XPL jumps 110.49% within a day as prices skyrocket

- XPL surged 110.49% in 24 hours, with 2895.95% gains over 7 days, 1 month, and 1 year, making it a top-performing digital asset. - Strong technical indicators and bullish momentum suggest continued upward trends, drawing attention from traders and analysts. - Heightened interest is attributed to increased demand for high-volatility assets and improved liquidity, though the immediate catalyst remains unclear.

On SEP 27 2025,

This swift price

Technical analysis signals ongoing strength in XPL’s upward trajectory. The asset has posted consecutive gains across different periods, resulting in a steep upward curve on price charts. The identical 7-day and 1-month increases of 2895.95% underscore the sustained momentum. Experts believe that, given these consistent gains, XPL could continue to experience rapid growth.

This dramatic rise has sparked increased interest from traders, many of whom credit the rally to a mix of renewed enthusiasm for high-volatility assets and better market liquidity. Although the exact reason behind the price spike is still uncertain, the overall market response has been highly positive, with investors viewing the surge as evidence of strong fundamentals and expanding adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

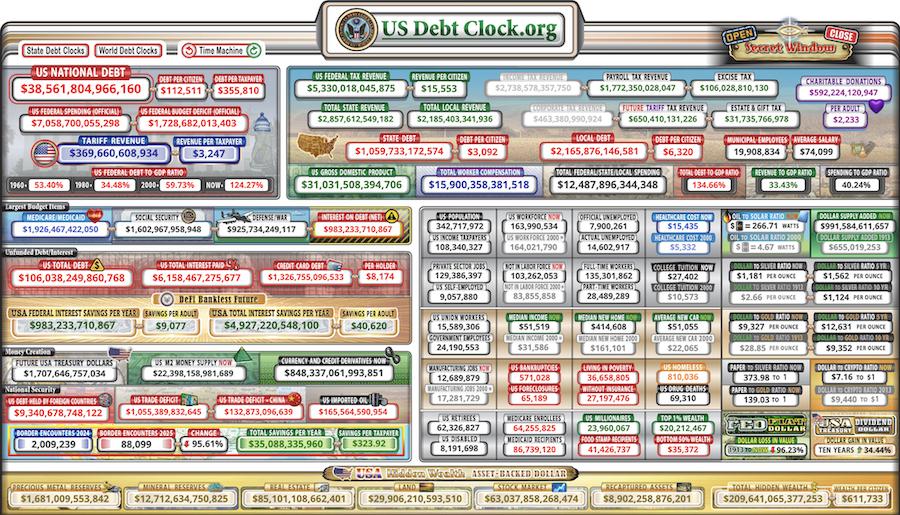

US national debt crosses $38.5T, as Bitcoiners celebrate 'Genesis Day'

NZD/USD rebounds above 0.5750 as traders expect more Fed rate cuts

WTI steadies near $57.50 as traders await OPEC+ meeting

US jobs report takes center stage next week – Deutsche Bank