Ethereum and Bitcoin ETFs just had their worst week ever.

Record outflows have raised significant doubts about institutional confidence in Bitcoin and Ethereum.

Last week became the bloodiest week to date for US spot Ethereum and Bitcoin ETFs. According to SoSoValue data, investors withdrew nearly $800 million from ETH products and over $900 million from BTC funds, marking the most dramatic week of outflows since these products launched. For a market once buoyed by institutional adoption, this latest data shows that confidence is being put to the test.

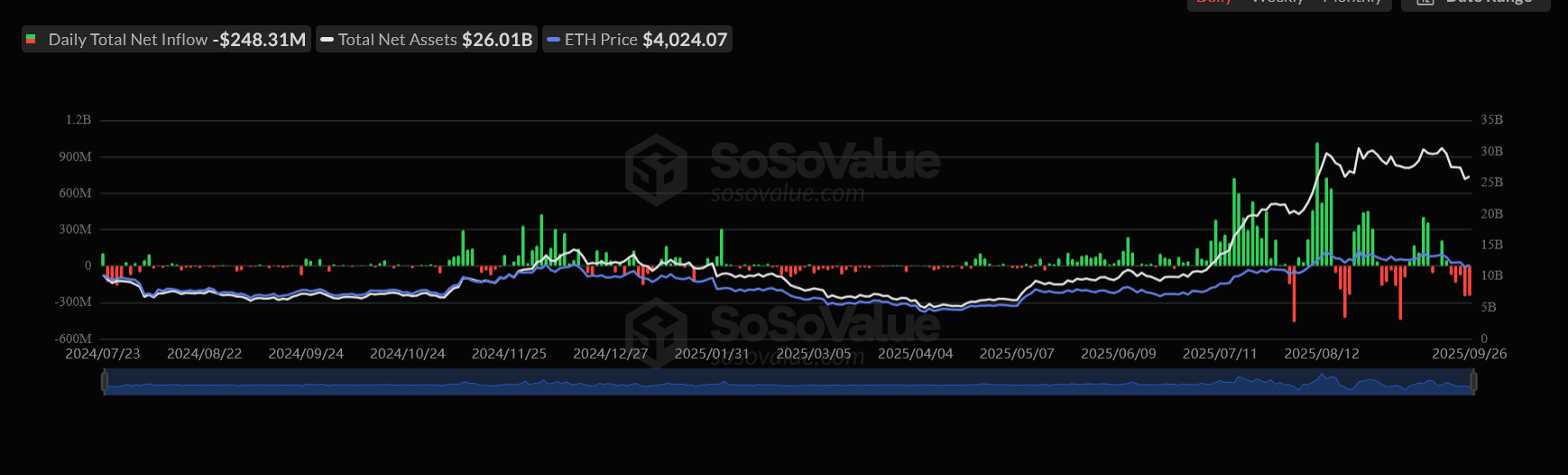

Nearly $800 Million Outflow from Ethereum ETFs

In the week ending September 26, spot Ethereum ETFs saw outflows of $795.6 million. Trading volume exceeded $10 billion, but redemptions outpaced new inflows at almost every turn.

Two funds bore the brunt of the losses:

- BlackRock’s ETHA fund lost over $200 million, though its assets under management still exceed $15.2 billion.

- Fidelity’s FETH fund took an even bigger hit, with $362 million in outflows.

On Thursday and Friday alone, Ethereum ETFs saw $250 million in daily redemptions, impacted by technical breakdowns on the charts, macroeconomic concerns, and cascading liquidations in the derivatives market. ETH fell below the key $4,000 level before rebounding to $4,020 on Saturday.

