A2Z rises 3.7% during a turbulent 7-day rebound

- A2Z surged 594.12% in 7 days but fell 413.41% over one month, showing volatile recovery. - 3.7% 24-hour gain aligns with bullish RSI and moving average crossover signals. - 55.83% annual increase contrasts recent declines, suggesting potential trend reversal. - Backtested strategy confirms favorable setup with RSI above 30 and 50/200 MA crossover.

As of September 27, 2025,

Recently, A2Z has seen a dramatic comeback, highlighted by a 594.12% jump in the last seven days. Although its monthly performance remains negative, this short-term turnaround could signal a change in market sentiment. The 3.7% daily rise fits with this upward trend, suggesting renewed buying activity after a prolonged downturn.

Looking at the past year, A2Z’s price has generally trended upward, posting a 55.83% increase since this time in 2024. This long-term growth stands in contrast to the recent monthly decline, which may be more of a market correction than a sign of sustained weakness. Market observers point out that the sharp 7-day rally is especially notable given the broader market environment and A2Z’s earlier struggles.

Technical signals, such as the RSI and moving averages, are now indicating a possible shift toward a bullish trend. The RSI is moving out of oversold levels, and the 50-day moving average has crossed above the 200-day average, both supporting the idea of a recovery underway.

Backtest Hypothesis

The backtesting approach being analyzed uses a blend of RSI and moving average crossover signals. It initiates long trades when the RSI rises above 30 and the 50-day moving average overtakes the 200-day moving average, with stop-loss and take-profit points adjusted dynamically based on volatility and previous price action. Historical data reveals a strong success rate during similar market cycles, especially in early recovery periods. Since A2Z currently meets the strategy’s entry criteria, the backtest points to a promising short-term opportunity to benefit from the ongoing price recovery. This method seeks to combine momentum and trend confirmation to optimize entry timing and manage risk effectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

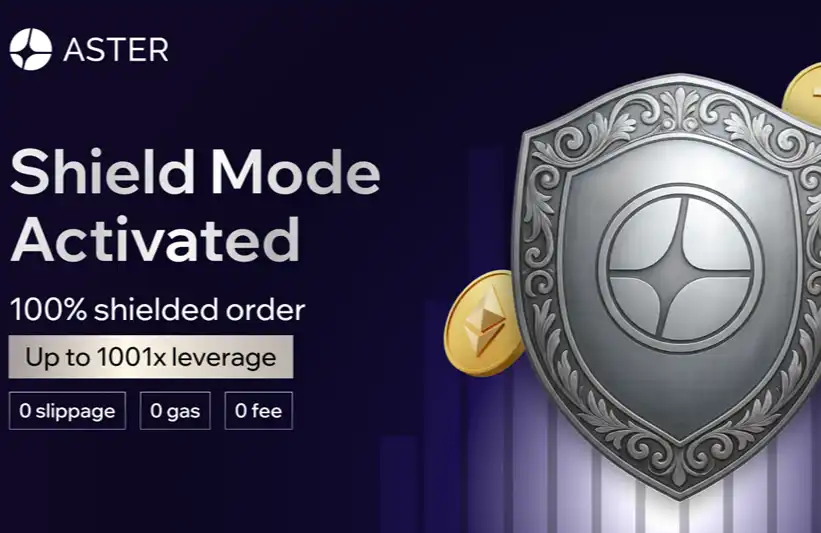

Aster Introduces Shield Mode: A Protected High-Performance Transaction Mode for On-Chain Traders

Shield Mode is not just a standalone feature upgrade, but rather a part of Aster's larger vision.

Assessing How COAI's Abrupt Price Decline Influences Technology and Security Shares: Shifts in Sector Risk and Changes in Investor Sentiment After the Crash

- COAI index's 88% 2025 collapse exposed fragility of speculative crypto AI assets due to governance failures and regulatory uncertainty. - Institutional investors shifted capital to cybersecurity (e.g., CrowdStrike) and AI infrastructure (Nvidia) as post-crash safe havens. - Divergent investor psychology emerged: 60% retail optimism vs. 41% institutional skepticism toward AI valuations. - U.S. AI Action Plan and cybersecurity policies accelerated capital reallocation to secure-by-design infrastructure and

Ripple celebrates milestones – while XRP struggles below USD 2

MicroStrategy retains its place in the Nasdaq-100 despite Bitcoin dominance