Ethereum’s Fragile $4,000 Recovery Faces Headwinds From Holders

Ethereum’s rebound to $4,000 faces growing risks as institutional outflows and long-term holder selling signal further downside ahead.

Leading altcoin Ethereum has rebounded slightly over the past 24 hours, recording a modest 1% gain to trade near the $4,000 level at press time.

This comes amid today’s broader improvement in market sentiment across the crypto sector. However, despite the recovery, on-chain data suggests that bearish pressure remains firmly in play.

ETF Outflows Threaten Ethereum’s Near-Term Recovery

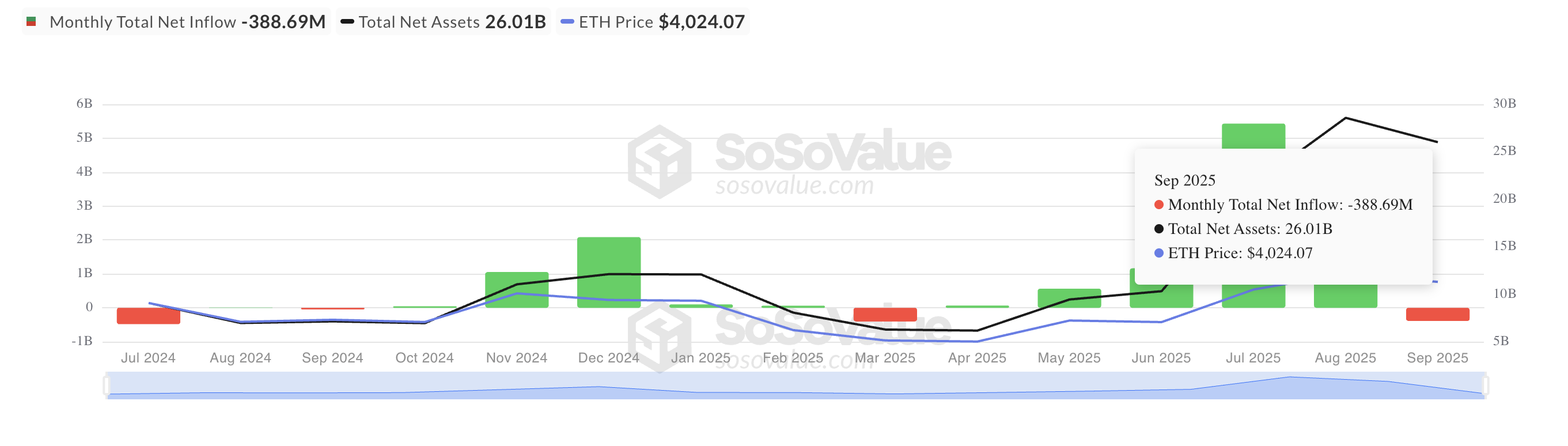

One of the most significant red flags comes from the dip in institutional flows into the altcoin. According to SosoValue, net outflows from spot ETH exchange-traded funds (ETFs) totaled $796 million this week, bringing the month-to-date liquidity exit from these funds to $388 million.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

If this pace continues, September will mark the first month of net outflows for ETH ETFs since March. This highlights the weakening institutional demand for the asset.

ETF flows are a key marker of investor sentiment, and the persistent outflows indicate that institutional players are steadily exiting positions. With these big-money backers retreating, ETH’s ability to sustain a push above $4,000 is increasingly under threat.

Further, the sentiment among ETH’s long-term holders has progressively worsened, as reflected by its climbing Liveliness metric. Per Glassnode, this key metric sits at a year-to-date high of 0.70, indicating strong selloffs from this investor cohort.

ETH Liveliness. Source:

Glassnode

ETH Liveliness. Source:

Glassnode

Liveliness measures the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it drops, LTHs are moving their assets off exchanges and opting to hold.

Conversely, as with ETH, when the metric climbs, long-held tokens are being moved or sold, signaling profit-taking by long-term holders. This trend contributes to the downward pressure on ETH’s price and hints at the likelihood of further declines.

Ethereum Holds $3,875 Support—For Now

ETH’s 1% rebound appears fragile with ETF outflows mounting and long-term holders selling into the market. While the $3,875 support level has held for now, failure to attract renewed buying pressure could set the stage for further declines.

In this scenario, the altcoin’s price could break below this key price floor and fall to $3,626.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if today’s rally gains strength and demand rises, it could push ETH’s price toward $4,211.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jensen Huang's fried chicken meal sends Korean "chicken stocks" soaring

Jensen Huang appeared at the Kkanbu Chicken restaurant in Seoul and had a fried chicken dinner with the heads of Samsung Electronics and Hyundai Motor, unexpectedly sparking a frenzy in Korean "meme stocks."

