Bitcoin Derivatives Stay Active as $110K Resistance Shapes Market Sentiment

Bitcoin derivatives activity remained intense over the weekend, with futures and options showing strong liquidity but mixed sentiment. On Saturday, Bitcoin traded at $109,449, with the $110,000 mark acting as a key zone for both bullish bets and protective hedges. Market signals now point to caution as technicals lean bearish, while futures and options flows reveal deep positioning.

In brief

- Futures OI hits $77.45B, with CME and Binance leading positions while smaller exchanges show mixed performance.

- Options skew shows 60.66% calls, but short-term flows lean bearish with puts gaining momentum on key strikes.

- Traders eye December calls at $140K and $200K, showing longer-term bullish appetite despite near-term caution.

- Bitcoin trades at $109,479, under pressure from ETF slowdown, profit-taking, and fragile support near cycle lows.

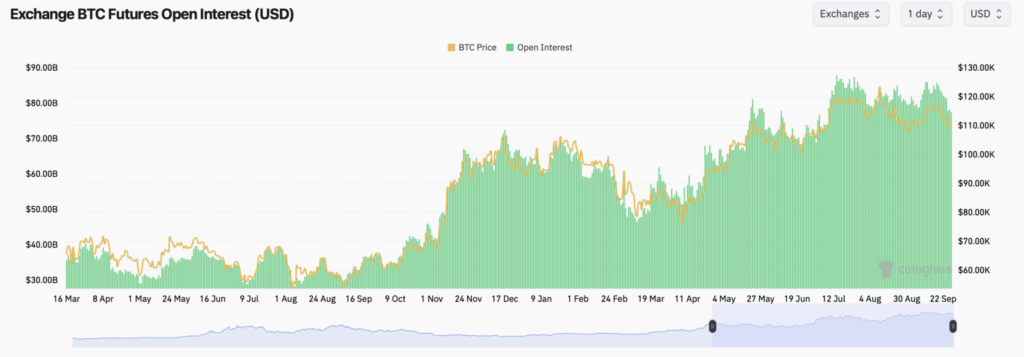

Futures Market: $77.45 Billion in Open Interest

Futures activity stayed strong, with total open interest (OI) reaching 707.59K BTC ($77.45 billion). CME leads with 138.82K BTC ($15.19 billion), followed by Binance at 123.30K BTC ($13.50 billion). Bybit holds 84.39K BTC ($9.23 billion), while OKX and Gate posted 37.78K BTC ($4.13 billion) and 78.24K BTC ($8.56 billion), respectively.

Smaller exchanges posted mixed results on the day. Bitget rose 0.45% to 52.33K BTC ($5.72 billion), while KuCoin fell 2.88% to 6.12K BTC ($669.49 million). MEXC gained 4.87% to 26.42K BTC ($2.89 billion), but BingX dropped sharply—down 42.96% to 9.15K BTC ($1.00 billion).

Calls Still Dominate Bitcoin Market, But Puts Gain Short-Term Flow

On the options side, calls hold 60.66% of OI (199,102.16 BTC) compared to 39.34% in puts (129,149.11 BTC). However, recent volume leaned slightly toward puts. In the last 24 hours on Deribit, puts accounted for 16,247.21 BTC (50.87%), versus 15,694.48 BTC in calls (49.13%)—a sign of hedging activity.

Contracts near the current trading level dominated short-term flows. The Sept. 28 $110,000 put traded 1,311.9 BTC, while the Oct. 10 $100,000 put added 853.3 BTC. On the bullish side, the Oct. 31 $116,000 call saw 812.5 Bitcoin in trades.

Further out, December expiries highlight traders’ appetite for higher prices. The December 26 $140,000 call leads with 9,804.5 BTC in OI, followed by the $200,000 call at 8,527.2 BTC. Strong interest also sits at the $120,000 and $150,000 strikes.

The current “max pain” range clusters between $110,000 and $116,000, marking a key zone where both bulls and bears face pressure.

Market sentiment has turned cautious despite heavy positioning:

- For now, 15 indicators flash bullish signals, while 18 lean bearish, tilting sentiment to the downside.

- The Fear & Greed Index stands at 37, reflecting a market mood of “Fear.”

- Bitcoin is trading close to its cycle low of $107,304, signaling fragile support.

- The asset sits 11.92% below its cycle high and just 1.93% above the cycle low.

At the time of writing, Bitcoin trades at $109,479, as profit-taking and an ETF outflow slowed the market , keeping price action just under the key $110K level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know