SEC Simplifies Crypto ETFs: Solana at the Forefront of Institutional Embrace

- SEC shortens crypto ETF approval to 75 days, with Solana (SOL) ETFs leading as first candidates for mid-October 2025 approval. - VanEck, Bitwise, and Grayscale submit staking-enabled Solana ETFs, leveraging July 2025 in-kind redemption rules to boost liquidity. - Analysts predict 95% approval odds for Solana ETFs by year-end, citing $200B market cap and growing institutional demand for DeFi-linked altcoins. - SEC's "first-to-file" framework intensifies competition, mirroring Ethereum ETF success, while X

The U.S. Securities and Exchange Commission (SEC) has made notable progress in simplifying the approval pathway for cryptocurrency exchange-traded funds (ETFs), as recent filings for

Leading asset managers such as VanEck, Bitwise, 21Shares, and Grayscale have all put forward proposals for Solana ETFs, with VanEck’s application currently at the forefront and facing an initial decision date of October 10, 2025. These proposals include staking components—a new addition to crypto ETF models—which could potentially boost returns for investors. The SEC’s approval in July 2025 of in-kind redemptions for crypto ETFs has further enhanced these products by increasing liquidity and operational effectiveness. Bloomberg analysts now see a 95% chance that Solana ETFs will be approved before the end of the year, citing the successful launches of Bitcoin and

The regulatory environment has shifted considerably under SEC Chair Paul Atkins, who has promoted a more innovation-oriented stance since taking the helm in April 2025. The agency’s adoption of a “first-to-file” policy for eligible assets has increased competition among applicants, with several Solana ETF proposals competing for a spot at the front of the approval line. This approach is similar to the swift approval process seen for Ethereum ETFs in May 2024, which attracted over $4 billion in investments within a few months. Experts point out that adding Solana—a high-performance blockchain valued at $200 billion—could draw significant institutional funds, especially as its role in decentralized finance (DeFi) and international payments expands.

Industry observers are also closely watching how the SEC manages simultaneous

The expected green light for Solana ETFs may trigger a new wave of crypto product innovation, with issuers already preparing applications for other altcoins like

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

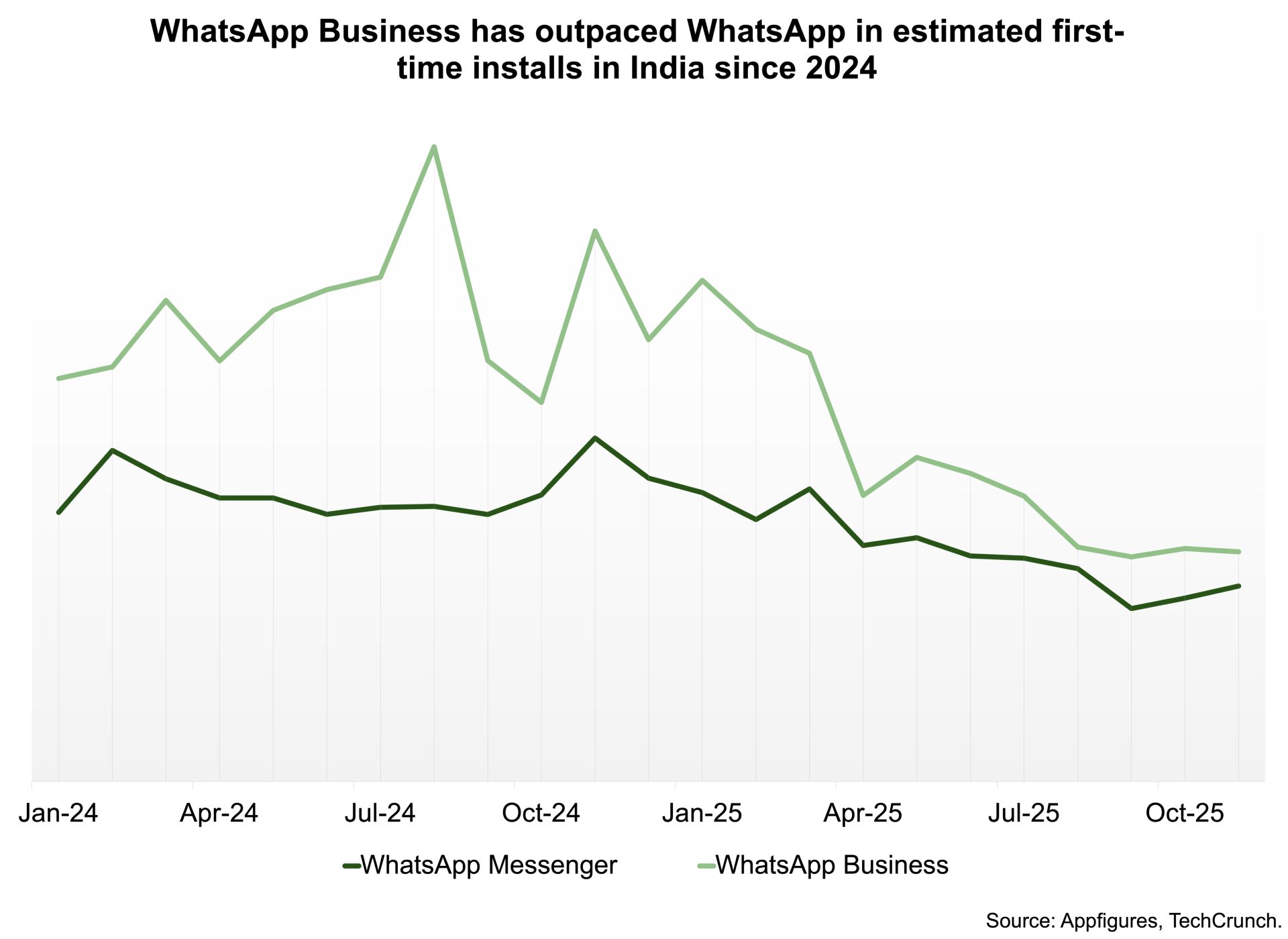

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026