Key Notes

- Solana ETFs with staking could receive US approval within two weeks.

- Major asset managers, including Fidelity, VanEck, and Grayscale, have filed amended S-1 documents.

- SOL price trades near $201 in a rising wedge, with $236 resistance and $180 support.

Solana could soon become the next major cryptocurrency with a spot exchange-traded fund (ETF) in the United States.

ETF analyst Nate Geraci said that recent filings suggest Solana ETFs with staking could receive approval within two weeks, triggering the asset’s ‘institutional moment.’

Another flurry of S-1 amendments filed today on spot sol ETFs…

Franklin, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, & Canary.

Includes staking (yes, bodes well for spot eth ETF staking).

Guessing these are approved w/in next two weeks. pic.twitter.com/g13NDFKSEU

— Nate Geraci (@NateGeraci) September 26, 2025

Major Firms Lined Up

Several leading managers, including Franklin Templeton, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, and Canary Capital, submitted amended S-1 documents to the US Securities and Exchange Commission (SEC) on Friday.

These updates came just two months after the first Solana staking ETF debuted on the Cboe BZX Exchange, attracting $33 million in trading volume and $12 million in inflows on launch day.

Staking Provisions

Bitwise CIO Hunter Horsley noted that its European Solana staking ETP drew $60 million in inflows in just five sessions.

$60,000,000 into the Europe Bitwise Solana Staking ETP this week —

Solana on people's minds. https://t.co/J3megoQwTO

— Hunter Horsley (@HHorsley) September 26, 2025

Pantera Capital has also described Solana as “next in line” for institutional allocation, highlighting its relative underweight position compared to Bitcoin and Ether.

The filings also include staking provisions. Geraci pointed out that this could strengthen the case for future Ethereum ETFs with staking, a feature issuers have been pressing the SEC to approve.

Analysts believe staking in ETFs would boost yields and significantly affect investor behavior.

SOL Price Analysis: What’s Next?

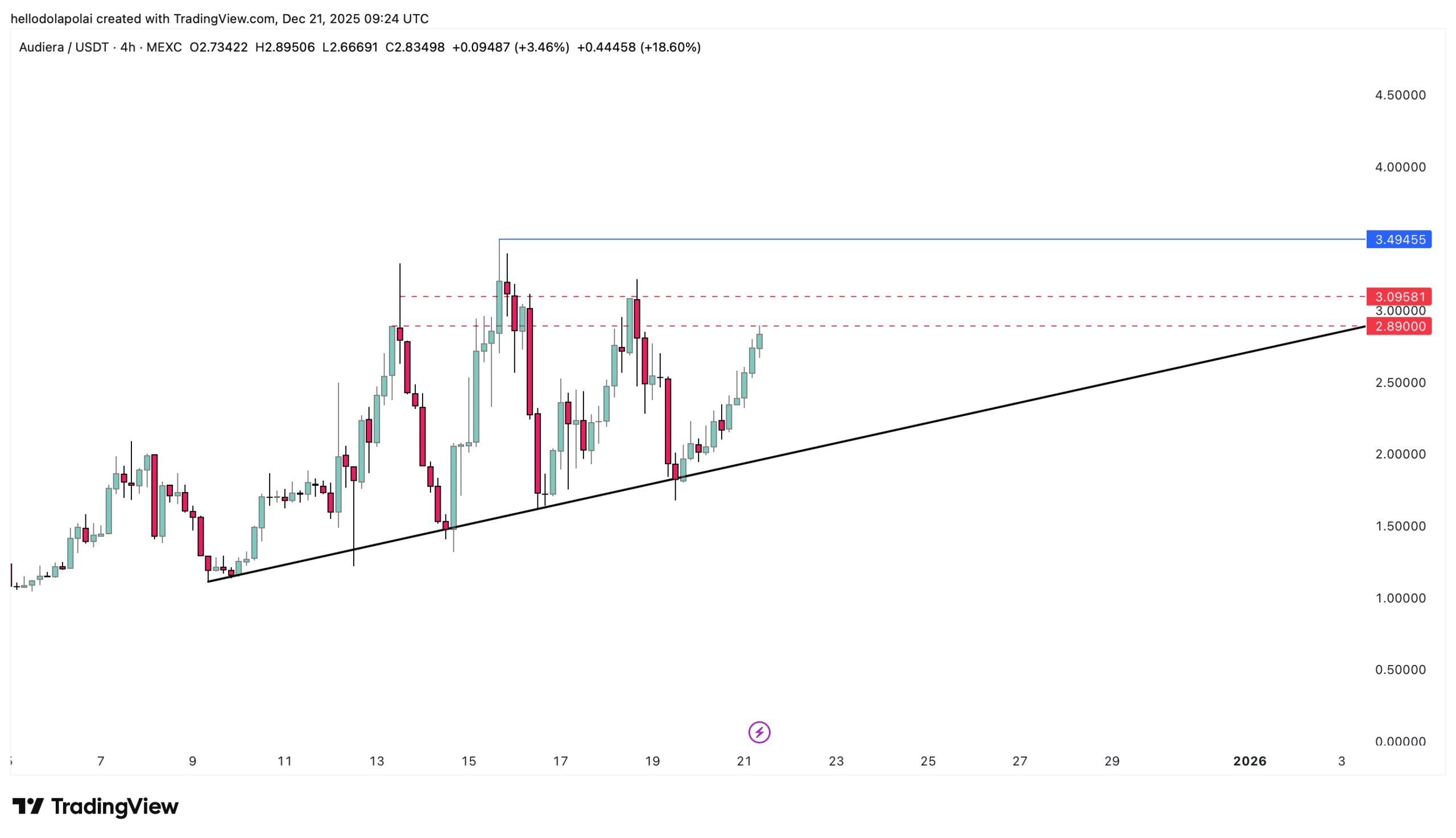

Solana (SOL) trades near $201, dropping almost 15% in the past week. The chart structure shows SOL consolidating within a rising wedge pattern, with resistance marked near $236 and support around $180.

A decisive move above $236 could open the path toward $300–$320, while a breakdown below $180 risks a deeper test toward the $124–$130 support zone.

Solana weekly price action inside rising wedge | Source: TradingView

Meanwhile, the RSI at 54 suggests neither overbought nor oversold conditions, leaving room for volatility.

The MACD is flattening, signaling slowing momentum, while volume spikes indicate strong trader positioning ahead of ETF-related developments.

If approval arrives by mid-October as Geraci predicts, the announcement could act as a powerful catalyst for Solana, potentially making SOL the next crypto to explode .

next