blockchain, supported by UK Finance and the Bank of England. - Bank of England Governor Andrew Bailey prioritizes tokenized deposits over stablecoins, citing systemic risks from unregulated digital currencies and emphasizing banking system stability. - PunkStrategy's tokenized NFT model saw $21M valuation surge by linking trading fees to CryptoPunk NFTs, but analysts warn of speculative risks ami

British banks are rapidly moving forward with the use of tokenized deposits, reflecting a wider shift toward blockchain-driven financial solutions. A group of leading banks—including

Bank of England Governor Andrew Bailey has consistently supported tokenized deposits over stablecoins, which he considers a risk to financial stability. In July 2025, Bailey argued that tokenized deposits add real value by ensuring payments remain within regulated banks, in contrast to stablecoins, which he criticized for lacking strong branding and for their potential to disrupt established finance Next Up, NFTStrategy [ 6 ]. The UK’s experiment is part of a global divergence in regulation, with the United States under the Trump administration taking a more relaxed approach to stablecoins. This difference underscores the ongoing debate about how to foster innovation while managing systemic risks in digital finance.

The UK’s efforts to advance tokenized deposits coincide with a boom in tokenized asset initiatives, including new crypto-NFT hybrid concepts. One notable case is PunkStrategy (PNKSTR), a tokenized NFT project experiencing swift expansion. PunkStrategy’s model allocates 10% of trading fees to acquire and resell CryptoPunk NFTs, using the profits to repurchase and burn PNKSTR tokens. This cycle is designed to help stabilize the token’s value and increase NFT demand. In late September 2025, PNKSTR’s market cap jumped from $1 million to over $21 million in just a week, with a single large investor seeing an unrealized profit of $2.1 million.

Although the project’s innovative approach has drawn interest, experts warn that its speculative design brings considerable risk. The NFT sector’s typical volatility and lack of liquidity could lead to sharp price movements, especially if major holders sell off their tokens. Moreover, PunkStrategy’s viability relies on ongoing trading and the overall strength of the NFT market. Other ventures, such as TokenWorks’ NFTStrategy tokens for Bored Apes and Moonbirds, are also appearing, aiming to build self-sustaining economic cycles around top NFT collections.

The UK’s tokenized deposit initiative and the emergence of NFT-related tokens signal a broader move toward programmable money and asset digitization. By turning traditional financial assets into digital form, institutions hope to cut costs, improve transparency, and open up new possibilities. Nevertheless, obstacles such as unclear regulations, liquidity issues, and the need for solid infrastructure remain. The Bank of England’s emphasis on tokenized deposits rather than stablecoins highlights its intent to retain oversight of monetary systems, while projects like PunkStrategy showcase the experimental side of tokenomics.

As the UK’s pilot unfolds, its results may shape international regulatory standards and influence investor attitudes toward tokenized assets. For now, the balance between institutional involvement and speculative innovation demonstrates the evolving and sometimes precarious nature of financial tokenization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: The CFTC-Endorsed Transformation

- CFTC approved CleanTrade as the first SEF for clean energy , addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of VPPAs and RECs with automated compliance and $16B in early trading volume. - Integrated analytics and regulatory compliance enhance transparency, reducing risks for investors in renewable energy assets. - Early adoption by Cargill and Mercuria highlights CleanTrade's potential to reshape $1.2T clean energy investment landscape.

How iRobot Strayed from Its Original Path

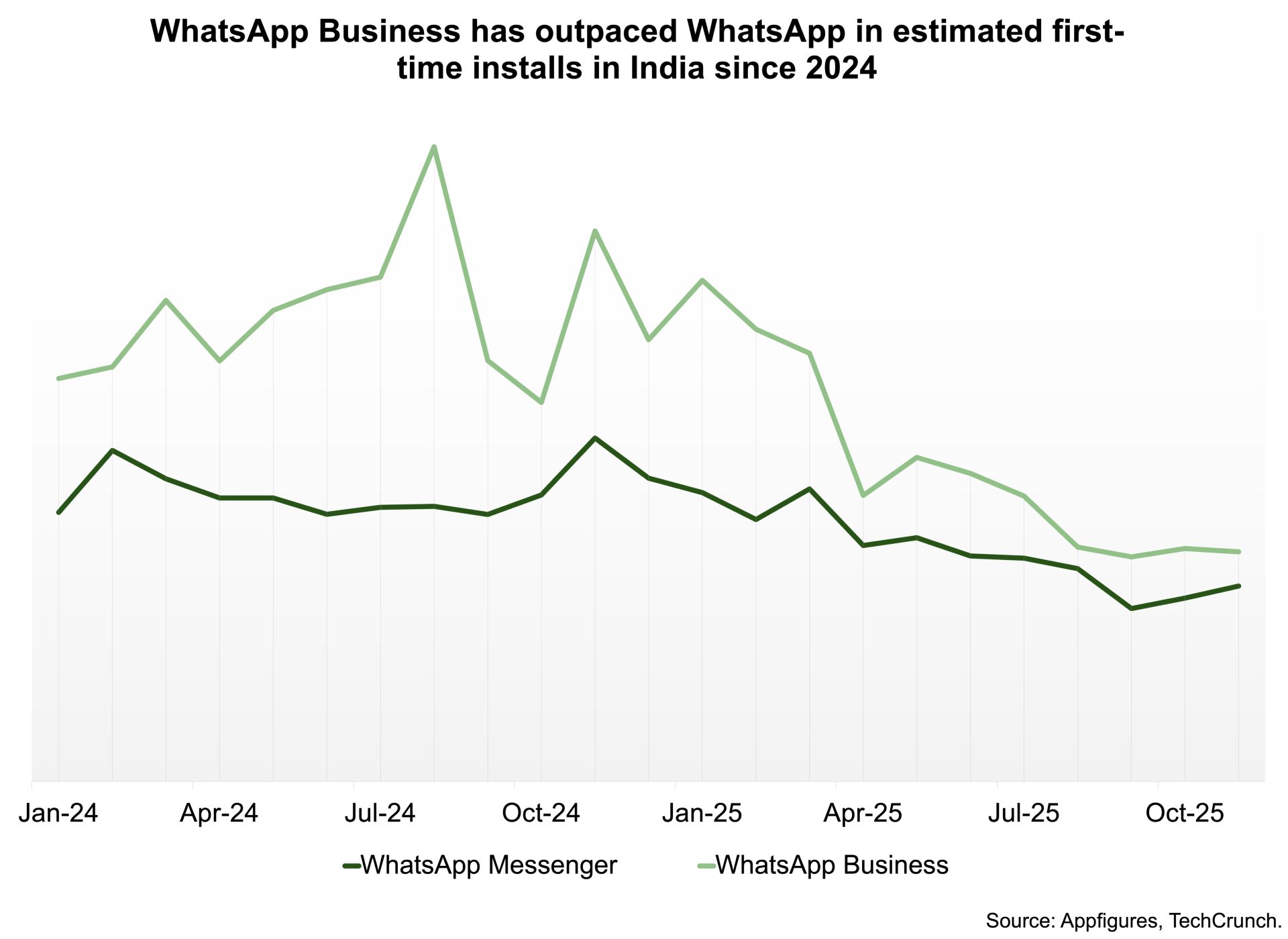

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t