Written by: kkk, Rhythm

On September 24, the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (Finra) jointly announced an investigation into more than 200 listed companies that had previously announced crypto treasury plans. The reason cited was "abnormal stock price fluctuations" commonly observed before these companies released related news.

Since MicroStrategy first included bitcoin on its balance sheet, "crypto treasury" has become a sensational "financial alchemy" in the U.S. stock market—newcomers like Bitmine and SharpLink saw their stock prices soar dozens of times due to similar moves. According to data released by Architect Partners, since 2025, 212 new companies have announced plans to raise about $102 billions to purchase mainstream crypto assets such as BTC and ETH.

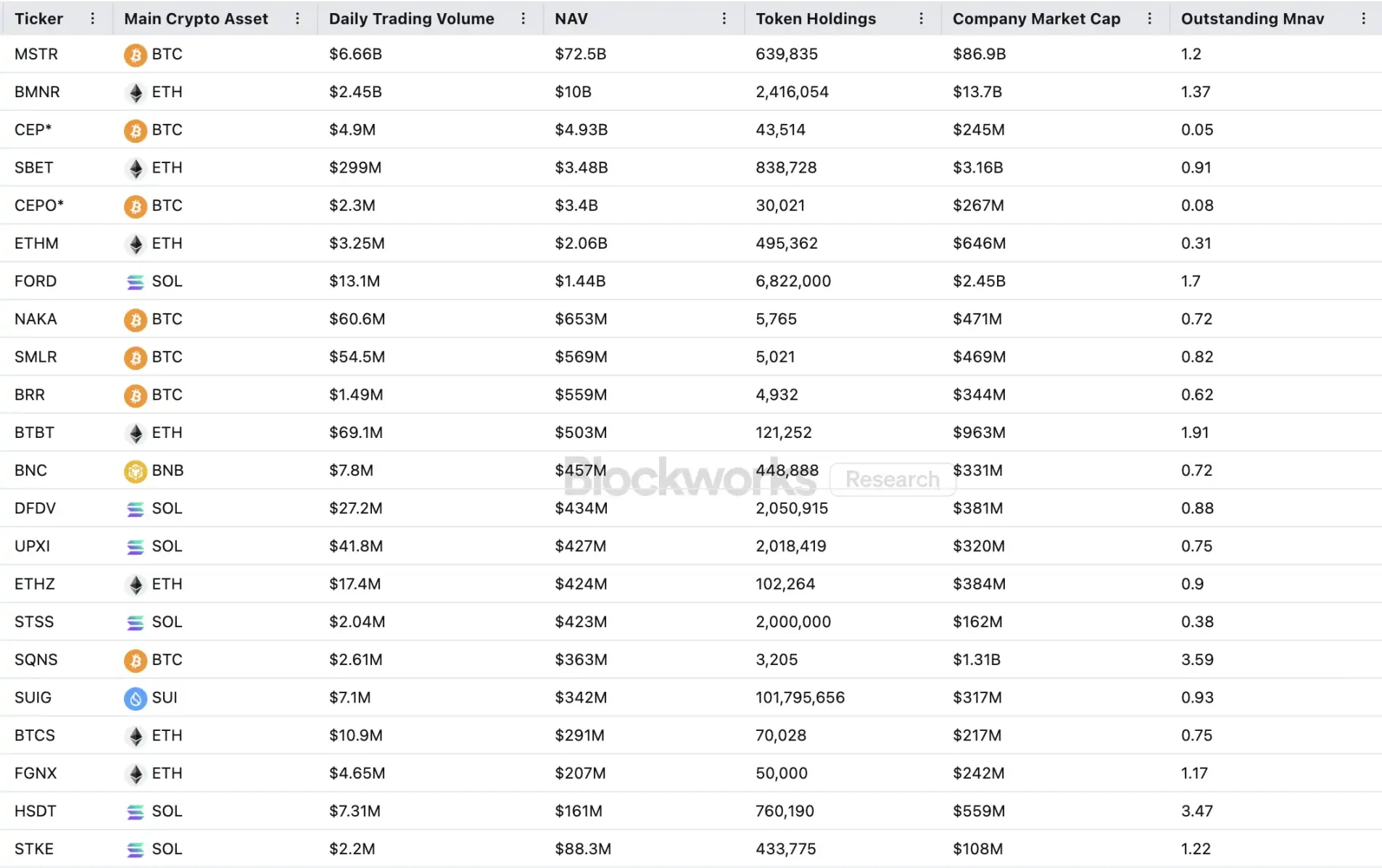

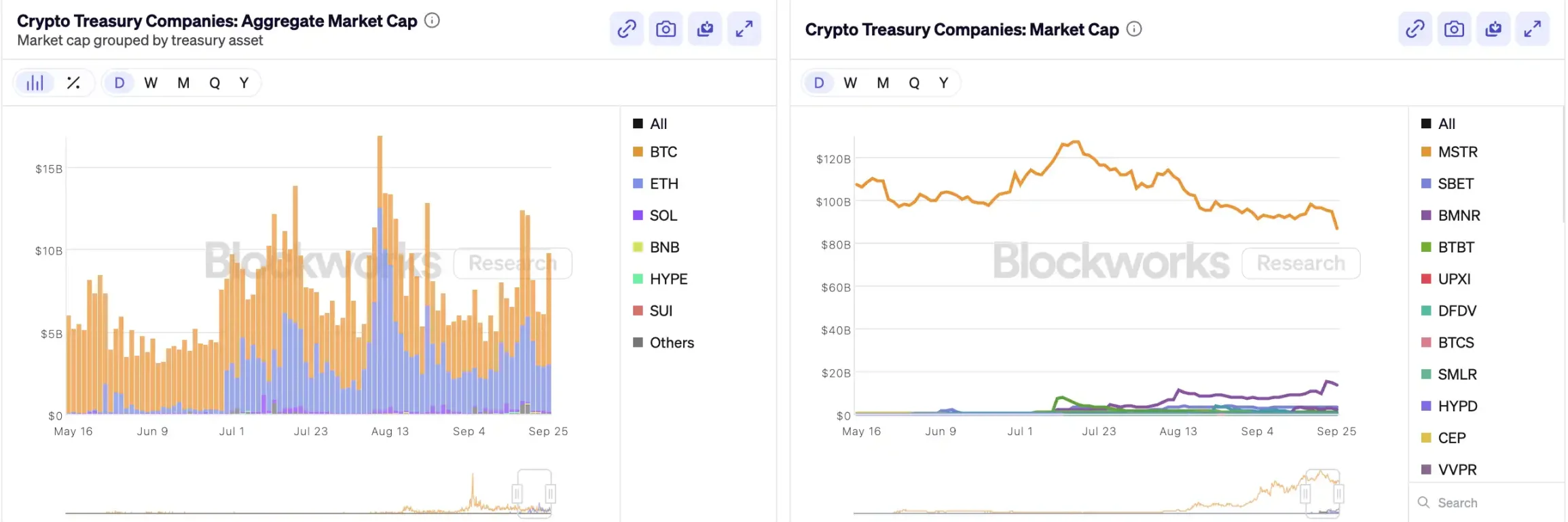

However, while this capital frenzy has driven up prices, it has also sparked widespread skepticism. MSTR's mNAV (the ratio of market capitalization to book net asset value) fell from 1.6 to 1.2 within a month, and two-thirds of the top twenty crypto treasury companies have an mNAV below 1. Concerns about asset bubbles, insider trading, and other issues are mounting, and this new asset allocation trend is now facing unprecedented regulatory challenges.

How the Crypto Treasury Company Flywheel Operates

The financing flywheel of treasury companies is built on the mNAV mechanism, which is essentially a reflexive flywheel logic that gives treasury companies seemingly "unlimited ammunition" in a bull market. mNAV refers to the market net asset value ratio, calculated as the company's market capitalization (P) relative to its net asset value per share (NAV). In the context of treasury strategy companies, NAV refers to the value of their digital asset holdings.

When the stock price P is higher than the net asset value per share NAV (i.e., mNAV > 1), the company can continuously raise funds and reinvest the proceeds into digital assets. Each additional issuance and purchase increases the per-share holdings and book value, further strengthening market confidence in the company's narrative and pushing the stock price higher. Thus, a closed-loop positive feedback flywheel begins to spin: mNAV rises → additional fundraising → purchase of digital assets → per-share holdings increase → market confidence strengthens → stock price rises again. It is through this mechanism that MicroStrategy has been able to continuously raise funds to buy bitcoin over the past few years without severely diluting shares.

Once the stock price and liquidity are pushed high enough, the company can unlock a whole set of institutional capital entry mechanisms: issuing debt, convertible bonds, preferred shares, and other financing tools, turning market narratives into assets on the books, which in turn push the stock price higher, forming a flywheel. The essence of this game is the complex resonance between stock price, story, and capital structure.