Will Solana's latest slogan ignite a financial revolution?

Solana is actively transforming "blockchain technology" into foundational infrastructure, emphasizing its financial attributes and capacity to support institutional applications.

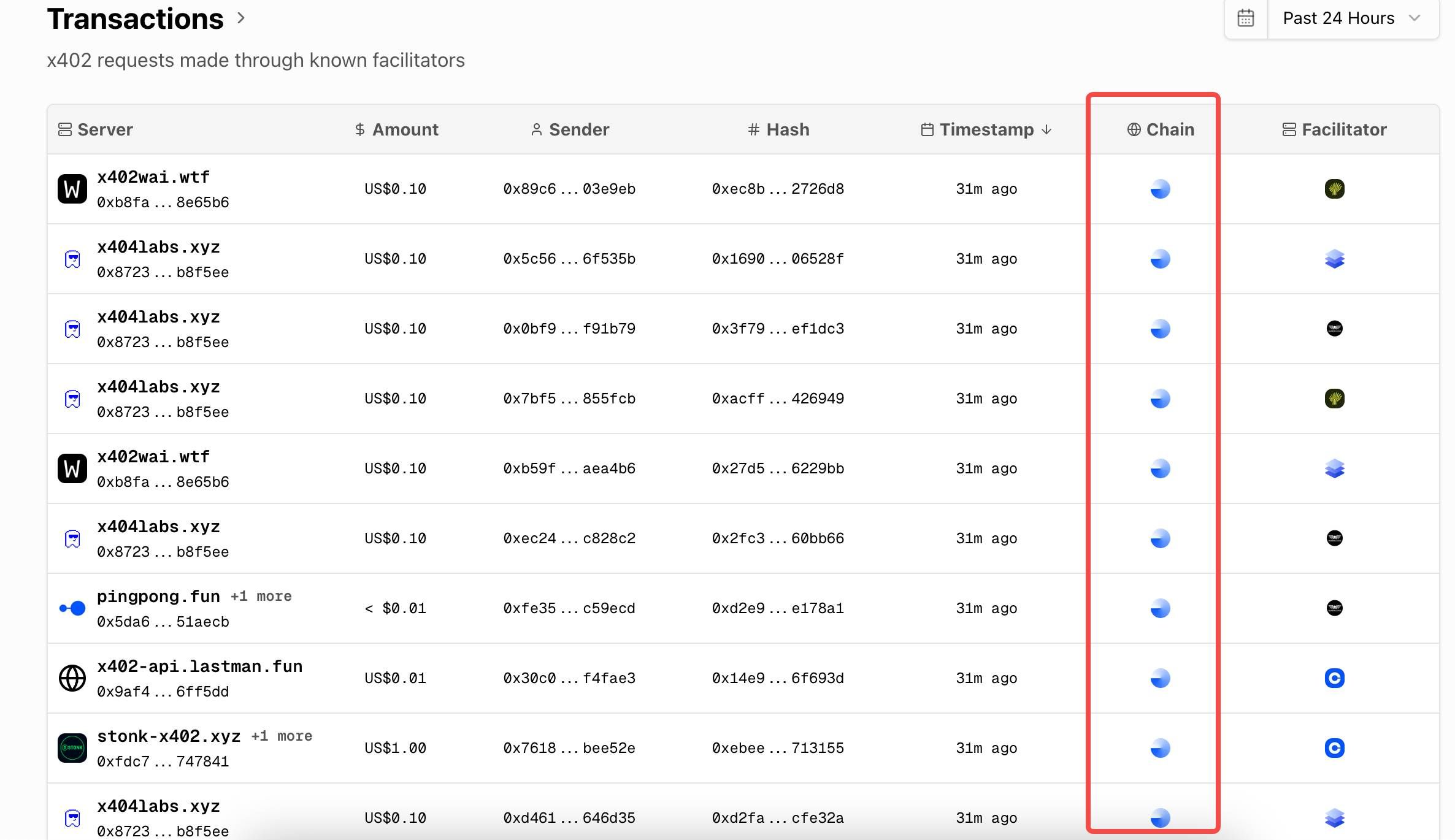

Where are the asset opportunities on BSC and Solana while x402 is booming on BASE?

We have reviewed the BNB Chain and Solana-related x402 projects currently on the market to help everyone better identify assets in this narrative cycle.

Sun Wukong's capital exceeds 100 millions! Innovative gameplay leads DEX resurgence, poised to become the new gateway for decentralized trading

The assets on the Sun Wukong platform have exceeded 100 millions. With its innovative user experience and ecosystem synergy, it is leading a new era of decentralized contract trading. Experts predict that the future will be characterized by the coexistence of DeFi and CeFi, but with decentralization taking the lead.