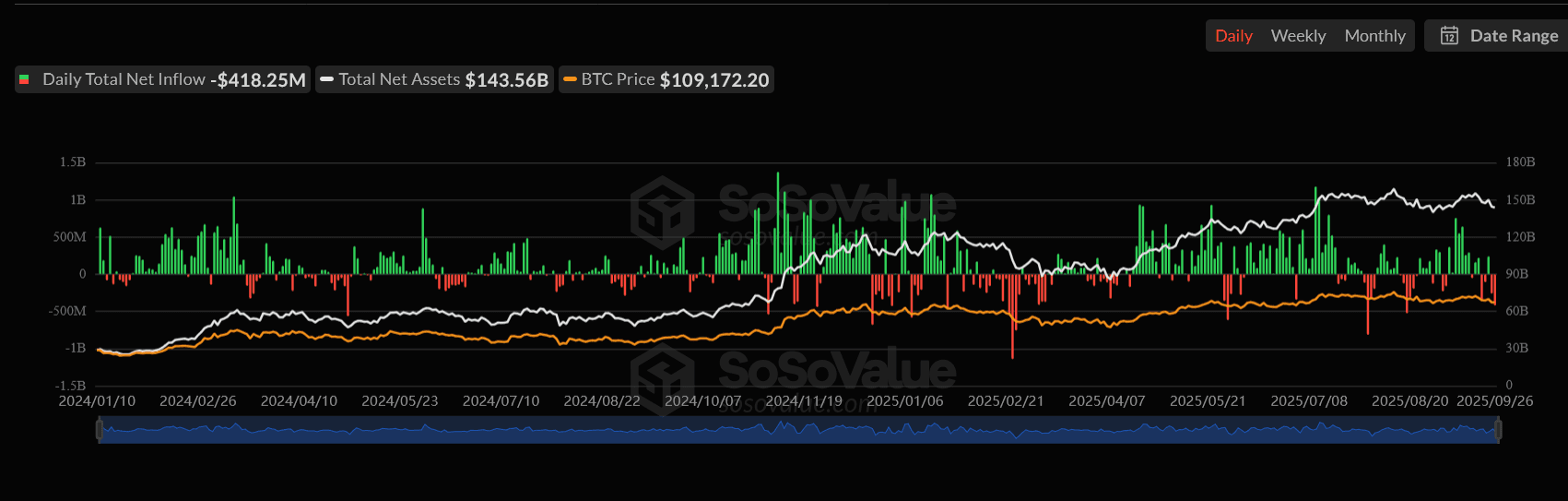

Bitcoin ETFs Follow Closely with $900 Million Outflow

Bitcoin funds were not spared either. Spot BTC ETFs recorded outflows of $902.5 million, with Fidelity’s FBTC seeing $300.4 million in outflows on Friday. BlackRock’s IBIT fund proved more resilient, losing only $37.3 million that day, further solidifying its market dominance.

IBIT has been expanding its market share, typically controlling over 80% of spot BTC ETF assets. However, this industry leader has yet to apply for a spot Solana ETF, while some competitors have already moved to diversify their offerings.

What’s Driving the Outflows?

Three main factors explain the massive ETF withdrawals:

- Technical Weakness: Both ETH and BTC broke below key support levels, forcing traders to unwind leveraged positions.

- Macroeconomic Pressure: Rising inflation and ongoing interest rate concerns have kept risk appetite subdued, hurting demand for speculative crypto assets.

- Cascading Liquidations: As spot prices fell, leveraged long positions were wiped out, creating a self-reinforcing cycle of selling.

Bottom Line

Ethereum and Bitcoin ETFs have just recorded their worst week of outflows ever. While ETH has managed a modest rebound, the two leading cryptocurrencies remain under pressure. If macro headwinds persist, ETF redemptions could accelerate, pushing prices even lower before any meaningful recovery. For traders, the message is clear: keep a close eye on fund flows—they are becoming one of the best early warning signals for predicting crypto price trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Overview of UNI Burn Proposal Voting, Lighter TGE Expectations, and Mainstream Ecosystem Trends

Revealed: Shorts Hold Slight Edge in BTC Perpetual Futures Across Top 3 Exchanges

Best Crypto to Buy Now – Midnight (NIGHT) Price Prediction

Bitcoin Faces Mounting Pressure as Analysts Eye $70,000 Support Level