However, mNAV is a double-edged sword. A premium can represent high market trust, but it may also be mere speculation. Once mNAV converges to 1 or falls below 1, the market shifts from a "thickening logic" to a "dilution logic." If at this time the token price itself falls, the flywheel will reverse from positive to negative feedback, resulting in a double blow to market capitalization and confidence. In addition, the financing of treasury strategy companies is also built on the mNAV premium flywheel. When mNAV remains at a discount for a long time, the space for additional issuance is blocked, and the business of small and mid-cap shell companies that are already stagnant or on the verge of delisting will be completely overturned, and the established flywheel effect will collapse instantly. In theory, when mNAV is 1, a more reasonable choice for the company is to sell holdings and buy back shares to restore balance, but this is not always the case; discounted companies may also represent undervalued assets.

During the bear market of 2022, even when MicroStrategy's mNAV once fell below 1, the company did not choose to sell coins and buy back shares, but instead insisted on retaining all its bitcoin through debt restructuring. This "holding to the death" logic comes from Saylor's faith-based vision for BTC, viewing it as a core collateral asset that will "never be sold." But this path cannot be replicated by all treasury companies. Most altcoin treasury stocks lack stable core businesses, and transforming into a "coin-buying company" is merely a survival tactic, without the support of faith. Once the market environment deteriorates, they are more likely to sell off to stop losses or realize profits, triggering a stampede.

Related reading: "First Coin Sale, Delisting: Crypto Stocks Are No Longer the Pixiu of Cryptocurrency"

Does Insider Trading Exist?

SharpLink Gaming was one of the earliest cases in this "crypto treasury craze" to shake the market. On May 27, the company announced it would increase its holdings of up to $425 millions in Ethereum as reserve assets. On the day the news was released, the stock price soared to $52. However, strangely, as early as May 22, the stock's trading volume had already increased significantly, and the price jumped from $2.7 to $7, even though the company had not yet made any announcement or disclosed any information to the SEC.

This phenomenon of "news not yet released, but stock price moves first" is not unique. On July 18, MEI Pharma announced a $100 millions Litecoin treasury strategy, but the stock price had risen for four consecutive days before the news, from $2.7 to $4.4, nearly doubling. The company did not submit any major updates or issue a press release, and its spokesperson declined to comment.

Similar situations have also occurred in companies such as Mill City Ventures, Kindly MD, Empery Digital, Fundamental Global, and 180 Life Sciences Corp, all of which experienced varying degrees of abnormal trading fluctuations before announcing crypto treasury plans. Whether there is information leakage and pre-trading has already attracted regulatory attention.

Will the DAT Narrative Collapse?

Arthur Hayes, advisor to "Solana MicroStrategy" Upexi, pointed out that crypto treasury has become a new narrative in the traditional corporate finance circle. He believes this trend will continue to evolve across multiple mainstream asset tracks. However, we must clearly see: on each chain, at most only one or two winners can ultimately emerge.

Meanwhile, the head effect is accelerating. Although more than 200 companies have announced crypto treasury strategies in 2025, covering BTC, ETH, SOL, BNB, TRX, and other chains, capital and valuations are rapidly concentrating in a very small number of companies and assets—BTC treasuries and ETH treasuries account for the vast majority of DAT companies. In each asset category, only one or two companies can truly break out: in the BTC track it's MicroStrategy, in the ETH track it's Bitmine, and in the SOL track it may be Upexi, while other projects struggle to compete at scale.

As Michael Saylor has demonstrated, there is a large amount of institutional capital managers in the market who want bitcoin exposure but cannot buy BTC directly or hold ETFs—but they can buy MSTR stock. If you can package a company holding crypto assets into their "compliance basket," these funds are willing to pay $2, $3, or even $10 for assets worth only $1 on the books. This is not irrational; it is regulatory arbitrage.

In the latter part of the cycle, new issuers will continue to emerge, resorting to more aggressive corporate finance tools to pursue higher stock price elasticity. When prices fall, these practices will backfire. Arthur Hayes predicts that this cycle will see a major DAT incident similar to the FTX collapse. At that time, these companies will crash, and their stocks or bonds may experience huge discounts, causing significant market turmoil.

Regulators have also noticed this structural risk. In early September, Nasdaq proposed enhanced scrutiny of DAT companies; today, the SEC and FINRA have jointly launched an investigation into insider trading. These regulatory actions are intended to compress insider space, raise issuance thresholds and financing difficulty, thereby reducing the room for manipulation by new DAT companies. For the market, this means that "pseudo-leaders" will be eliminated more quickly, while true leading companies will continue to survive and even grow stronger on the back of the narrative.

Summary

The crypto treasury narrative persists, but higher thresholds, stricter regulation, and bubble clearing will proceed simultaneously. For investors, it is necessary to understand the logic and arbitrage paths behind the financial structure, and always be alert to the risk accumulation behind the narrative—this "on-chain alchemy" cannot play out indefinitely. The winner takes all, the loser exits.