Date: Sun, Sept 28, 2025 | 06:25 AM GMT

The cryptocurrency market is under pressure, with Bitcoin (BTC) and Ethereum (ETH) both facing weekly losses. Ethereum has slipped more than 10% and is now hovering near the $4,000 mark. This bearish sentiment has spilled into the memecoin space as well, with Pepe (PEPE) taking a notable hit.

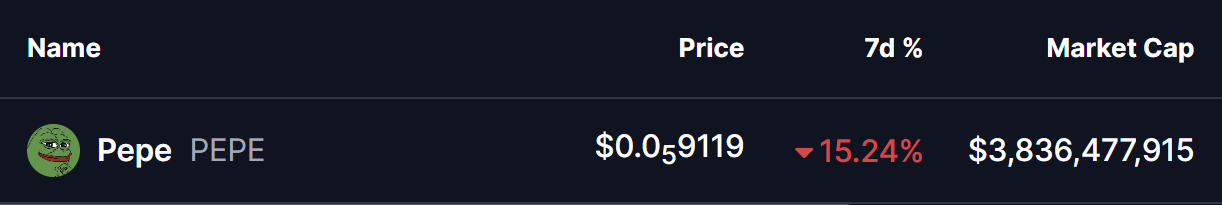

Over the past week, PEPE has dropped more than 15%. But while the short-term outlook looks shaky, the chart is flashing an interesting fractal setup that suggests the token could dip further before preparing for a bullish reversal.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Q4 2024

Looking at the daily chart, PEPE seems to be repeating a pattern similar to Q4 2024.

Back then, the price was trapped under a descending resistance trendline, followed by a sharp correction in the red zone. The coin corrected by around 35% in 35 days before making a strong comeback. The reversal kicked in after PEPE reclaimed its 50-day moving average (MA) and broke above the downtrend line, sparking a massive 259% rally.

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

Now, the current chart is showing nearly the same setup once again.

PEPE has recently faced rejection at the descending resistance trendline, triggering another correction. The token is now trading under the 50-day MA, already down about 28%, and is hovering around $0.0000091.

What’s Next for PEPE?

If history repeats itself, PEPE could see further downside before the bulls step in. A potential drop to around $0.0000083 is on the cards, which would also mark a 35% correction, aligning perfectly with the fractal setup. Adding to this, the RSI indicator has now reached levels similar to where PEPE previously staged a strong bounce, hinting that the coin might be close to forming a bottom.

If this fractal plays out, a reclaim of the 50-day MA followed by a breakout above the descending resistance trendline could act as the catalyst for the next big bullish run.

For now, traders should prepare for possible short-term pain before a bigger upside opportunity emerges.